Local Sales Tax Rate Orlando Florida - This is the total of state, county, and city sales tax rates. Orlando, fl sales tax rate. There is no applicable city tax or. The general sales tax rate in orlando, florida is determined by a combination of state, county, and city tax rates. The december 2020 total local sales. The current sales tax rate in orlando, fl is 6.5%. The local sales tax rate in orange county is 0.5%, and the maximum rate (including florida and city sales taxes) is 7.5% as of january 2025. Click for sales tax rates, orlando sales tax calculator, and printable sales tax table from. The 6.5% sales tax rate in orlando consists of 6% florida state sales tax and 0.5% orange county sales tax. The state of florida has a general.

Click for sales tax rates, orlando sales tax calculator, and printable sales tax table from. There is no applicable city tax or. There are a total of 366. The general sales tax rate in orlando, florida is determined by a combination of state, county, and city tax rates. This is the total of state, county, and city sales tax rates. Orlando, fl sales tax rate. 725 rows florida has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 1.5%. The current total local sales tax rate in orlando, fl is 6.500%. The local sales tax rate in orange county is 0.5%, and the maximum rate (including florida and city sales taxes) is 7.5% as of january 2025. The state of florida has a general.

There are a total of 366. The current sales tax rate in orlando, fl is 6.5%. The general sales tax rate in orlando, florida is determined by a combination of state, county, and city tax rates. The current total local sales tax rate in orlando, fl is 6.500%. 725 rows florida has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 1.5%. The december 2020 total local sales. There is no applicable city tax or. The local sales tax rate in orange county is 0.5%, and the maximum rate (including florida and city sales taxes) is 7.5% as of january 2025. Orlando, fl sales tax rate. The 6.5% sales tax rate in orlando consists of 6% florida state sales tax and 0.5% orange county sales tax.

Florida Local Sales Tax Rates and Changes, 19922006 Download Table

This is the total of state, county, and city sales tax rates. The current sales tax rate in orlando, fl is 6.5%. There is no applicable city tax or. The minimum combined 2025 sales tax rate for orlando, florida is 6.5%. Click for sales tax rates, orlando sales tax calculator, and printable sales tax table from.

Florida Sales Tax Guide for Businesses

725 rows florida has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 1.5%. This is the total of state, county, and city sales tax rates. There is no applicable city tax or. The state of florida has a general. The 6.5% sales tax rate in orlando consists of 6%.

Florida Legislature Wants To Roll Property Taxes Into State Sales

Orlando, fl sales tax rate. This is the total of state, county, and city sales tax rates. The 6.5% sales tax rate in orlando consists of 6% florida state sales tax and 0.5% orange county sales tax. The current total local sales tax rate in orlando, fl is 6.500%. The general sales tax rate in orlando, florida is determined by.

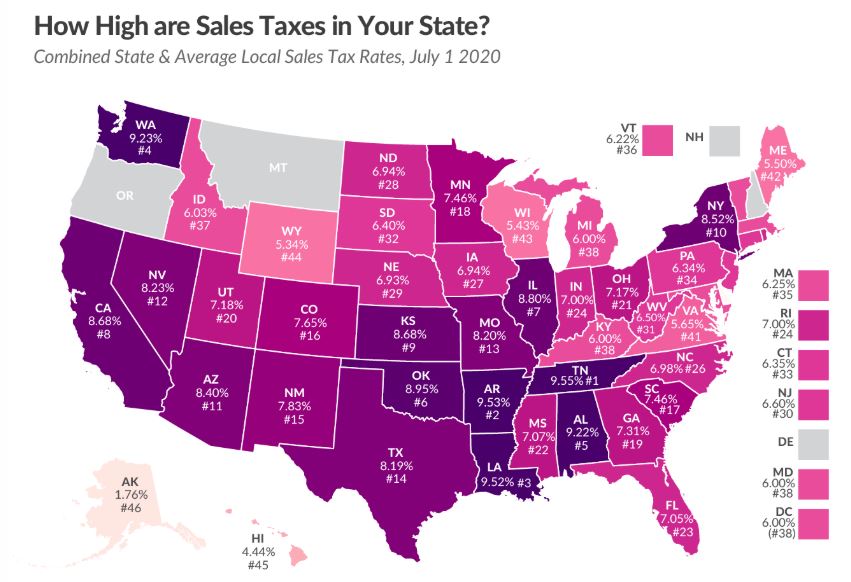

Kansas has 9th highest state and local sales tax rate The Sentinel

The current total local sales tax rate in orlando, fl is 6.500%. The minimum combined 2025 sales tax rate for orlando, florida is 6.5%. This is the total of state, county, and city sales tax rates. The 6.5% sales tax rate in orlando consists of 6% florida state sales tax and 0.5% orange county sales tax. There are a total.

Florida Sales Tax Rates By City & County 2024

The 6.5% sales tax rate in orlando consists of 6% florida state sales tax and 0.5% orange county sales tax. The state of florida has a general. 725 rows florida has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 1.5%. The general sales tax rate in orlando, florida is.

Orlando Florida Crime Rate 2024 Sissy Philomena

Click for sales tax rates, orlando sales tax calculator, and printable sales tax table from. There are a total of 366. Orlando, fl sales tax rate. The december 2020 total local sales. The general sales tax rate in orlando, florida is determined by a combination of state, county, and city tax rates.

Sales Tax Rate Chart 2012 Rating Log

This is the total of state, county, and city sales tax rates. The minimum combined 2025 sales tax rate for orlando, florida is 6.5%. 725 rows florida has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 1.5%. Click for sales tax rates, orlando sales tax calculator, and printable sales.

How to Calculate Florida Sales Tax 4 Steps (with Pictures)

The minimum combined 2025 sales tax rate for orlando, florida is 6.5%. There is no applicable city tax or. Orlando, fl sales tax rate. 725 rows florida has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 1.5%. Click for sales tax rates, orlando sales tax calculator, and printable sales.

Florida Sales and Use Taxes What You Need to Know Ramsey

Click for sales tax rates, orlando sales tax calculator, and printable sales tax table from. The general sales tax rate in orlando, florida is determined by a combination of state, county, and city tax rates. The 6.5% sales tax rate in orlando consists of 6% florida state sales tax and 0.5% orange county sales tax. 725 rows florida has state.

2021 Florida Sales Tax Rates for Commercial Tenants WHWW, PA Winter

Click for sales tax rates, orlando sales tax calculator, and printable sales tax table from. There are a total of 366. The current total local sales tax rate in orlando, fl is 6.500%. The december 2020 total local sales. This is the total of state, county, and city sales tax rates.

The December 2020 Total Local Sales.

The state of florida has a general. This is the total of state, county, and city sales tax rates. 725 rows florida has state sales tax of 6%, and allows local governments to collect a local option sales tax of up to 1.5%. Orlando, fl sales tax rate.

The General Sales Tax Rate In Orlando, Florida Is Determined By A Combination Of State, County, And City Tax Rates.

The minimum combined 2025 sales tax rate for orlando, florida is 6.5%. The local sales tax rate in orange county is 0.5%, and the maximum rate (including florida and city sales taxes) is 7.5% as of january 2025. There is no applicable city tax or. The current sales tax rate in orlando, fl is 6.5%.

Click For Sales Tax Rates, Orlando Sales Tax Calculator, And Printable Sales Tax Table From.

There are a total of 366. The current total local sales tax rate in orlando, fl is 6.500%. The 6.5% sales tax rate in orlando consists of 6% florida state sales tax and 0.5% orange county sales tax.