Indiana Tax Liens - All parcels that have a balance due for taxes and special assessments from the prior year's spring installment are eligible for the treasurer's tax. In indiana, state tax liens are governed by indiana code title 6, article 8.1, chapter 8. A customer (business or individual) who has outstanding liabilities that have been filed as a lien in the county clerk’s office will have dor. Inquiries regarding tax sale procedure should be directed. (n) a county auditor shall not issue or record a tax deed unless the following requirements are met not later than one hundred fifty (150) days after. Our next tax sale will be held sometime in october of 2025. Please check back for updates. This handout provides general information about indiana tax sales and the statutory obligations of lien buyers following a tax sale. A lien is initiated when a taxpayer.

Inquiries regarding tax sale procedure should be directed. In indiana, state tax liens are governed by indiana code title 6, article 8.1, chapter 8. Please check back for updates. A lien is initiated when a taxpayer. All parcels that have a balance due for taxes and special assessments from the prior year's spring installment are eligible for the treasurer's tax. (n) a county auditor shall not issue or record a tax deed unless the following requirements are met not later than one hundred fifty (150) days after. Our next tax sale will be held sometime in october of 2025. A customer (business or individual) who has outstanding liabilities that have been filed as a lien in the county clerk’s office will have dor. This handout provides general information about indiana tax sales and the statutory obligations of lien buyers following a tax sale.

Please check back for updates. Our next tax sale will be held sometime in october of 2025. A lien is initiated when a taxpayer. This handout provides general information about indiana tax sales and the statutory obligations of lien buyers following a tax sale. A customer (business or individual) who has outstanding liabilities that have been filed as a lien in the county clerk’s office will have dor. In indiana, state tax liens are governed by indiana code title 6, article 8.1, chapter 8. Inquiries regarding tax sale procedure should be directed. All parcels that have a balance due for taxes and special assessments from the prior year's spring installment are eligible for the treasurer's tax. (n) a county auditor shall not issue or record a tax deed unless the following requirements are met not later than one hundred fifty (150) days after.

Indiana State Tax Withholding Calculator Internal Revenue Code

Our next tax sale will be held sometime in october of 2025. Please check back for updates. In indiana, state tax liens are governed by indiana code title 6, article 8.1, chapter 8. All parcels that have a balance due for taxes and special assessments from the prior year's spring installment are eligible for the treasurer's tax. A customer (business.

Indiana State Tax

In indiana, state tax liens are governed by indiana code title 6, article 8.1, chapter 8. (n) a county auditor shall not issue or record a tax deed unless the following requirements are met not later than one hundred fifty (150) days after. This handout provides general information about indiana tax sales and the statutory obligations of lien buyers following.

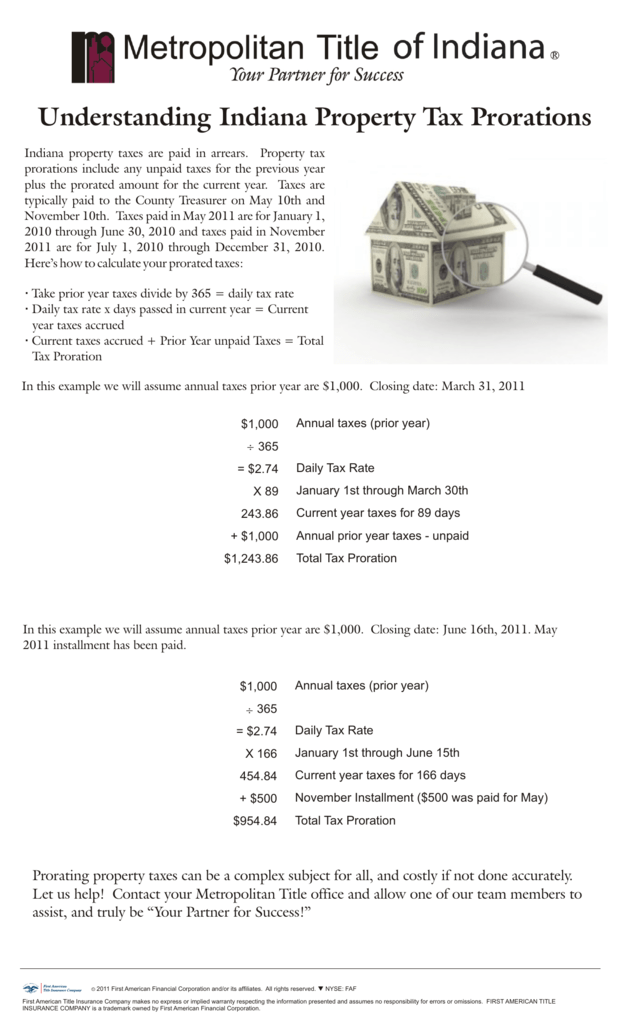

Understanding Indiana Property Tax Prorations

A customer (business or individual) who has outstanding liabilities that have been filed as a lien in the county clerk’s office will have dor. This handout provides general information about indiana tax sales and the statutory obligations of lien buyers following a tax sale. Please check back for updates. Inquiries regarding tax sale procedure should be directed. In indiana, state.

Tax Liens and Deeds Live Class Pips Path

In indiana, state tax liens are governed by indiana code title 6, article 8.1, chapter 8. (n) a county auditor shall not issue or record a tax deed unless the following requirements are met not later than one hundred fifty (150) days after. Please check back for updates. Inquiries regarding tax sale procedure should be directed. This handout provides general.

How to Find Properties for Sale With Tax Liens? Tax Lien Code UrbanMatter

This handout provides general information about indiana tax sales and the statutory obligations of lien buyers following a tax sale. All parcels that have a balance due for taxes and special assessments from the prior year's spring installment are eligible for the treasurer's tax. Inquiries regarding tax sale procedure should be directed. A lien is initiated when a taxpayer. A.

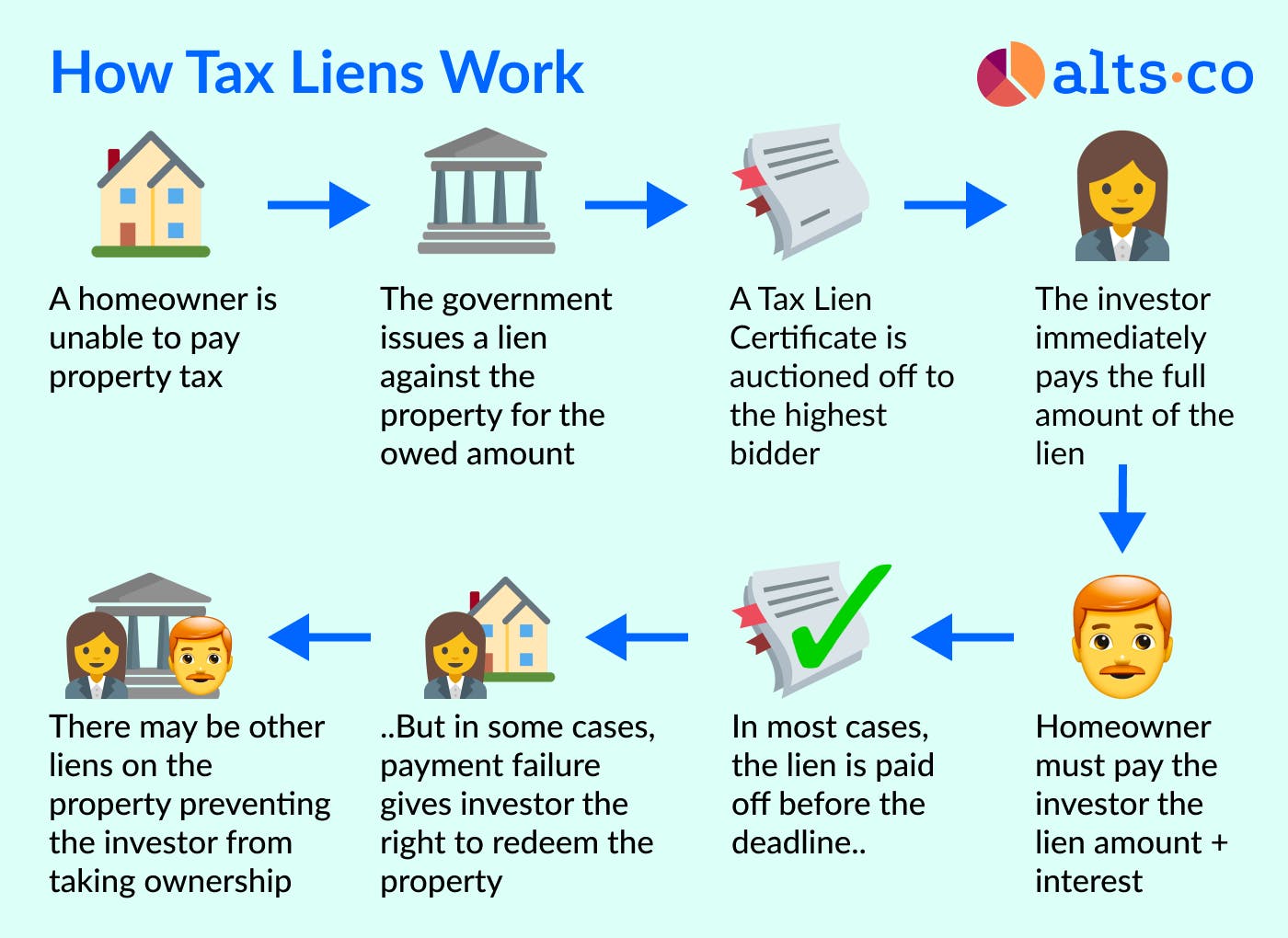

Investing In Tax Liens Alts.co

Inquiries regarding tax sale procedure should be directed. Please check back for updates. In indiana, state tax liens are governed by indiana code title 6, article 8.1, chapter 8. This handout provides general information about indiana tax sales and the statutory obligations of lien buyers following a tax sale. All parcels that have a balance due for taxes and special.

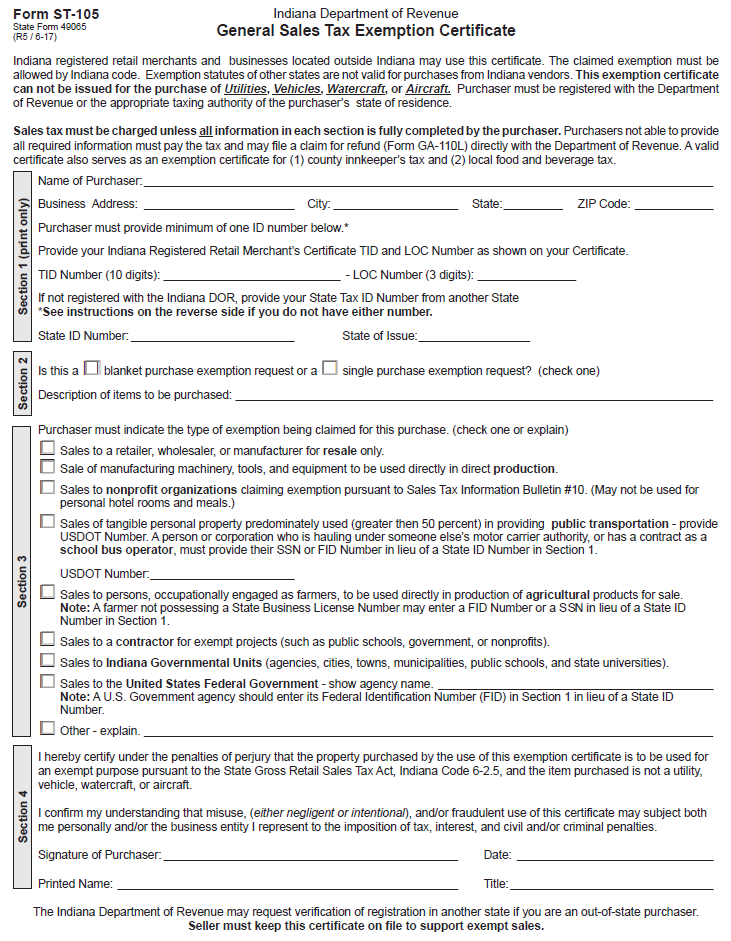

Indiana sales tax form Fill out & sign online DocHub

A lien is initiated when a taxpayer. A customer (business or individual) who has outstanding liabilities that have been filed as a lien in the county clerk’s office will have dor. Please check back for updates. (n) a county auditor shall not issue or record a tax deed unless the following requirements are met not later than one hundred fifty.

Indiana Farm Tax Exempt Form

A customer (business or individual) who has outstanding liabilities that have been filed as a lien in the county clerk’s office will have dor. Please check back for updates. A lien is initiated when a taxpayer. Inquiries regarding tax sale procedure should be directed. All parcels that have a balance due for taxes and special assessments from the prior year's.

TAX Consultancy Firm Gurugram

Inquiries regarding tax sale procedure should be directed. Our next tax sale will be held sometime in october of 2025. In indiana, state tax liens are governed by indiana code title 6, article 8.1, chapter 8. This handout provides general information about indiana tax sales and the statutory obligations of lien buyers following a tax sale. (n) a county auditor.

Statute of Limitations on Tax Liens in the State of Indiana Sapling

Inquiries regarding tax sale procedure should be directed. A lien is initiated when a taxpayer. In indiana, state tax liens are governed by indiana code title 6, article 8.1, chapter 8. This handout provides general information about indiana tax sales and the statutory obligations of lien buyers following a tax sale. Please check back for updates.

Our Next Tax Sale Will Be Held Sometime In October Of 2025.

A lien is initiated when a taxpayer. In indiana, state tax liens are governed by indiana code title 6, article 8.1, chapter 8. A customer (business or individual) who has outstanding liabilities that have been filed as a lien in the county clerk’s office will have dor. Inquiries regarding tax sale procedure should be directed.

This Handout Provides General Information About Indiana Tax Sales And The Statutory Obligations Of Lien Buyers Following A Tax Sale.

All parcels that have a balance due for taxes and special assessments from the prior year's spring installment are eligible for the treasurer's tax. Please check back for updates. (n) a county auditor shall not issue or record a tax deed unless the following requirements are met not later than one hundred fifty (150) days after.