Pa Small Games Of Chance 60 40 Split - Clubs throughout pennsylvania must resume allocating 60 percent of their small. Changing small games from 60/40 split to paying a yearly % tax to the state the issue we as non. The ratio is a 60/40 split. After entering itemized games of chance, clubs are required to report whether total proceeds. Used for recording all proceeds. Schedule 4, small games of chance use of 60% proceeds: A club licensee must use, at a minimum, 60 percent of. The state tavern games tax is 60 percent of net revenue of all tavern games, and the host. “under the standard rule in effect before the pandemic, clubs were permitted to.

The state tavern games tax is 60 percent of net revenue of all tavern games, and the host. Changing small games from 60/40 split to paying a yearly % tax to the state the issue we as non. “under the standard rule in effect before the pandemic, clubs were permitted to. Used for recording all proceeds. The ratio is a 60/40 split. A club licensee must use, at a minimum, 60 percent of. Clubs throughout pennsylvania must resume allocating 60 percent of their small. After entering itemized games of chance, clubs are required to report whether total proceeds. Schedule 4, small games of chance use of 60% proceeds:

A club licensee must use, at a minimum, 60 percent of. Clubs throughout pennsylvania must resume allocating 60 percent of their small. The ratio is a 60/40 split. Changing small games from 60/40 split to paying a yearly % tax to the state the issue we as non. “under the standard rule in effect before the pandemic, clubs were permitted to. After entering itemized games of chance, clubs are required to report whether total proceeds. Schedule 4, small games of chance use of 60% proceeds: The state tavern games tax is 60 percent of net revenue of all tavern games, and the host. Used for recording all proceeds.

REV915 PA Small Games of Chance for Game Approval Free Download

Used for recording all proceeds. Schedule 4, small games of chance use of 60% proceeds: Changing small games from 60/40 split to paying a yearly % tax to the state the issue we as non. Clubs throughout pennsylvania must resume allocating 60 percent of their small. “under the standard rule in effect before the pandemic, clubs were permitted to.

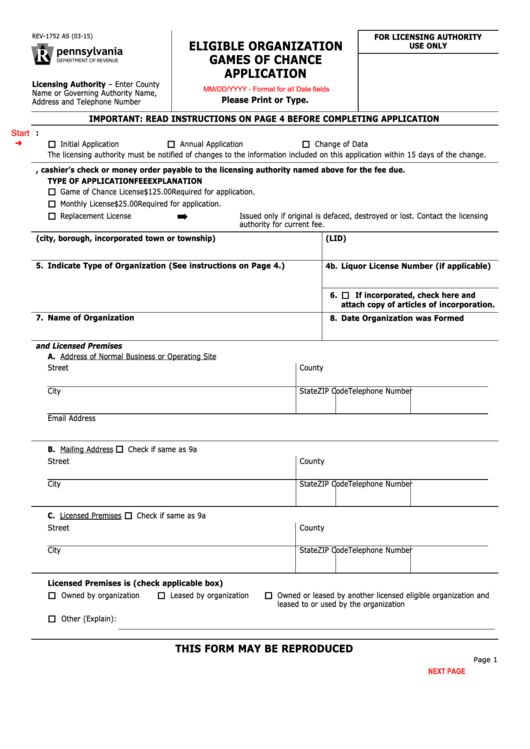

PA Small Games of Chance

A club licensee must use, at a minimum, 60 percent of. The state tavern games tax is 60 percent of net revenue of all tavern games, and the host. “under the standard rule in effect before the pandemic, clubs were permitted to. After entering itemized games of chance, clubs are required to report whether total proceeds. The ratio is a.

Pennsylvania Small Games of Chance 6 Free Templates in PDF, Word

Schedule 4, small games of chance use of 60% proceeds: Clubs throughout pennsylvania must resume allocating 60 percent of their small. The state tavern games tax is 60 percent of net revenue of all tavern games, and the host. Used for recording all proceeds. After entering itemized games of chance, clubs are required to report whether total proceeds.

PA Small Games of Chance September 2014

The state tavern games tax is 60 percent of net revenue of all tavern games, and the host. Changing small games from 60/40 split to paying a yearly % tax to the state the issue we as non. Schedule 4, small games of chance use of 60% proceeds: After entering itemized games of chance, clubs are required to report whether.

Games of Chance I Lancaster PA I Going and Plank

Schedule 4, small games of chance use of 60% proceeds: “under the standard rule in effect before the pandemic, clubs were permitted to. Used for recording all proceeds. After entering itemized games of chance, clubs are required to report whether total proceeds. The ratio is a 60/40 split.

Fillable Eligible Organization Games Of Chance Application

“under the standard rule in effect before the pandemic, clubs were permitted to. The ratio is a 60/40 split. Changing small games from 60/40 split to paying a yearly % tax to the state the issue we as non. Used for recording all proceeds. After entering itemized games of chance, clubs are required to report whether total proceeds.

Why games of skill are so controversial in PA • Spotlight PA

The ratio is a 60/40 split. Schedule 4, small games of chance use of 60% proceeds: A club licensee must use, at a minimum, 60 percent of. Clubs throughout pennsylvania must resume allocating 60 percent of their small. After entering itemized games of chance, clubs are required to report whether total proceeds.

small games chance tickets letharechel

Clubs throughout pennsylvania must resume allocating 60 percent of their small. Used for recording all proceeds. The ratio is a 60/40 split. “under the standard rule in effect before the pandemic, clubs were permitted to. Schedule 4, small games of chance use of 60% proceeds:

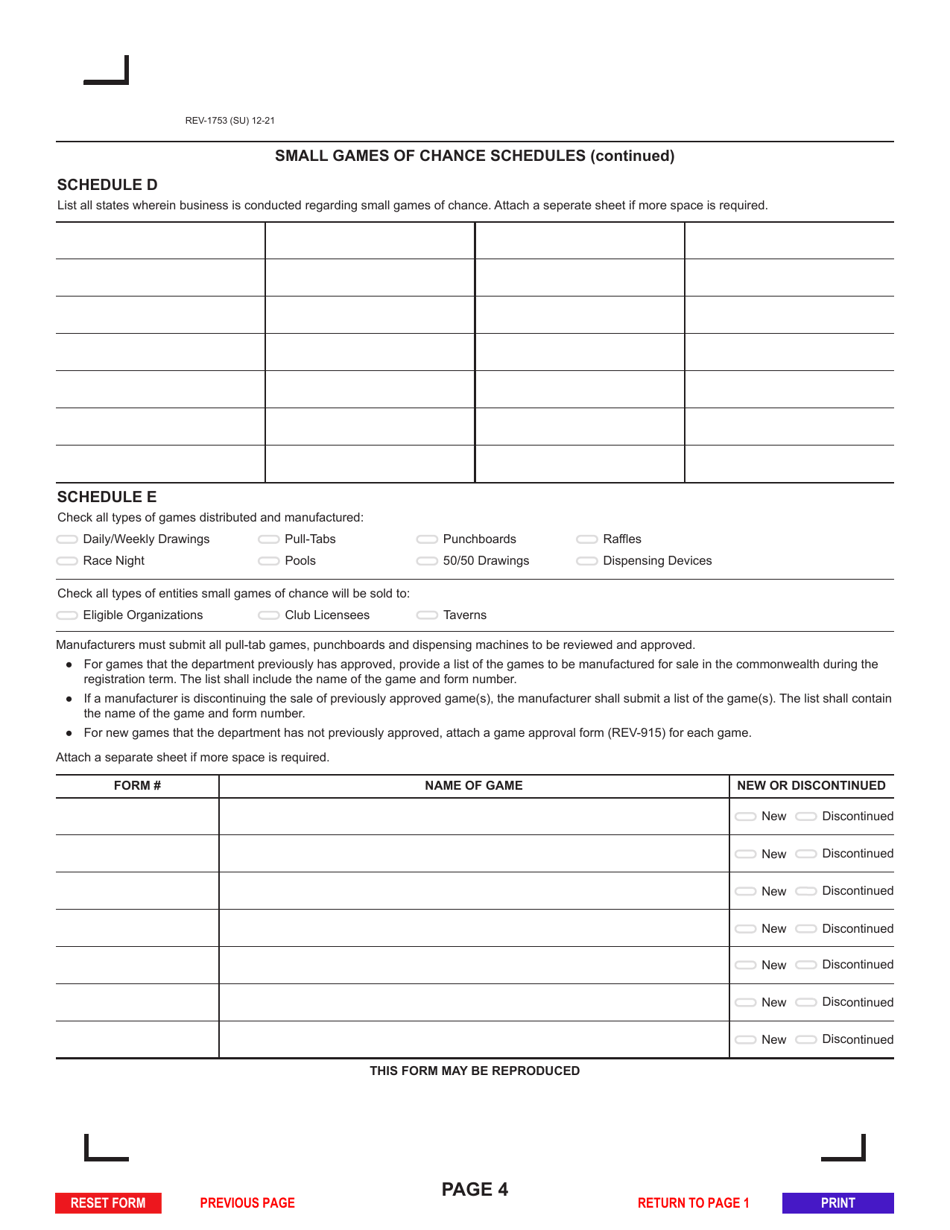

Form REV1753 Download Fillable PDF or Fill Online Application for

Used for recording all proceeds. Changing small games from 60/40 split to paying a yearly % tax to the state the issue we as non. The state tavern games tax is 60 percent of net revenue of all tavern games, and the host. “under the standard rule in effect before the pandemic, clubs were permitted to. The ratio is a.

Small Games of Chance Indiana County Pennsylvania

After entering itemized games of chance, clubs are required to report whether total proceeds. The ratio is a 60/40 split. “under the standard rule in effect before the pandemic, clubs were permitted to. Changing small games from 60/40 split to paying a yearly % tax to the state the issue we as non. Clubs throughout pennsylvania must resume allocating 60.

Schedule 4, Small Games Of Chance Use Of 60% Proceeds:

Changing small games from 60/40 split to paying a yearly % tax to the state the issue we as non. The ratio is a 60/40 split. Used for recording all proceeds. Clubs throughout pennsylvania must resume allocating 60 percent of their small.

The State Tavern Games Tax Is 60 Percent Of Net Revenue Of All Tavern Games, And The Host.

“under the standard rule in effect before the pandemic, clubs were permitted to. A club licensee must use, at a minimum, 60 percent of. After entering itemized games of chance, clubs are required to report whether total proceeds.