Minimal Activity Business License Tn - The “application for business tax license or minimal activity license” is available for. Minimal activity business licenses are for businesses that gross more than $3,000 to $100,000 annually. Businesses with annual gross receipts of more than $3,000 but less than $100,000 within a jurisdiction are required to. Businesses with less than $3,000 in gross receipts per year may. Businesses with more than $3,000 but less than $100,000 in gross receipts during the tax year must obtain a minimal activity license. You can now apply for a new business license online! It takes up to 10 business days for the department of revenue to register your business. Between $3,000 and $100,000* in gross sales. To obtain the annual license,. Minimal activity license annually for $15 from the local county and/or city clerk.

Under $3,000 in gross sales. Businesses with annual gross receipts of more than $3,000 but less than $100,000 within a jurisdiction are required to. You can now apply for a new business license online! To obtain the annual license,. Minimal activity business licenses are for businesses that gross more than $3,000 to $100,000 annually. Between $3,000 and $100,000* in gross sales. Businesses with less than $3,000 in gross receipts per year may. It takes up to 10 business days for the department of revenue to register your business. Businesses with more than $3,000 but less than $100,000 in gross receipts during the tax year must obtain a minimal activity license. The “application for business tax license or minimal activity license” is available for.

Businesses with less than $3,000 in gross receipts per year may. It takes up to 10 business days for the department of revenue to register your business. Between $3,000 and $100,000* in gross sales. Businesses with annual gross receipts of more than $3,000 but less than $100,000 within a jurisdiction are required to. The “application for business tax license or minimal activity license” is available for. Minimal activity license annually for $15 from the local county and/or city clerk. Minimal activity business licenses are for businesses that gross more than $3,000 to $100,000 annually. To obtain the annual license,. Under $3,000 in gross sales. You can now apply for a new business license online!

Tennessee Business License License Lookup

Businesses with annual gross receipts of more than $3,000 but less than $100,000 within a jurisdiction are required to. Under $3,000 in gross sales. Minimal activity license annually for $15 from the local county and/or city clerk. Minimal activity business licenses are for businesses that gross more than $3,000 to $100,000 annually. Businesses with more than $3,000 but less than.

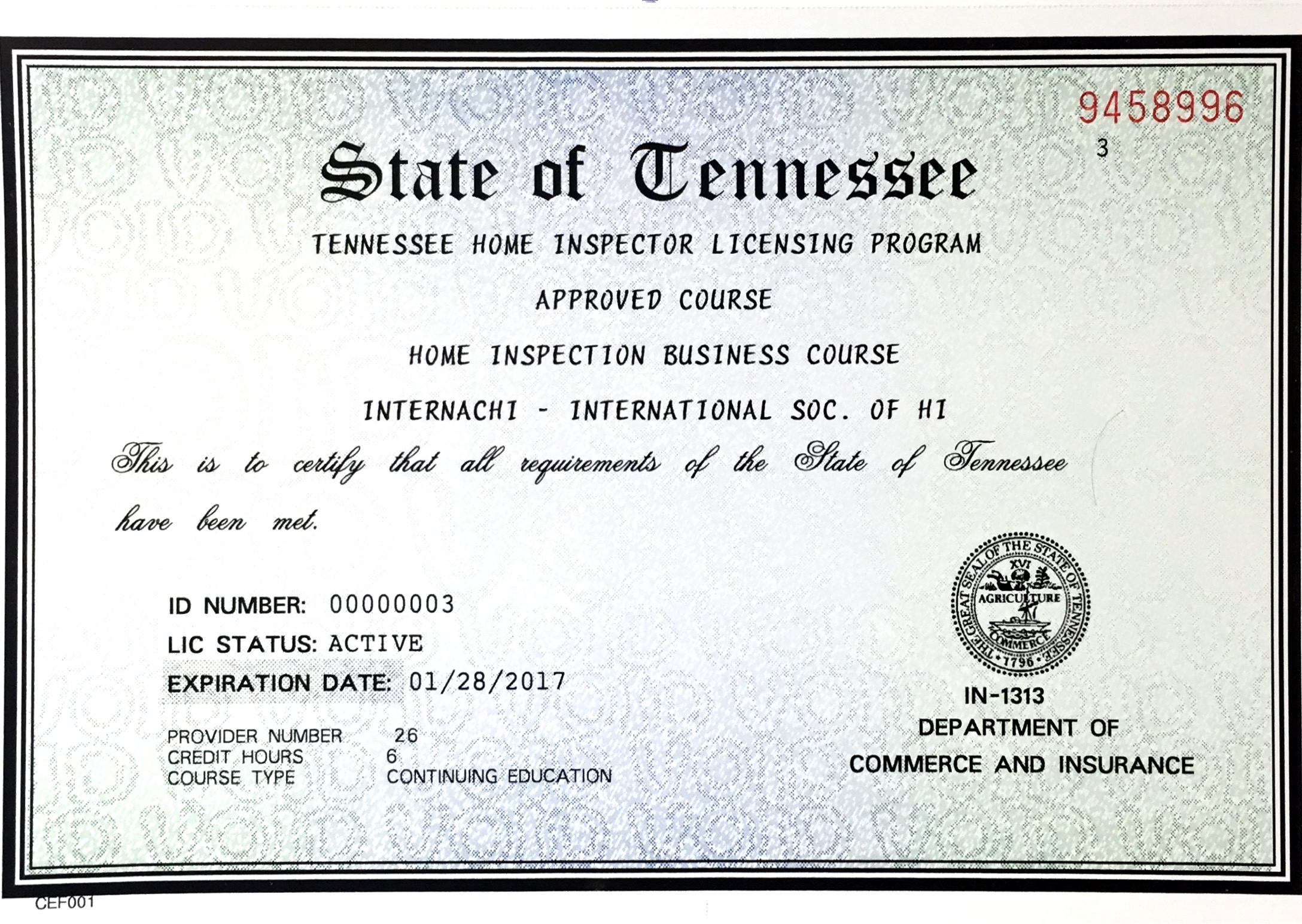

TN Contractor’s License Exp. 123122 C3 Industrial

You can now apply for a new business license online! The “application for business tax license or minimal activity license” is available for. Businesses with less than $3,000 in gross receipts per year may. To obtain the annual license,. Businesses with annual gross receipts of more than $3,000 but less than $100,000 within a jurisdiction are required to.

TN DOS Drivers License Rules Driving Guide

The “application for business tax license or minimal activity license” is available for. It takes up to 10 business days for the department of revenue to register your business. You can now apply for a new business license online! Businesses with more than $3,000 but less than $100,000 in gross receipts during the tax year must obtain a minimal activity.

How to Get a Business License in Tennessee

Businesses with annual gross receipts of more than $3,000 but less than $100,000 within a jurisdiction are required to. Minimal activity business licenses are for businesses that gross more than $3,000 to $100,000 annually. You can now apply for a new business license online! To obtain the annual license,. Minimal activity license annually for $15 from the local county and/or.

How To Get A Business License In Tn Leah Beachum's Template

Minimal activity business licenses are for businesses that gross more than $3,000 to $100,000 annually. The “application for business tax license or minimal activity license” is available for. Businesses with more than $3,000 but less than $100,000 in gross receipts during the tax year must obtain a minimal activity license. It takes up to 10 business days for the department.

Insurance License In Tn Financial Report

Under $3,000 in gross sales. Minimal activity business licenses are for businesses that gross more than $3,000 to $100,000 annually. Businesses with annual gross receipts of more than $3,000 but less than $100,000 within a jurisdiction are required to. Minimal activity license annually for $15 from the local county and/or city clerk. Businesses with less than $3,000 in gross receipts.

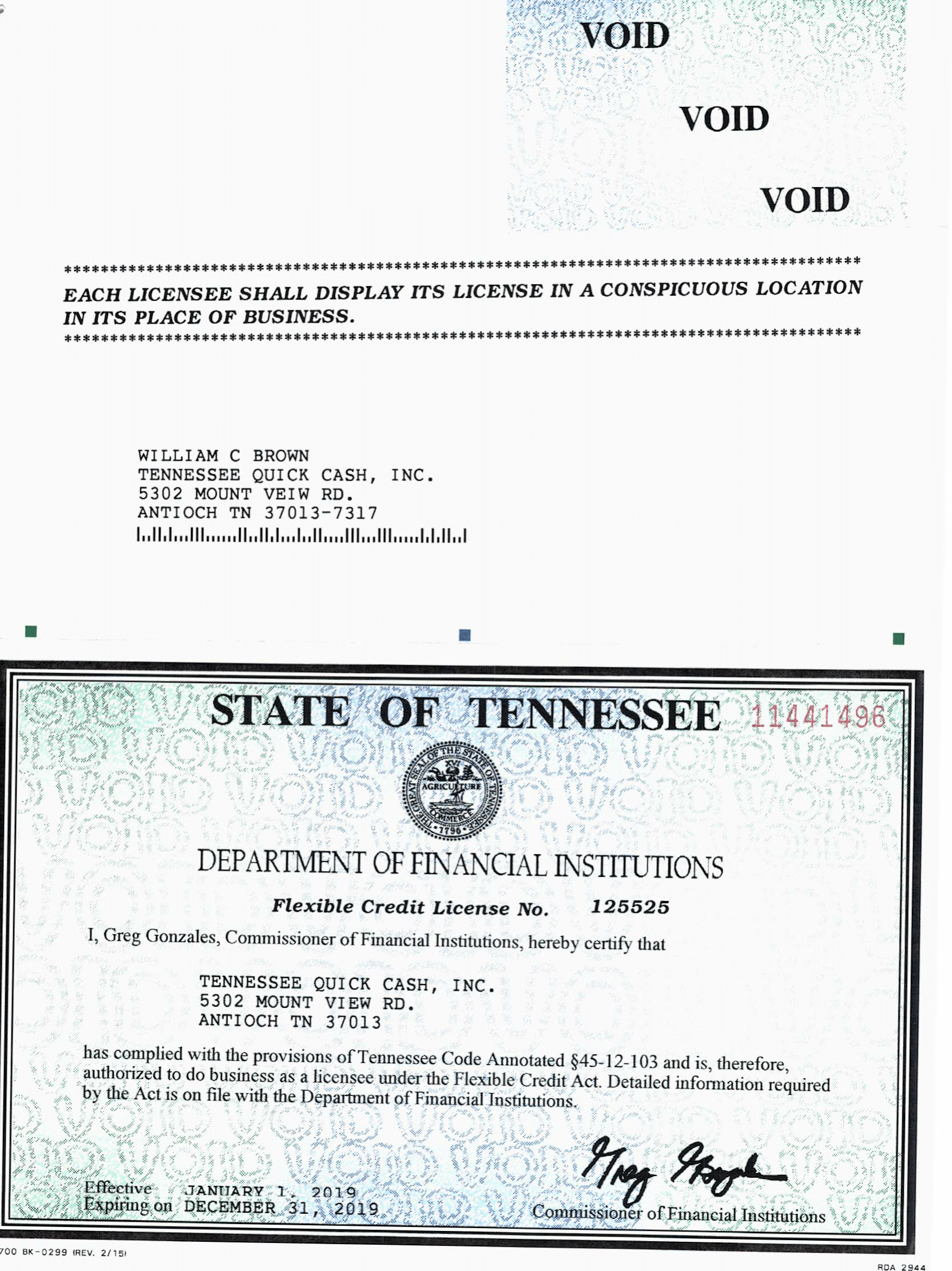

License Tennessee Quick Cash

Under $3,000 in gross sales. Between $3,000 and $100,000* in gross sales. Minimal activity business licenses are for businesses that gross more than $3,000 to $100,000 annually. Businesses with annual gross receipts of more than $3,000 but less than $100,000 within a jurisdiction are required to. It takes up to 10 business days for the department of revenue to register.

How much are TN fishing licenses? Daisy Outdoors

Businesses with annual gross receipts of more than $3,000 but less than $100,000 within a jurisdiction are required to. Minimal activity license annually for $15 from the local county and/or city clerk. Minimal activity business licenses are for businesses that gross more than $3,000 to $100,000 annually. Between $3,000 and $100,000* in gross sales. Businesses with more than $3,000 but.

Business License Knoxville Tn Biusnsse

Under $3,000 in gross sales. Minimal activity business licenses are for businesses that gross more than $3,000 to $100,000 annually. You can now apply for a new business license online! The “application for business tax license or minimal activity license” is available for. To obtain the annual license,.

How To Get A Business License In Tn Leah Beachum's Template

It takes up to 10 business days for the department of revenue to register your business. Between $3,000 and $100,000* in gross sales. Businesses with less than $3,000 in gross receipts per year may. The “application for business tax license or minimal activity license” is available for. Under $3,000 in gross sales.

To Obtain The Annual License,.

Businesses with less than $3,000 in gross receipts per year may. You can now apply for a new business license online! Businesses with more than $3,000 but less than $100,000 in gross receipts during the tax year must obtain a minimal activity license. Under $3,000 in gross sales.

It Takes Up To 10 Business Days For The Department Of Revenue To Register Your Business.

Businesses with annual gross receipts of more than $3,000 but less than $100,000 within a jurisdiction are required to. Minimal activity business licenses are for businesses that gross more than $3,000 to $100,000 annually. The “application for business tax license or minimal activity license” is available for. Between $3,000 and $100,000* in gross sales.