Look Up Irs Tax Lien - You can search for a federal tax lien at the recorder's office in the taxpayer's home county and state, or you can use a private. Notices of federal tax lien. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. Establishes the government’s priority rights. Document filed with the local recording office that identifies tax liabilities owed by the taxpayer; If you have missed irs notices or are unsure about your status, there are a few sources you can refer to in order to identify a. For general lien information, taxpayers may refer to the understanding a federal tax lien page on.

If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. For general lien information, taxpayers may refer to the understanding a federal tax lien page on. Establishes the government’s priority rights. Document filed with the local recording office that identifies tax liabilities owed by the taxpayer; Notices of federal tax lien. You can search for a federal tax lien at the recorder's office in the taxpayer's home county and state, or you can use a private. If you have missed irs notices or are unsure about your status, there are a few sources you can refer to in order to identify a.

If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. Document filed with the local recording office that identifies tax liabilities owed by the taxpayer; If you have missed irs notices or are unsure about your status, there are a few sources you can refer to in order to identify a. Establishes the government’s priority rights. For general lien information, taxpayers may refer to the understanding a federal tax lien page on. You can search for a federal tax lien at the recorder's office in the taxpayer's home county and state, or you can use a private. Notices of federal tax lien.

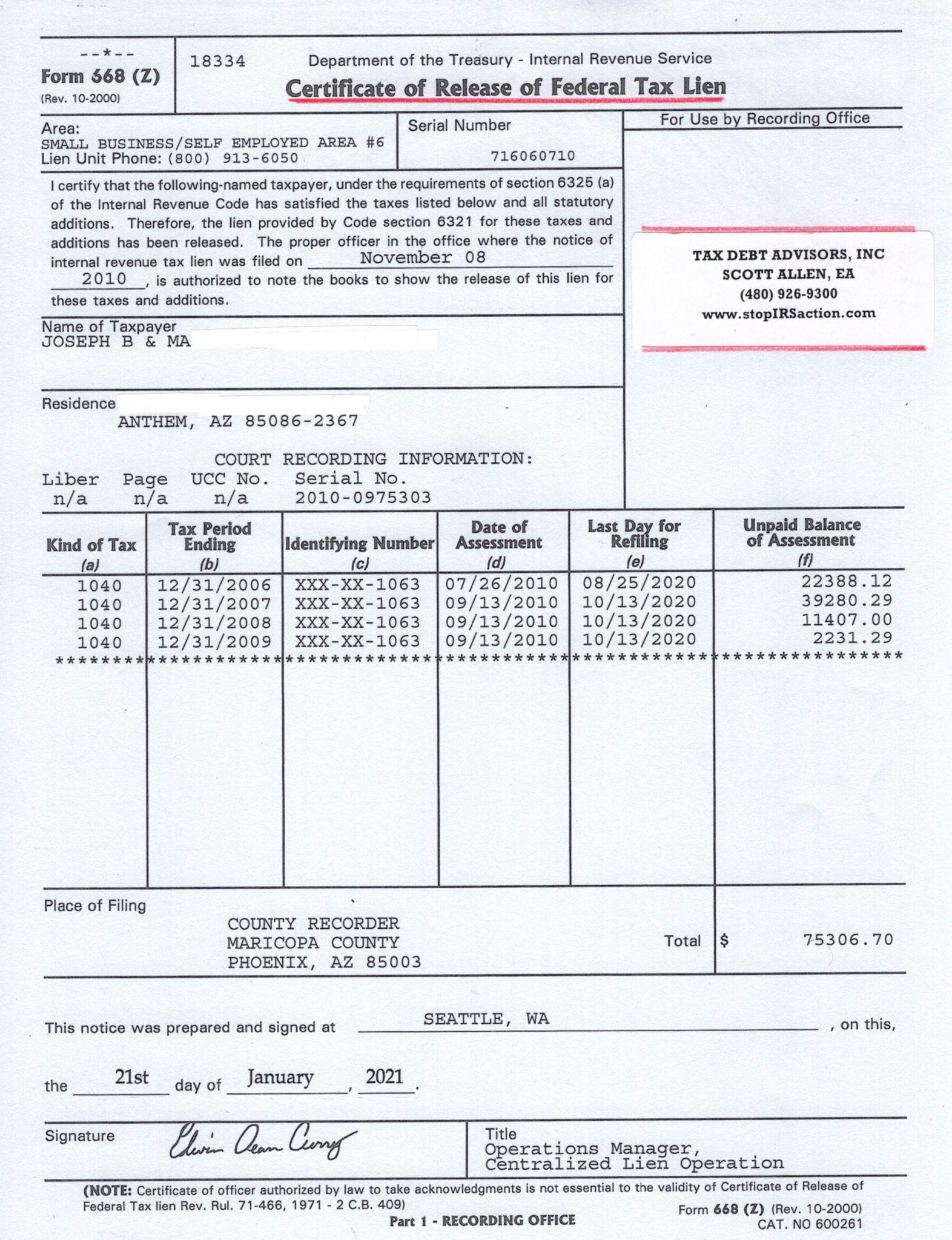

Notice of Tax Lien IRS RJS LAW Best Tax Attorney San Diego

For general lien information, taxpayers may refer to the understanding a federal tax lien page on. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. You can search for a federal tax lien at the recorder's office in the taxpayer's home county and state,.

What Is IRS Tax Lien? Serving Food That Rocks

You can search for a federal tax lien at the recorder's office in the taxpayer's home county and state, or you can use a private. Document filed with the local recording office that identifies tax liabilities owed by the taxpayer; Establishes the government’s priority rights. If you have missed irs notices or are unsure about your status, there are a.

IRS Tax Lien in Arizona IRS help from Tax Debt Advisors, Inc Tax

Notices of federal tax lien. Establishes the government’s priority rights. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. If you have missed irs notices or are unsure about your status, there are a few sources you can refer to in order to identify.

When Does The Irs File A Tax Lien?

If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. Notices of federal tax lien. You can search for a federal tax lien at the recorder's office in the taxpayer's home county and state, or you can use a private. If you have missed irs.

A Complete breakdown of IRS tax lien Conto Business

You can search for a federal tax lien at the recorder's office in the taxpayer's home county and state, or you can use a private. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. If you have missed irs notices or are unsure about.

Federal Tax Lien What Options Are Available For You? Landmark Tax Group

If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. You can search for a federal tax lien at the recorder's office in the taxpayer's home county and state, or you can use a private. Establishes the government’s priority rights. Document filed with the local.

IRS Federal and State Tax Lien Help — Genesis Tax Consultants

If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. If you have missed irs notices or are unsure about your status, there are a few sources you can refer to in order to identify a. Notices of federal tax lien. For general lien information,.

How to Tackle IRS Tax Lien or Levy Notice? Internal Revenue Code

Document filed with the local recording office that identifies tax liabilities owed by the taxpayer; If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. Establishes the government’s priority rights. For general lien information, taxpayers may refer to the understanding a federal tax lien page.

Tax Lien Form Free Word Templates

If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. If you have missed irs notices or are unsure about your status, there are a few sources you can refer to in order to identify a. Establishes the government’s priority rights. Document filed with the.

When Does the IRS File a Tax Lien? Heartland Tax Solutions

Document filed with the local recording office that identifies tax liabilities owed by the taxpayer; If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. For general lien information, taxpayers may refer to the understanding a federal tax lien page on. You can search for.

You Can Search For A Federal Tax Lien At The Recorder's Office In The Taxpayer's Home County And State, Or You Can Use A Private.

Notices of federal tax lien. Establishes the government’s priority rights. If a property owner fails to pay federal taxes, the irs files a notice of federal tax lien with the state recorder's office to secure. If you have missed irs notices or are unsure about your status, there are a few sources you can refer to in order to identify a.

Document Filed With The Local Recording Office That Identifies Tax Liabilities Owed By The Taxpayer;

For general lien information, taxpayers may refer to the understanding a federal tax lien page on.