Payroll Project Chapter 7 Answers 2022 - (as you complete your work, answer the following questions.). What is the amount of oasdi withheld for norman a. Q payroll project chapter 7 textbook is payroll accounting 2022 edition december 3 deposit with the state of pennsylvania Journalize transfer of cash to the payroll cash account, the payroll entry, and payroll tax entry;

(as you complete your work, answer the following questions.). What is the amount of oasdi withheld for norman a. Journalize transfer of cash to the payroll cash account, the payroll entry, and payroll tax entry; Q payroll project chapter 7 textbook is payroll accounting 2022 edition december 3 deposit with the state of pennsylvania

Journalize transfer of cash to the payroll cash account, the payroll entry, and payroll tax entry; Q payroll project chapter 7 textbook is payroll accounting 2022 edition december 3 deposit with the state of pennsylvania What is the amount of oasdi withheld for norman a. (as you complete your work, answer the following questions.).

One month project from chapter 7 of “payroll

(as you complete your work, answer the following questions.). What is the amount of oasdi withheld for norman a. Journalize transfer of cash to the payroll cash account, the payroll entry, and payroll tax entry; Q payroll project chapter 7 textbook is payroll accounting 2022 edition december 3 deposit with the state of pennsylvania

hello,i need the answers for Chapter 7

(as you complete your work, answer the following questions.). Q payroll project chapter 7 textbook is payroll accounting 2022 edition december 3 deposit with the state of pennsylvania What is the amount of oasdi withheld for norman a. Journalize transfer of cash to the payroll cash account, the payroll entry, and payroll tax entry;

Hello, I needs answers for the payroll accounting chapter 7... Course

What is the amount of oasdi withheld for norman a. (as you complete your work, answer the following questions.). Journalize transfer of cash to the payroll cash account, the payroll entry, and payroll tax entry; Q payroll project chapter 7 textbook is payroll accounting 2022 edition december 3 deposit with the state of pennsylvania

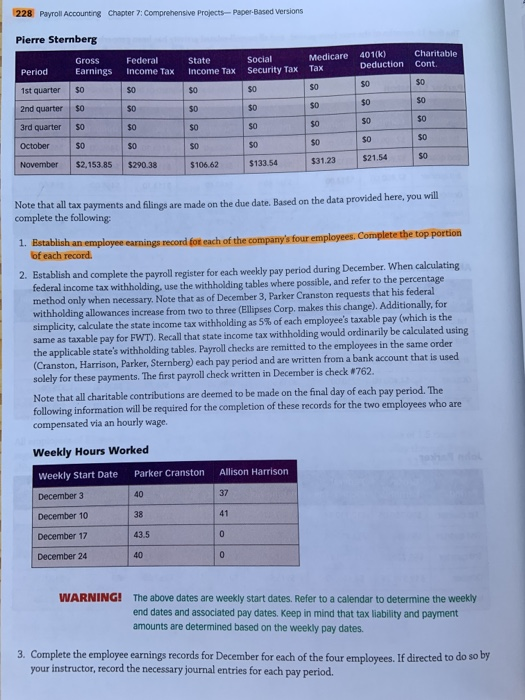

76 CHAPTER 7. Paytoll Project Payroll Accounting

(as you complete your work, answer the following questions.). What is the amount of oasdi withheld for norman a. Journalize transfer of cash to the payroll cash account, the payroll entry, and payroll tax entry; Q payroll project chapter 7 textbook is payroll accounting 2022 edition december 3 deposit with the state of pennsylvania

I needs answers for the payroll accounting chapter 7 project. The

Journalize transfer of cash to the payroll cash account, the payroll entry, and payroll tax entry; (as you complete your work, answer the following questions.). Q payroll project chapter 7 textbook is payroll accounting 2022 edition december 3 deposit with the state of pennsylvania What is the amount of oasdi withheld for norman a.

Payroll Project Chapter 7 2019 PDF Payroll Tax Debits And Credits

What is the amount of oasdi withheld for norman a. Journalize transfer of cash to the payroll cash account, the payroll entry, and payroll tax entry; (as you complete your work, answer the following questions.). Q payroll project chapter 7 textbook is payroll accounting 2022 edition december 3 deposit with the state of pennsylvania

I needs answers for the payroll accounting chapter 7 project. The

What is the amount of oasdi withheld for norman a. Q payroll project chapter 7 textbook is payroll accounting 2022 edition december 3 deposit with the state of pennsylvania (as you complete your work, answer the following questions.). Journalize transfer of cash to the payroll cash account, the payroll entry, and payroll tax entry;

I needs answers for the payroll accounting chapter 7 project. The

What is the amount of oasdi withheld for norman a. Q payroll project chapter 7 textbook is payroll accounting 2022 edition december 3 deposit with the state of pennsylvania (as you complete your work, answer the following questions.). Journalize transfer of cash to the payroll cash account, the payroll entry, and payroll tax entry;

SOLUTION Excel Payroll Project Chapter 7 Studypool

Journalize transfer of cash to the payroll cash account, the payroll entry, and payroll tax entry; (as you complete your work, answer the following questions.). Q payroll project chapter 7 textbook is payroll accounting 2022 edition december 3 deposit with the state of pennsylvania What is the amount of oasdi withheld for norman a.

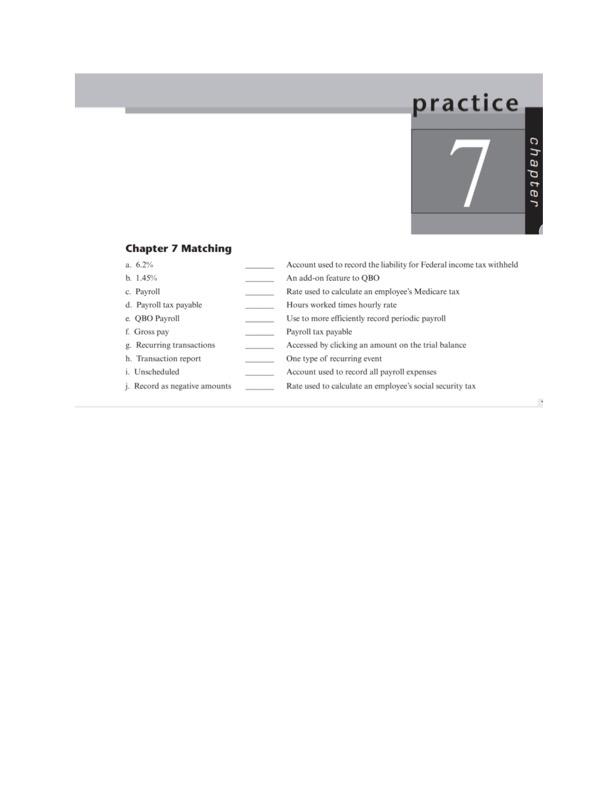

Solved practice 7. chapter Chapter 7 Matching 1.49 cPayroll

(as you complete your work, answer the following questions.). Journalize transfer of cash to the payroll cash account, the payroll entry, and payroll tax entry; What is the amount of oasdi withheld for norman a. Q payroll project chapter 7 textbook is payroll accounting 2022 edition december 3 deposit with the state of pennsylvania

(As You Complete Your Work, Answer The Following Questions.).

Q payroll project chapter 7 textbook is payroll accounting 2022 edition december 3 deposit with the state of pennsylvania What is the amount of oasdi withheld for norman a. Journalize transfer of cash to the payroll cash account, the payroll entry, and payroll tax entry;