Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet - Shoeboxed is an expense & receipt. Mileage…only the expenses incurred to operate the truck during that time such as fuel, tolls, scales, etc., would likely be deductible. You cannot legitimately deduct for downtime (with. In order for an expense to be deductible, it must be considered. Truck driver tax deductions the purpose of this worksheet is to help you organize your tax deductible business expenses.

Truck driver tax deductions the purpose of this worksheet is to help you organize your tax deductible business expenses. In order for an expense to be deductible, it must be considered. Shoeboxed is an expense & receipt. Mileage…only the expenses incurred to operate the truck during that time such as fuel, tolls, scales, etc., would likely be deductible. You cannot legitimately deduct for downtime (with.

Shoeboxed is an expense & receipt. In order for an expense to be deductible, it must be considered. Mileage…only the expenses incurred to operate the truck during that time such as fuel, tolls, scales, etc., would likely be deductible. You cannot legitimately deduct for downtime (with. Truck driver tax deductions the purpose of this worksheet is to help you organize your tax deductible business expenses.

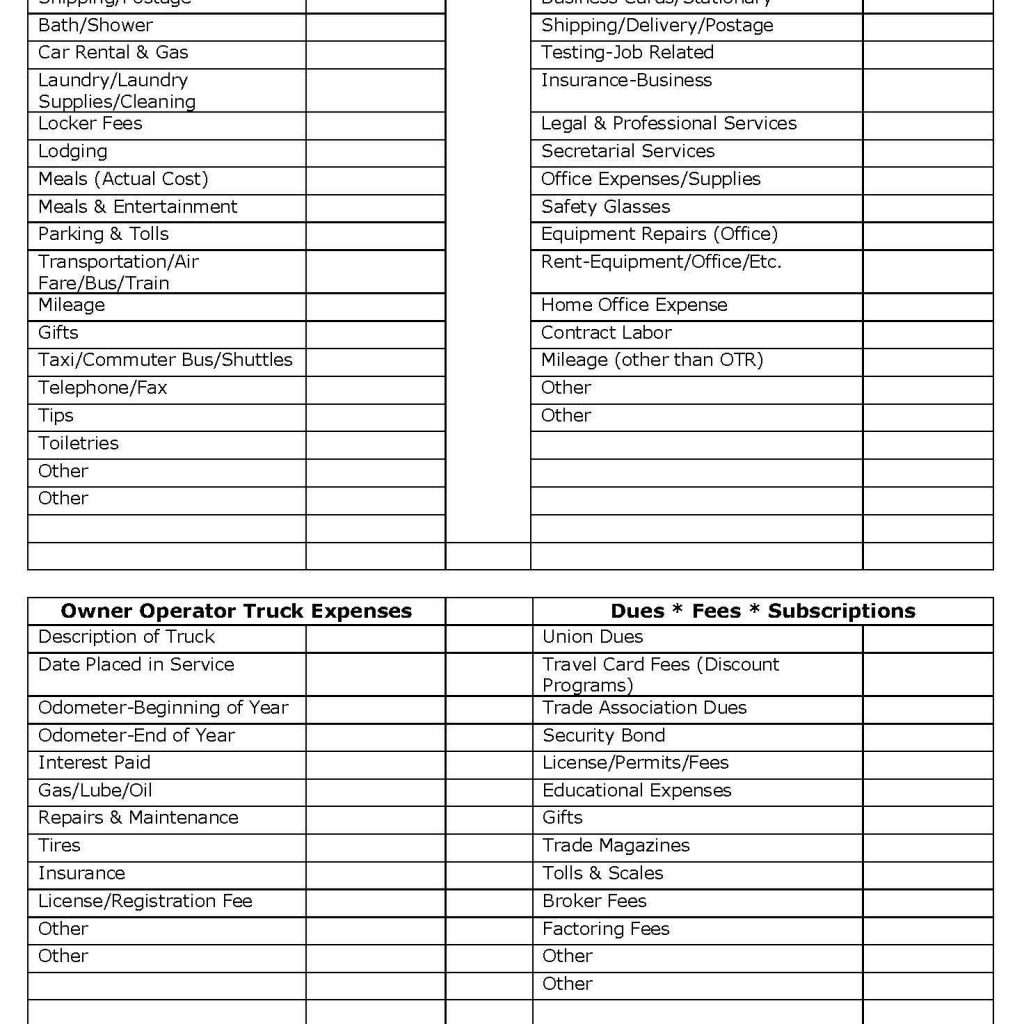

Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet

Shoeboxed is an expense & receipt. You cannot legitimately deduct for downtime (with. Mileage…only the expenses incurred to operate the truck during that time such as fuel, tolls, scales, etc., would likely be deductible. In order for an expense to be deductible, it must be considered. Truck driver tax deductions the purpose of this worksheet is to help you organize.

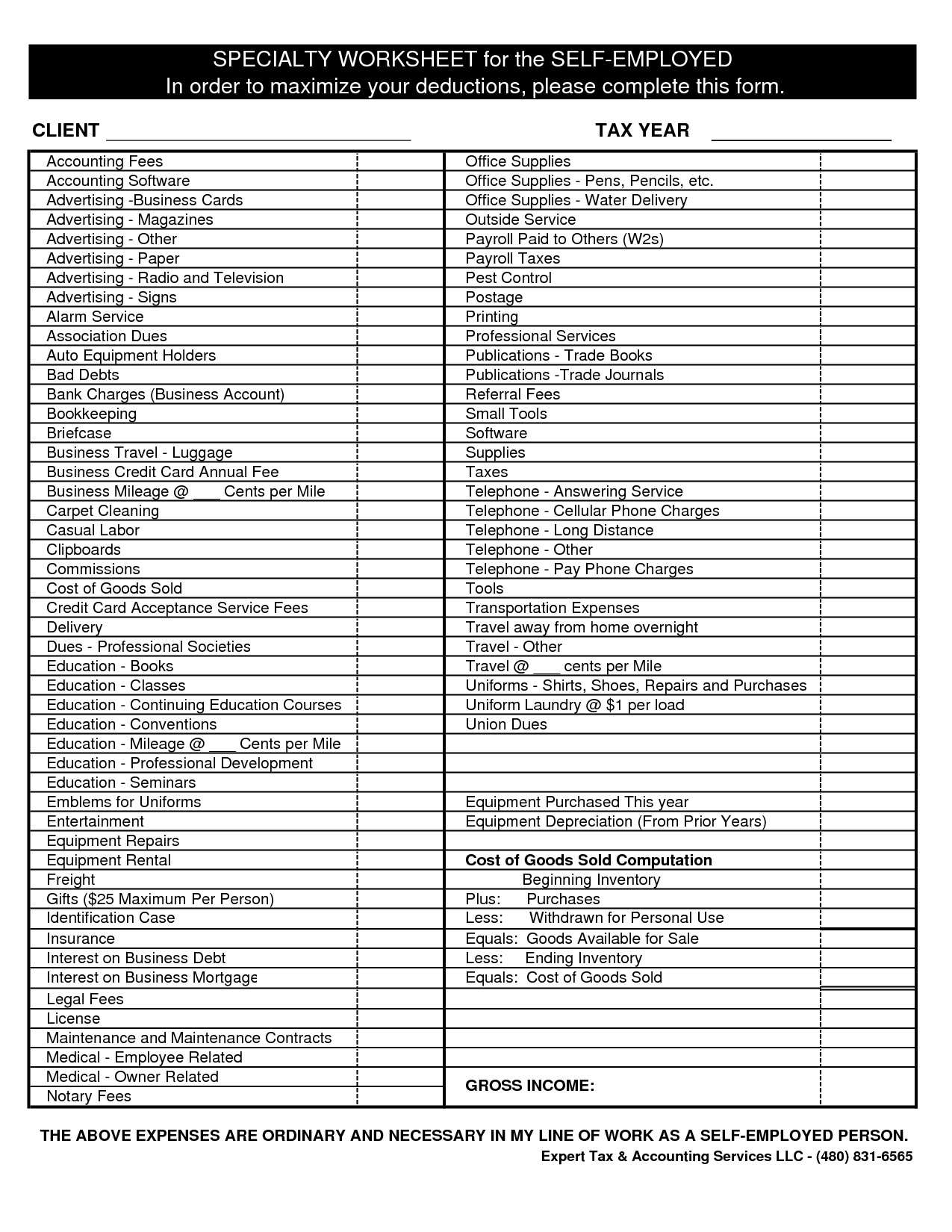

The OwnerOperator's Quick Guide to Taxes (2024)

In order for an expense to be deductible, it must be considered. You cannot legitimately deduct for downtime (with. Shoeboxed is an expense & receipt. Mileage…only the expenses incurred to operate the truck during that time such as fuel, tolls, scales, etc., would likely be deductible. Truck driver tax deductions the purpose of this worksheet is to help you organize.

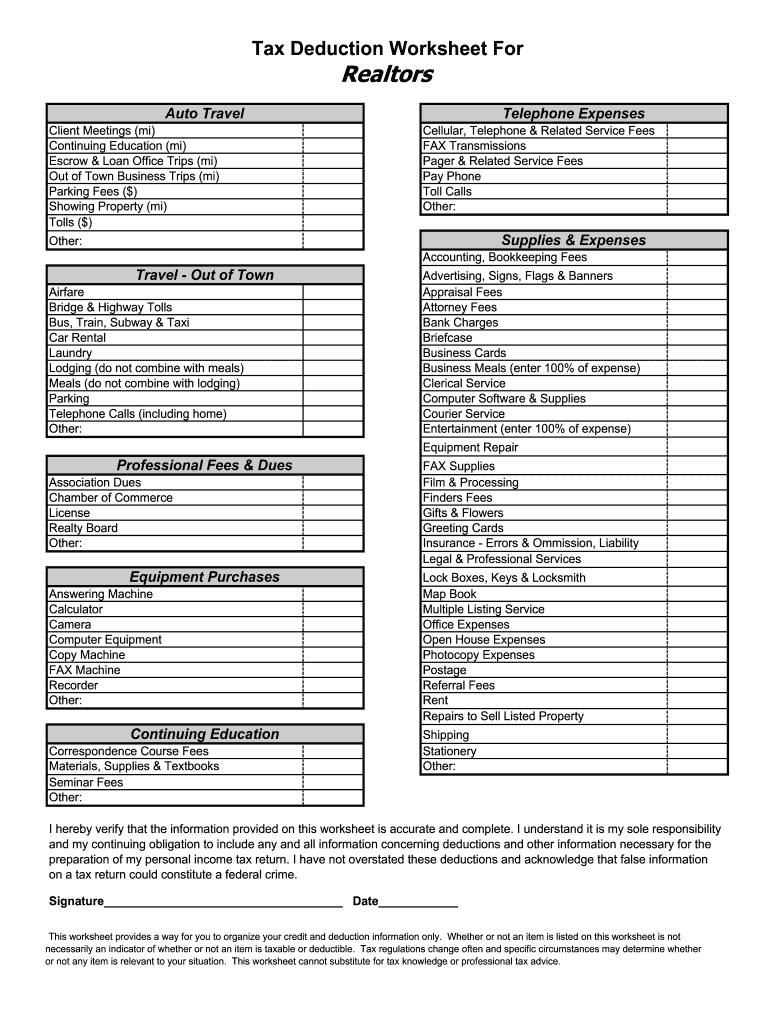

Real Estate Agent Tax Deductions Worksheet 2022 Fill Online

In order for an expense to be deductible, it must be considered. Mileage…only the expenses incurred to operate the truck during that time such as fuel, tolls, scales, etc., would likely be deductible. Truck driver tax deductions the purpose of this worksheet is to help you organize your tax deductible business expenses. You cannot legitimately deduct for downtime (with. Shoeboxed.

Printable Truck Driver Expense Owner Operator Tax Deductions

Mileage…only the expenses incurred to operate the truck during that time such as fuel, tolls, scales, etc., would likely be deductible. You cannot legitimately deduct for downtime (with. Shoeboxed is an expense & receipt. In order for an expense to be deductible, it must be considered. Truck driver tax deductions the purpose of this worksheet is to help you organize.

Free Owner Operator Expense Spreadsheet within Trucking Business

Shoeboxed is an expense & receipt. Mileage…only the expenses incurred to operate the truck during that time such as fuel, tolls, scales, etc., would likely be deductible. Truck driver tax deductions the purpose of this worksheet is to help you organize your tax deductible business expenses. In order for an expense to be deductible, it must be considered. You cannot.

Printable Truck Driver Expense Owner Operator Tax Deductions

You cannot legitimately deduct for downtime (with. In order for an expense to be deductible, it must be considered. Mileage…only the expenses incurred to operate the truck during that time such as fuel, tolls, scales, etc., would likely be deductible. Truck driver tax deductions the purpose of this worksheet is to help you organize your tax deductible business expenses. Shoeboxed.

Truck Driver Tax Deductions Worksheets

Shoeboxed is an expense & receipt. In order for an expense to be deductible, it must be considered. Mileage…only the expenses incurred to operate the truck during that time such as fuel, tolls, scales, etc., would likely be deductible. Truck driver tax deductions the purpose of this worksheet is to help you organize your tax deductible business expenses. You cannot.

Printable Truck Driver Expense Owner Operator Tax Deductions

Shoeboxed is an expense & receipt. Mileage…only the expenses incurred to operate the truck during that time such as fuel, tolls, scales, etc., would likely be deductible. In order for an expense to be deductible, it must be considered. Truck driver tax deductions the purpose of this worksheet is to help you organize your tax deductible business expenses. You cannot.

Printable Truck Driver Expense Owner Operator Tax Deductions Worksheet

Truck driver tax deductions the purpose of this worksheet is to help you organize your tax deductible business expenses. Mileage…only the expenses incurred to operate the truck during that time such as fuel, tolls, scales, etc., would likely be deductible. Shoeboxed is an expense & receipt. In order for an expense to be deductible, it must be considered. You cannot.

Truck Driver Expense Spreadsheet —

Mileage…only the expenses incurred to operate the truck during that time such as fuel, tolls, scales, etc., would likely be deductible. Shoeboxed is an expense & receipt. Truck driver tax deductions the purpose of this worksheet is to help you organize your tax deductible business expenses. You cannot legitimately deduct for downtime (with. In order for an expense to be.

You Cannot Legitimately Deduct For Downtime (With.

Mileage…only the expenses incurred to operate the truck during that time such as fuel, tolls, scales, etc., would likely be deductible. In order for an expense to be deductible, it must be considered. Truck driver tax deductions the purpose of this worksheet is to help you organize your tax deductible business expenses. Shoeboxed is an expense & receipt.