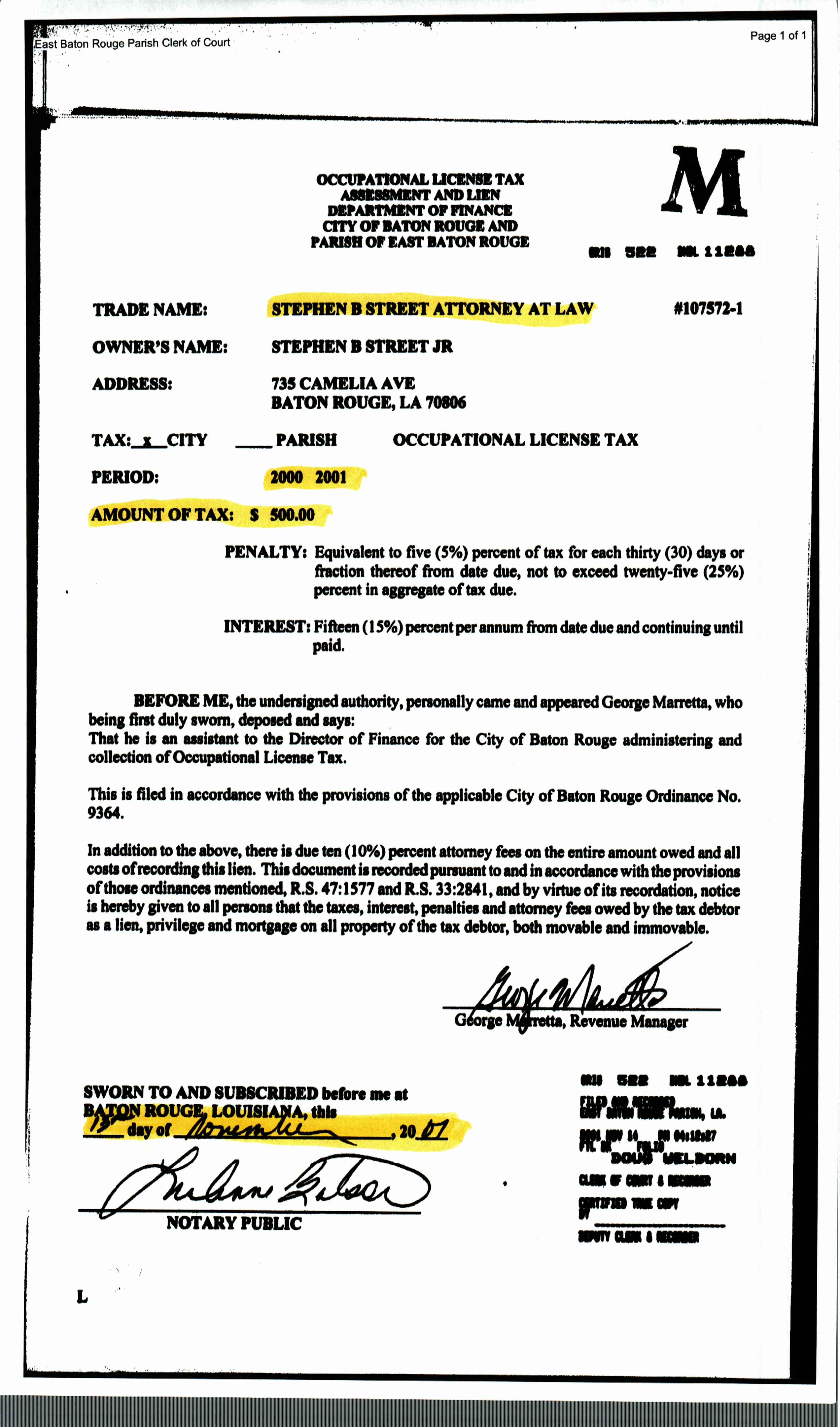

Louisiana Tax Lien - Until paid) that must be repaid. All partial lien releases must be approved by the louisiana board of tax appeals. A lien is a legal claim to secure a debt and may encumber real or personal property. As a service provided by the livingston parish sheriff’s office this system allows access to case information 24 hours a day. At a tax sale, you don’t fully own the property immediately; You purchase a “tax deed” from the tax collector and you have something. For more information concerning tax liens, see lac. A state tax lien (also known as a state tax execution ) is.

All partial lien releases must be approved by the louisiana board of tax appeals. Until paid) that must be repaid. A lien is a legal claim to secure a debt and may encumber real or personal property. You purchase a “tax deed” from the tax collector and you have something. As a service provided by the livingston parish sheriff’s office this system allows access to case information 24 hours a day. A state tax lien (also known as a state tax execution ) is. For more information concerning tax liens, see lac. At a tax sale, you don’t fully own the property immediately;

Until paid) that must be repaid. For more information concerning tax liens, see lac. As a service provided by the livingston parish sheriff’s office this system allows access to case information 24 hours a day. A state tax lien (also known as a state tax execution ) is. You purchase a “tax deed” from the tax collector and you have something. A lien is a legal claim to secure a debt and may encumber real or personal property. At a tax sale, you don’t fully own the property immediately; All partial lien releases must be approved by the louisiana board of tax appeals.

Tax Lien Investing Services Tax Sale Market, LLC.

All partial lien releases must be approved by the louisiana board of tax appeals. As a service provided by the livingston parish sheriff’s office this system allows access to case information 24 hours a day. Until paid) that must be repaid. A state tax lien (also known as a state tax execution ) is. At a tax sale, you don’t.

EasytoUnderstand Tax Lien Code Certificates Posteezy

At a tax sale, you don’t fully own the property immediately; For more information concerning tax liens, see lac. As a service provided by the livingston parish sheriff’s office this system allows access to case information 24 hours a day. A lien is a legal claim to secure a debt and may encumber real or personal property. You purchase a.

Louisiana Tax Liens and Adjudicated Property Tax Sale Investing

As a service provided by the livingston parish sheriff’s office this system allows access to case information 24 hours a day. All partial lien releases must be approved by the louisiana board of tax appeals. For more information concerning tax liens, see lac. At a tax sale, you don’t fully own the property immediately; Until paid) that must be repaid.

tax lien PDF Free Download

You purchase a “tax deed” from the tax collector and you have something. As a service provided by the livingston parish sheriff’s office this system allows access to case information 24 hours a day. For more information concerning tax liens, see lac. All partial lien releases must be approved by the louisiana board of tax appeals. A state tax lien.

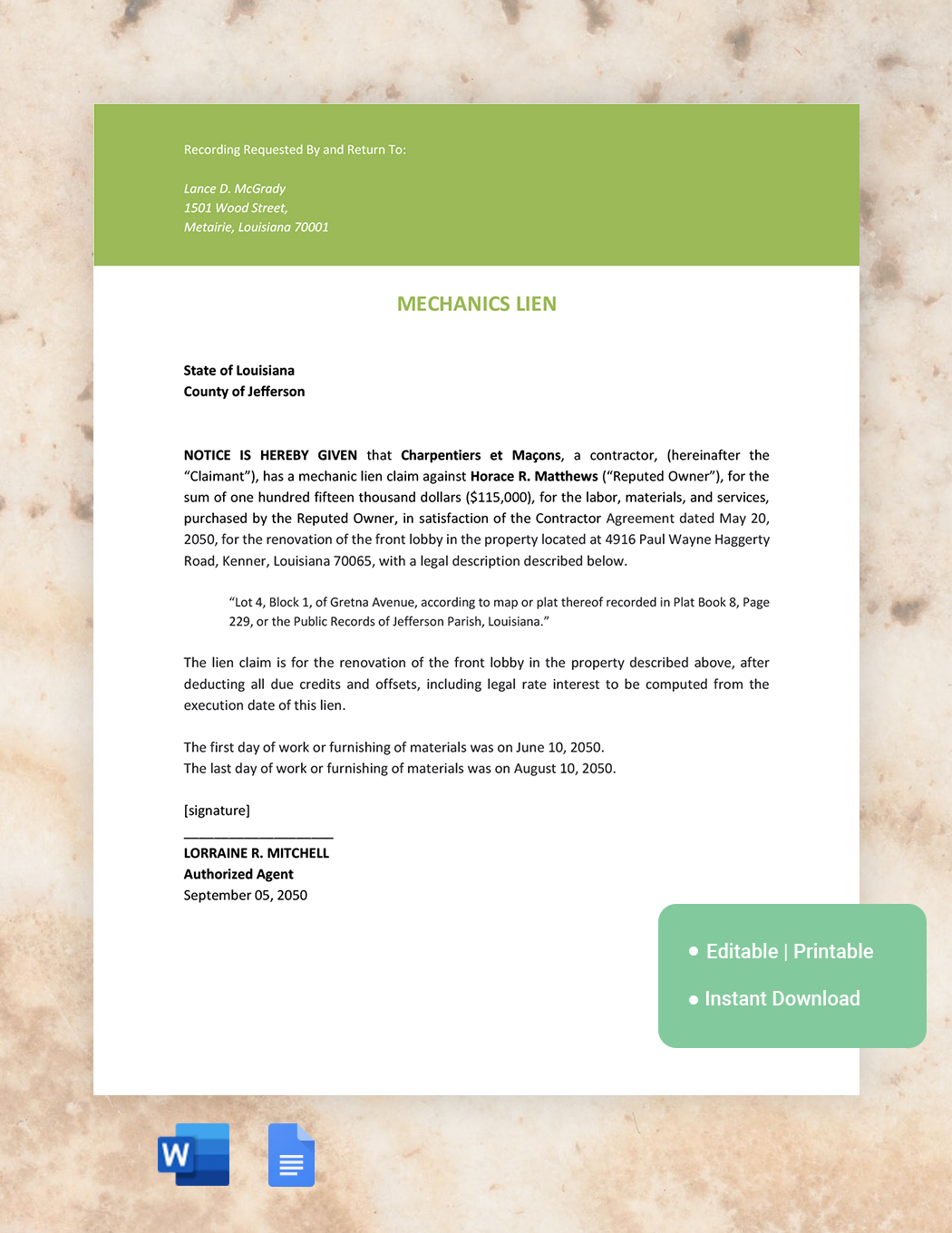

Louisiana Mechanics Lien Law Guide Notices, Liens, & Getting Paid

A state tax lien (also known as a state tax execution ) is. Until paid) that must be repaid. You purchase a “tax deed” from the tax collector and you have something. For more information concerning tax liens, see lac. At a tax sale, you don’t fully own the property immediately;

Request for Louisiana Tax Assessment and Lien Payoff PDF

A lien is a legal claim to secure a debt and may encumber real or personal property. At a tax sale, you don’t fully own the property immediately; As a service provided by the livingston parish sheriff’s office this system allows access to case information 24 hours a day. All partial lien releases must be approved by the louisiana board.

Louisiana Inspector General Street's historical 3year Federal tax lien

At a tax sale, you don’t fully own the property immediately; Until paid) that must be repaid. You purchase a “tax deed” from the tax collector and you have something. As a service provided by the livingston parish sheriff’s office this system allows access to case information 24 hours a day. A lien is a legal claim to secure a.

Investing in Tax Lien Seminars and Courses

A state tax lien (also known as a state tax execution ) is. A lien is a legal claim to secure a debt and may encumber real or personal property. You purchase a “tax deed” from the tax collector and you have something. At a tax sale, you don’t fully own the property immediately; For more information concerning tax liens,.

Tax Lien Sale Download Free PDF Tax Lien Taxes

At a tax sale, you don’t fully own the property immediately; As a service provided by the livingston parish sheriff’s office this system allows access to case information 24 hours a day. A state tax lien (also known as a state tax execution ) is. For more information concerning tax liens, see lac. All partial lien releases must be approved.

Louisiana Mechanics Lien Template in Word, Google Docs Download

For more information concerning tax liens, see lac. At a tax sale, you don’t fully own the property immediately; A lien is a legal claim to secure a debt and may encumber real or personal property. A state tax lien (also known as a state tax execution ) is. You purchase a “tax deed” from the tax collector and you.

You Purchase A “Tax Deed” From The Tax Collector And You Have Something.

At a tax sale, you don’t fully own the property immediately; A state tax lien (also known as a state tax execution ) is. For more information concerning tax liens, see lac. A lien is a legal claim to secure a debt and may encumber real or personal property.

Until Paid) That Must Be Repaid.

As a service provided by the livingston parish sheriff’s office this system allows access to case information 24 hours a day. All partial lien releases must be approved by the louisiana board of tax appeals.