What Is The Local Sales Tax - The 7% sales tax rate in west mifflin consists of 6% pennsylvania state sales tax and 1% allegheny county sales tax. Discover our free online 2024 us sales tax calculator specifically for 15122, west mifflin residents. With local taxes, the total sales tax rate is between 6.000% and 8.000%. The sales tax rate is. There is no applicable city. This is the total of state, county, and city sales tax rates. West mifflin borough has a number of taxes that impact residents and businesses. The minimum combined 2024 sales tax rate for west mifflin, pennsylvania is 7.0%. 53 rows in this interactive sales tax map, salestaxhandbook has visualized local sales tax rates across the united states by coloring each. Taxes imposed by the borough are through ordinances that.

The december 2020 total local sales tax rate was also 7.000%. This is the total of state, county, and city sales tax rates. The current total local sales tax rate in west mifflin, pa is 7.000%. With local taxes, the total sales tax rate is between 6.000% and 8.000%. The sales tax rate is. Discover our free online 2024 us sales tax calculator specifically for 15122, west mifflin residents. How 2024 sales taxes are calculated in west mifflin. The minimum combined 2024 sales tax rate for west mifflin, pennsylvania is 7.0%. 53 rows in this interactive sales tax map, salestaxhandbook has visualized local sales tax rates across the united states by coloring each. West mifflin borough has a number of taxes that impact residents and businesses.

How 2024 sales taxes are calculated in west mifflin. There is no applicable city. This is the total of state, county, and city sales tax rates. With local taxes, the total sales tax rate is between 6.000% and 8.000%. The west mifflin, pennsylvania, general sales tax rate is 6%. The december 2020 total local sales tax rate was also 7.000%. The minimum combined 2024 sales tax rate for west mifflin, pennsylvania is 7.0%. West mifflin borough has a number of taxes that impact residents and businesses. 31 rows the state sales tax rate in pennsylvania is 6.000%. Taxes imposed by the borough are through ordinances that.

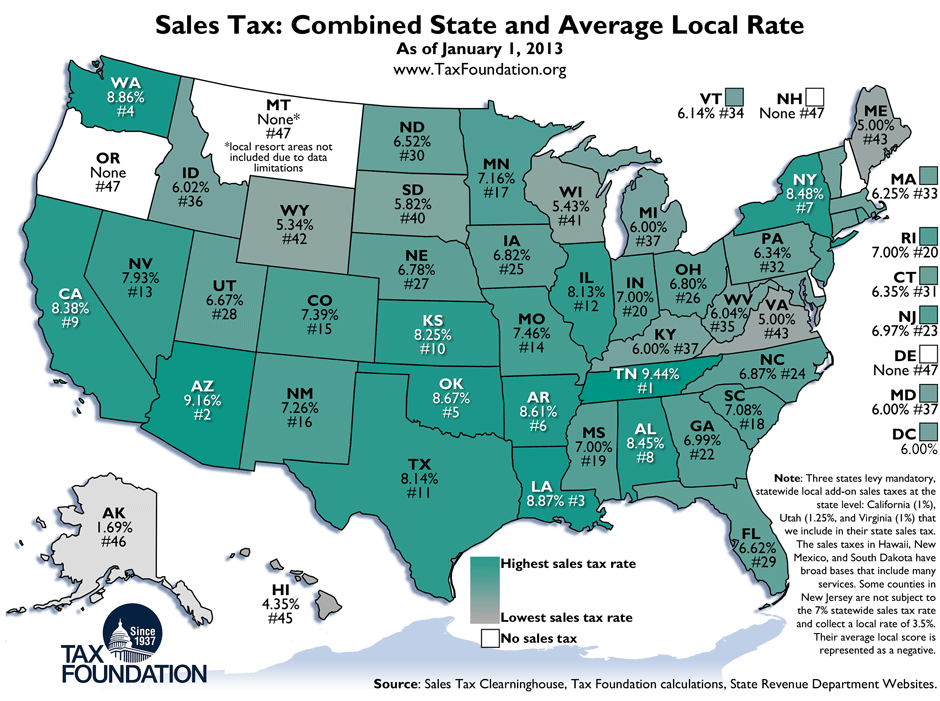

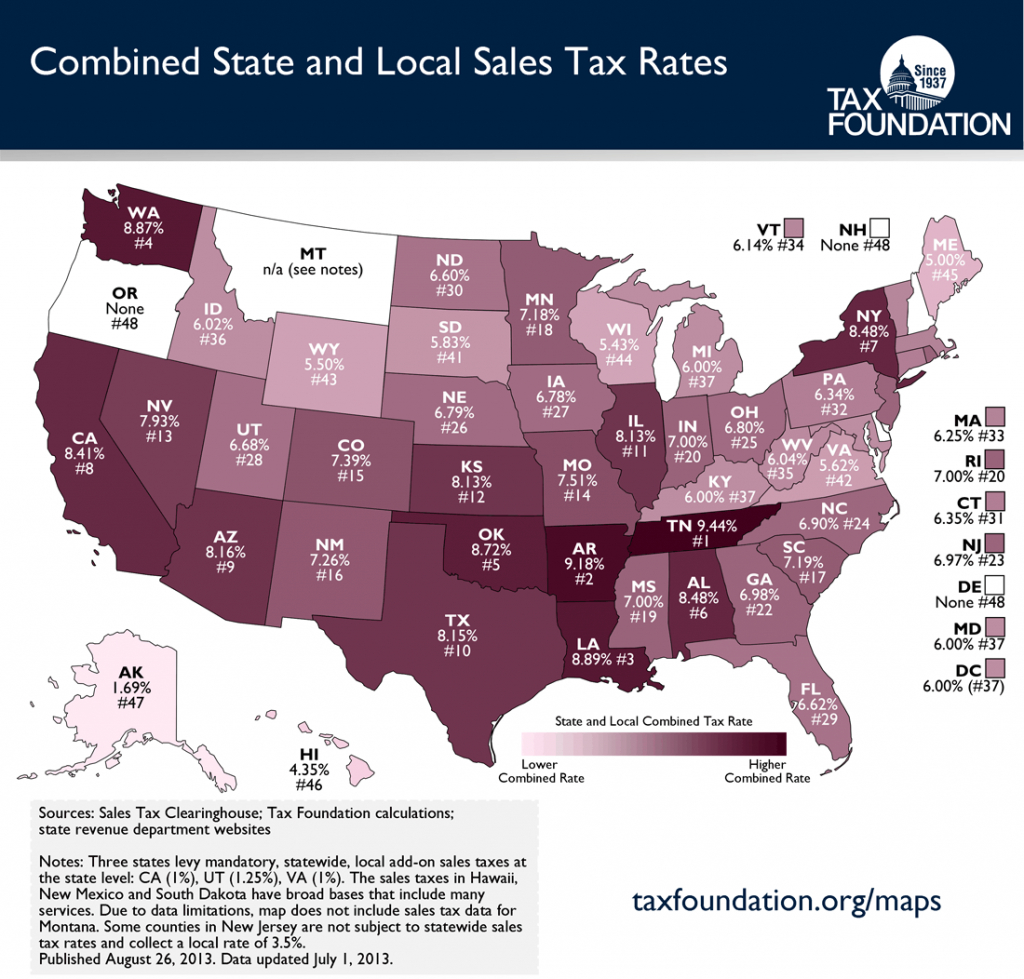

State and Local Sales Tax Rates Midyear 2013 Tax Foundation

The 7% sales tax rate in west mifflin consists of 6% pennsylvania state sales tax and 1% allegheny county sales tax. How 2024 sales taxes are calculated in west mifflin. This is the total of state, county, and city sales tax rates. With local taxes, the total sales tax rate is between 6.000% and 8.000%. The minimum combined 2024 sales.

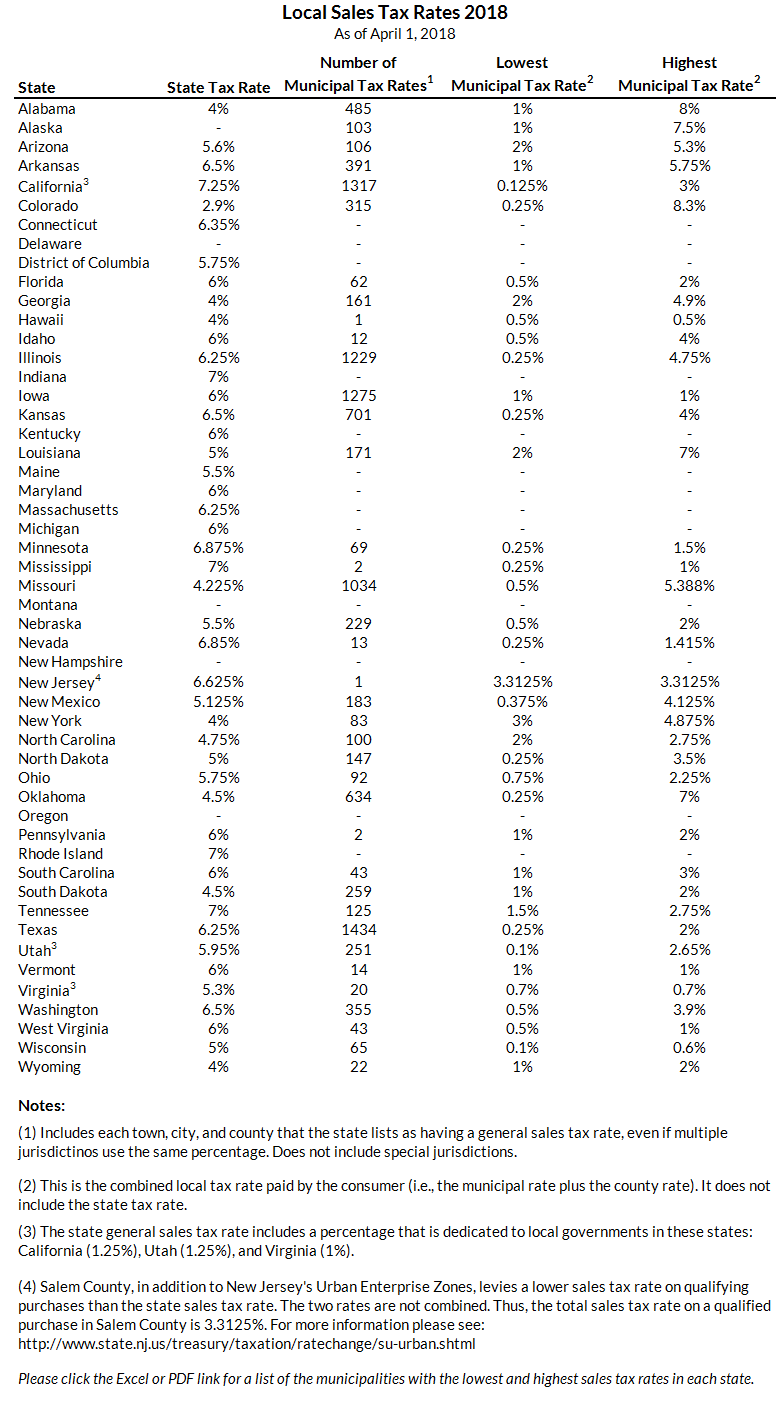

State Sales Tax State Sales Tax Vs Local Sales Tax

The west mifflin, pennsylvania, general sales tax rate is 6%. Taxes imposed by the borough are through ordinances that. The current total local sales tax rate in west mifflin, pa is 7.000%. 53 rows in this interactive sales tax map, salestaxhandbook has visualized local sales tax rates across the united states by coloring each. The december 2020 total local sales.

Weekly Map State and Local Sales Tax Rates, 2013 Tax Foundation

The sales tax rate is. Taxes imposed by the borough are through ordinances that. How 2024 sales taxes are calculated in west mifflin. The minimum combined 2024 sales tax rate for west mifflin, pennsylvania is 7.0%. The west mifflin, pennsylvania, general sales tax rate is 6%.

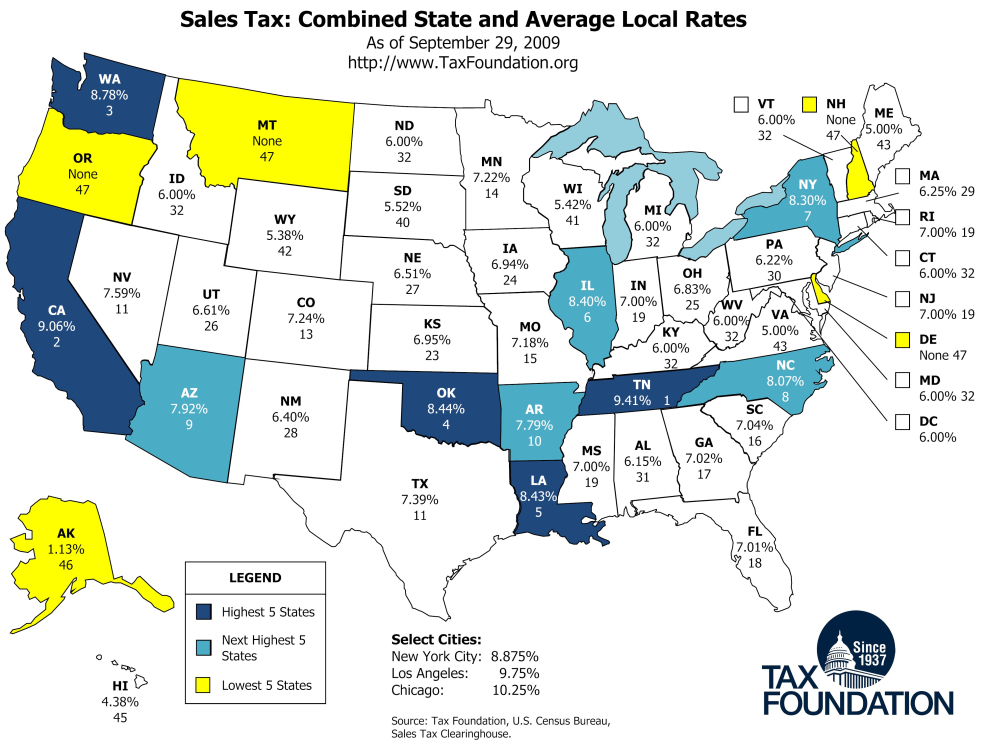

Updated State and Local Option Sales Tax Tax Foundation

With local taxes, the total sales tax rate is between 6.000% and 8.000%. 53 rows in this interactive sales tax map, salestaxhandbook has visualized local sales tax rates across the united states by coloring each. The 7% sales tax rate in west mifflin consists of 6% pennsylvania state sales tax and 1% allegheny county sales tax. There is no applicable.

State and Local Sales Tax Rates, Midyear 2020 Tax Foundation

With local taxes, the total sales tax rate is between 6.000% and 8.000%. West mifflin borough has a number of taxes that impact residents and businesses. There is no applicable city. This is the total of state, county, and city sales tax rates. The december 2020 total local sales tax rate was also 7.000%.

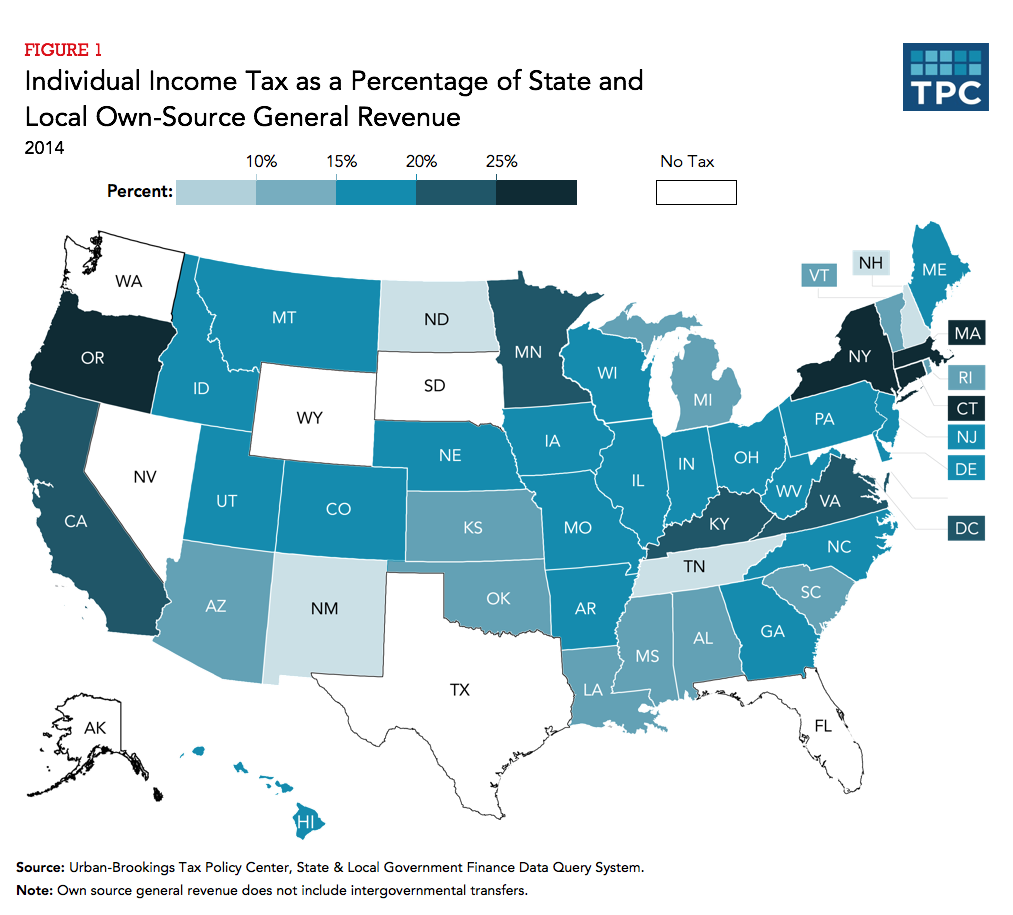

Local Sales Tax Rates Tax Policy Center

With local taxes, the total sales tax rate is between 6.000% and 8.000%. 31 rows the state sales tax rate in pennsylvania is 6.000%. The december 2020 total local sales tax rate was also 7.000%. 53 rows in this interactive sales tax map, salestaxhandbook has visualized local sales tax rates across the united states by coloring each. Taxes imposed by.

Monday Map Sales Tax Combined State and Average Local Rates

31 rows the state sales tax rate in pennsylvania is 6.000%. Discover our free online 2024 us sales tax calculator specifically for 15122, west mifflin residents. The current total local sales tax rate in west mifflin, pa is 7.000%. The west mifflin, pennsylvania, general sales tax rate is 6%. The december 2020 total local sales tax rate was also 7.000%.

State And Local Sales Tax Rates Midyear 2013 Tax Foundation Texas

Discover our free online 2024 us sales tax calculator specifically for 15122, west mifflin residents. How 2024 sales taxes are calculated in west mifflin. 53 rows in this interactive sales tax map, salestaxhandbook has visualized local sales tax rates across the united states by coloring each. The december 2020 total local sales tax rate was also 7.000%. West mifflin borough.

Combined State and Average Local Sales Tax Rates Tax Foundation

The december 2020 total local sales tax rate was also 7.000%. 31 rows the state sales tax rate in pennsylvania is 6.000%. Taxes imposed by the borough are through ordinances that. How 2024 sales taxes are calculated in west mifflin. With local taxes, the total sales tax rate is between 6.000% and 8.000%.

Ranking State and Local Sales Taxes Tax Foundation

The current total local sales tax rate in west mifflin, pa is 7.000%. The 7% sales tax rate in west mifflin consists of 6% pennsylvania state sales tax and 1% allegheny county sales tax. How 2024 sales taxes are calculated in west mifflin. This is the total of state, county, and city sales tax rates. There is no applicable city.

The West Mifflin, Pennsylvania, General Sales Tax Rate Is 6%.

There is no applicable city. West mifflin borough has a number of taxes that impact residents and businesses. The december 2020 total local sales tax rate was also 7.000%. The minimum combined 2024 sales tax rate for west mifflin, pennsylvania is 7.0%.

How 2024 Sales Taxes Are Calculated In West Mifflin.

Taxes imposed by the borough are through ordinances that. The current total local sales tax rate in west mifflin, pa is 7.000%. The 7% sales tax rate in west mifflin consists of 6% pennsylvania state sales tax and 1% allegheny county sales tax. 53 rows in this interactive sales tax map, salestaxhandbook has visualized local sales tax rates across the united states by coloring each.

This Is The Total Of State, County, And City Sales Tax Rates.

31 rows the state sales tax rate in pennsylvania is 6.000%. Discover our free online 2024 us sales tax calculator specifically for 15122, west mifflin residents. The sales tax rate is. With local taxes, the total sales tax rate is between 6.000% and 8.000%.

.png)

.png)