Shelby County Tax Lien Sale - Effective april 2024, the chancery court clerk and master’s tax sales will be held online by sri through their website at. This is a sale of ownership,. Pay all delinquent taxes through the tax year initiating the sale. Tax sale properties are sold to the public for the amount of delinquent taxes due, plus any accrued interest, penalties, costs and other statutory. The shelby county trustee, in conjunction with shelby county chancery court, holds tax sales throughout the year to sell property for. General questions regarding the tax sale process. A complete listing for each sale may be printed for your convenience or. Is this a tax lien or a tax certificate sale? The shelby county trustee, in conjunction with the chancery court clerk's office, holds online tax sales throughout the year to sell property for. You can pay your delinquent taxes by mail or by coming into the office.

General questions regarding the tax sale process. Tax sale properties are sold to the public for the amount of delinquent taxes due, plus any accrued interest, penalties, costs and other statutory. The shelby county trustee, in conjunction with shelby county chancery court, holds tax sales throughout the year to sell property for. Properties for each sale are listed in parcel number order. Is this a tax lien or a tax certificate sale? This is a sale of ownership,. A complete listing for each sale may be printed for your convenience or. You can pay your delinquent taxes by mail or by coming into the office. The shelby county trustee, in conjunction with the chancery court clerk's office, holds online tax sales throughout the year to sell property for. Pay all delinquent taxes through the tax year initiating the sale.

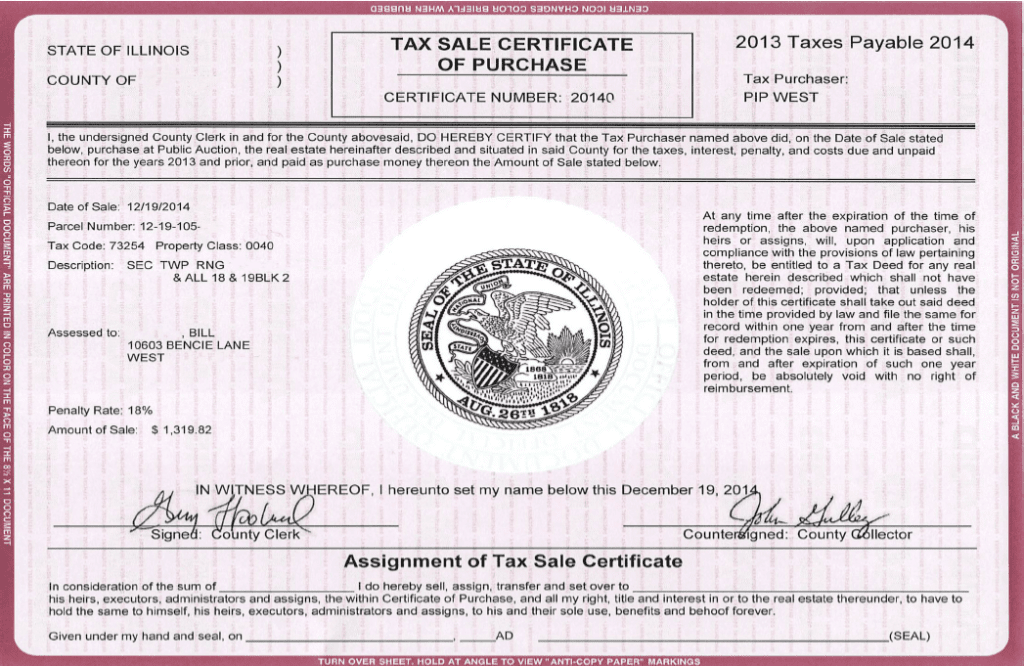

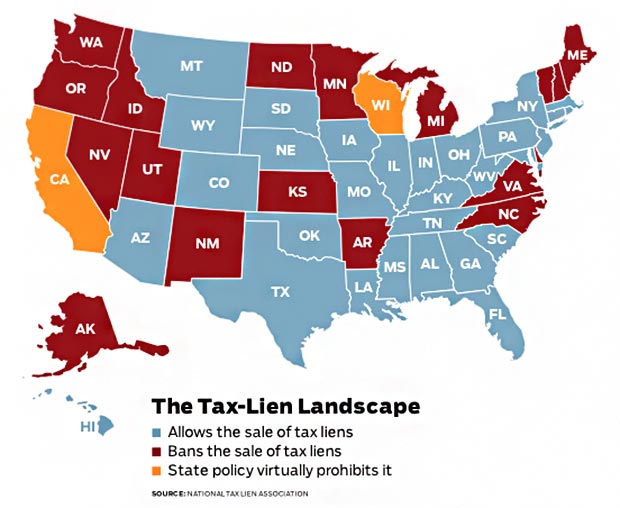

Is this a tax lien or a tax certificate sale? You can pay your delinquent taxes by mail or by coming into the office. The shelby county trustee, in conjunction with the chancery court clerk's office, holds online tax sales throughout the year to sell property for. Properties for each sale are listed in parcel number order. Tax sale properties are sold to the public for the amount of delinquent taxes due, plus any accrued interest, penalties, costs and other statutory. General questions regarding the tax sale process. The shelby county trustee does not offer tax lien certificates or make over the counter sales. This is a sale of ownership,. A complete listing for each sale may be printed for your convenience or. The shelby county trustee, in conjunction with shelby county chancery court, holds tax sales throughout the year to sell property for.

NYC Tax Lien Sale Reform Conference EastNewYorkCLT

The shelby county trustee does not offer tax lien certificates or make over the counter sales. General questions regarding the tax sale process. Effective april 2024, the chancery court clerk and master’s tax sales will be held online by sri through their website at. The shelby county trustee, in conjunction with the chancery court clerk's office, holds online tax sales.

Suffolk County Tax Lien Sale 2024 Marne Sharona

Effective april 2024, the chancery court clerk and master’s tax sales will be held online by sri through their website at. This is a sale of ownership,. You can pay your delinquent taxes by mail or by coming into the office. The shelby county trustee, in conjunction with shelby county chancery court, holds tax sales throughout the year to sell.

Suffolk County Tax Lien Sale 2024 Marne Sharona

This is a sale of ownership,. The shelby county trustee does not offer tax lien certificates or make over the counter sales. The shelby county trustee, in conjunction with shelby county chancery court, holds tax sales throughout the year to sell property for. Effective april 2024, the chancery court clerk and master’s tax sales will be held online by sri.

Charles County Tax Lien Sale 2024 Bryna Marleah

This is a sale of ownership,. Properties for each sale are listed in parcel number order. You can pay your delinquent taxes by mail or by coming into the office. Pay all delinquent taxes through the tax year initiating the sale. Tax sale properties are sold to the public for the amount of delinquent taxes due, plus any accrued interest,.

Maricopa County Tax Lien Sale 2024 Maure Shirlee

A complete listing for each sale may be printed for your convenience or. Is this a tax lien or a tax certificate sale? Properties for each sale are listed in parcel number order. Effective april 2024, the chancery court clerk and master’s tax sales will be held online by sri through their website at. Pay all delinquent taxes through the.

Tax Lien Sale San Juan County

The shelby county trustee does not offer tax lien certificates or make over the counter sales. The shelby county trustee, in conjunction with the chancery court clerk's office, holds online tax sales throughout the year to sell property for. Effective april 2024, the chancery court clerk and master’s tax sales will be held online by sri through their website at..

Tax Instructions Shelby County Net Profit License Fee Printable Pdf

You can pay your delinquent taxes by mail or by coming into the office. General questions regarding the tax sale process. The shelby county trustee, in conjunction with shelby county chancery court, holds tax sales throughout the year to sell property for. Effective april 2024, the chancery court clerk and master’s tax sales will be held online by sri through.

Mohave County Tax Lien Sale 2024 Dore Nancey

The shelby county trustee does not offer tax lien certificates or make over the counter sales. General questions regarding the tax sale process. Properties for each sale are listed in parcel number order. You can pay your delinquent taxes by mail or by coming into the office. Tax sale properties are sold to the public for the amount of delinquent.

Charles County Tax Lien Sale 2024 Bryna Marleah

Is this a tax lien or a tax certificate sale? You can pay your delinquent taxes by mail or by coming into the office. A complete listing for each sale may be printed for your convenience or. Tax sale properties are sold to the public for the amount of delinquent taxes due, plus any accrued interest, penalties, costs and other.

Shelby County Personal Property Tax Form

The shelby county trustee, in conjunction with the chancery court clerk's office, holds online tax sales throughout the year to sell property for. Effective april 2024, the chancery court clerk and master’s tax sales will be held online by sri through their website at. General questions regarding the tax sale process. You can pay your delinquent taxes by mail or.

Properties For Each Sale Are Listed In Parcel Number Order.

The shelby county trustee, in conjunction with shelby county chancery court, holds tax sales throughout the year to sell property for. You can pay your delinquent taxes by mail or by coming into the office. A complete listing for each sale may be printed for your convenience or. General questions regarding the tax sale process.

This Is A Sale Of Ownership,.

Pay all delinquent taxes through the tax year initiating the sale. The shelby county trustee does not offer tax lien certificates or make over the counter sales. The shelby county trustee, in conjunction with the chancery court clerk's office, holds online tax sales throughout the year to sell property for. Effective april 2024, the chancery court clerk and master’s tax sales will be held online by sri through their website at.

Is This A Tax Lien Or A Tax Certificate Sale?

Tax sale properties are sold to the public for the amount of delinquent taxes due, plus any accrued interest, penalties, costs and other statutory.