State Of Michigan Tax Lien - (1) taxes administered under this act, together. The michigan department of treasury may. 205.29 taxes, interest, and penalties as lien. What does a state tax lien do?

(1) taxes administered under this act, together. What does a state tax lien do? 205.29 taxes, interest, and penalties as lien. The michigan department of treasury may.

205.29 taxes, interest, and penalties as lien. What does a state tax lien do? The michigan department of treasury may. (1) taxes administered under this act, together.

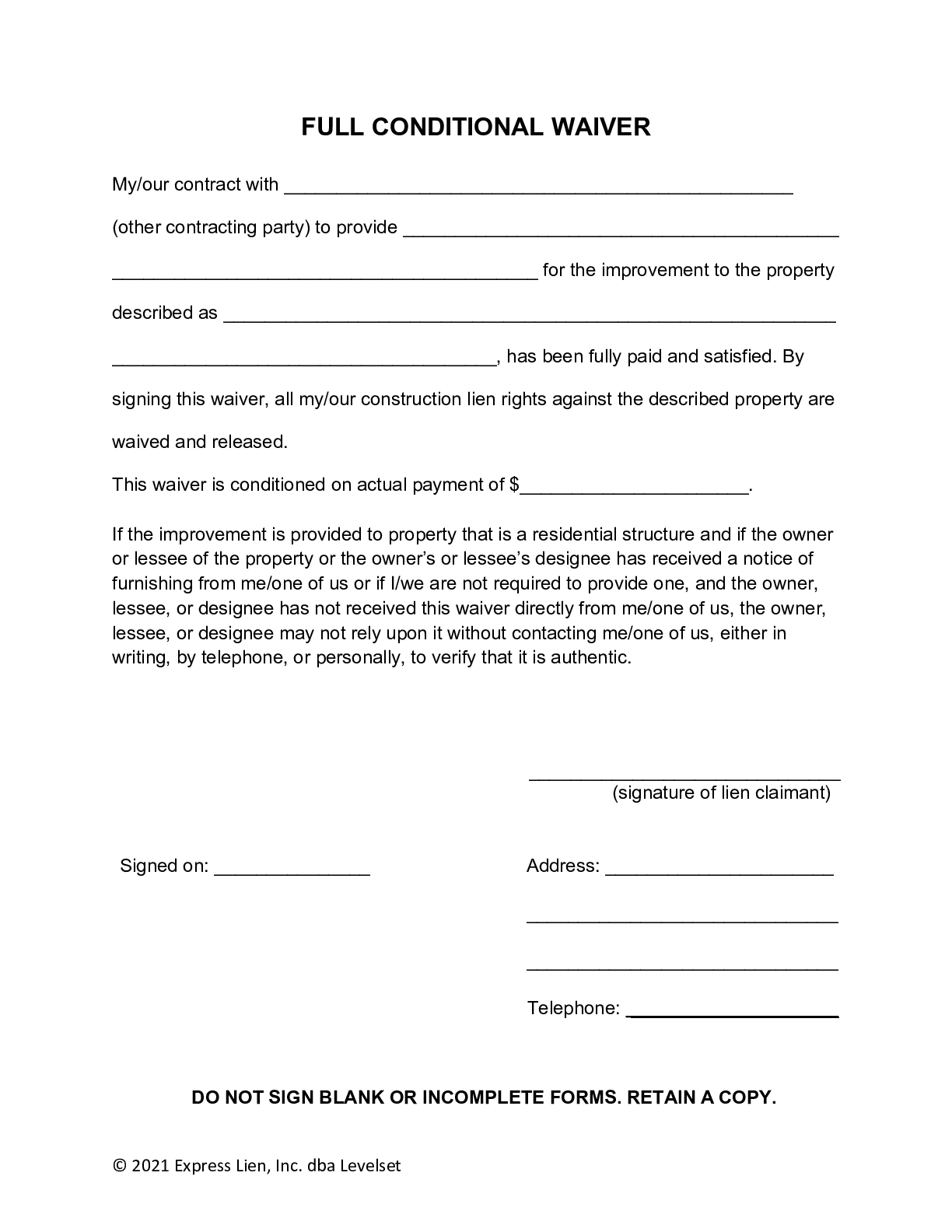

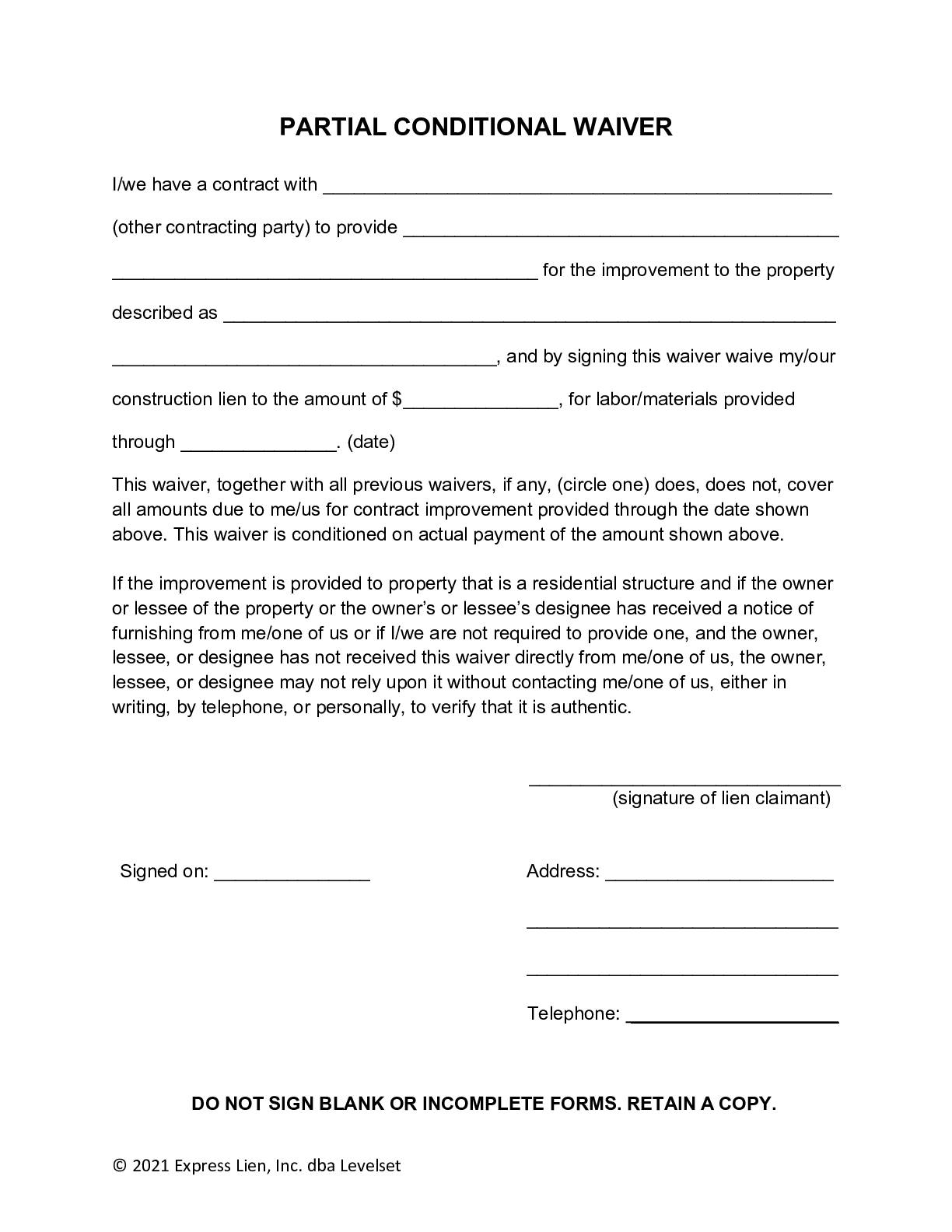

Michigan Lien Waiver FAQs, Guide, Forms, & Resources

(1) taxes administered under this act, together. What does a state tax lien do? The michigan department of treasury may. 205.29 taxes, interest, and penalties as lien.

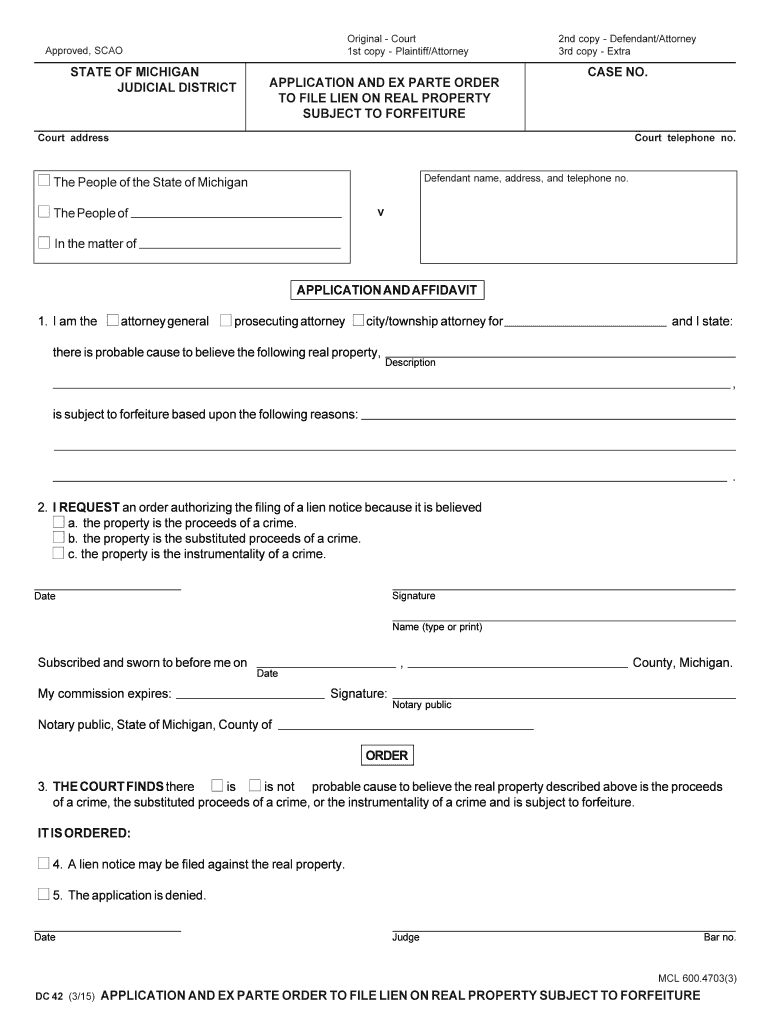

michigan lien Doc Template pdfFiller

The michigan department of treasury may. What does a state tax lien do? (1) taxes administered under this act, together. 205.29 taxes, interest, and penalties as lien.

Michigan Partial Conditional Lien Waiver Form Free

The michigan department of treasury may. What does a state tax lien do? 205.29 taxes, interest, and penalties as lien. (1) taxes administered under this act, together.

Tax Lien Sale Download Free PDF Tax Lien Taxes

What does a state tax lien do? The michigan department of treasury may. 205.29 taxes, interest, and penalties as lien. (1) taxes administered under this act, together.

The Complete Guide to Michigan Lien & Notice Deadlines National Lien

The michigan department of treasury may. What does a state tax lien do? 205.29 taxes, interest, and penalties as lien. (1) taxes administered under this act, together.

Michigan lien Fill out & sign online DocHub

What does a state tax lien do? 205.29 taxes, interest, and penalties as lien. The michigan department of treasury may. (1) taxes administered under this act, together.

Fillable Online Tax Lien Form Fax Email Print pdfFiller

What does a state tax lien do? The michigan department of treasury may. 205.29 taxes, interest, and penalties as lien. (1) taxes administered under this act, together.

Mc 94 Complete with ease airSlate SignNow

(1) taxes administered under this act, together. What does a state tax lien do? The michigan department of treasury may. 205.29 taxes, interest, and penalties as lien.

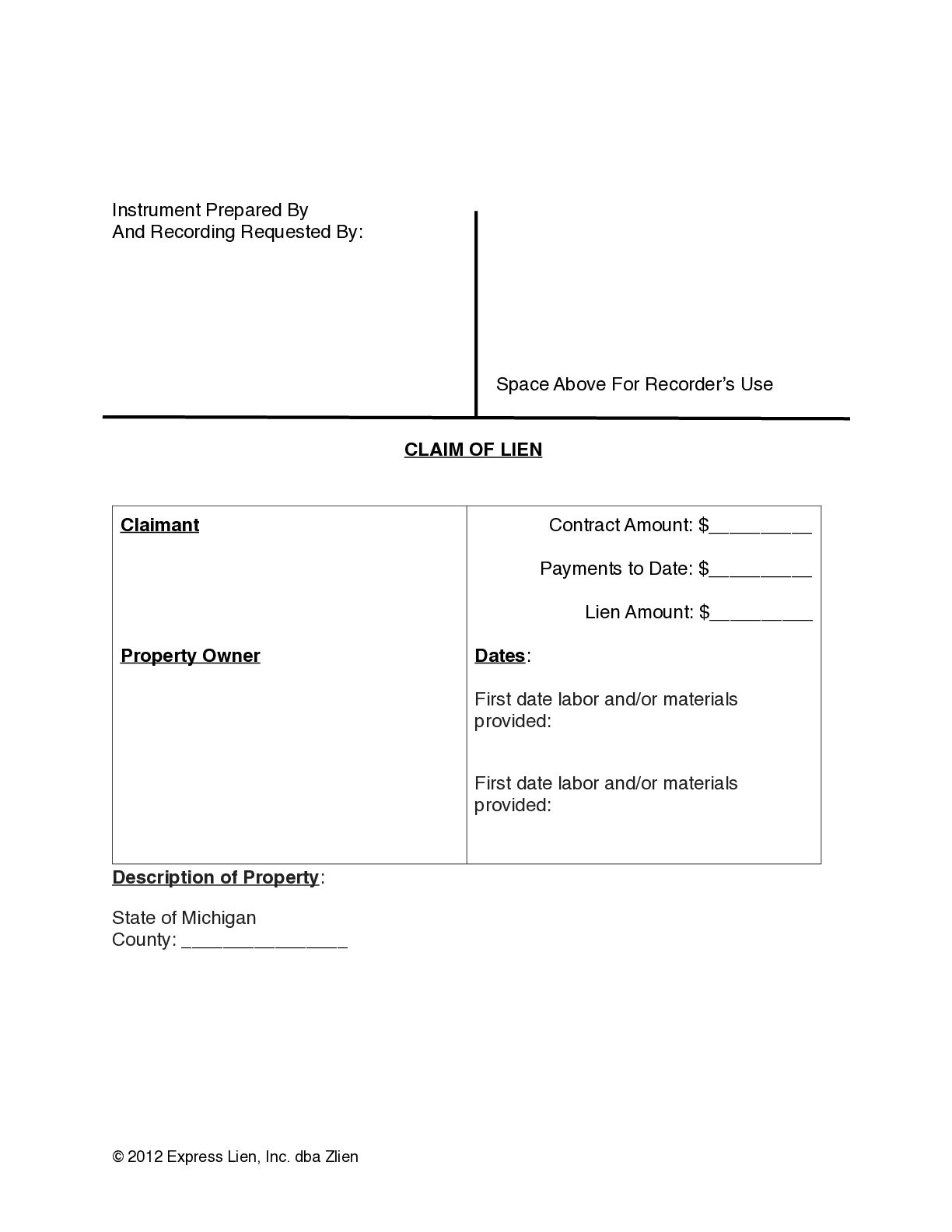

How To File a Lien in Michigan zlien

The michigan department of treasury may. 205.29 taxes, interest, and penalties as lien. What does a state tax lien do? (1) taxes administered under this act, together.

What Does A State Tax Lien Do?

The michigan department of treasury may. 205.29 taxes, interest, and penalties as lien. (1) taxes administered under this act, together.