Local Income Tax Forms For Pa - To get started, refine your search using the search settings. Employers with worksites located in pennsylvania are required. Remit to the local earned income tax collector for every tax collection district in which you lived during the year. Locate and download forms needed to complete your filing and payment processes. Employers with worksites located in pennsylvania are required to withhold and remit the local. Dced local government services act 32: Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15. The pennsylvania local income tax exchange (palite) system allows taxpayers in participating localities to quickly prepare a tax return, which. Local income tax requirements for employers. Part year resident eit worksheet use this form if you have moved during the tax year to allocate earnings/tax to each residence.

Employers with worksites located in pennsylvania are required. Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15. Dced local government services act 32: Locate and download forms needed to complete your filing and payment processes. The pennsylvania local income tax exchange (palite) system allows taxpayers in participating localities to quickly prepare a tax return, which. To get started, refine your search using the search settings. Employers with worksites located in pennsylvania are required to withhold and remit the local. Part year resident eit worksheet use this form if you have moved during the tax year to allocate earnings/tax to each residence. Remit to the local earned income tax collector for every tax collection district in which you lived during the year. Local income tax requirements for employers.

Remit to the local earned income tax collector for every tax collection district in which you lived during the year. Dced local government services act 32: Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15. Employers with worksites located in pennsylvania are required. Part year resident eit worksheet use this form if you have moved during the tax year to allocate earnings/tax to each residence. Local income tax requirements for employers. Locate and download forms needed to complete your filing and payment processes. To get started, refine your search using the search settings. The pennsylvania local income tax exchange (palite) system allows taxpayers in participating localities to quickly prepare a tax return, which. Employers with worksites located in pennsylvania are required to withhold and remit the local.

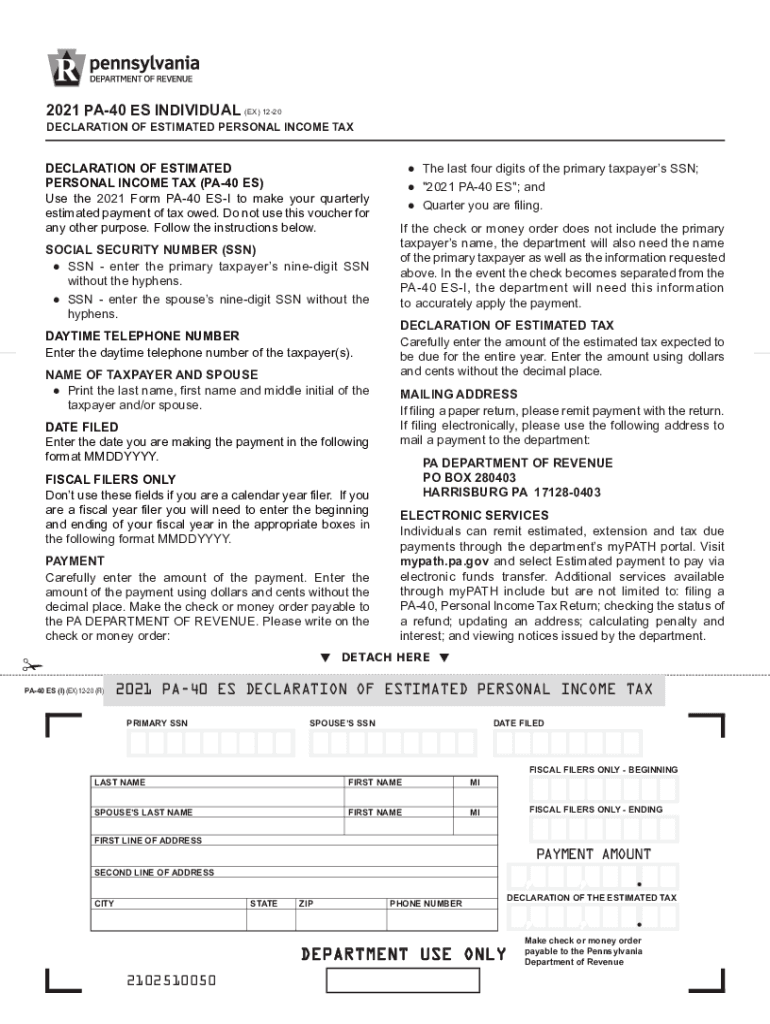

Printable Pennsylvania State Tax Forms Printable Forms Free Online

Local income tax requirements for employers. Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15. Employers with worksites located in pennsylvania are required. Remit to the local earned income tax collector for every tax collection district in which you lived during the year. To get started,.

Printable Pa Tax Forms

Local income tax requirements for employers. Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15. Employers with worksites located in pennsylvania are required to withhold and remit the local. Employers with worksites located in pennsylvania are required. Part year resident eit worksheet use this form if.

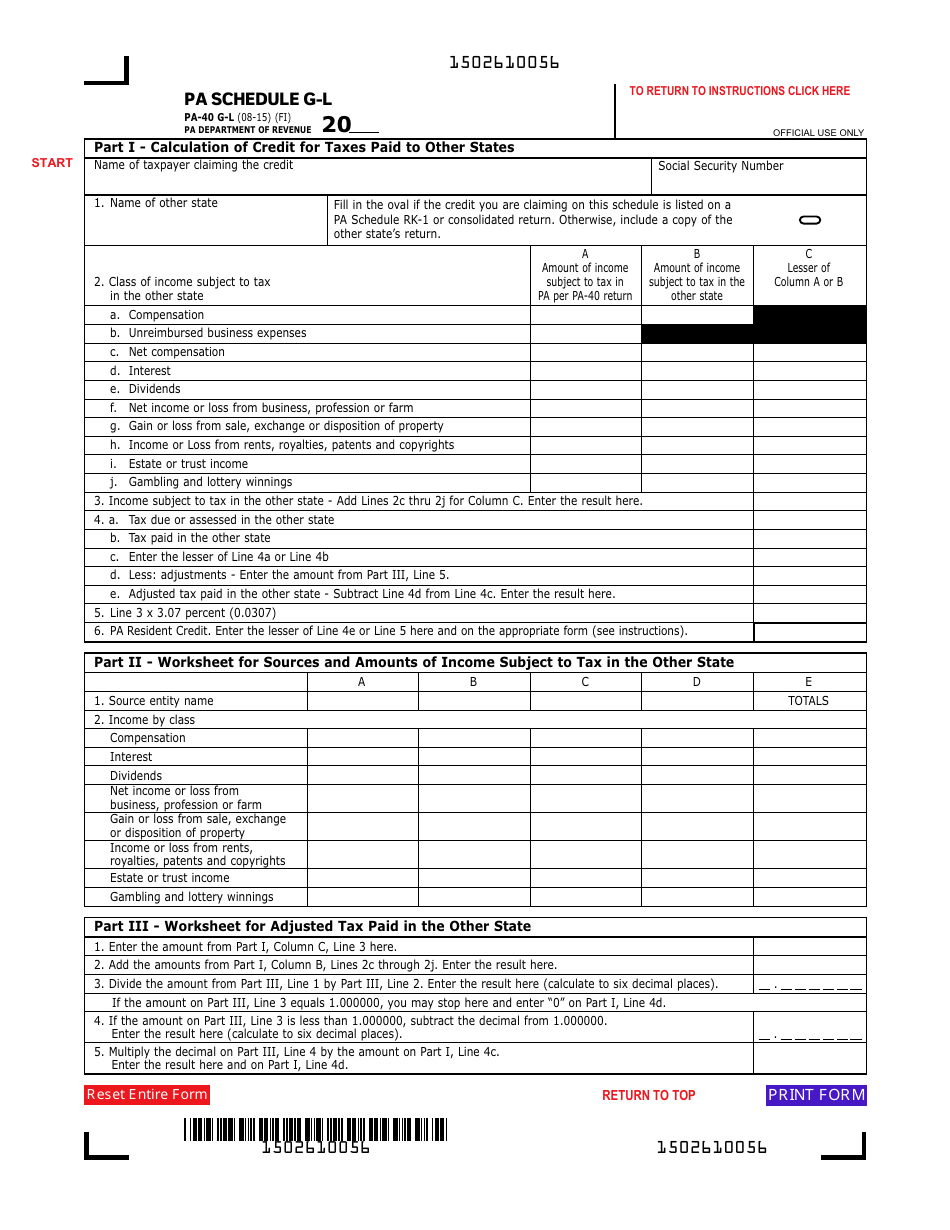

Pa Tax Forms Printable Printable Forms Free Online

Employers with worksites located in pennsylvania are required to withhold and remit the local. Dced local government services act 32: Local income tax requirements for employers. Part year resident eit worksheet use this form if you have moved during the tax year to allocate earnings/tax to each residence. Employers with worksites located in pennsylvania are required.

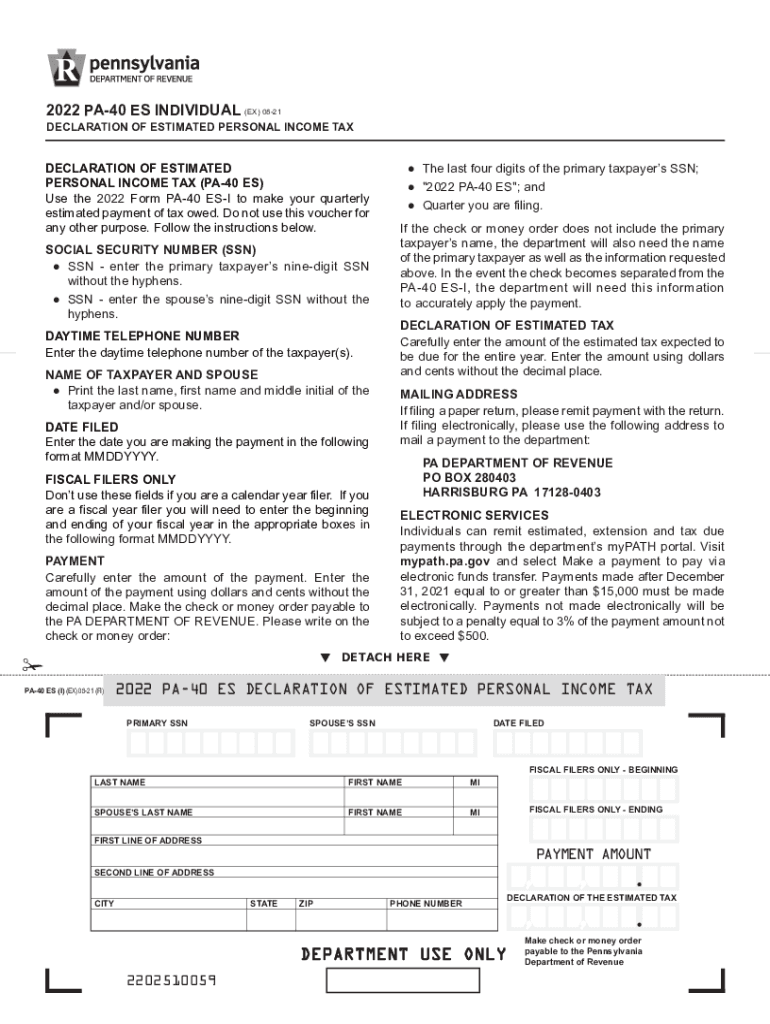

Printable Pa Tax Forms 2023 Printable Forms Free Online

Local income tax requirements for employers. Part year resident eit worksheet use this form if you have moved during the tax year to allocate earnings/tax to each residence. To get started, refine your search using the search settings. The pennsylvania local income tax exchange (palite) system allows taxpayers in participating localities to quickly prepare a tax return, which. Locate and.

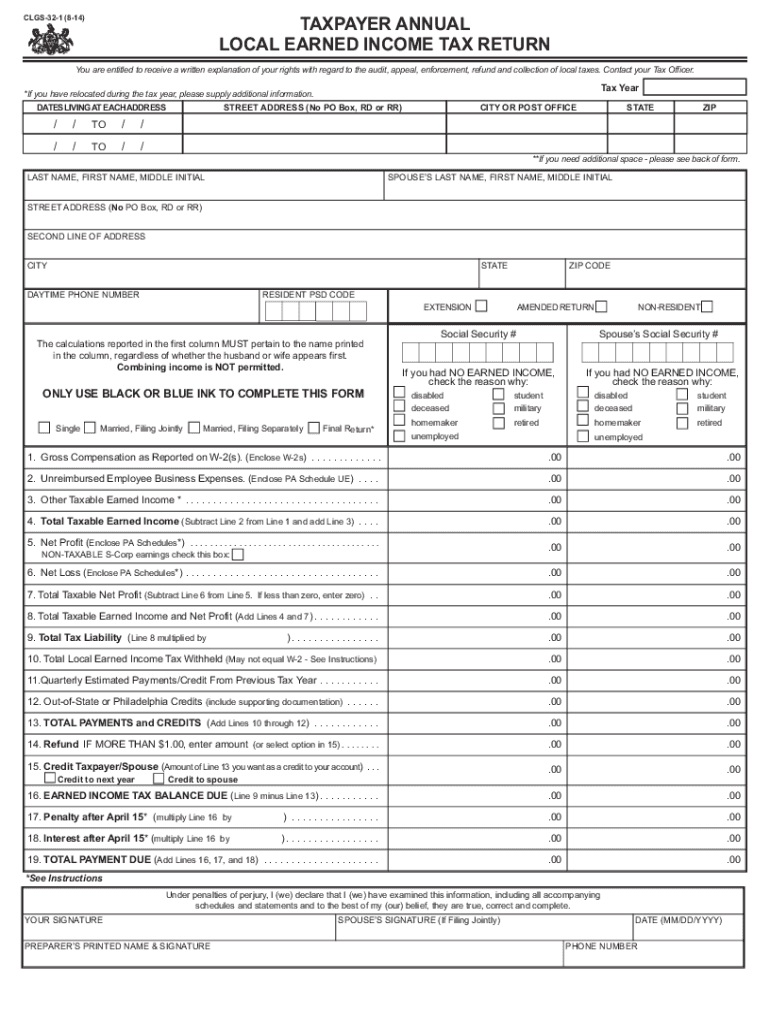

20162024 Form PA DCED CLGS321 Fill Online, Printable, Fillable

The pennsylvania local income tax exchange (palite) system allows taxpayers in participating localities to quickly prepare a tax return, which. Employers with worksites located in pennsylvania are required to withhold and remit the local. Part year resident eit worksheet use this form if you have moved during the tax year to allocate earnings/tax to each residence. Remit to the local.

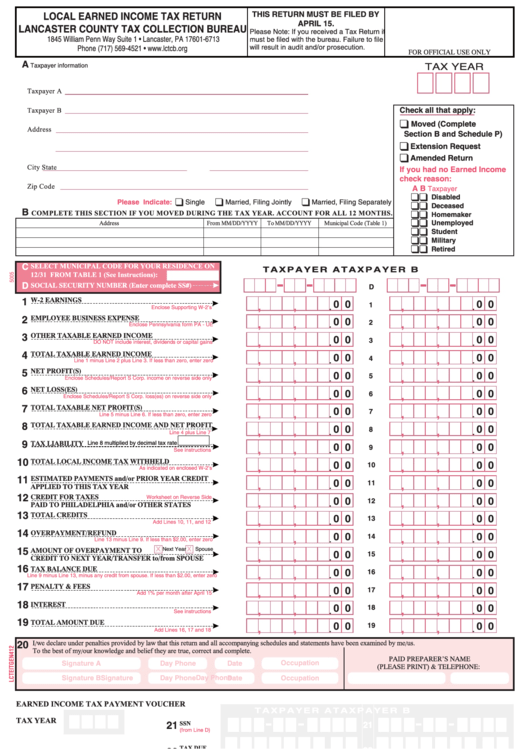

Local Earned Tax Return Form Lancaster County 2005 Printable

Employers with worksites located in pennsylvania are required to withhold and remit the local. Remit to the local earned income tax collector for every tax collection district in which you lived during the year. To get started, refine your search using the search settings. Dced local government services act 32: Local income tax requirements for employers.

Fillable Tax Form Instructions Printable Forms Free Online

Employers with worksites located in pennsylvania are required. Local income tax requirements for employers. Employers with worksites located in pennsylvania are required to withhold and remit the local. Dced local government services act 32: Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15.

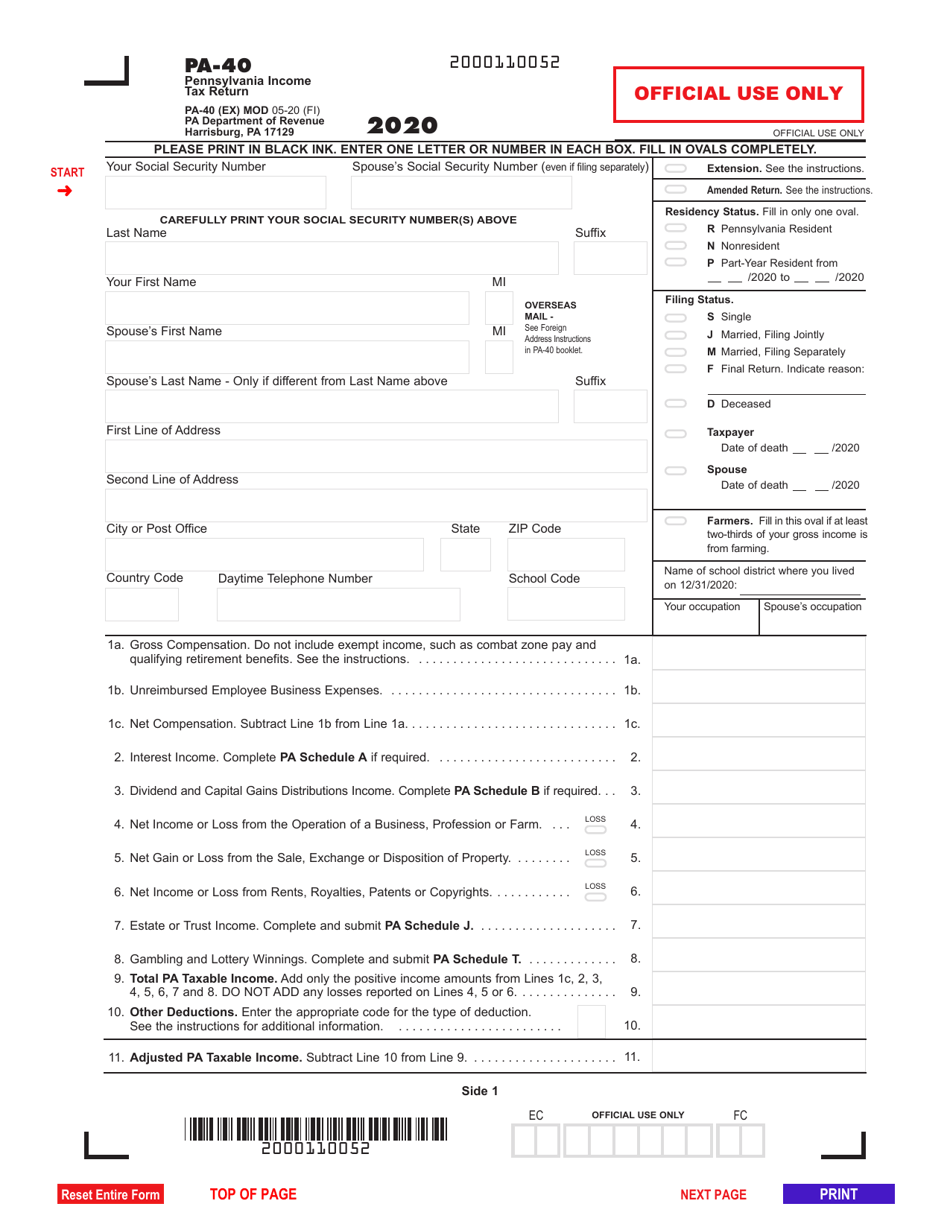

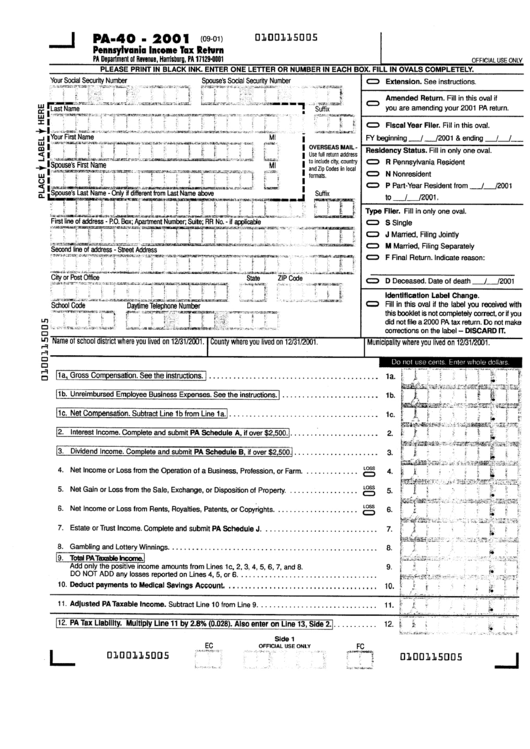

Form Pa40 Pennsylvania Tax Return 2001 printable pdf download

Part year resident eit worksheet use this form if you have moved during the tax year to allocate earnings/tax to each residence. The pennsylvania local income tax exchange (palite) system allows taxpayers in participating localities to quickly prepare a tax return, which. Pennsylvania residents with earned income or net profits must file a local earned income tax return online or.

Cumberland County Pa Local Earned Tax Return

To get started, refine your search using the search settings. Part year resident eit worksheet use this form if you have moved during the tax year to allocate earnings/tax to each residence. Locate and download forms needed to complete your filing and payment processes. Remit to the local earned income tax collector for every tax collection district in which you.

Taxpayer Annual Local Earned Tax Return PA Department Of

Dced local government services act 32: Part year resident eit worksheet use this form if you have moved during the tax year to allocate earnings/tax to each residence. To get started, refine your search using the search settings. Local income tax requirements for employers. Remit to the local earned income tax collector for every tax collection district in which you.

To Get Started, Refine Your Search Using The Search Settings.

Part year resident eit worksheet use this form if you have moved during the tax year to allocate earnings/tax to each residence. Local income tax requirements for employers. Employers with worksites located in pennsylvania are required to withhold and remit the local. Employers with worksites located in pennsylvania are required.

Dced Local Government Services Act 32:

Pennsylvania residents with earned income or net profits must file a local earned income tax return online or by mail by april 15. The pennsylvania local income tax exchange (palite) system allows taxpayers in participating localities to quickly prepare a tax return, which. Locate and download forms needed to complete your filing and payment processes. Remit to the local earned income tax collector for every tax collection district in which you lived during the year.