Llc Name Change Irs - The specific action required may vary depending on. If you’re considering changing your name or the name of your business, you have to follow the correct procedure to ensure your. Business owners and other authorized individuals can submit a name change for their business. As of september 29, 2024, taxpayers, both individual and business entities, applying for a united states certification of residency are. Generally, businesses need a new ein when their ownership or structure has changed. Although changing the name of your business does not.

The specific action required may vary depending on. Although changing the name of your business does not. If you’re considering changing your name or the name of your business, you have to follow the correct procedure to ensure your. Business owners and other authorized individuals can submit a name change for their business. Generally, businesses need a new ein when their ownership or structure has changed. As of september 29, 2024, taxpayers, both individual and business entities, applying for a united states certification of residency are.

As of september 29, 2024, taxpayers, both individual and business entities, applying for a united states certification of residency are. Business owners and other authorized individuals can submit a name change for their business. Generally, businesses need a new ein when their ownership or structure has changed. Although changing the name of your business does not. The specific action required may vary depending on. If you’re considering changing your name or the name of your business, you have to follow the correct procedure to ensure your.

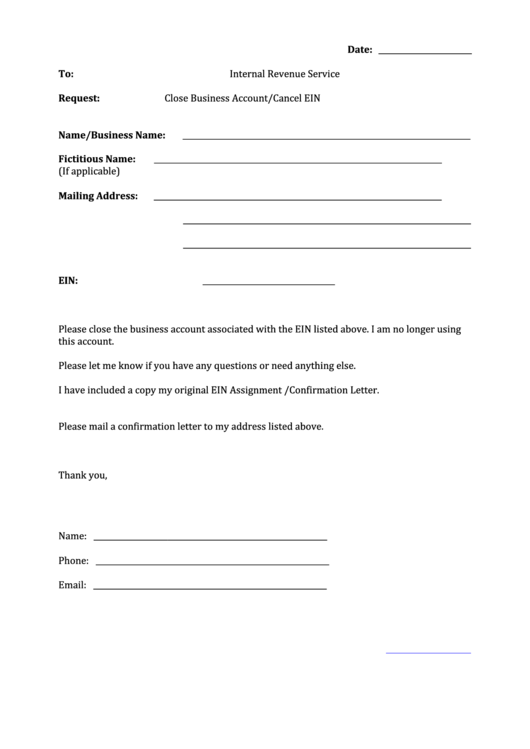

Irs Business Name Change Letter Template

Business owners and other authorized individuals can submit a name change for their business. Generally, businesses need a new ein when their ownership or structure has changed. Although changing the name of your business does not. The specific action required may vary depending on. As of september 29, 2024, taxpayers, both individual and business entities, applying for a united states.

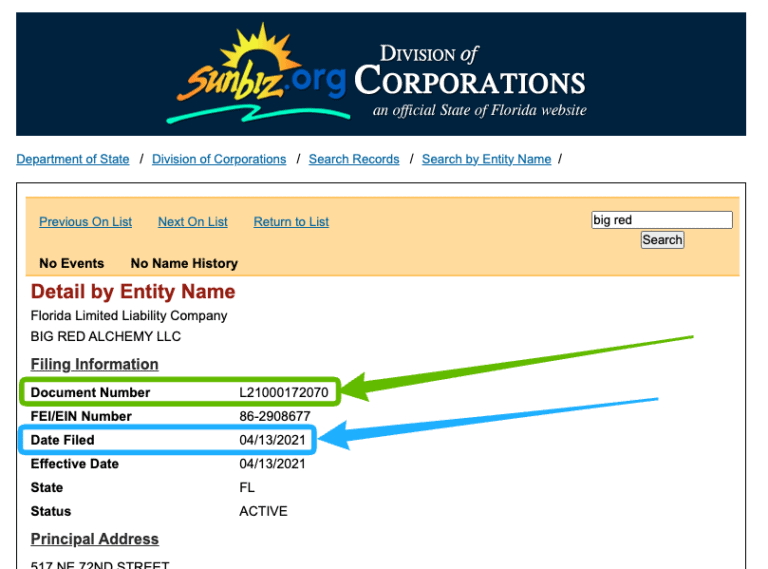

How to Change your LLC Name with the IRS? LLC University®

Generally, businesses need a new ein when their ownership or structure has changed. Although changing the name of your business does not. The specific action required may vary depending on. If you’re considering changing your name or the name of your business, you have to follow the correct procedure to ensure your. Business owners and other authorized individuals can submit.

How to Change an LLC Name in Florida (Stepbystep) LLCU®

Generally, businesses need a new ein when their ownership or structure has changed. Although changing the name of your business does not. If you’re considering changing your name or the name of your business, you have to follow the correct procedure to ensure your. As of september 29, 2024, taxpayers, both individual and business entities, applying for a united states.

Business Name Change Irs Sample Letter Irs Ein Name Change Form

The specific action required may vary depending on. As of september 29, 2024, taxpayers, both individual and business entities, applying for a united states certification of residency are. Business owners and other authorized individuals can submit a name change for their business. If you’re considering changing your name or the name of your business, you have to follow the correct.

Irs Business Name Change Letter Template

Although changing the name of your business does not. As of september 29, 2024, taxpayers, both individual and business entities, applying for a united states certification of residency are. Generally, businesses need a new ein when their ownership or structure has changed. The specific action required may vary depending on. Business owners and other authorized individuals can submit a name.

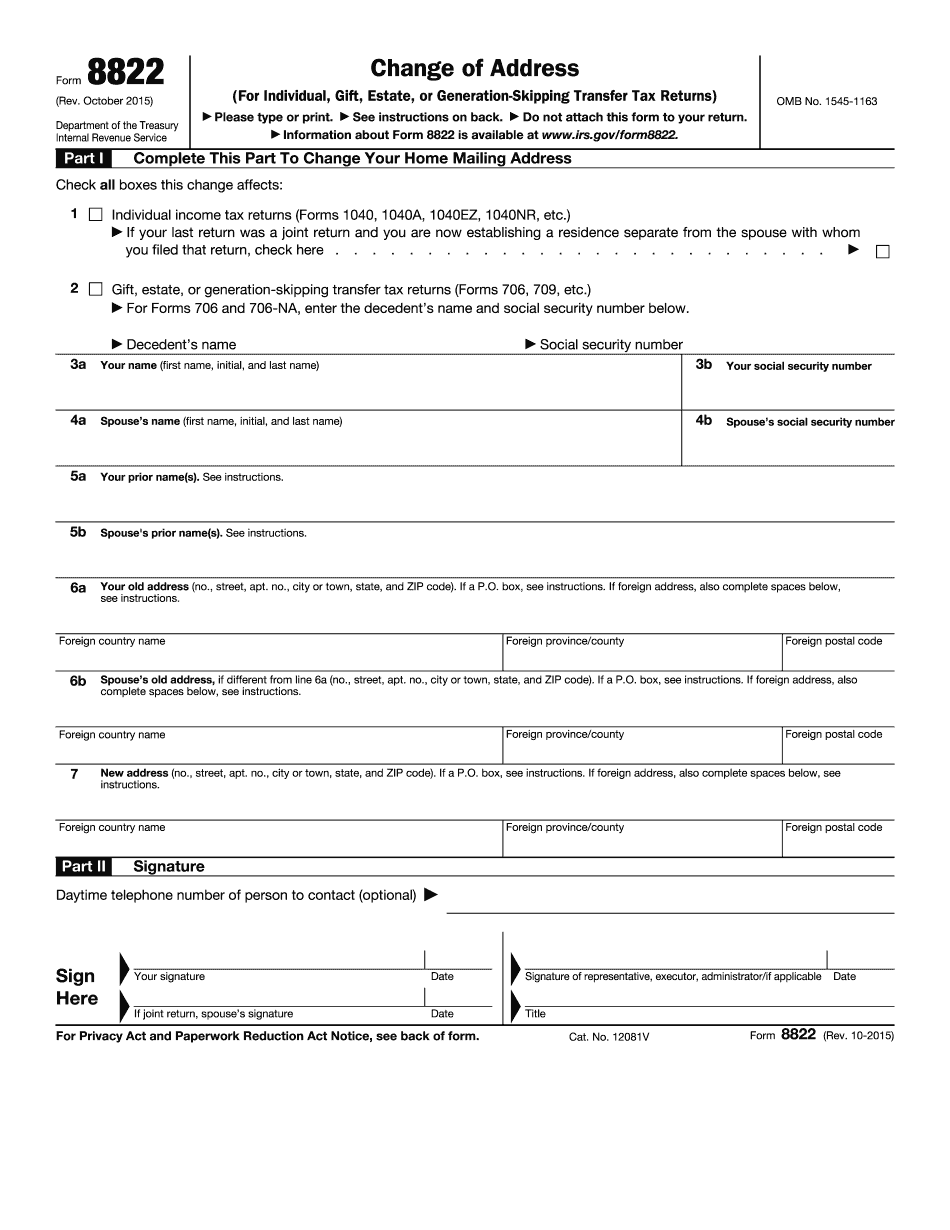

irs name change form Fill Online, Printable, Fillable Blank form

If you’re considering changing your name or the name of your business, you have to follow the correct procedure to ensure your. As of september 29, 2024, taxpayers, both individual and business entities, applying for a united states certification of residency are. Business owners and other authorized individuals can submit a name change for their business. The specific action required.

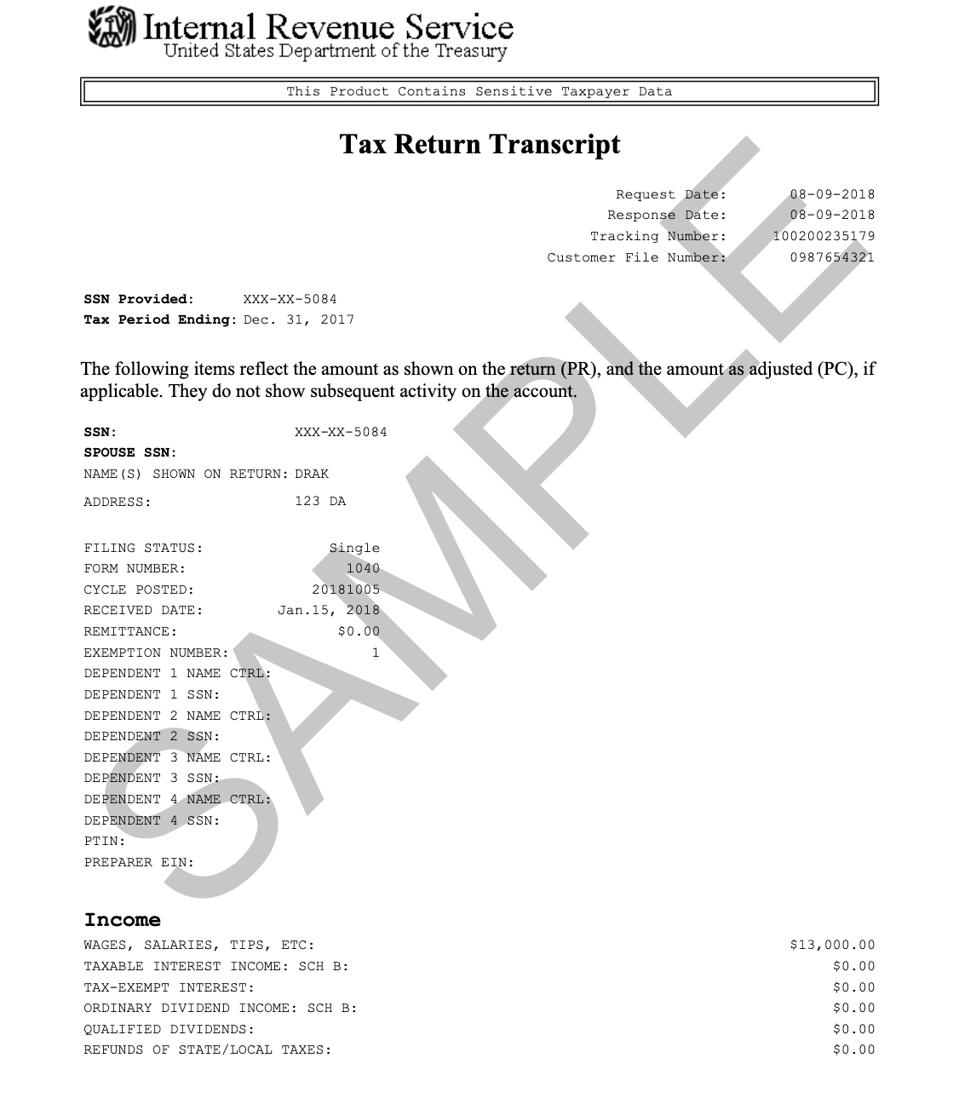

How to get copy of EIN Verification Letter (147C) from the IRS?

Generally, businesses need a new ein when their ownership or structure has changed. The specific action required may vary depending on. Although changing the name of your business does not. As of september 29, 2024, taxpayers, both individual and business entities, applying for a united states certification of residency are. If you’re considering changing your name or the name of.

IRS Business Name Change

As of september 29, 2024, taxpayers, both individual and business entities, applying for a united states certification of residency are. Business owners and other authorized individuals can submit a name change for their business. The specific action required may vary depending on. Generally, businesses need a new ein when their ownership or structure has changed. Although changing the name of.

Irs Name Change Letter Sample Form W 2 Wikipedia Send a letter

Although changing the name of your business does not. If you’re considering changing your name or the name of your business, you have to follow the correct procedure to ensure your. The specific action required may vary depending on. Generally, businesses need a new ein when their ownership or structure has changed. As of september 29, 2024, taxpayers, both individual.

Business Name Change Irs Sample Letter / Irs Business Name Change

As of september 29, 2024, taxpayers, both individual and business entities, applying for a united states certification of residency are. The specific action required may vary depending on. Generally, businesses need a new ein when their ownership or structure has changed. Business owners and other authorized individuals can submit a name change for their business. If you’re considering changing your.

If You’re Considering Changing Your Name Or The Name Of Your Business, You Have To Follow The Correct Procedure To Ensure Your.

Generally, businesses need a new ein when their ownership or structure has changed. Although changing the name of your business does not. As of september 29, 2024, taxpayers, both individual and business entities, applying for a united states certification of residency are. Business owners and other authorized individuals can submit a name change for their business.