Local Earned Income Tax Pa - Learn about act 32 and local earned income tax (eit) for employers and employees in pennsylvania. To learn more, click here. Report separately your earned income, tax paid and tax liability for each. For local earned income tax (eit) forms and assistance, contact the local eit collector serving the municipality in which you. Find psd codes, eit rates, tax. You can click on any city or county for more details, including. Employers with worksites located in pennsylvania are required to withhold and remit the local. We have information on the local income tax rates in 12 localities in pennsylvania. If you have a simple. You can file your local earned income tax return online at:

For local earned income tax (eit) forms and assistance, contact the local eit collector serving the municipality in which you. To learn more, click here. Employers with worksites located in pennsylvania are required to withhold and remit the local. Report separately your earned income, tax paid and tax liability for each. Find psd codes, eit rates, tax. You can click on any city or county for more details, including. File one local earned income tax return for each municipality. Local income tax requirements for employers. Learn about act 32 and local earned income tax (eit) for employers and employees in pennsylvania. If you have a simple.

Find psd codes, eit rates, tax. You can click on any city or county for more details, including. To learn more, click here. For local earned income tax (eit) forms and assistance, contact the local eit collector serving the municipality in which you. We have information on the local income tax rates in 12 localities in pennsylvania. File one local earned income tax return for each municipality. Employers with worksites located in pennsylvania are required to withhold and remit the local. Report separately your earned income, tax paid and tax liability for each. Learn about act 32 and local earned income tax (eit) for employers and employees in pennsylvania. You can file your local earned income tax return online at:

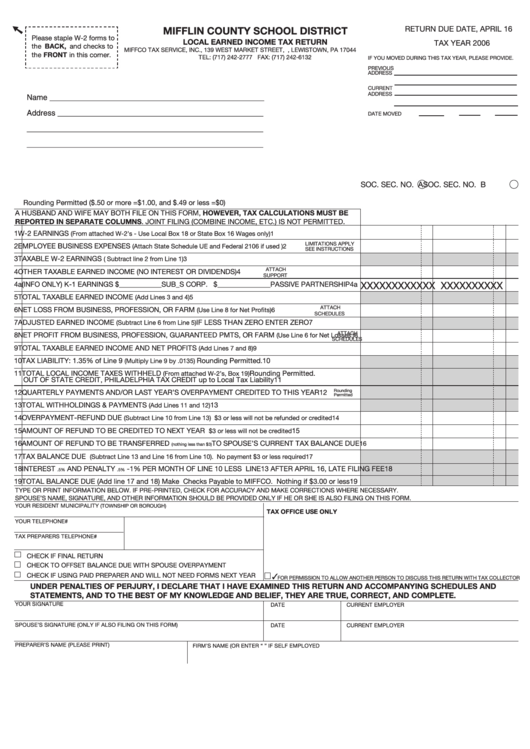

Local Earned Tax Return Form 2006 printable pdf download

Learn about act 32 and local earned income tax (eit) for employers and employees in pennsylvania. Find psd codes, eit rates, tax. Report separately your earned income, tax paid and tax liability for each. To learn more, click here. Local income tax requirements for employers.

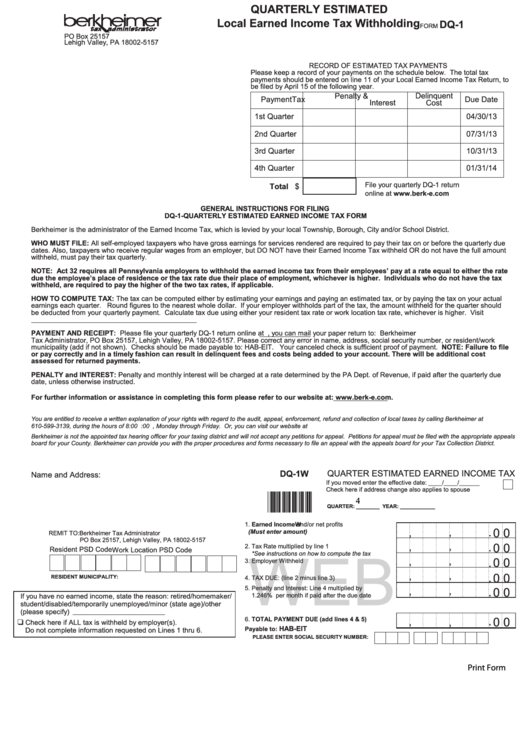

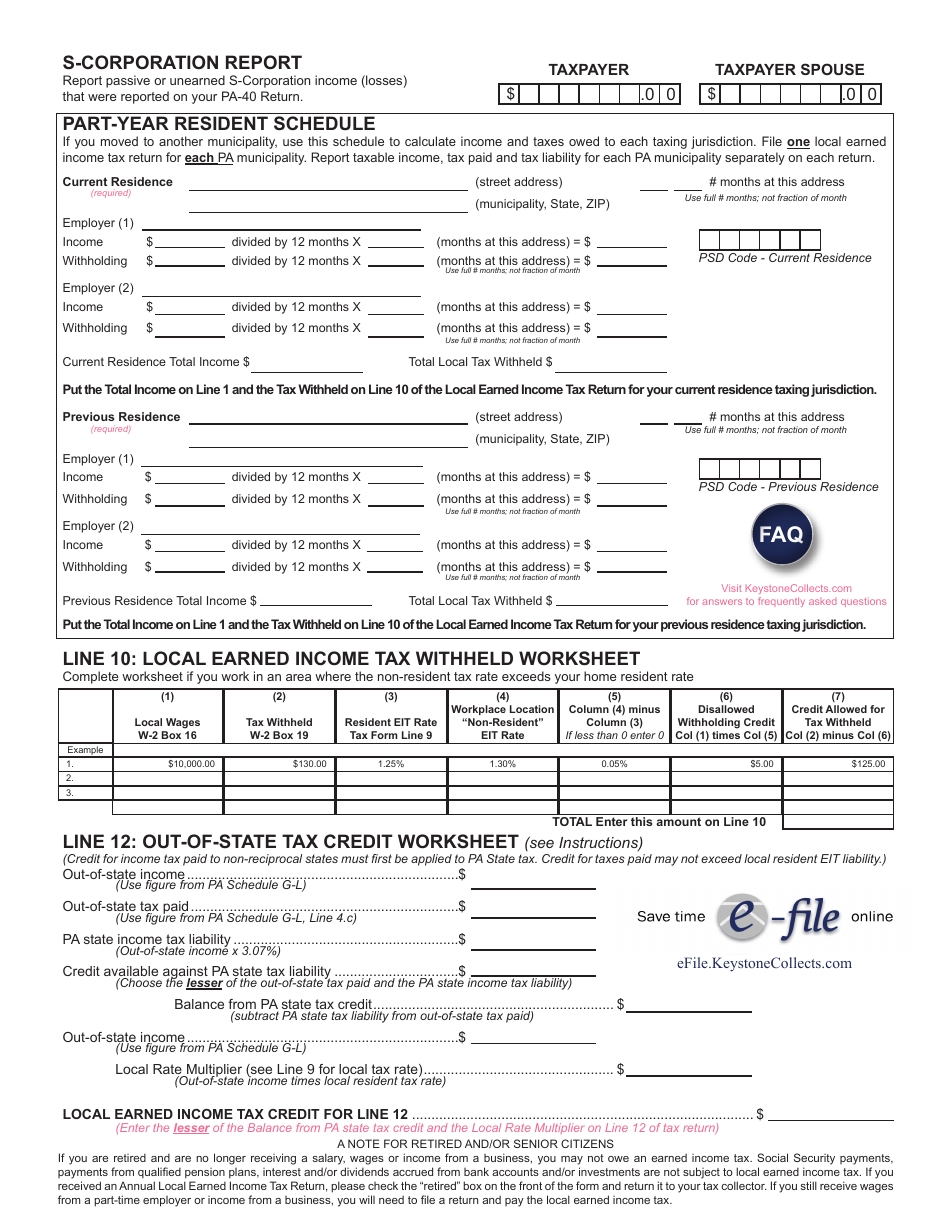

Pennsylvania Local Earned Tax Withholding Form

For local earned income tax (eit) forms and assistance, contact the local eit collector serving the municipality in which you. To learn more, click here. Learn about act 32 and local earned income tax (eit) for employers and employees in pennsylvania. Local income tax requirements for employers. You can file your local earned income tax return online at:

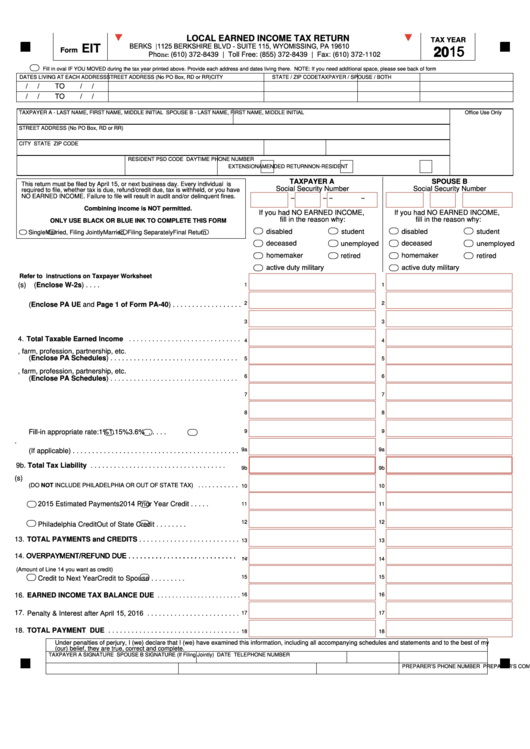

Fillable Local Earned Tax Return Pa Eit 2015 printable pdf download

Employers with worksites located in pennsylvania are required to withhold and remit the local. For local earned income tax (eit) forms and assistance, contact the local eit collector serving the municipality in which you. To learn more, click here. You can click on any city or county for more details, including. Find psd codes, eit rates, tax.

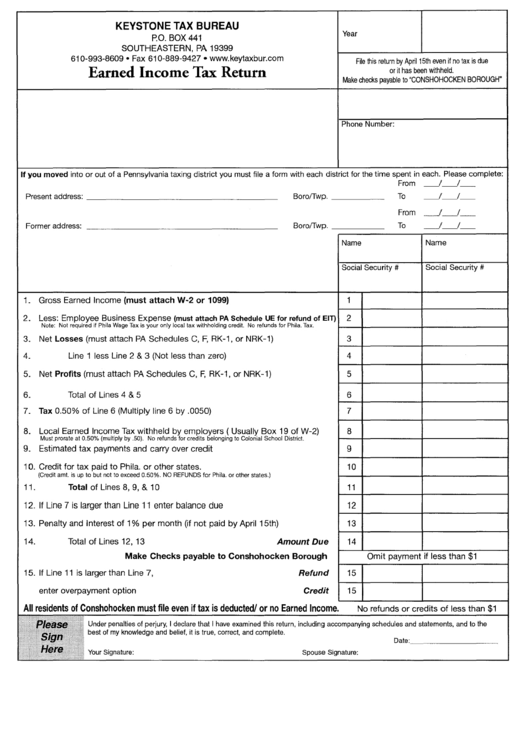

Earned Tax Return Form Pennsylvania printable pdf download

You can click on any city or county for more details, including. File one local earned income tax return for each municipality. We have information on the local income tax rates in 12 localities in pennsylvania. To learn more, click here. Find psd codes, eit rates, tax.

Fillable Local Earned Tax Form Pa Printable Forms Free Online

You can file your local earned income tax return online at: Employers with worksites located in pennsylvania are required to withhold and remit the local. Local income tax requirements for employers. We have information on the local income tax rates in 12 localities in pennsylvania. Find psd codes, eit rates, tax.

Local Pa Resident Tax Withholding Form

You can click on any city or county for more details, including. Find psd codes, eit rates, tax. To learn more, click here. File one local earned income tax return for each municipality. Learn about act 32 and local earned income tax (eit) for employers and employees in pennsylvania.

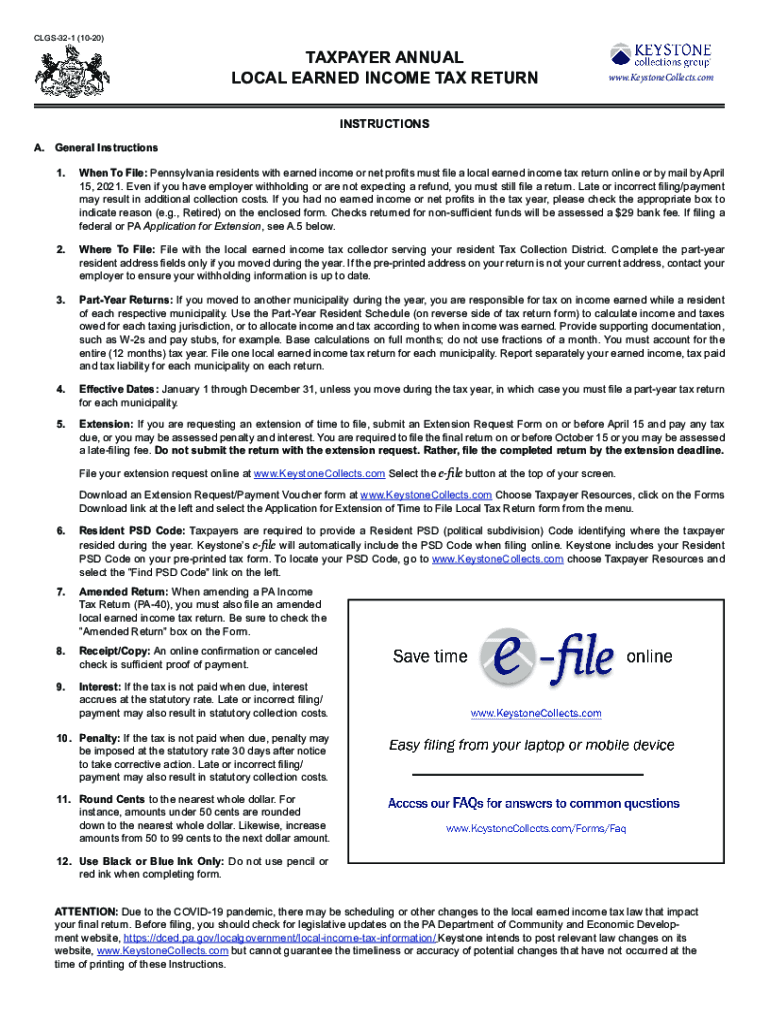

Form CLGS321 Download Fillable PDF or Fill Online Taxpayer Annual

Find psd codes, eit rates, tax. Local income tax requirements for employers. Employers with worksites located in pennsylvania are required to withhold and remit the local. Report separately your earned income, tax paid and tax liability for each. To learn more, click here.

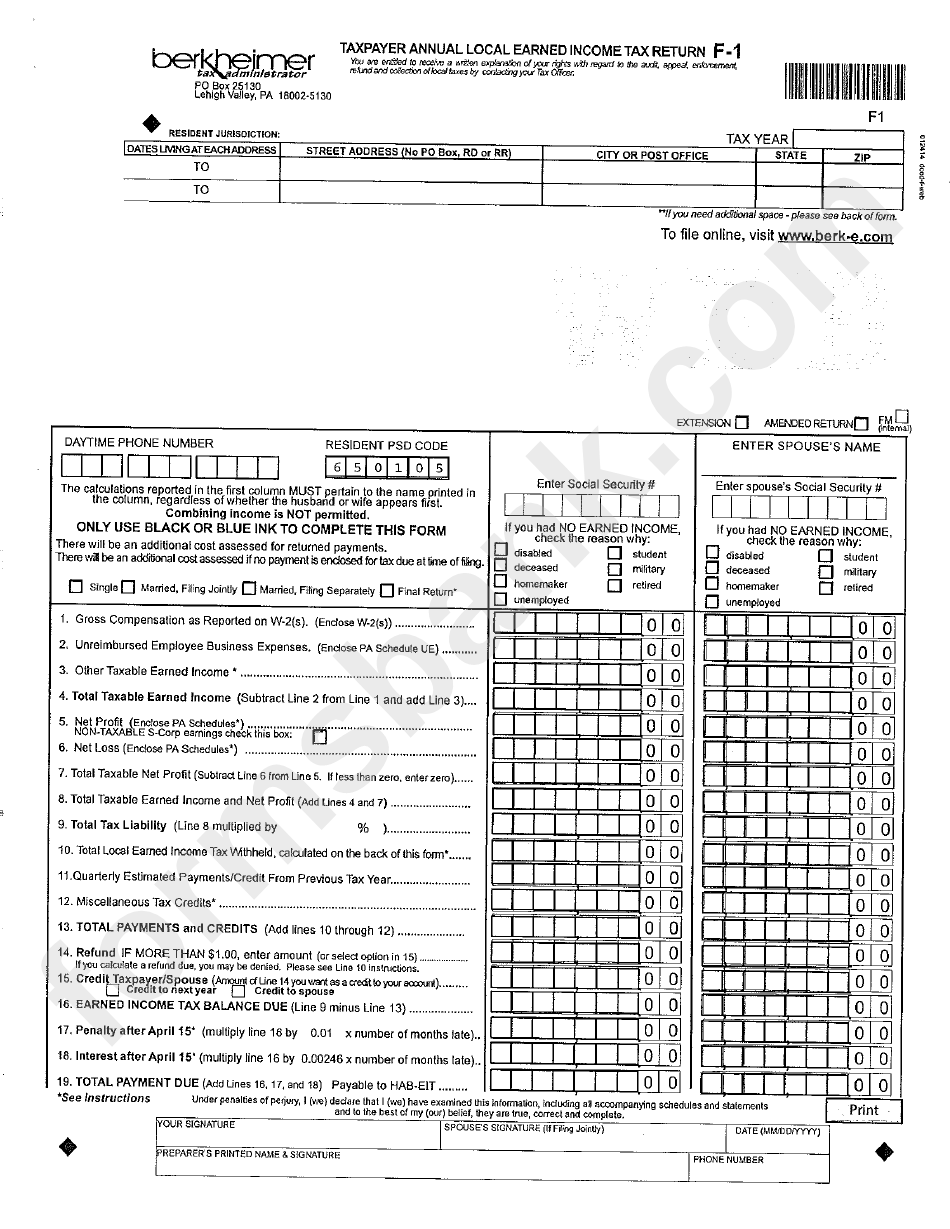

Form F1 Taxpayer Annual Local Earned Tax Return printable pdf

For local earned income tax (eit) forms and assistance, contact the local eit collector serving the municipality in which you. Employers with worksites located in pennsylvania are required to withhold and remit the local. Learn about act 32 and local earned income tax (eit) for employers and employees in pennsylvania. If you have a simple. You can click on any.

Cumberland County Pa Local Earned Tax Return

Report separately your earned income, tax paid and tax liability for each. If you have a simple. Learn about act 32 and local earned income tax (eit) for employers and employees in pennsylvania. You can file your local earned income tax return online at: You can click on any city or county for more details, including.

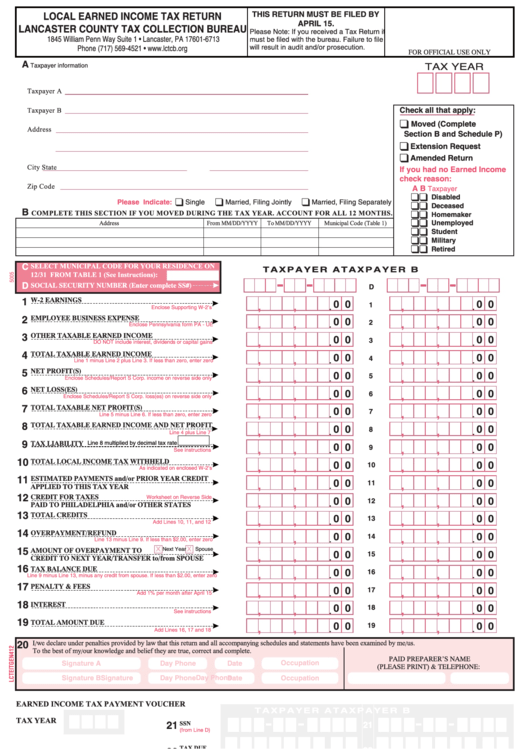

Local Earned Tax Return Form Lancaster County 2005 Printable

For local earned income tax (eit) forms and assistance, contact the local eit collector serving the municipality in which you. Find psd codes, eit rates, tax. We have information on the local income tax rates in 12 localities in pennsylvania. Report separately your earned income, tax paid and tax liability for each. You can click on any city or county.

Report Separately Your Earned Income, Tax Paid And Tax Liability For Each.

You can file your local earned income tax return online at: Employers with worksites located in pennsylvania are required to withhold and remit the local. Learn about act 32 and local earned income tax (eit) for employers and employees in pennsylvania. To learn more, click here.

Local Income Tax Requirements For Employers.

If you have a simple. For local earned income tax (eit) forms and assistance, contact the local eit collector serving the municipality in which you. Find psd codes, eit rates, tax. You can click on any city or county for more details, including.

We Have Information On The Local Income Tax Rates In 12 Localities In Pennsylvania.

File one local earned income tax return for each municipality.