State Tax Lien Illinois - How tax liens work in illinois. In illinois, the lien extends to all real and personal property within the county, amplifying its financial impact. The registry will be an online, statewide system for maintaining notices of tax liens filed or. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. Filing a lien will have a negative impact on your credit rating. Resolution and release of liens. What is the state tax lien registry? In the state of illinois, the sale of property tax liens goes through the following steps.

What is the state tax lien registry? Resolution and release of liens. How tax liens work in illinois. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. In the state of illinois, the sale of property tax liens goes through the following steps. In illinois, the lien extends to all real and personal property within the county, amplifying its financial impact. Filing a lien will have a negative impact on your credit rating. The registry will be an online, statewide system for maintaining notices of tax liens filed or.

In the state of illinois, the sale of property tax liens goes through the following steps. Filing a lien will have a negative impact on your credit rating. The registry will be an online, statewide system for maintaining notices of tax liens filed or. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. In illinois, the lien extends to all real and personal property within the county, amplifying its financial impact. Resolution and release of liens. What is the state tax lien registry? How tax liens work in illinois.

Tax Lien State Tax Lien California

The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. The registry will be an online, statewide system for maintaining notices of tax liens filed or. What is the state tax lien registry? How tax liens work in illinois. In illinois, the lien extends to.

Tips On Dealing With A State Tax Lien Legal News Letter

The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. The registry will be an online, statewide system for maintaining notices of tax liens filed or. Resolution and release of liens. In the state of illinois, the sale of property tax liens goes through the.

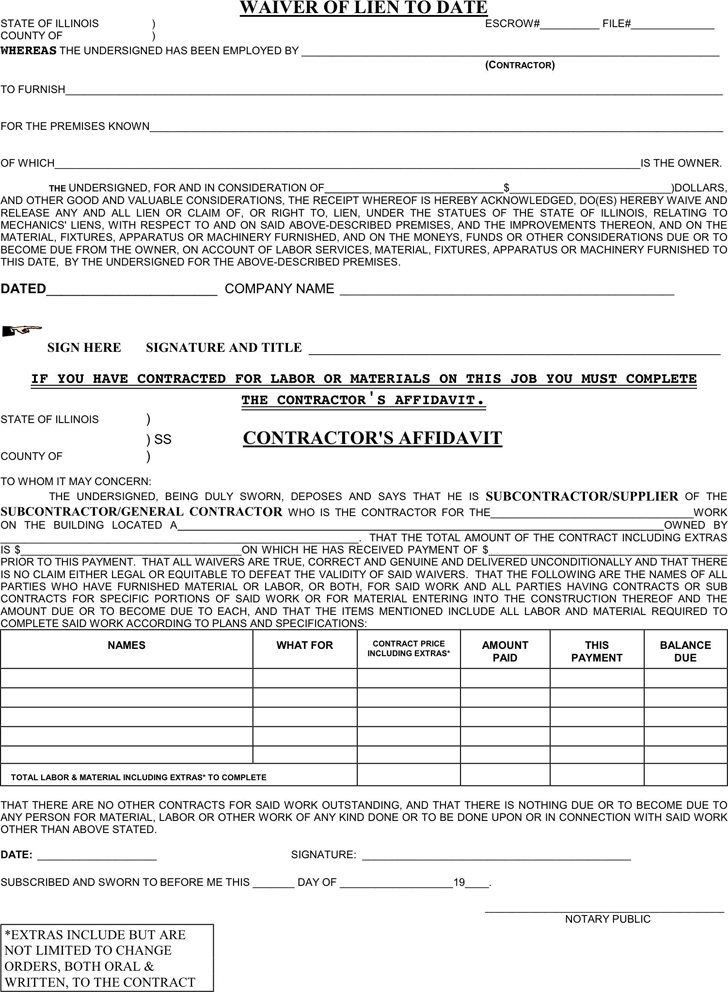

Residential Subcontractor Illinois Mechanic Lien Documents and Packages

The registry will be an online, statewide system for maintaining notices of tax liens filed or. In illinois, the lien extends to all real and personal property within the county, amplifying its financial impact. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. How.

Tax Lien Mailing List Spectrum Mailing Lists

In illinois, the lien extends to all real and personal property within the county, amplifying its financial impact. The registry will be an online, statewide system for maintaining notices of tax liens filed or. Filing a lien will have a negative impact on your credit rating. Resolution and release of liens. In the state of illinois, the sale of property.

Tax Lien Sale PDF Tax Lien Taxes

The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. In illinois, the lien extends to all real and personal property within the county, amplifying its financial impact. Resolution and release of liens. How tax liens work in illinois. In the state of illinois, the.

Tax Lien Focus Group Real Estate And Profit Acceleration Enjoy Your

The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. How tax liens work in illinois. In illinois, the lien extends to all real and personal property within the county, amplifying its financial impact. Filing a lien will have a negative impact on your credit.

State Tax Lien vs. Federal Tax Lien How to Remove Them

How tax liens work in illinois. Resolution and release of liens. Filing a lien will have a negative impact on your credit rating. The registry will be an online, statewide system for maintaining notices of tax liens filed or. In the state of illinois, the sale of property tax liens goes through the following steps.

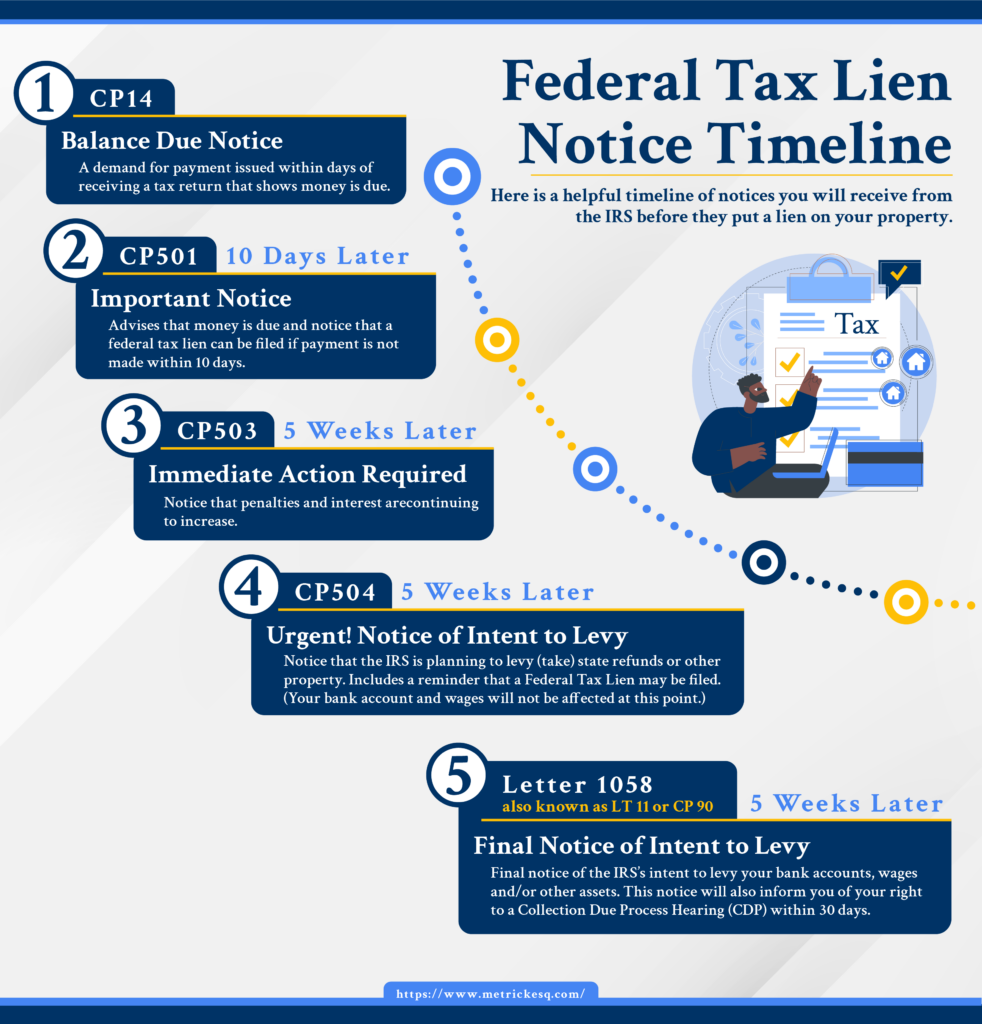

Federal Tax Lien Notice Timeline Ira J. Metrick, Esq.

Filing a lien will have a negative impact on your credit rating. How tax liens work in illinois. Resolution and release of liens. What is the state tax lien registry? In the state of illinois, the sale of property tax liens goes through the following steps.

Tax Lien California State Tax Lien

The registry will be an online, statewide system for maintaining notices of tax liens filed or. In illinois, the lien extends to all real and personal property within the county, amplifying its financial impact. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. In.

Free Illinois Waiver of Lien PDF 14KB 1 Page(s)

What is the state tax lien registry? In illinois, the lien extends to all real and personal property within the county, amplifying its financial impact. The registry will be an online, statewide system for maintaining notices of tax liens filed or. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released.

Resolution And Release Of Liens.

How tax liens work in illinois. The state tax lien registry is an online, statewide system for maintaining notices of tax liens filed or released that are enforced by the illinois. What is the state tax lien registry? In illinois, the lien extends to all real and personal property within the county, amplifying its financial impact.

In The State Of Illinois, The Sale Of Property Tax Liens Goes Through The Following Steps.

The registry will be an online, statewide system for maintaining notices of tax liens filed or. Filing a lien will have a negative impact on your credit rating.