Minimum Payments Mean Costly Consequences Chapter 4 Lesson 1 - The credit card has a 19% annual percentage rate (apr)—that’s the interest rate he’ll have to pay to use the money he. Ss.912.fl.5.1 analyze the ways that consumers can compare the cost of credit by using the annual percentage. How much will zach’s first minimum. Page 3 of 4 minimum payments mean costly consequences chapter 4, lesson 1 1. After 154 minimum payments, how much would zach pay for his $910 of emergency purchases? How much money in total interest did he pay for.

The credit card has a 19% annual percentage rate (apr)—that’s the interest rate he’ll have to pay to use the money he. How much money in total interest did he pay for. Ss.912.fl.5.1 analyze the ways that consumers can compare the cost of credit by using the annual percentage. How much will zach’s first minimum. After 154 minimum payments, how much would zach pay for his $910 of emergency purchases? Page 3 of 4 minimum payments mean costly consequences chapter 4, lesson 1 1.

The credit card has a 19% annual percentage rate (apr)—that’s the interest rate he’ll have to pay to use the money he. How much will zach’s first minimum. Ss.912.fl.5.1 analyze the ways that consumers can compare the cost of credit by using the annual percentage. Page 3 of 4 minimum payments mean costly consequences chapter 4, lesson 1 1. How much money in total interest did he pay for. After 154 minimum payments, how much would zach pay for his $910 of emergency purchases?

SOLUTION Lesson 1 4 Studypool

The credit card has a 19% annual percentage rate (apr)—that’s the interest rate he’ll have to pay to use the money he. After 154 minimum payments, how much would zach pay for his $910 of emergency purchases? Ss.912.fl.5.1 analyze the ways that consumers can compare the cost of credit by using the annual percentage. How much will zach’s first minimum..

Group 2 Module 4 Lesson 1 Download Free PDF Morality Bible

How much money in total interest did he pay for. The credit card has a 19% annual percentage rate (apr)—that’s the interest rate he’ll have to pay to use the money he. Page 3 of 4 minimum payments mean costly consequences chapter 4, lesson 1 1. Ss.912.fl.5.1 analyze the ways that consumers can compare the cost of credit by using.

Unit 4 Lesson 1 Life Concerns 20212022 PDF

How much will zach’s first minimum. The credit card has a 19% annual percentage rate (apr)—that’s the interest rate he’ll have to pay to use the money he. Ss.912.fl.5.1 analyze the ways that consumers can compare the cost of credit by using the annual percentage. Page 3 of 4 minimum payments mean costly consequences chapter 4, lesson 1 1. How.

Chapter 4 Lesson 3 Notes MATH 120R Studocu

After 154 minimum payments, how much would zach pay for his $910 of emergency purchases? Ss.912.fl.5.1 analyze the ways that consumers can compare the cost of credit by using the annual percentage. The credit card has a 19% annual percentage rate (apr)—that’s the interest rate he’ll have to pay to use the money he. How much money in total interest.

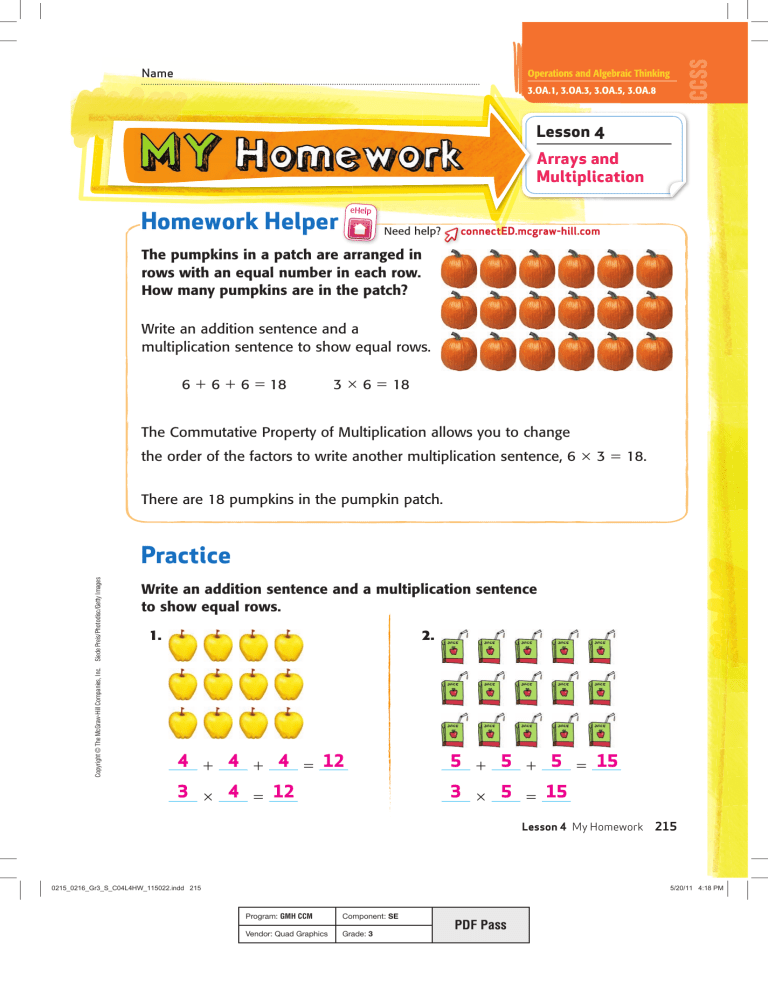

MATH 4 Lesson 19 4 Quarter Mathematics 4 Lesson 1 9 Lesson Rounding

How much will zach’s first minimum. Ss.912.fl.5.1 analyze the ways that consumers can compare the cost of credit by using the annual percentage. The credit card has a 19% annual percentage rate (apr)—that’s the interest rate he’ll have to pay to use the money he. Page 3 of 4 minimum payments mean costly consequences chapter 4, lesson 1 1. After.

Module 4 Lesson 1, Costas Ana Mae PDF Motivation Motivational

Ss.912.fl.5.1 analyze the ways that consumers can compare the cost of credit by using the annual percentage. The credit card has a 19% annual percentage rate (apr)—that’s the interest rate he’ll have to pay to use the money he. After 154 minimum payments, how much would zach pay for his $910 of emergency purchases? How much will zach’s first minimum..

Module 4 Lesson 1 Download Free PDF Rational Number Decimal

After 154 minimum payments, how much would zach pay for his $910 of emergency purchases? Page 3 of 4 minimum payments mean costly consequences chapter 4, lesson 1 1. Ss.912.fl.5.1 analyze the ways that consumers can compare the cost of credit by using the annual percentage. The credit card has a 19% annual percentage rate (apr)—that’s the interest rate he’ll.

Chapter 4Lesson 4 Key

After 154 minimum payments, how much would zach pay for his $910 of emergency purchases? How much money in total interest did he pay for. How much will zach’s first minimum. Ss.912.fl.5.1 analyze the ways that consumers can compare the cost of credit by using the annual percentage. Page 3 of 4 minimum payments mean costly consequences chapter 4, lesson.

Q1 LE Mathematics 4 Lesson 1 Week 1 PDF Angle Learning

How much money in total interest did he pay for. The credit card has a 19% annual percentage rate (apr)—that’s the interest rate he’ll have to pay to use the money he. After 154 minimum payments, how much would zach pay for his $910 of emergency purchases? Ss.912.fl.5.1 analyze the ways that consumers can compare the cost of credit by.

Chapter 4 Lesson 12 PDF

The credit card has a 19% annual percentage rate (apr)—that’s the interest rate he’ll have to pay to use the money he. How much will zach’s first minimum. Ss.912.fl.5.1 analyze the ways that consumers can compare the cost of credit by using the annual percentage. After 154 minimum payments, how much would zach pay for his $910 of emergency purchases?.

After 154 Minimum Payments, How Much Would Zach Pay For His $910 Of Emergency Purchases?

How much will zach’s first minimum. Ss.912.fl.5.1 analyze the ways that consumers can compare the cost of credit by using the annual percentage. How much money in total interest did he pay for. Page 3 of 4 minimum payments mean costly consequences chapter 4, lesson 1 1.