Harris County Tax Foreclosure - The harris county tax auction is a live auction that takes place on the first tuesday of every month from 10:00am to 4:00 pm. Foreclosures reflect(s) postings accepted through 1/7/2025 images available from 12/3/2013 to present. The information provided on this website is updated daily from. Can someone bid on behalf. Harris county delinquent tax sale property listing sale date: You can contact the harris county tax assessor collector’s office at 713.368.2000 for more information.

The harris county tax auction is a live auction that takes place on the first tuesday of every month from 10:00am to 4:00 pm. Harris county delinquent tax sale property listing sale date: You can contact the harris county tax assessor collector’s office at 713.368.2000 for more information. Foreclosures reflect(s) postings accepted through 1/7/2025 images available from 12/3/2013 to present. The information provided on this website is updated daily from. Can someone bid on behalf.

The information provided on this website is updated daily from. The harris county tax auction is a live auction that takes place on the first tuesday of every month from 10:00am to 4:00 pm. Can someone bid on behalf. Harris county delinquent tax sale property listing sale date: Foreclosures reflect(s) postings accepted through 1/7/2025 images available from 12/3/2013 to present. You can contact the harris county tax assessor collector’s office at 713.368.2000 for more information.

How The Harris County Tax Deferral Works Senior Citizen Property Taxes

Can someone bid on behalf. The harris county tax auction is a live auction that takes place on the first tuesday of every month from 10:00am to 4:00 pm. The information provided on this website is updated daily from. You can contact the harris county tax assessor collector’s office at 713.368.2000 for more information. Harris county delinquent tax sale property.

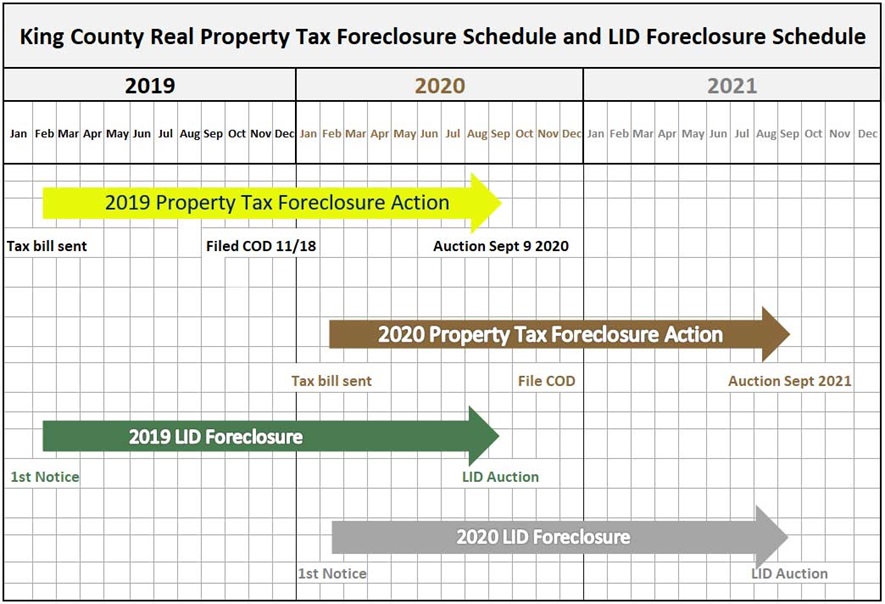

King County Property Tax Foreclosure List Tooyul Adventure

The harris county tax auction is a live auction that takes place on the first tuesday of every month from 10:00am to 4:00 pm. You can contact the harris county tax assessor collector’s office at 713.368.2000 for more information. The information provided on this website is updated daily from. Harris county delinquent tax sale property listing sale date: Foreclosures reflect(s).

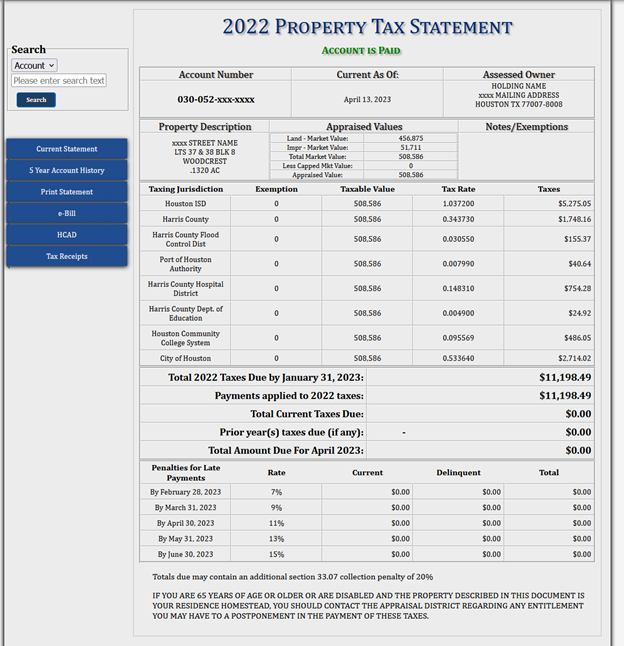

Harris County Property Tax Website

The harris county tax auction is a live auction that takes place on the first tuesday of every month from 10:00am to 4:00 pm. Harris county delinquent tax sale property listing sale date: You can contact the harris county tax assessor collector’s office at 713.368.2000 for more information. The information provided on this website is updated daily from. Foreclosures reflect(s).

Property Tax Foreclosure Chemung County, NY

Foreclosures reflect(s) postings accepted through 1/7/2025 images available from 12/3/2013 to present. Harris county delinquent tax sale property listing sale date: You can contact the harris county tax assessor collector’s office at 713.368.2000 for more information. Can someone bid on behalf. The harris county tax auction is a live auction that takes place on the first tuesday of every month.

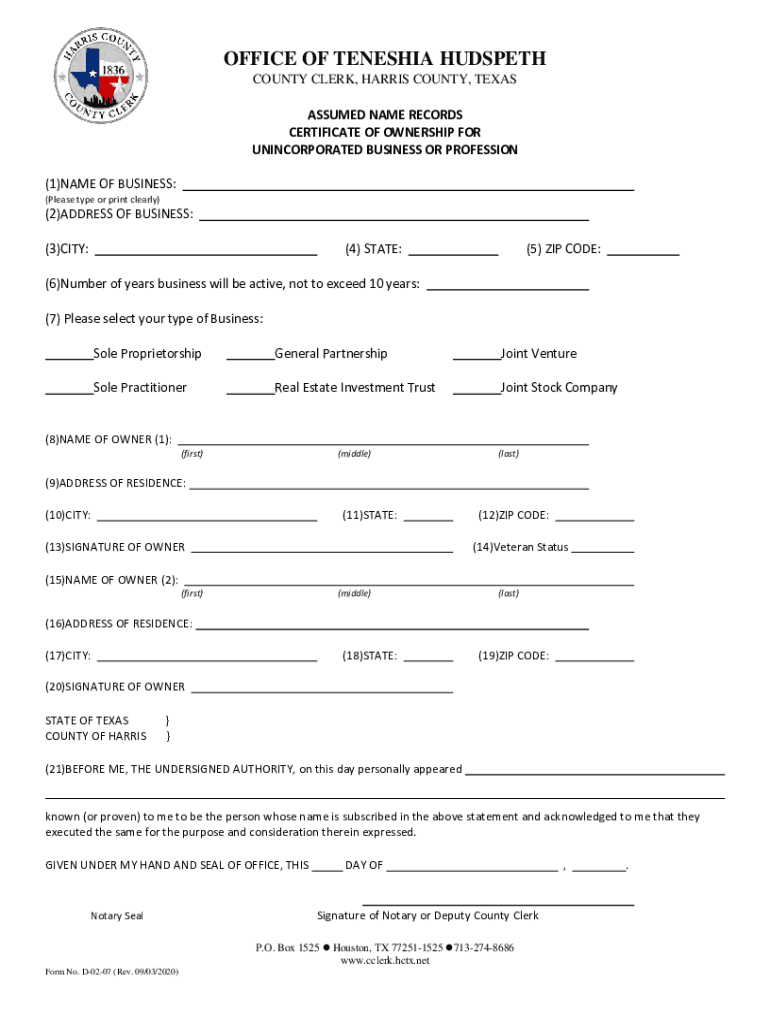

Fill Free fillable Harris County Tax Office PDF forms

The information provided on this website is updated daily from. Harris county delinquent tax sale property listing sale date: You can contact the harris county tax assessor collector’s office at 713.368.2000 for more information. Can someone bid on behalf. The harris county tax auction is a live auction that takes place on the first tuesday of every month from 10:00am.

The Truth About the Harris County Property Tax Rate

The information provided on this website is updated daily from. Can someone bid on behalf. Foreclosures reflect(s) postings accepted through 1/7/2025 images available from 12/3/2013 to present. The harris county tax auction is a live auction that takes place on the first tuesday of every month from 10:00am to 4:00 pm. Harris county delinquent tax sale property listing sale date:

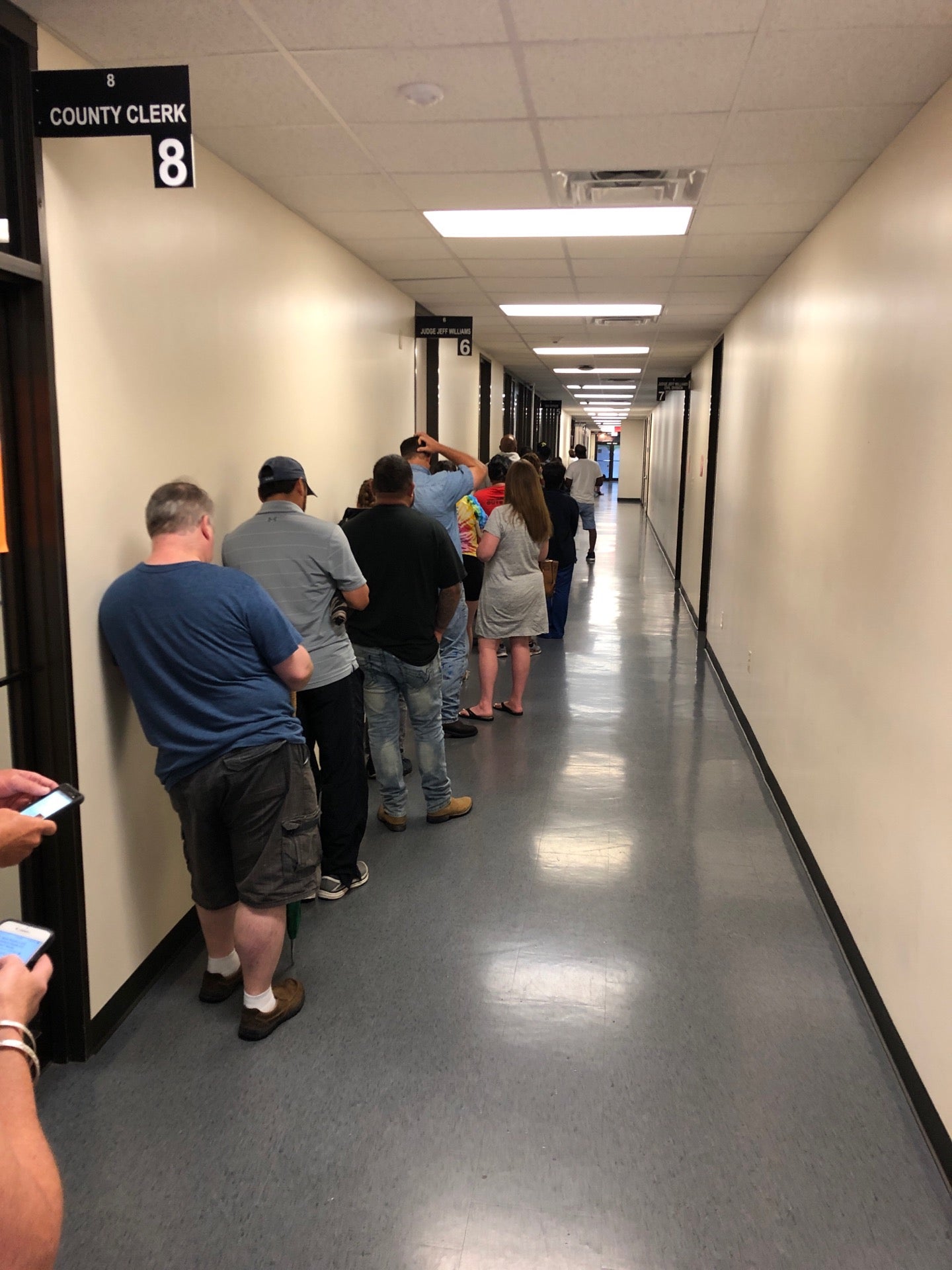

Harris County Tax Office Appointment Lamarcounty.us

The information provided on this website is updated daily from. You can contact the harris county tax assessor collector’s office at 713.368.2000 for more information. The harris county tax auction is a live auction that takes place on the first tuesday of every month from 10:00am to 4:00 pm. Harris county delinquent tax sale property listing sale date: Foreclosures reflect(s).

Sample Foreclosure Answer Download Free PDF Foreclosure Complaint

You can contact the harris county tax assessor collector’s office at 713.368.2000 for more information. Harris county delinquent tax sale property listing sale date: The harris county tax auction is a live auction that takes place on the first tuesday of every month from 10:00am to 4:00 pm. The information provided on this website is updated daily from. Can someone.

Harris County Tax Collector, 16715 Clay Rd, Ste 4, Houston, TX, Court

Can someone bid on behalf. The harris county tax auction is a live auction that takes place on the first tuesday of every month from 10:00am to 4:00 pm. The information provided on this website is updated daily from. You can contact the harris county tax assessor collector’s office at 713.368.2000 for more information. Foreclosures reflect(s) postings accepted through 1/7/2025.

Harris County Tax Assessor, 1001 Preston St, Suite 400, Houston, TX

You can contact the harris county tax assessor collector’s office at 713.368.2000 for more information. The information provided on this website is updated daily from. Foreclosures reflect(s) postings accepted through 1/7/2025 images available from 12/3/2013 to present. The harris county tax auction is a live auction that takes place on the first tuesday of every month from 10:00am to 4:00.

The Harris County Tax Auction Is A Live Auction That Takes Place On The First Tuesday Of Every Month From 10:00Am To 4:00 Pm.

Can someone bid on behalf. You can contact the harris county tax assessor collector’s office at 713.368.2000 for more information. Foreclosures reflect(s) postings accepted through 1/7/2025 images available from 12/3/2013 to present. The information provided on this website is updated daily from.