Seattle Local Sales Tax Rate 2023 - Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. Understanding seattle's combined sales tax rates in 2023. There is no applicable county tax or. The 10.35% sales tax rate in seattle consists of 6.5% washington state sales tax and 3.85% seattle tax. Washington has a 6.5% sales tax and king county collects an additional n/a, so the minimum sales tax rate in king county is 6.5% (not including.

The 10.35% sales tax rate in seattle consists of 6.5% washington state sales tax and 3.85% seattle tax. Washington has a 6.5% sales tax and king county collects an additional n/a, so the minimum sales tax rate in king county is 6.5% (not including. Understanding seattle's combined sales tax rates in 2023. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and. There is no applicable county tax or.

There is no applicable county tax or. Understanding seattle's combined sales tax rates in 2023. The 10.35% sales tax rate in seattle consists of 6.5% washington state sales tax and 3.85% seattle tax. Washington has a 6.5% sales tax and king county collects an additional n/a, so the minimum sales tax rate in king county is 6.5% (not including. Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%.

State & Local Sales Tax Rates 2023 Sales Tax Rates American Legal

Understanding seattle's combined sales tax rates in 2023. There is no applicable county tax or. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or.

State & Local Sales Tax Rates 2023 Sales Tax Rates American Legal

Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and. There is no applicable county tax or. Understanding seattle's combined sales tax rates in 2023. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up.

Ny Sales Tax Rate 2024 Reba Valera

Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and. Understanding seattle's combined sales tax rates in 2023. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. There is no applicable county.

Seattle Sales Tax Rate Changes

There is no applicable county tax or. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. Washington has a 6.5% sales tax and king county collects an additional n/a, so the minimum sales tax rate in king county is 6.5% (not including. Understanding seattle's combined.

Skagit County Sales Tax Rate 2024 Wilow Lisetta

Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. Understanding seattle's combined sales tax rates in 2023. The 10.35% sales tax rate.

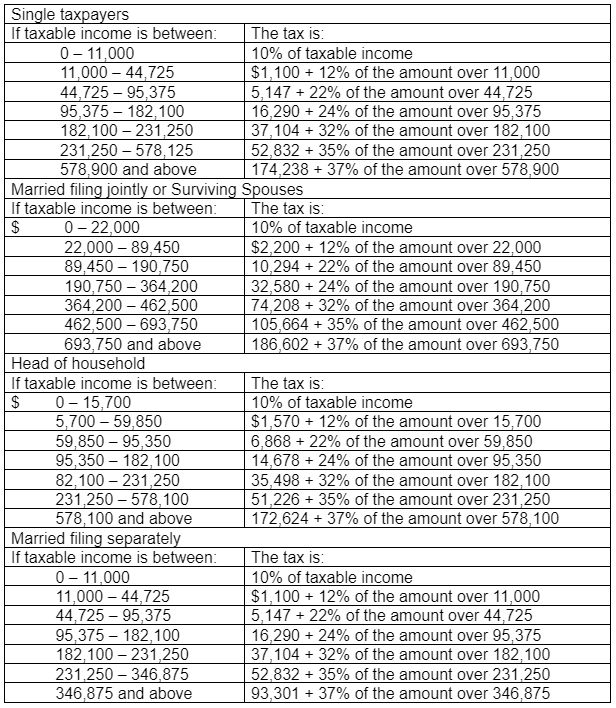

2023 Tax Rates And Deduction Amounts Sales Taxes VAT, GST Tax

There is no applicable county tax or. Washington has a 6.5% sales tax and king county collects an additional n/a, so the minimum sales tax rate in king county is 6.5% (not including. Understanding seattle's combined sales tax rates in 2023. Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles.

Seattle Washington State Sales Tax Rate 2023

Washington has a 6.5% sales tax and king county collects an additional n/a, so the minimum sales tax rate in king county is 6.5% (not including. The 10.35% sales tax rate in seattle consists of 6.5% washington state sales tax and 3.85% seattle tax. Lists of local sales & use tax rates and changes, as well as information for lodging.

Seattle Washington State Sales Tax Rate 2023

There is no applicable county tax or. Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and. Understanding seattle's combined sales tax rates in 2023. The 10.35% sales tax rate in seattle consists of 6.5% washington state sales tax and 3.85% seattle tax. 536 rows washington has.

Tax Return Chart 2023 Printable Forms Free Online

There is no applicable county tax or. 536 rows washington has state sales tax of 6.5%, and allows local governments to collect a local option sales tax of up to 3.1%. Understanding seattle's combined sales tax rates in 2023. The 10.35% sales tax rate in seattle consists of 6.5% washington state sales tax and 3.85% seattle tax. Lists of local.

Sales Tax In Seattle Washington 2024 Mufi Tabina

Washington has a 6.5% sales tax and king county collects an additional n/a, so the minimum sales tax rate in king county is 6.5% (not including. Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and. 536 rows washington has state sales tax of 6.5%, and allows.

There Is No Applicable County Tax Or.

Lists of local sales & use tax rates and changes, as well as information for lodging sales, motor vehicles sales or leases, and. Understanding seattle's combined sales tax rates in 2023. The 10.35% sales tax rate in seattle consists of 6.5% washington state sales tax and 3.85% seattle tax. Washington has a 6.5% sales tax and king county collects an additional n/a, so the minimum sales tax rate in king county is 6.5% (not including.