Property Tax Lien California - The lien will attach to any real property the assessee owns in los angeles county until the taxes, penalties, and costs are paid in full. If you don't pay your california property taxes, you could eventually lose your home through a tax sale. The california franchise tax board (ftb) can issue a state tax lien against your personal property if you have unpaid state taxes. Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory lien date).

The lien will attach to any real property the assessee owns in los angeles county until the taxes, penalties, and costs are paid in full. The california franchise tax board (ftb) can issue a state tax lien against your personal property if you have unpaid state taxes. Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory lien date). If you don't pay your california property taxes, you could eventually lose your home through a tax sale.

If you don't pay your california property taxes, you could eventually lose your home through a tax sale. Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory lien date). The california franchise tax board (ftb) can issue a state tax lien against your personal property if you have unpaid state taxes. The lien will attach to any real property the assessee owns in los angeles county until the taxes, penalties, and costs are paid in full.

Tax Lien California State Tax Lien

If you don't pay your california property taxes, you could eventually lose your home through a tax sale. Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory lien date). The lien will attach to any real property the assessee owns in los angeles county until the taxes, penalties, and.

Real Property Tax Lien Hymson Goldstein Pantiliat & Lohr, PLLC

If you don't pay your california property taxes, you could eventually lose your home through a tax sale. The california franchise tax board (ftb) can issue a state tax lien against your personal property if you have unpaid state taxes. The lien will attach to any real property the assessee owns in los angeles county until the taxes, penalties, and.

What is a property Tax Lien? Real Estate Articles by

Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory lien date). The california franchise tax board (ftb) can issue a state tax lien against your personal property if you have unpaid state taxes. The lien will attach to any real property the assessee owns in los angeles county until.

Tax Lien State Tax Lien California

If you don't pay your california property taxes, you could eventually lose your home through a tax sale. The lien will attach to any real property the assessee owns in los angeles county until the taxes, penalties, and costs are paid in full. Under california law, priority between state and federal tax liens is determined when each liability was first.

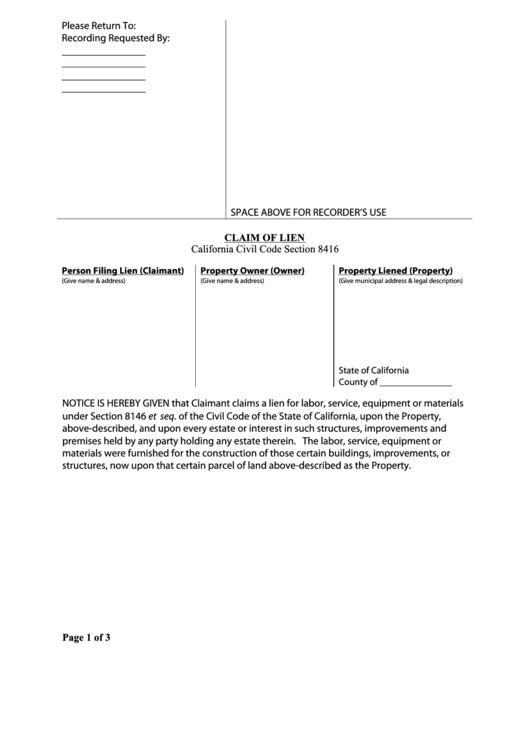

Claim Of Lien California printable pdf download

The california franchise tax board (ftb) can issue a state tax lien against your personal property if you have unpaid state taxes. The lien will attach to any real property the assessee owns in los angeles county until the taxes, penalties, and costs are paid in full. If you don't pay your california property taxes, you could eventually lose your.

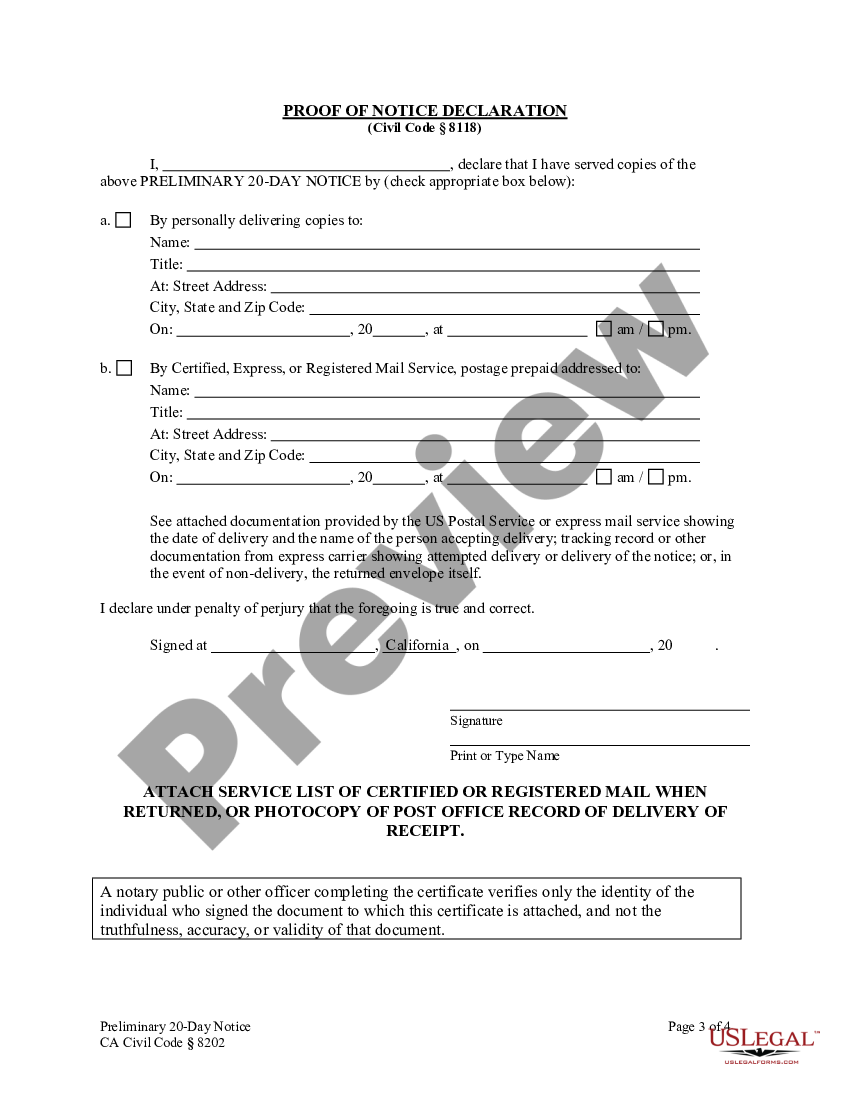

Ca Intent Lien Form Fill Online, Printable, Fillable, Blank pdfFiller

The california franchise tax board (ftb) can issue a state tax lien against your personal property if you have unpaid state taxes. If you don't pay your california property taxes, you could eventually lose your home through a tax sale. Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory.

California Property Lien Law at Mark Hayse blog

If you don't pay your california property taxes, you could eventually lose your home through a tax sale. The california franchise tax board (ftb) can issue a state tax lien against your personal property if you have unpaid state taxes. Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory.

Tax Lien California State Tax Lien

Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory lien date). The california franchise tax board (ftb) can issue a state tax lien against your personal property if you have unpaid state taxes. If you don't pay your california property taxes, you could eventually lose your home through a.

Tax Lien Sale Download Free PDF Tax Lien Taxes

If you don't pay your california property taxes, you could eventually lose your home through a tax sale. Under california law, priority between state and federal tax liens is determined when each liability was first created (the statutory lien date). The lien will attach to any real property the assessee owns in los angeles county until the taxes, penalties, and.

Investing in Tax Lien Seminars and Courses

If you don't pay your california property taxes, you could eventually lose your home through a tax sale. The lien will attach to any real property the assessee owns in los angeles county until the taxes, penalties, and costs are paid in full. Under california law, priority between state and federal tax liens is determined when each liability was first.

Under California Law, Priority Between State And Federal Tax Liens Is Determined When Each Liability Was First Created (The Statutory Lien Date).

If you don't pay your california property taxes, you could eventually lose your home through a tax sale. The lien will attach to any real property the assessee owns in los angeles county until the taxes, penalties, and costs are paid in full. The california franchise tax board (ftb) can issue a state tax lien against your personal property if you have unpaid state taxes.