Indiana Local Withholding Tax - 1, how to compute withholding for state and county income tax, to reflect changes to county income tax rates. If you have questions about. You can click on any city or county for more details, including the nonresident income tax rate and tax forms. Browse county local income taxes and local tax report for all indiana counties. Subscribe for email updates and learn about local tax statistics. We have information on the local income tax rates in 91 localities in indiana. Effective january 1, 2024, the indiana department of revenue revised departmental notice no. Below you’ll find more information about withholding tax and additional resources including the business tax application, frequently asked questions and county tax rates. The indiana department of revenue provided guidance to help employers determine the correct amount of indiana county income tax to withhold from employee wages effective.

The indiana department of revenue provided guidance to help employers determine the correct amount of indiana county income tax to withhold from employee wages effective. You can click on any city or county for more details, including the nonresident income tax rate and tax forms. If you have questions about. Browse county local income taxes and local tax report for all indiana counties. Below you’ll find more information about withholding tax and additional resources including the business tax application, frequently asked questions and county tax rates. Subscribe for email updates and learn about local tax statistics. Effective january 1, 2024, the indiana department of revenue revised departmental notice no. We have information on the local income tax rates in 91 localities in indiana. 1, how to compute withholding for state and county income tax, to reflect changes to county income tax rates.

Browse county local income taxes and local tax report for all indiana counties. You can click on any city or county for more details, including the nonresident income tax rate and tax forms. If you have questions about. Below you’ll find more information about withholding tax and additional resources including the business tax application, frequently asked questions and county tax rates. The indiana department of revenue provided guidance to help employers determine the correct amount of indiana county income tax to withhold from employee wages effective. Subscribe for email updates and learn about local tax statistics. We have information on the local income tax rates in 91 localities in indiana. Effective january 1, 2024, the indiana department of revenue revised departmental notice no. 1, how to compute withholding for state and county income tax, to reflect changes to county income tax rates.

Indiana Withholding Rate 2024 Indira Brigida

Effective january 1, 2024, the indiana department of revenue revised departmental notice no. Subscribe for email updates and learn about local tax statistics. The indiana department of revenue provided guidance to help employers determine the correct amount of indiana county income tax to withhold from employee wages effective. If you have questions about. You can click on any city or.

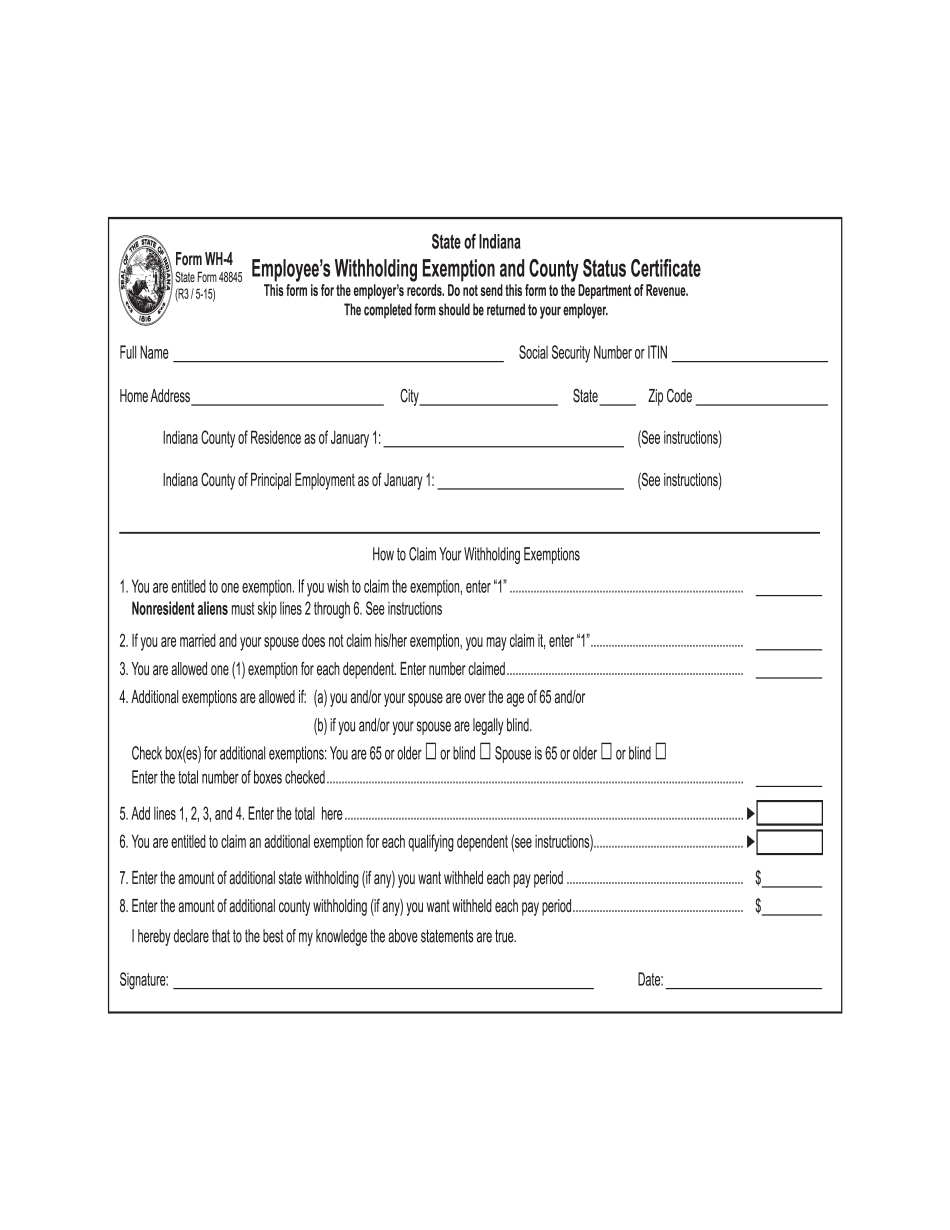

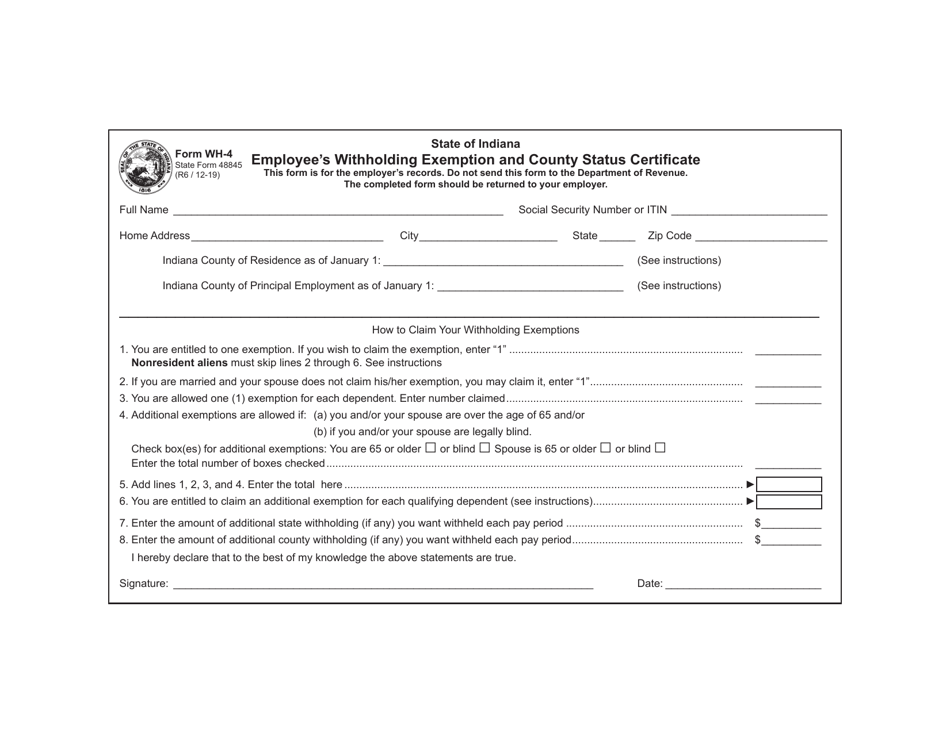

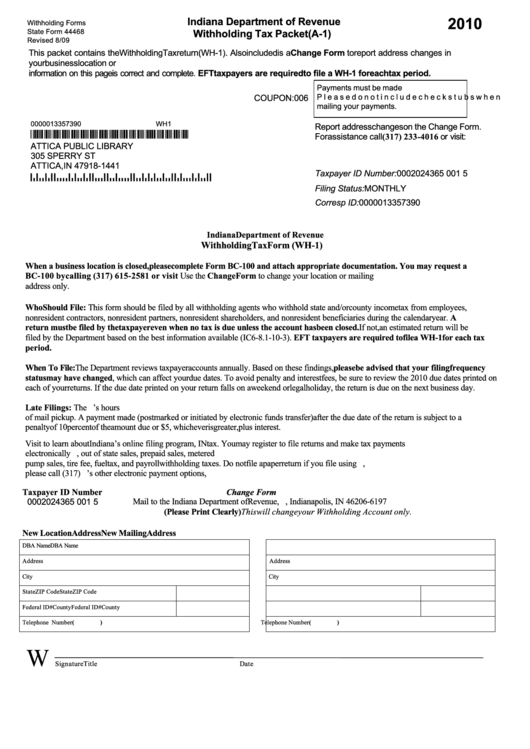

Indiana Withholding 20202024 Form Fill Out and Sign Printable

The indiana department of revenue provided guidance to help employers determine the correct amount of indiana county income tax to withhold from employee wages effective. We have information on the local income tax rates in 91 localities in indiana. If you have questions about. Below you’ll find more information about withholding tax and additional resources including the business tax application,.

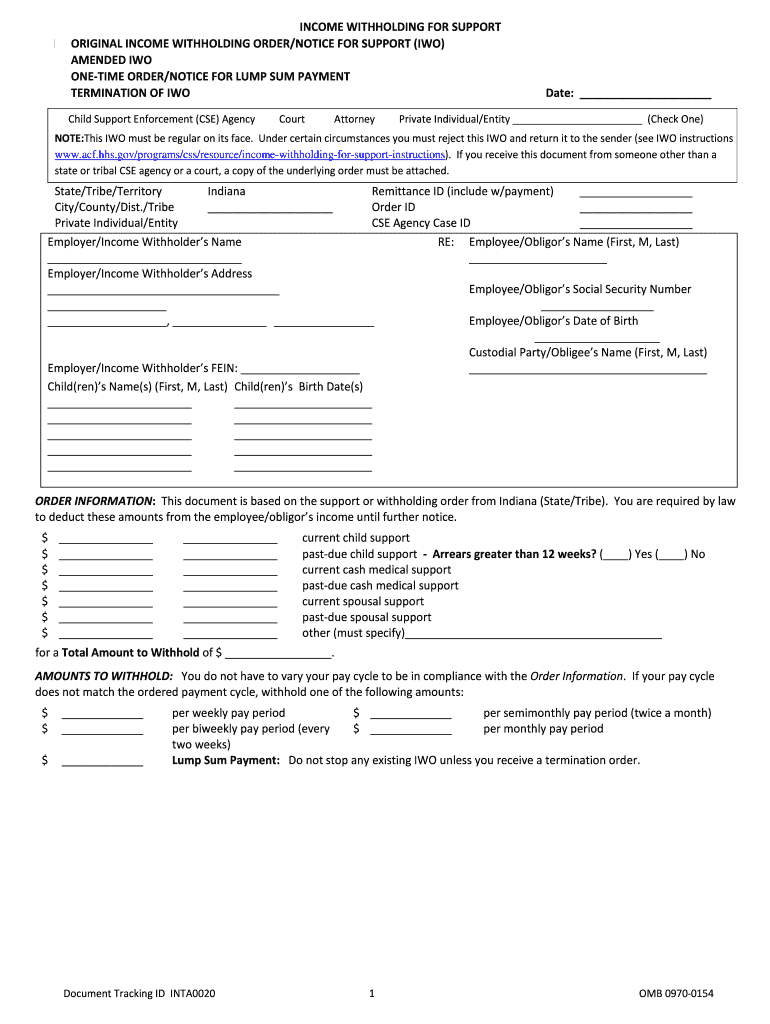

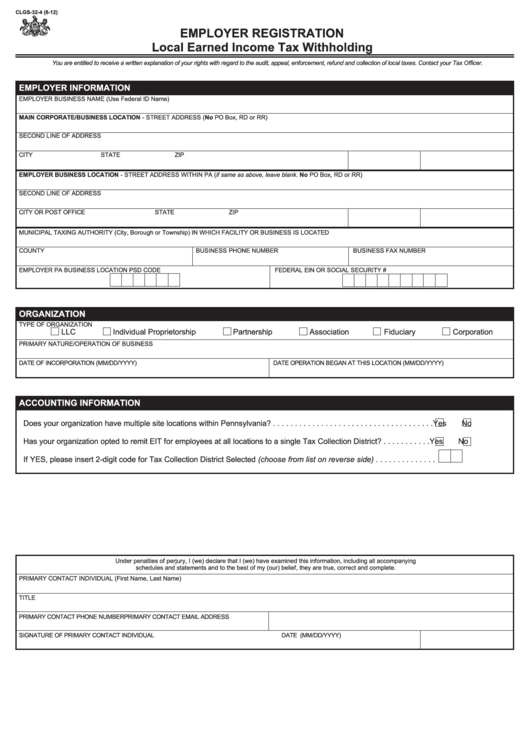

Indiana Local Tax Withholding Form

The indiana department of revenue provided guidance to help employers determine the correct amount of indiana county income tax to withhold from employee wages effective. You can click on any city or county for more details, including the nonresident income tax rate and tax forms. We have information on the local income tax rates in 91 localities in indiana. 1,.

State Of Indiana Withholding Tax Form

Effective january 1, 2024, the indiana department of revenue revised departmental notice no. You can click on any city or county for more details, including the nonresident income tax rate and tax forms. Browse county local income taxes and local tax report for all indiana counties. If you have questions about. Subscribe for email updates and learn about local tax.

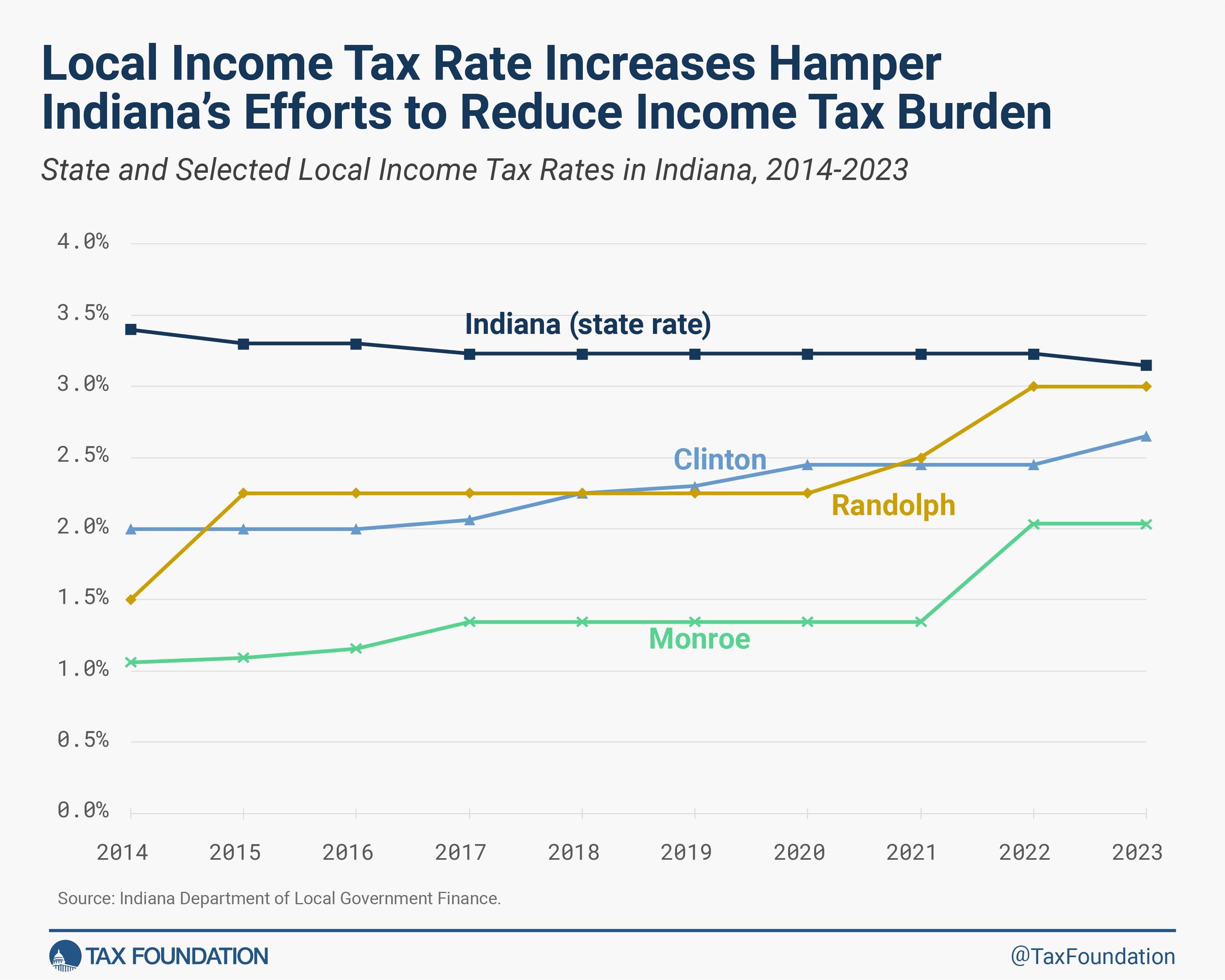

Indiana County Withholding Tax Rates 2024 Koral Miguela

1, how to compute withholding for state and county income tax, to reflect changes to county income tax rates. We have information on the local income tax rates in 91 localities in indiana. The indiana department of revenue provided guidance to help employers determine the correct amount of indiana county income tax to withhold from employee wages effective. Effective january.

Form WH4 (State Form 48845) Fill Out, Sign Online and Download

We have information on the local income tax rates in 91 localities in indiana. Below you’ll find more information about withholding tax and additional resources including the business tax application, frequently asked questions and county tax rates. Effective january 1, 2024, the indiana department of revenue revised departmental notice no. The indiana department of revenue provided guidance to help employers.

Indiana State Tax Withholding Form 2024 Casi Martie

Below you’ll find more information about withholding tax and additional resources including the business tax application, frequently asked questions and county tax rates. The indiana department of revenue provided guidance to help employers determine the correct amount of indiana county income tax to withhold from employee wages effective. You can click on any city or county for more details, including.

Indiana Local Tax Withholding Form

Subscribe for email updates and learn about local tax statistics. If you have questions about. We have information on the local income tax rates in 91 localities in indiana. You can click on any city or county for more details, including the nonresident income tax rate and tax forms. The indiana department of revenue provided guidance to help employers determine.

Indiana Employee State Withholding Form

If you have questions about. 1, how to compute withholding for state and county income tax, to reflect changes to county income tax rates. Below you’ll find more information about withholding tax and additional resources including the business tax application, frequently asked questions and county tax rates. Effective january 1, 2024, the indiana department of revenue revised departmental notice no..

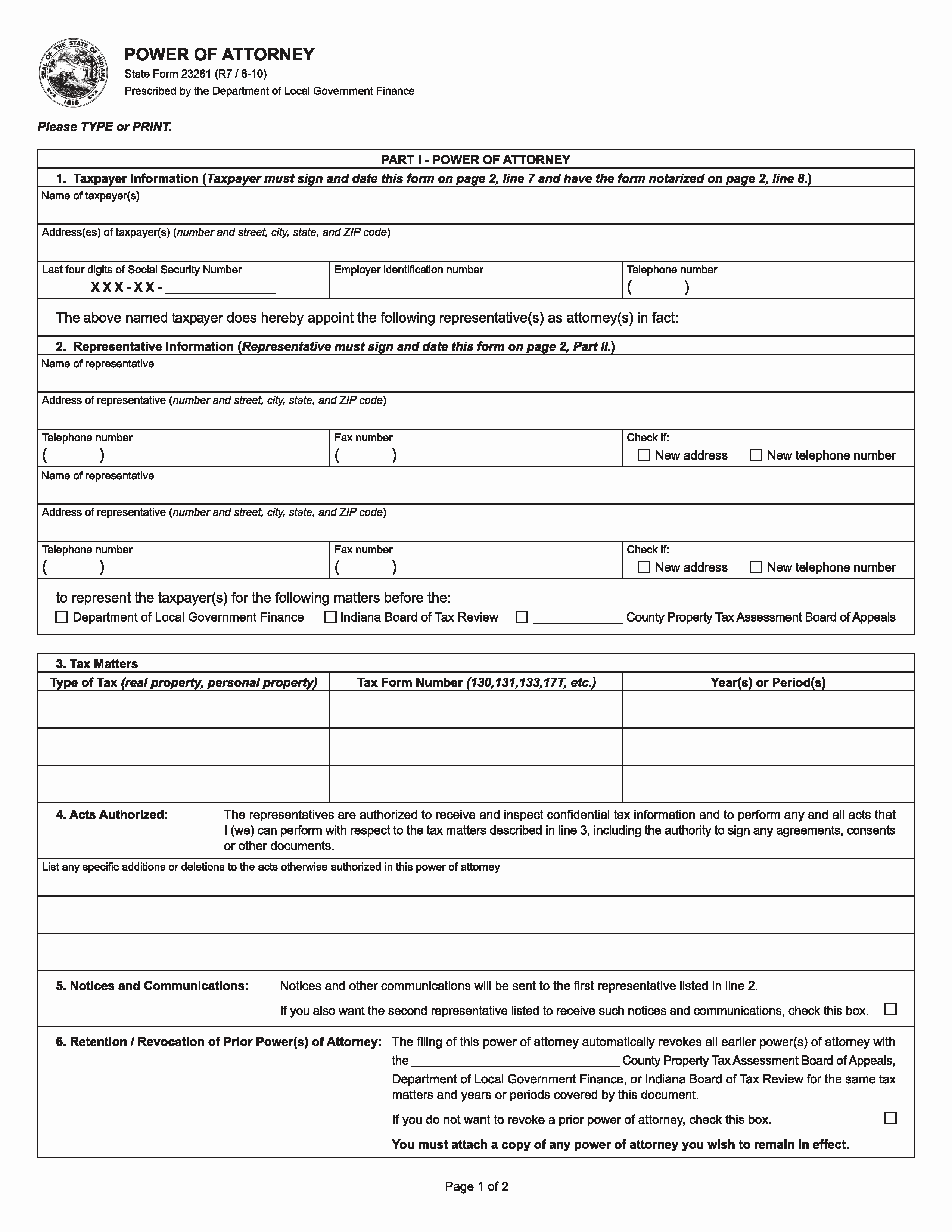

Testimony Considerations for Improving Indiana’s Tax Structure and

Effective january 1, 2024, the indiana department of revenue revised departmental notice no. If you have questions about. We have information on the local income tax rates in 91 localities in indiana. Subscribe for email updates and learn about local tax statistics. You can click on any city or county for more details, including the nonresident income tax rate and.

1, How To Compute Withholding For State And County Income Tax, To Reflect Changes To County Income Tax Rates.

You can click on any city or county for more details, including the nonresident income tax rate and tax forms. If you have questions about. Browse county local income taxes and local tax report for all indiana counties. Effective january 1, 2024, the indiana department of revenue revised departmental notice no.

Below You’ll Find More Information About Withholding Tax And Additional Resources Including The Business Tax Application, Frequently Asked Questions And County Tax Rates.

We have information on the local income tax rates in 91 localities in indiana. Subscribe for email updates and learn about local tax statistics. The indiana department of revenue provided guidance to help employers determine the correct amount of indiana county income tax to withhold from employee wages effective.