How Long Does A Federal Tax Lien Last - If the irs timely refiles the tax lien, it is treated as continuation of the initial lien. The irs tax lien expires when your tax debt is no longer collectible. The irs releases your lien within 30 days after you have paid your tax debt. Does a federal tax lien expire? When conditions are in the best interest of both the government and the taxpayer, other options for reducing the impact of a lien exist. A discharge removes the lien from. The federal tax lien continues until the liability for the amount assessed is satisfied or becomes unenforceable by reason of lapse of time, i.e., passing of the collection statute expiration date (csed). After the 10 year statute of limitations on collections expires, the irs is required to release the lien. The general rule is that the irs has ten years to collect delinquent taxes, but a number of events can extend this period.

The irs releases your lien within 30 days after you have paid your tax debt. If the irs timely refiles the tax lien, it is treated as continuation of the initial lien. A discharge removes the lien from. The federal tax lien continues until the liability for the amount assessed is satisfied or becomes unenforceable by reason of lapse of time, i.e., passing of the collection statute expiration date (csed). The irs tax lien expires when your tax debt is no longer collectible. After the 10 year statute of limitations on collections expires, the irs is required to release the lien. The general rule is that the irs has ten years to collect delinquent taxes, but a number of events can extend this period. When conditions are in the best interest of both the government and the taxpayer, other options for reducing the impact of a lien exist. Does a federal tax lien expire?

The irs releases your lien within 30 days after you have paid your tax debt. If the irs timely refiles the tax lien, it is treated as continuation of the initial lien. The general rule is that the irs has ten years to collect delinquent taxes, but a number of events can extend this period. A discharge removes the lien from. When conditions are in the best interest of both the government and the taxpayer, other options for reducing the impact of a lien exist. The federal tax lien continues until the liability for the amount assessed is satisfied or becomes unenforceable by reason of lapse of time, i.e., passing of the collection statute expiration date (csed). The irs tax lien expires when your tax debt is no longer collectible. Does a federal tax lien expire? After the 10 year statute of limitations on collections expires, the irs is required to release the lien.

Title Basics of the Federal Tax Lien SnapClose

Does a federal tax lien expire? The general rule is that the irs has ten years to collect delinquent taxes, but a number of events can extend this period. The irs releases your lien within 30 days after you have paid your tax debt. The federal tax lien continues until the liability for the amount assessed is satisfied or becomes.

State Tax Lien vs. Federal Tax Lien How to Remove Them

When conditions are in the best interest of both the government and the taxpayer, other options for reducing the impact of a lien exist. Does a federal tax lien expire? The irs releases your lien within 30 days after you have paid your tax debt. The irs tax lien expires when your tax debt is no longer collectible. The federal.

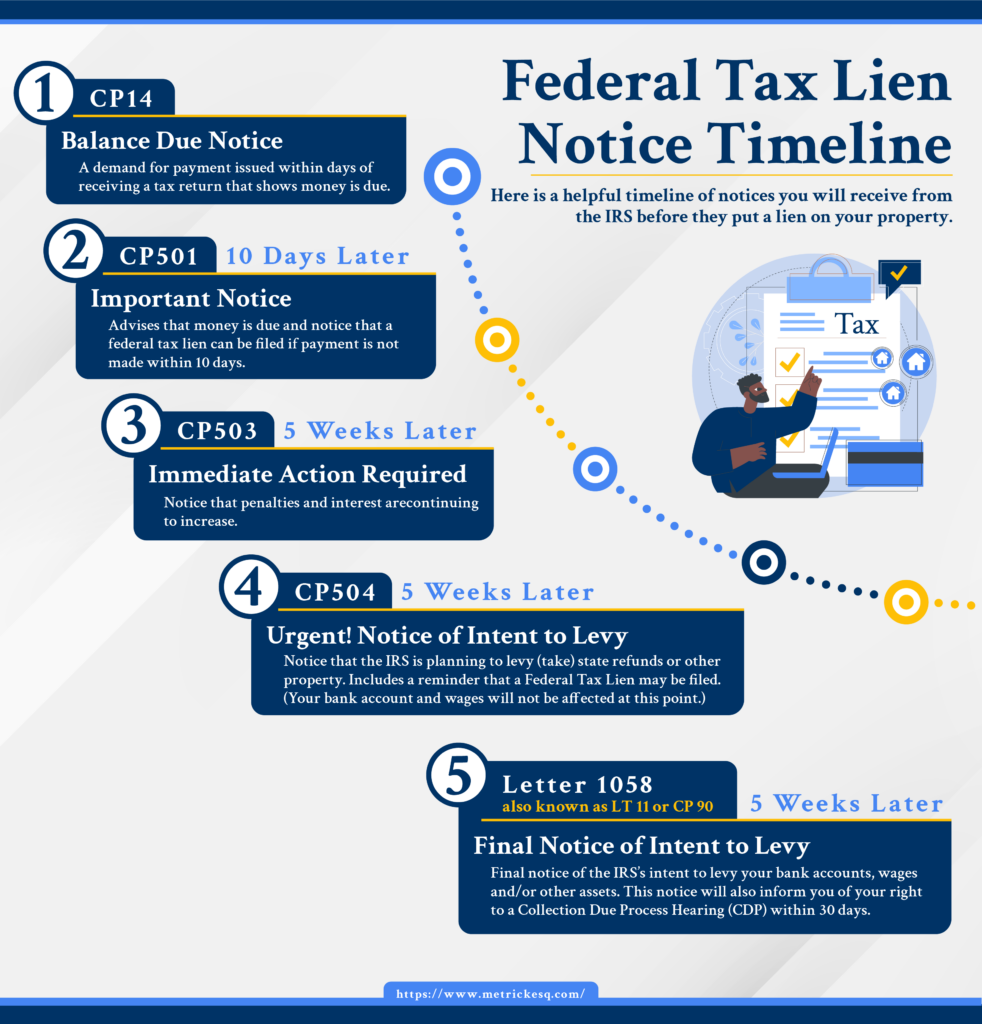

Federal Tax Lien Notice Timeline Ira J. Metrick, Esq.

When conditions are in the best interest of both the government and the taxpayer, other options for reducing the impact of a lien exist. The federal tax lien continues until the liability for the amount assessed is satisfied or becomes unenforceable by reason of lapse of time, i.e., passing of the collection statute expiration date (csed). A discharge removes the.

How to Remove a Federal Tax Lien Heartland Tax Solutions

The federal tax lien continues until the liability for the amount assessed is satisfied or becomes unenforceable by reason of lapse of time, i.e., passing of the collection statute expiration date (csed). After the 10 year statute of limitations on collections expires, the irs is required to release the lien. The general rule is that the irs has ten years.

How Long Does a Tax Lien Last? Community Tax

If the irs timely refiles the tax lien, it is treated as continuation of the initial lien. A discharge removes the lien from. The irs releases your lien within 30 days after you have paid your tax debt. The general rule is that the irs has ten years to collect delinquent taxes, but a number of events can extend this.

How Long Does a Federal Tax Lien Last? Heartland Tax Solutions

The irs tax lien expires when your tax debt is no longer collectible. The irs releases your lien within 30 days after you have paid your tax debt. Does a federal tax lien expire? When conditions are in the best interest of both the government and the taxpayer, other options for reducing the impact of a lien exist. A discharge.

Understanding a Federal Tax Lien Release Traxion Tax

If the irs timely refiles the tax lien, it is treated as continuation of the initial lien. The federal tax lien continues until the liability for the amount assessed is satisfied or becomes unenforceable by reason of lapse of time, i.e., passing of the collection statute expiration date (csed). The irs tax lien expires when your tax debt is no.

How Long Does a Federal Tax Lien Last? Heartland Tax Solutions

After the 10 year statute of limitations on collections expires, the irs is required to release the lien. The federal tax lien continues until the liability for the amount assessed is satisfied or becomes unenforceable by reason of lapse of time, i.e., passing of the collection statute expiration date (csed). Does a federal tax lien expire? When conditions are in.

How Long Does a State Tax Lien Last? Tax Lien Code

The irs releases your lien within 30 days after you have paid your tax debt. When conditions are in the best interest of both the government and the taxpayer, other options for reducing the impact of a lien exist. Does a federal tax lien expire? The irs tax lien expires when your tax debt is no longer collectible. The general.

Federal tax lien on foreclosed property laderdriver

A discharge removes the lien from. The federal tax lien continues until the liability for the amount assessed is satisfied or becomes unenforceable by reason of lapse of time, i.e., passing of the collection statute expiration date (csed). If the irs timely refiles the tax lien, it is treated as continuation of the initial lien. The irs releases your lien.

Does A Federal Tax Lien Expire?

When conditions are in the best interest of both the government and the taxpayer, other options for reducing the impact of a lien exist. If the irs timely refiles the tax lien, it is treated as continuation of the initial lien. The irs releases your lien within 30 days after you have paid your tax debt. The federal tax lien continues until the liability for the amount assessed is satisfied or becomes unenforceable by reason of lapse of time, i.e., passing of the collection statute expiration date (csed).

The Irs Tax Lien Expires When Your Tax Debt Is No Longer Collectible.

The general rule is that the irs has ten years to collect delinquent taxes, but a number of events can extend this period. A discharge removes the lien from. After the 10 year statute of limitations on collections expires, the irs is required to release the lien.