Notice Of Tax Lien And Demand For Payment Virginia - When a tax account becomes delinquent, the taxpayer should be sent a delinquent notice. You want to get the letter out as soon as possible,. The tax commissioner may file a memorandum of lien in the circuit court clerk's office of the county or city in which the taxpayer's place of. On company letterhead or on the lien notice,. If your notice was from the virginia department of taxation, it could be a “notice of intent to file memorandum of lien.” or, it could be the more. If you can't pay in full, you may be able to set up a payment plan. If any taxes or fees, including penalties and interest, assessed by the department of taxation in pursuance of law. If you do not resolve your tax bills on time, we may proceed with collections. If the employee the tax lien was issued for no longer works for my company, what do i do?

When a tax account becomes delinquent, the taxpayer should be sent a delinquent notice. On company letterhead or on the lien notice,. You want to get the letter out as soon as possible,. If your notice was from the virginia department of taxation, it could be a “notice of intent to file memorandum of lien.” or, it could be the more. If you can't pay in full, you may be able to set up a payment plan. If the employee the tax lien was issued for no longer works for my company, what do i do? If you do not resolve your tax bills on time, we may proceed with collections. The tax commissioner may file a memorandum of lien in the circuit court clerk's office of the county or city in which the taxpayer's place of. If any taxes or fees, including penalties and interest, assessed by the department of taxation in pursuance of law.

On company letterhead or on the lien notice,. If you do not resolve your tax bills on time, we may proceed with collections. You want to get the letter out as soon as possible,. If your notice was from the virginia department of taxation, it could be a “notice of intent to file memorandum of lien.” or, it could be the more. If you can't pay in full, you may be able to set up a payment plan. The tax commissioner may file a memorandum of lien in the circuit court clerk's office of the county or city in which the taxpayer's place of. When a tax account becomes delinquent, the taxpayer should be sent a delinquent notice. If the employee the tax lien was issued for no longer works for my company, what do i do? If any taxes or fees, including penalties and interest, assessed by the department of taxation in pursuance of law.

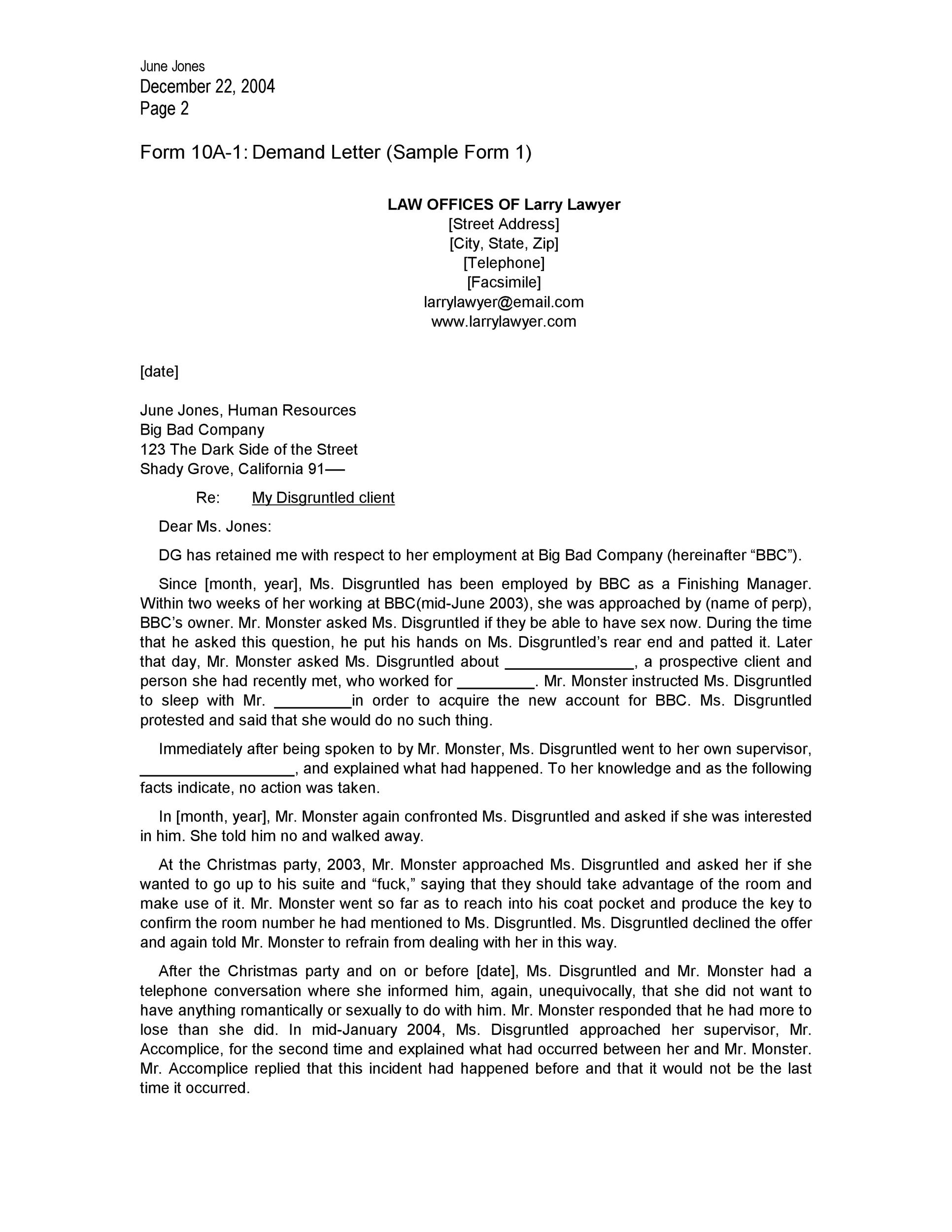

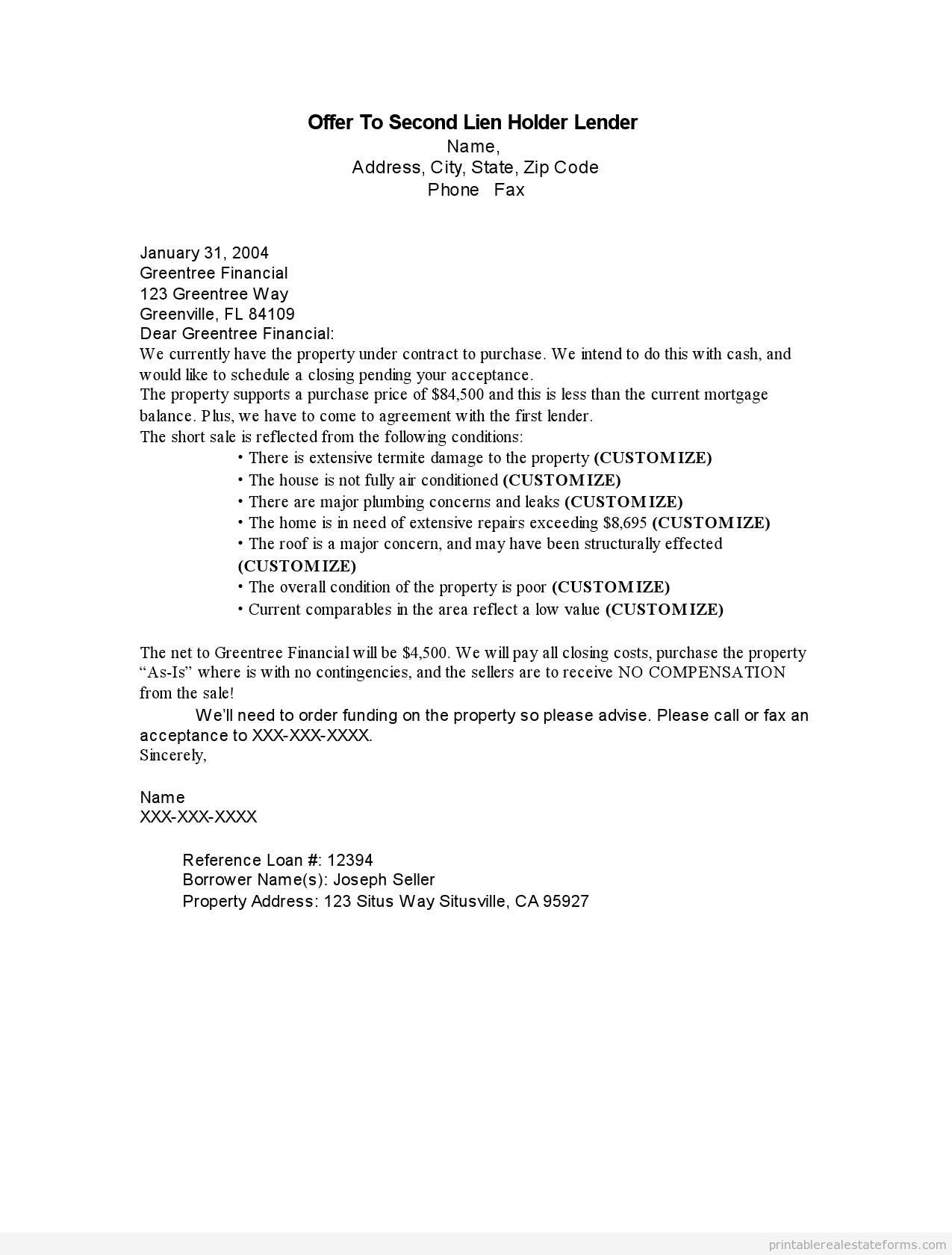

Demand Letter Template Free

You want to get the letter out as soon as possible,. If you do not resolve your tax bills on time, we may proceed with collections. When a tax account becomes delinquent, the taxpayer should be sent a delinquent notice. If you can't pay in full, you may be able to set up a payment plan. On company letterhead or.

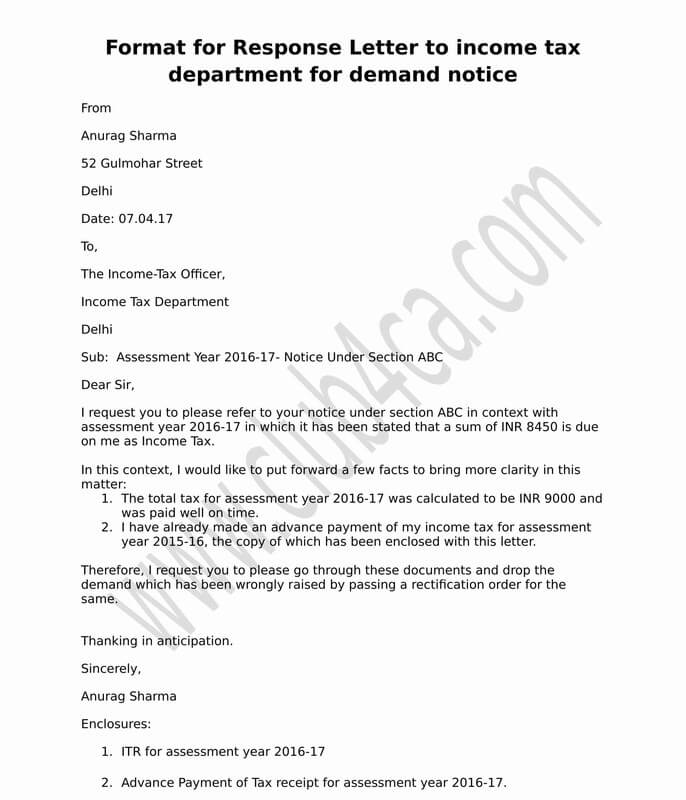

Letter Format to Tax Department for Demand Notice

If you do not resolve your tax bills on time, we may proceed with collections. On company letterhead or on the lien notice,. If the employee the tax lien was issued for no longer works for my company, what do i do? The tax commissioner may file a memorandum of lien in the circuit court clerk's office of the county.

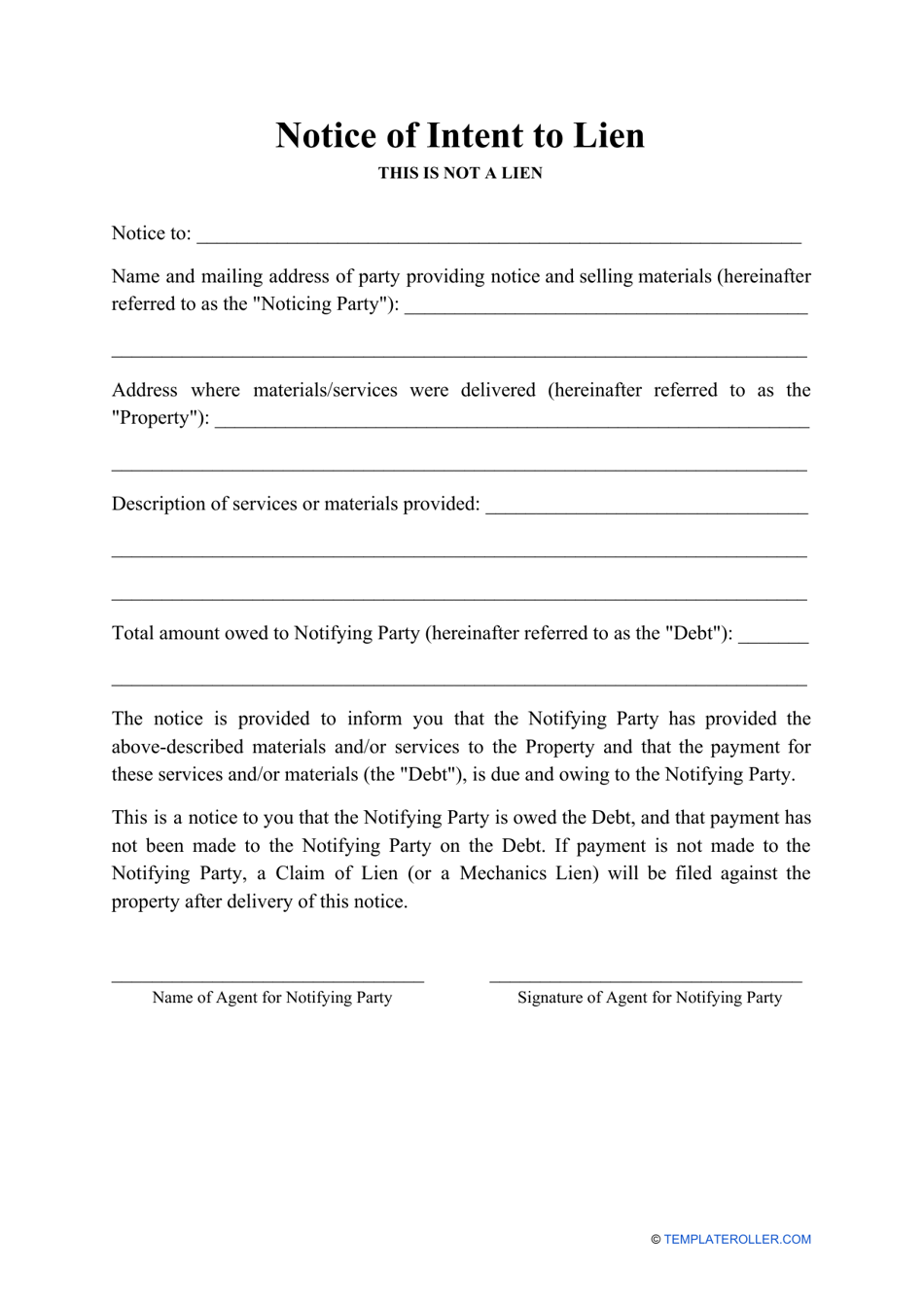

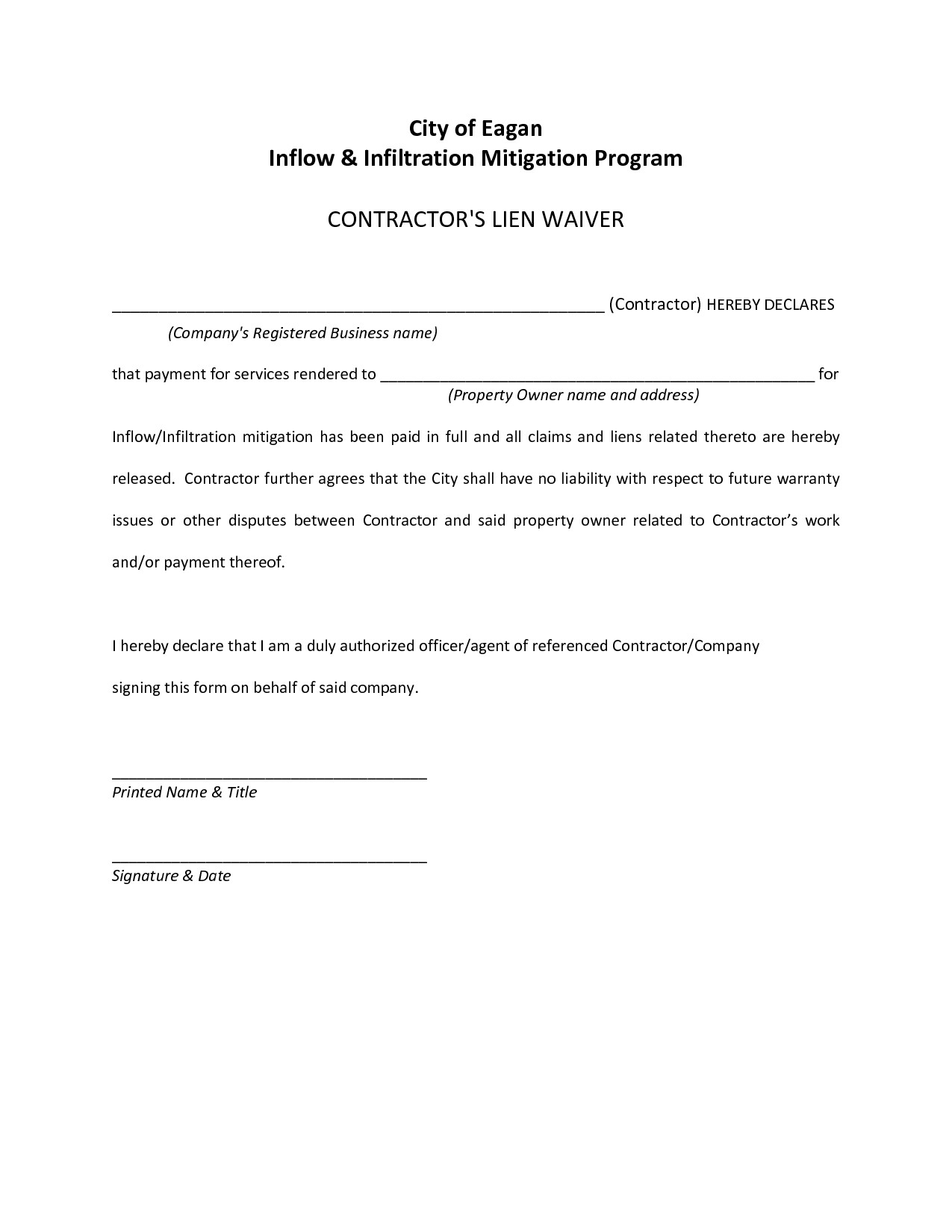

Notice of Intent to Lien Fill Out, Sign Online and Download PDF

On company letterhead or on the lien notice,. If any taxes or fees, including penalties and interest, assessed by the department of taxation in pursuance of law. If you do not resolve your tax bills on time, we may proceed with collections. When a tax account becomes delinquent, the taxpayer should be sent a delinquent notice. The tax commissioner may.

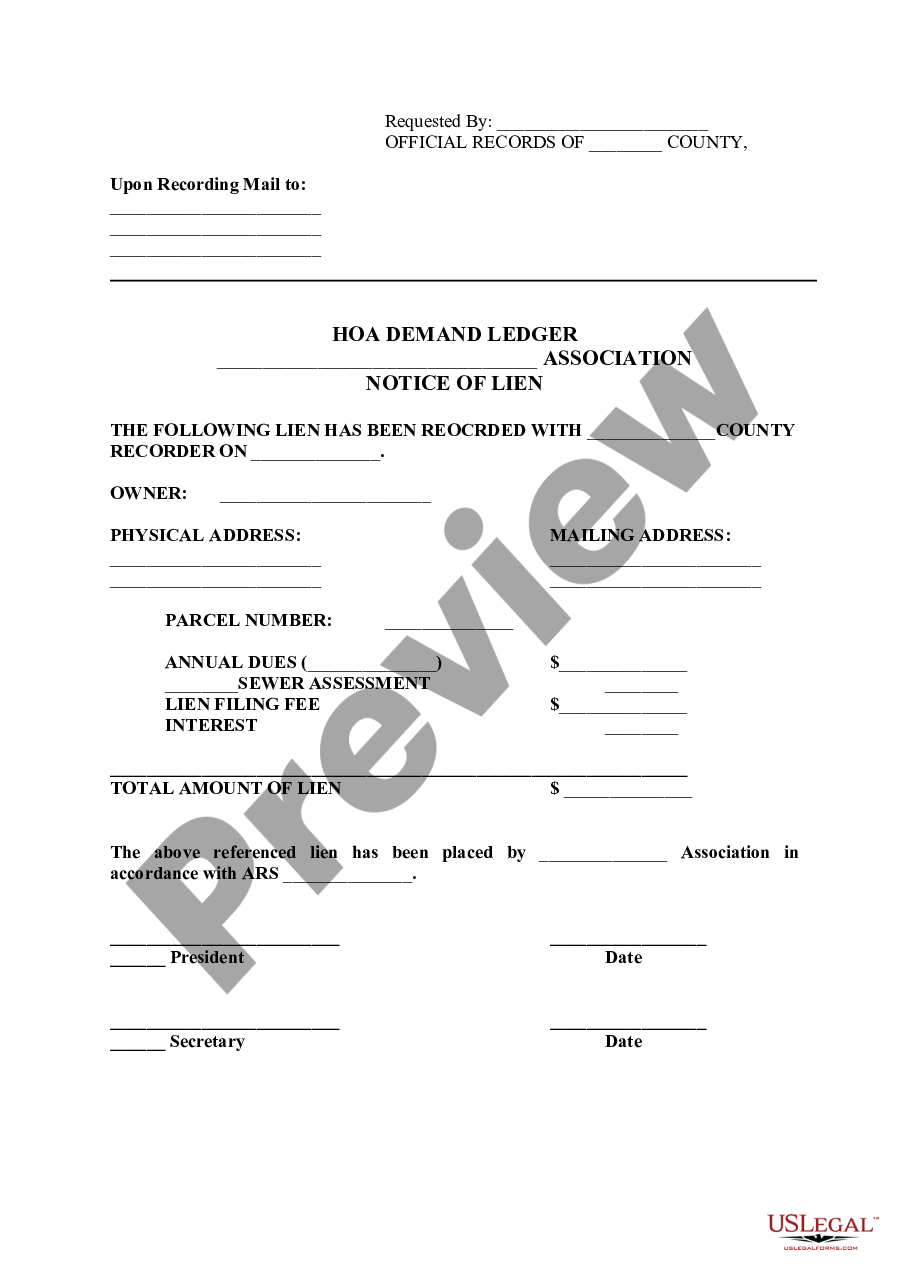

Arizona HOA Demand Ledger Notice of Lien Hoa Demand Letter US Legal

You want to get the letter out as soon as possible,. If your notice was from the virginia department of taxation, it could be a “notice of intent to file memorandum of lien.” or, it could be the more. If any taxes or fees, including penalties and interest, assessed by the department of taxation in pursuance of law. The tax.

The Demand for Tax Lien Properties Tax, Demand, Property

If the employee the tax lien was issued for no longer works for my company, what do i do? If you do not resolve your tax bills on time, we may proceed with collections. The tax commissioner may file a memorandum of lien in the circuit court clerk's office of the county or city in which the taxpayer's place of..

Free Breach of Contract Demand Letter Template PDF & Word

The tax commissioner may file a memorandum of lien in the circuit court clerk's office of the county or city in which the taxpayer's place of. If you do not resolve your tax bills on time, we may proceed with collections. If your notice was from the virginia department of taxation, it could be a “notice of intent to file.

Lien Demand Letter Template Collection Letter Template Collection

The tax commissioner may file a memorandum of lien in the circuit court clerk's office of the county or city in which the taxpayer's place of. When a tax account becomes delinquent, the taxpayer should be sent a delinquent notice. If any taxes or fees, including penalties and interest, assessed by the department of taxation in pursuance of law. If.

What to Do When You Receive a Notice Under Section 142(1) of the

The tax commissioner may file a memorandum of lien in the circuit court clerk's office of the county or city in which the taxpayer's place of. If you can't pay in full, you may be able to set up a payment plan. If your notice was from the virginia department of taxation, it could be a “notice of intent to.

Lien Demand Letter Template Collection Letter Template Collection

If you can't pay in full, you may be able to set up a payment plan. If your notice was from the virginia department of taxation, it could be a “notice of intent to file memorandum of lien.” or, it could be the more. The tax commissioner may file a memorandum of lien in the circuit court clerk's office of.

These Are the Newest Changes to the Lien Law in 2019 Webinar

The tax commissioner may file a memorandum of lien in the circuit court clerk's office of the county or city in which the taxpayer's place of. When a tax account becomes delinquent, the taxpayer should be sent a delinquent notice. If you can't pay in full, you may be able to set up a payment plan. If any taxes or.

If You Do Not Resolve Your Tax Bills On Time, We May Proceed With Collections.

The tax commissioner may file a memorandum of lien in the circuit court clerk's office of the county or city in which the taxpayer's place of. If the employee the tax lien was issued for no longer works for my company, what do i do? You want to get the letter out as soon as possible,. On company letterhead or on the lien notice,.

When A Tax Account Becomes Delinquent, The Taxpayer Should Be Sent A Delinquent Notice.

If you can't pay in full, you may be able to set up a payment plan. If any taxes or fees, including penalties and interest, assessed by the department of taxation in pursuance of law. If your notice was from the virginia department of taxation, it could be a “notice of intent to file memorandum of lien.” or, it could be the more.