West Virginia Tax Lien Sales - All payments for delinquent real estate taxes received within fourteen business days prior to the date of sale must be paid by cashier check,. Effective this year, the sheriff’s office will no longer conduct the annual real estate tax lien sale. After october 14th, and before november 23rd, the sheriff sells the tax lien on unredeemed property at a public auction. Search west virginia delinquent tax land sale properties by county, name, description or status of the property. After the sale of any tax lien on any real property purchased at the delinquent land sales conducted by the sheriffs, the owner of, or any other.

Search west virginia delinquent tax land sale properties by county, name, description or status of the property. After october 14th, and before november 23rd, the sheriff sells the tax lien on unredeemed property at a public auction. All payments for delinquent real estate taxes received within fourteen business days prior to the date of sale must be paid by cashier check,. Effective this year, the sheriff’s office will no longer conduct the annual real estate tax lien sale. After the sale of any tax lien on any real property purchased at the delinquent land sales conducted by the sheriffs, the owner of, or any other.

All payments for delinquent real estate taxes received within fourteen business days prior to the date of sale must be paid by cashier check,. After october 14th, and before november 23rd, the sheriff sells the tax lien on unredeemed property at a public auction. After the sale of any tax lien on any real property purchased at the delinquent land sales conducted by the sheriffs, the owner of, or any other. Search west virginia delinquent tax land sale properties by county, name, description or status of the property. Effective this year, the sheriff’s office will no longer conduct the annual real estate tax lien sale.

Gov. Justice announces West Virginia Sales Tax Holiday to take place

Effective this year, the sheriff’s office will no longer conduct the annual real estate tax lien sale. After october 14th, and before november 23rd, the sheriff sells the tax lien on unredeemed property at a public auction. Search west virginia delinquent tax land sale properties by county, name, description or status of the property. After the sale of any tax.

NYC Tax Lien Sale Information Session Jamaica311

Effective this year, the sheriff’s office will no longer conduct the annual real estate tax lien sale. Search west virginia delinquent tax land sale properties by county, name, description or status of the property. After the sale of any tax lien on any real property purchased at the delinquent land sales conducted by the sheriffs, the owner of, or any.

Tax Lien Virginia State Tax Lien

After october 14th, and before november 23rd, the sheriff sells the tax lien on unredeemed property at a public auction. After the sale of any tax lien on any real property purchased at the delinquent land sales conducted by the sheriffs, the owner of, or any other. Search west virginia delinquent tax land sale properties by county, name, description or.

Tax Lien Properties In West Virginia Brightside Tax Relief

Effective this year, the sheriff’s office will no longer conduct the annual real estate tax lien sale. All payments for delinquent real estate taxes received within fourteen business days prior to the date of sale must be paid by cashier check,. After october 14th, and before november 23rd, the sheriff sells the tax lien on unredeemed property at a public.

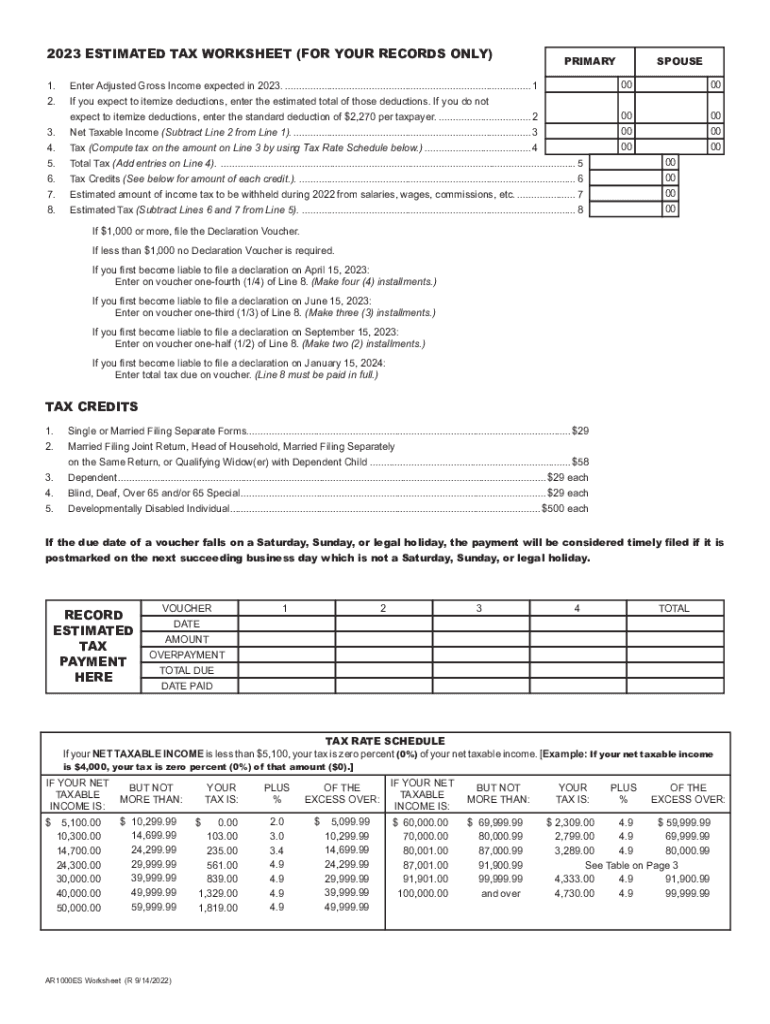

Ar1000es Complete with ease airSlate SignNow

Effective this year, the sheriff’s office will no longer conduct the annual real estate tax lien sale. Search west virginia delinquent tax land sale properties by county, name, description or status of the property. After october 14th, and before november 23rd, the sheriff sells the tax lien on unredeemed property at a public auction. After the sale of any tax.

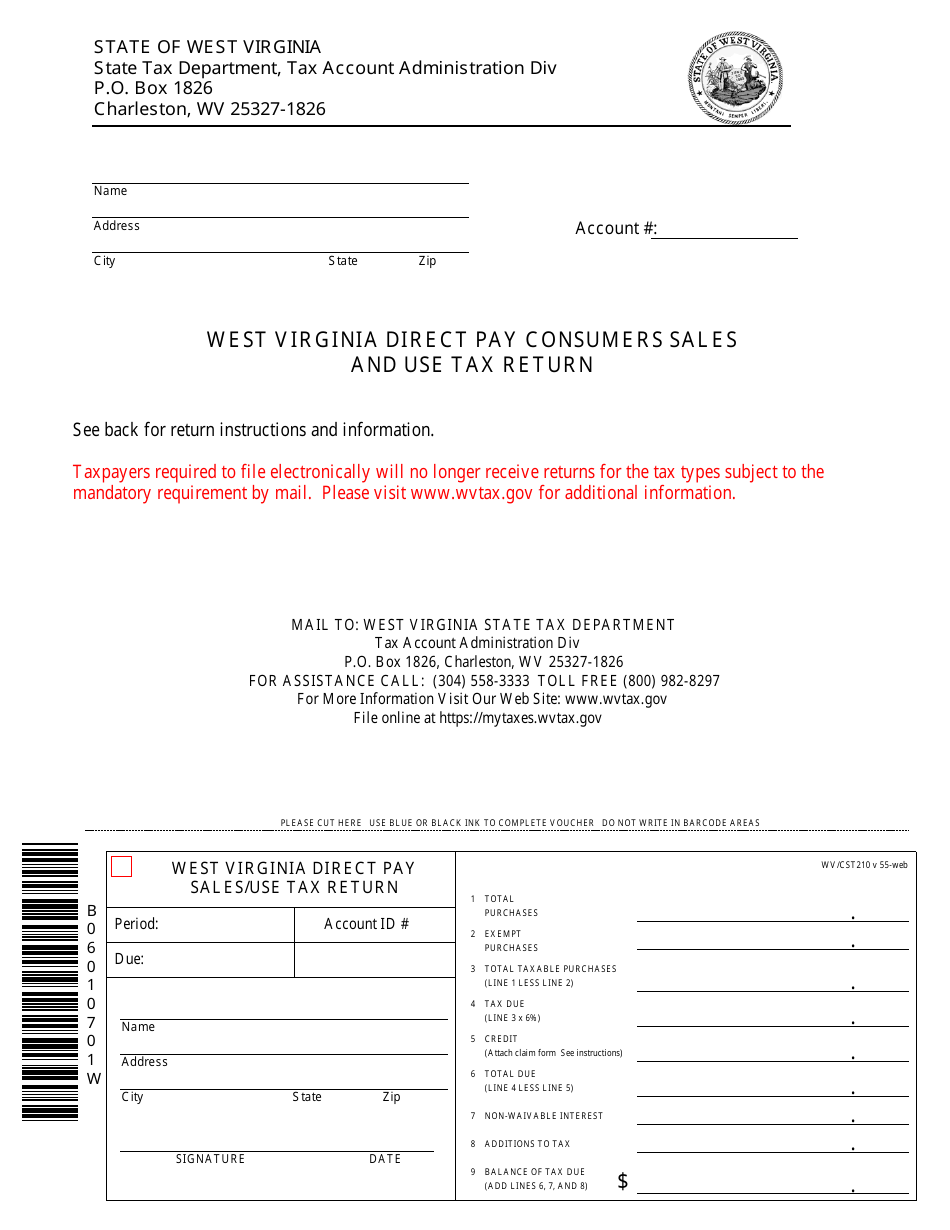

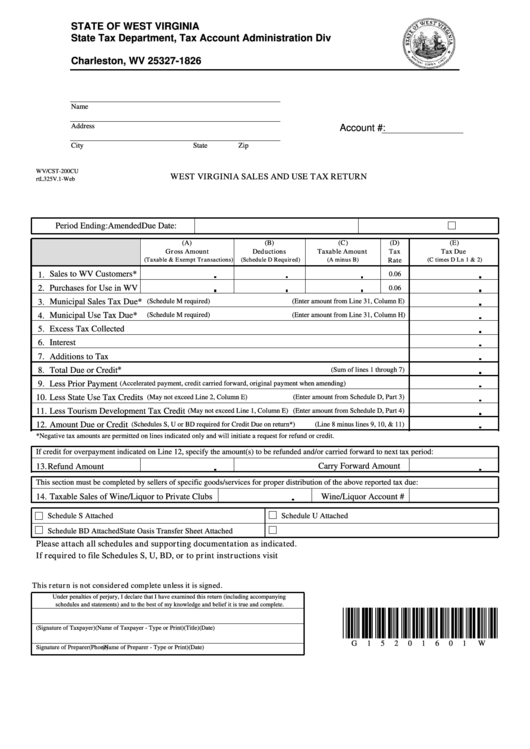

Form WV/CST210 Fill Out, Sign Online and Download Printable PDF

After the sale of any tax lien on any real property purchased at the delinquent land sales conducted by the sheriffs, the owner of, or any other. Effective this year, the sheriff’s office will no longer conduct the annual real estate tax lien sale. After october 14th, and before november 23rd, the sheriff sells the tax lien on unredeemed property.

Tax Lien Investing What to Know CheckBook IRA LLC

After october 14th, and before november 23rd, the sheriff sells the tax lien on unredeemed property at a public auction. All payments for delinquent real estate taxes received within fourteen business days prior to the date of sale must be paid by cashier check,. Effective this year, the sheriff’s office will no longer conduct the annual real estate tax lien.

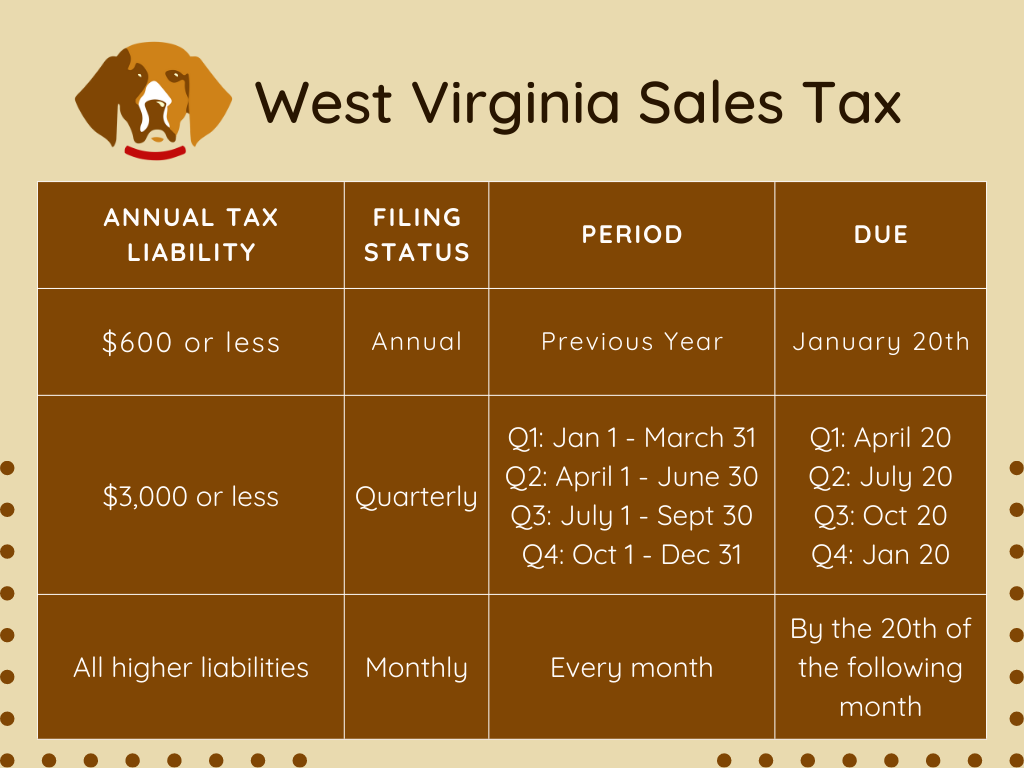

Sales Tax West Virginia West Virginia Sales Tax Registration

After october 14th, and before november 23rd, the sheriff sells the tax lien on unredeemed property at a public auction. Search west virginia delinquent tax land sale properties by county, name, description or status of the property. All payments for delinquent real estate taxes received within fourteen business days prior to the date of sale must be paid by cashier.

Form Cst200cu West Virginia Sales And Use Tax Return printable pdf

Search west virginia delinquent tax land sale properties by county, name, description or status of the property. All payments for delinquent real estate taxes received within fourteen business days prior to the date of sale must be paid by cashier check,. Effective this year, the sheriff’s office will no longer conduct the annual real estate tax lien sale. After october.

The Wonderful Benefits of Tax Lien Sales Michael Schuett

All payments for delinquent real estate taxes received within fourteen business days prior to the date of sale must be paid by cashier check,. After october 14th, and before november 23rd, the sheriff sells the tax lien on unredeemed property at a public auction. Effective this year, the sheriff’s office will no longer conduct the annual real estate tax lien.

Search West Virginia Delinquent Tax Land Sale Properties By County, Name, Description Or Status Of The Property.

After the sale of any tax lien on any real property purchased at the delinquent land sales conducted by the sheriffs, the owner of, or any other. Effective this year, the sheriff’s office will no longer conduct the annual real estate tax lien sale. All payments for delinquent real estate taxes received within fourteen business days prior to the date of sale must be paid by cashier check,. After october 14th, and before november 23rd, the sheriff sells the tax lien on unredeemed property at a public auction.