State Of Ohio Tax Lien - An official state of ohio site. Local governments in ohio may levy taxes on real property. Property taxes are imposed as a lien of the state against the property until they are. A tax lien is filed with the county courts when a tax liability is referred for collection. The department of taxation does not forward. The attorney general’s taxation section defends the state tax commissioner's administrative decisions to tax assessments, refund.

Property taxes are imposed as a lien of the state against the property until they are. The attorney general’s taxation section defends the state tax commissioner's administrative decisions to tax assessments, refund. A tax lien is filed with the county courts when a tax liability is referred for collection. An official state of ohio site. The department of taxation does not forward. Local governments in ohio may levy taxes on real property.

The department of taxation does not forward. An official state of ohio site. A tax lien is filed with the county courts when a tax liability is referred for collection. Local governments in ohio may levy taxes on real property. Property taxes are imposed as a lien of the state against the property until they are. The attorney general’s taxation section defends the state tax commissioner's administrative decisions to tax assessments, refund.

Tax Lien Sale PDF Tax Lien Taxes

Local governments in ohio may levy taxes on real property. The attorney general’s taxation section defends the state tax commissioner's administrative decisions to tax assessments, refund. Property taxes are imposed as a lien of the state against the property until they are. The department of taxation does not forward. A tax lien is filed with the county courts when a.

tax lien PDF Free Download

Property taxes are imposed as a lien of the state against the property until they are. Local governments in ohio may levy taxes on real property. The attorney general’s taxation section defends the state tax commissioner's administrative decisions to tax assessments, refund. A tax lien is filed with the county courts when a tax liability is referred for collection. An.

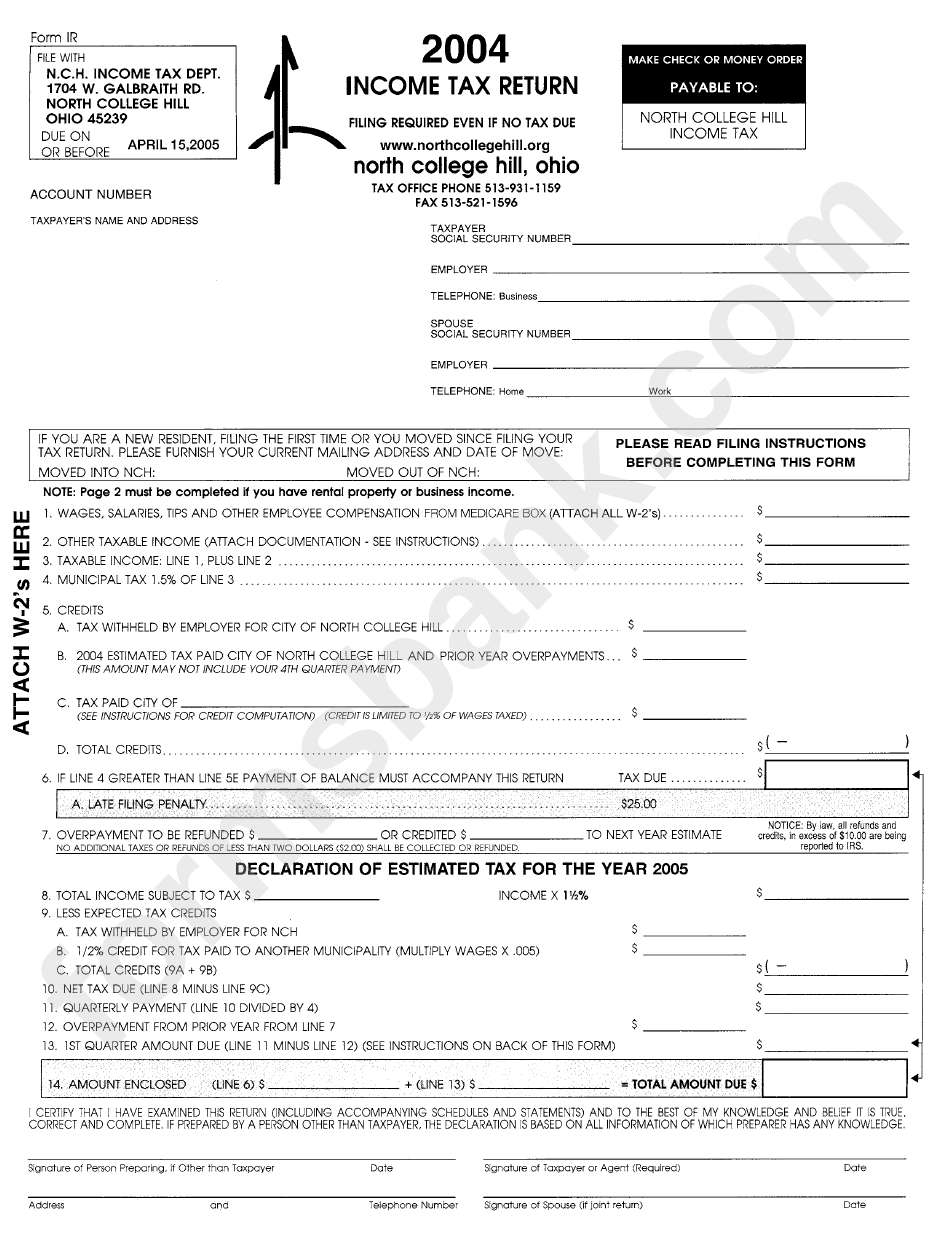

Form Ir Tax Return 2004 State Of Ohio printable pdf download

The attorney general’s taxation section defends the state tax commissioner's administrative decisions to tax assessments, refund. A tax lien is filed with the county courts when a tax liability is referred for collection. An official state of ohio site. Property taxes are imposed as a lien of the state against the property until they are. The department of taxation does.

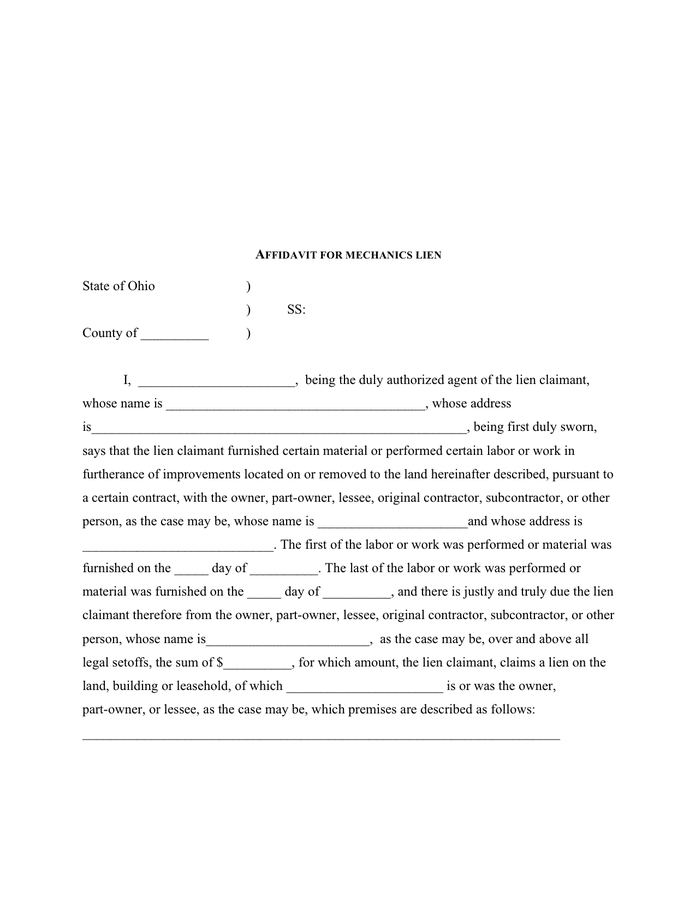

Affidavit for mechanics lien (Ohio) in Word and Pdf formats

Property taxes are imposed as a lien of the state against the property until they are. A tax lien is filed with the county courts when a tax liability is referred for collection. An official state of ohio site. The department of taxation does not forward. Local governments in ohio may levy taxes on real property.

Ohio Mechanics Lien Form Fill Online, Printable, Fillable, Blank

A tax lien is filed with the county courts when a tax liability is referred for collection. Local governments in ohio may levy taxes on real property. The department of taxation does not forward. An official state of ohio site. Property taxes are imposed as a lien of the state against the property until they are.

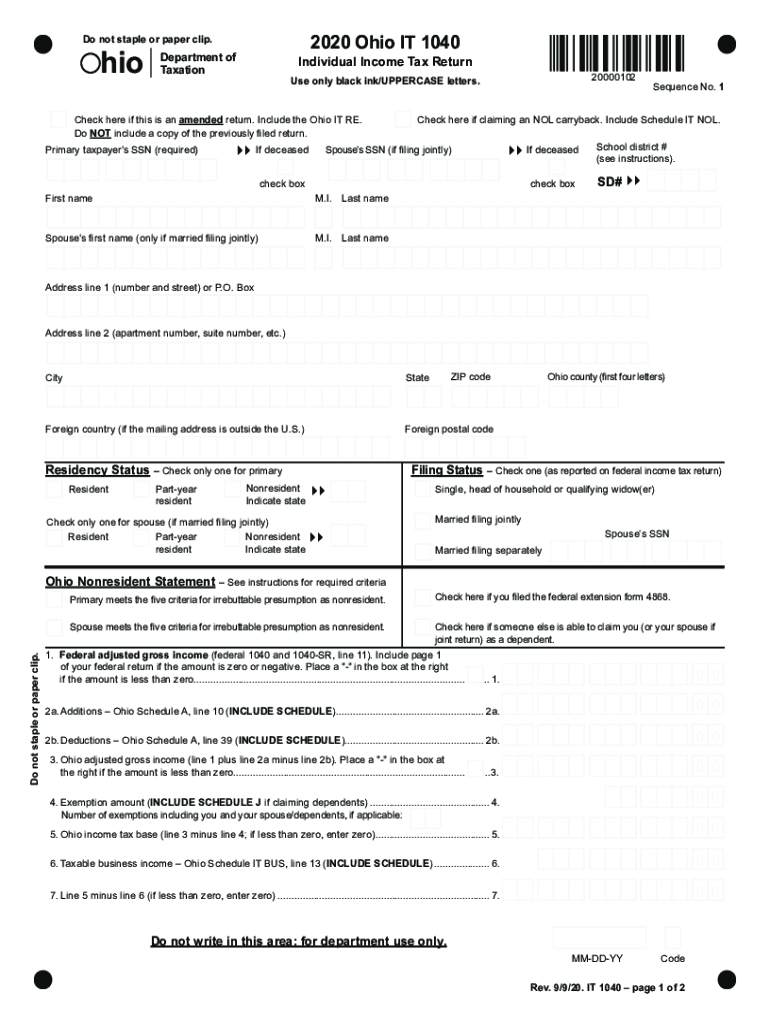

2020 Form OH IT 1040 Fill Online, Printable, Fillable, Blank pdfFiller

A tax lien is filed with the county courts when a tax liability is referred for collection. The department of taxation does not forward. Property taxes are imposed as a lien of the state against the property until they are. An official state of ohio site. The attorney general’s taxation section defends the state tax commissioner's administrative decisions to tax.

Tax Lien Ohio State Tax Lien

Local governments in ohio may levy taxes on real property. A tax lien is filed with the county courts when a tax liability is referred for collection. The attorney general’s taxation section defends the state tax commissioner's administrative decisions to tax assessments, refund. The department of taxation does not forward. Property taxes are imposed as a lien of the state.

Tax Lien What Is A State Tax Lien Ohio

Property taxes are imposed as a lien of the state against the property until they are. The department of taxation does not forward. An official state of ohio site. A tax lien is filed with the county courts when a tax liability is referred for collection. Local governments in ohio may levy taxes on real property.

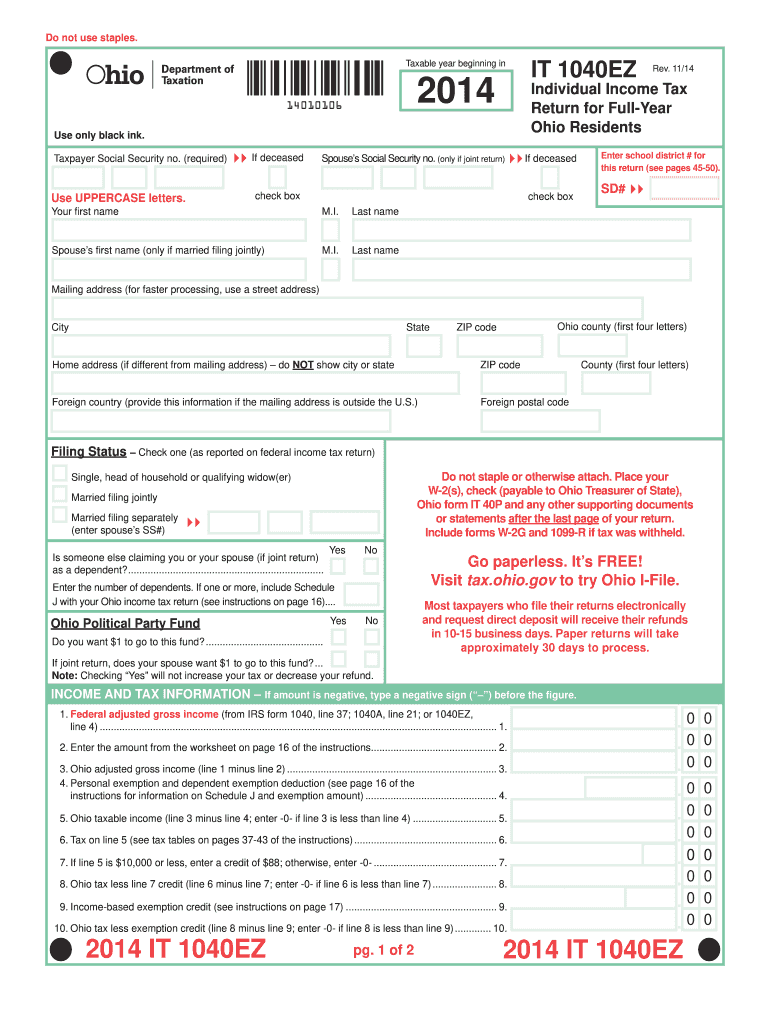

Ohio State Tax Forms Printable Printable Forms Free Online

The department of taxation does not forward. A tax lien is filed with the county courts when a tax liability is referred for collection. The attorney general’s taxation section defends the state tax commissioner's administrative decisions to tax assessments, refund. An official state of ohio site. Local governments in ohio may levy taxes on real property.

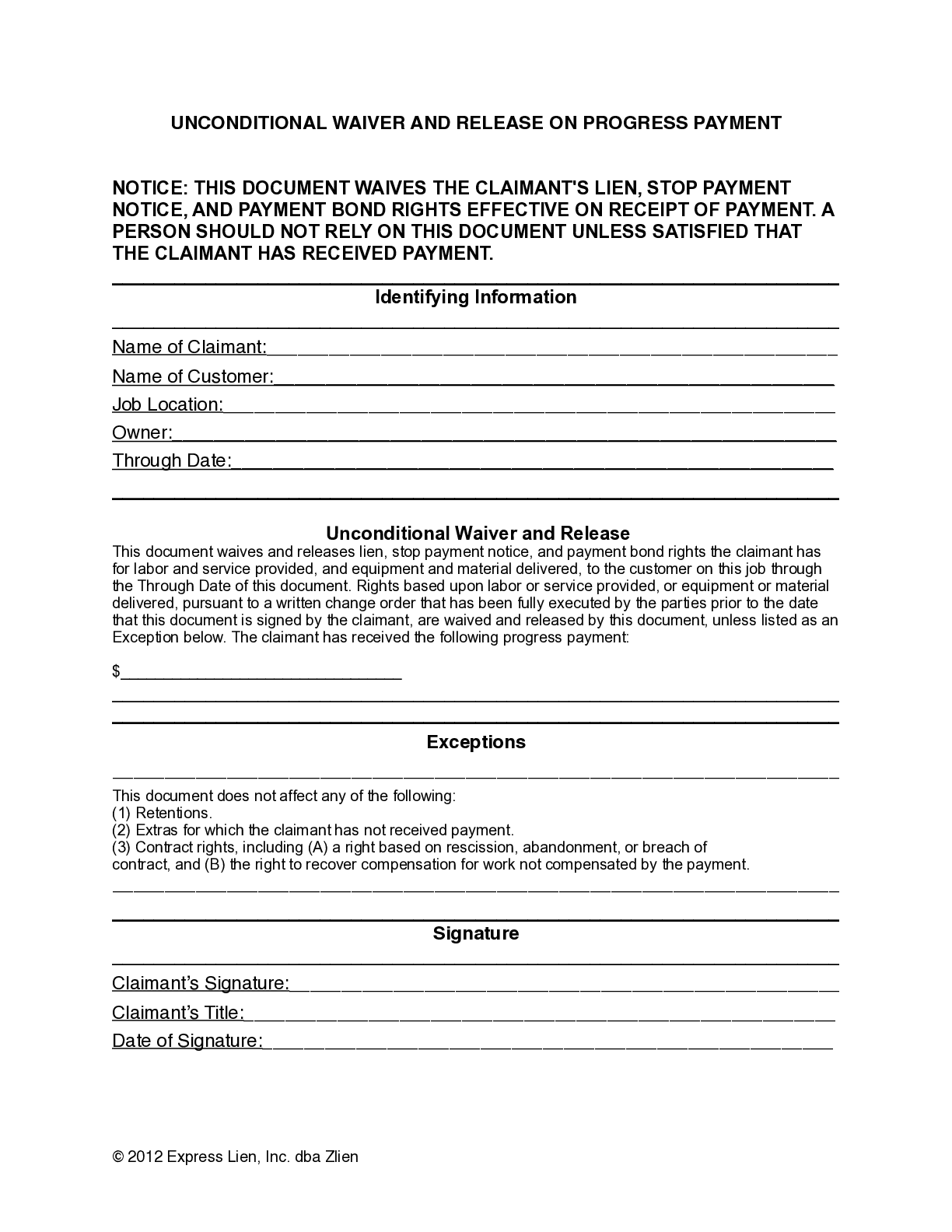

Ohio Lien Waiver FAQs, Guide, Forms, & Resources

A tax lien is filed with the county courts when a tax liability is referred for collection. The department of taxation does not forward. An official state of ohio site. The attorney general’s taxation section defends the state tax commissioner's administrative decisions to tax assessments, refund. Local governments in ohio may levy taxes on real property.

Property Taxes Are Imposed As A Lien Of The State Against The Property Until They Are.

The attorney general’s taxation section defends the state tax commissioner's administrative decisions to tax assessments, refund. The department of taxation does not forward. Local governments in ohio may levy taxes on real property. An official state of ohio site.