Guilford County Local Sales And Use Tax - The local sales tax rate in guilford county is 2.25%, and the maximum rate (including north carolina and city sales taxes) is 7% as of january 2025. Sales tax is collected by retailers on taxable goods and services at stores and. Listed below by county are the total (4.75% state rate plus applicable local rates) sales and use tax rates in effect: For instance, the webpage states guilford county residents currently pay a combined state and local sales tax of 6.75 percent, which comes out to $6.75 per $100 purchase. The guilford county, north carolina sales tax is 6.75% , consisting of 4.75% north carolina state sales tax and 2.00% guilford county local sales taxes.the local sales tax consists of a 2.00%. * includes the 0.50% transit county sales and use tax. Guilford county residents currently pay a combined state and local sales tax of 6.75%, meaning $6.75 on a $100 purchase.

The local sales tax rate in guilford county is 2.25%, and the maximum rate (including north carolina and city sales taxes) is 7% as of january 2025. The guilford county, north carolina sales tax is 6.75% , consisting of 4.75% north carolina state sales tax and 2.00% guilford county local sales taxes.the local sales tax consists of a 2.00%. Sales tax is collected by retailers on taxable goods and services at stores and. Guilford county residents currently pay a combined state and local sales tax of 6.75%, meaning $6.75 on a $100 purchase. Listed below by county are the total (4.75% state rate plus applicable local rates) sales and use tax rates in effect: * includes the 0.50% transit county sales and use tax. For instance, the webpage states guilford county residents currently pay a combined state and local sales tax of 6.75 percent, which comes out to $6.75 per $100 purchase.

The guilford county, north carolina sales tax is 6.75% , consisting of 4.75% north carolina state sales tax and 2.00% guilford county local sales taxes.the local sales tax consists of a 2.00%. Listed below by county are the total (4.75% state rate plus applicable local rates) sales and use tax rates in effect: Sales tax is collected by retailers on taxable goods and services at stores and. For instance, the webpage states guilford county residents currently pay a combined state and local sales tax of 6.75 percent, which comes out to $6.75 per $100 purchase. Guilford county residents currently pay a combined state and local sales tax of 6.75%, meaning $6.75 on a $100 purchase. * includes the 0.50% transit county sales and use tax. The local sales tax rate in guilford county is 2.25%, and the maximum rate (including north carolina and city sales taxes) is 7% as of january 2025.

State and Local Sales Tax Rates Sales Taxes Tax Foundation

For instance, the webpage states guilford county residents currently pay a combined state and local sales tax of 6.75 percent, which comes out to $6.75 per $100 purchase. * includes the 0.50% transit county sales and use tax. Listed below by county are the total (4.75% state rate plus applicable local rates) sales and use tax rates in effect: The.

GUILFORD TOWNSHIP

The local sales tax rate in guilford county is 2.25%, and the maximum rate (including north carolina and city sales taxes) is 7% as of january 2025. * includes the 0.50% transit county sales and use tax. The guilford county, north carolina sales tax is 6.75% , consisting of 4.75% north carolina state sales tax and 2.00% guilford county local.

Guilford County Tax Department Guilford County, NC

The guilford county, north carolina sales tax is 6.75% , consisting of 4.75% north carolina state sales tax and 2.00% guilford county local sales taxes.the local sales tax consists of a 2.00%. For instance, the webpage states guilford county residents currently pay a combined state and local sales tax of 6.75 percent, which comes out to $6.75 per $100 purchase..

Guilford County accused of illegal electioneering in favor of school

Listed below by county are the total (4.75% state rate plus applicable local rates) sales and use tax rates in effect: For instance, the webpage states guilford county residents currently pay a combined state and local sales tax of 6.75 percent, which comes out to $6.75 per $100 purchase. Guilford county residents currently pay a combined state and local sales.

Guilford Co. Voters To Consider 1/4 Cent Sales Tax Increase

Listed below by county are the total (4.75% state rate plus applicable local rates) sales and use tax rates in effect: * includes the 0.50% transit county sales and use tax. Guilford county residents currently pay a combined state and local sales tax of 6.75%, meaning $6.75 on a $100 purchase. The local sales tax rate in guilford county is.

Guilford County, NC Home

The local sales tax rate in guilford county is 2.25%, and the maximum rate (including north carolina and city sales taxes) is 7% as of january 2025. * includes the 0.50% transit county sales and use tax. Guilford county residents currently pay a combined state and local sales tax of 6.75%, meaning $6.75 on a $100 purchase. For instance, the.

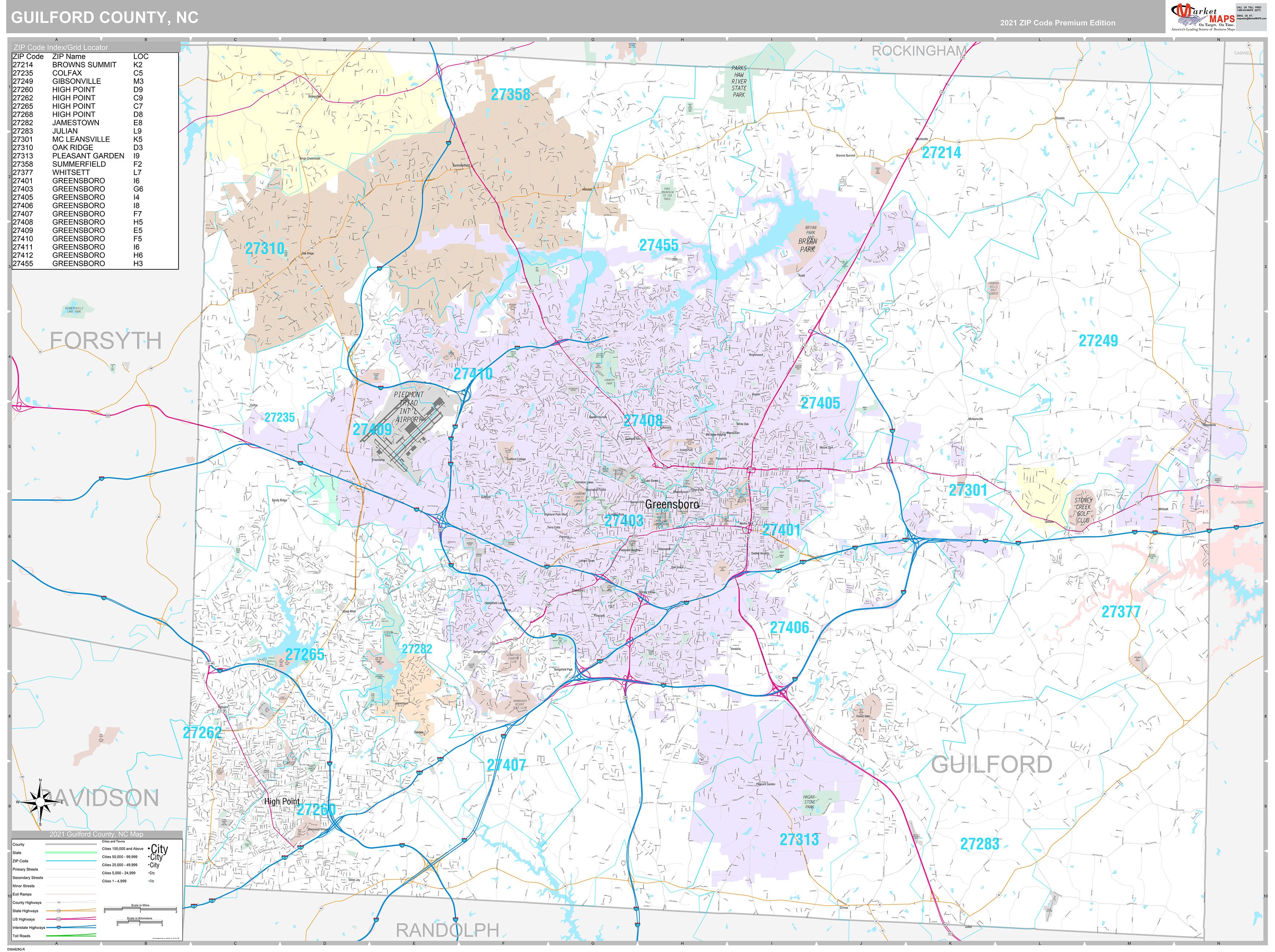

Guilford County, NC Wall Map Premium Style by MarketMAPS MapSales

Guilford county residents currently pay a combined state and local sales tax of 6.75%, meaning $6.75 on a $100 purchase. The guilford county, north carolina sales tax is 6.75% , consisting of 4.75% north carolina state sales tax and 2.00% guilford county local sales taxes.the local sales tax consists of a 2.00%. Sales tax is collected by retailers on taxable.

* includes the 0.50% transit county sales and use tax. Listed below by county are the total (4.75% state rate plus applicable local rates) sales and use tax rates in effect: The guilford county, north carolina sales tax is 6.75% , consisting of 4.75% north carolina state sales tax and 2.00% guilford county local sales taxes.the local sales tax consists.

About Guilford County

Listed below by county are the total (4.75% state rate plus applicable local rates) sales and use tax rates in effect: For instance, the webpage states guilford county residents currently pay a combined state and local sales tax of 6.75 percent, which comes out to $6.75 per $100 purchase. * includes the 0.50% transit county sales and use tax. Guilford.

Guilford County Tax Director Gets Raise Of Only 11 Percent The Rhino

* includes the 0.50% transit county sales and use tax. Guilford county residents currently pay a combined state and local sales tax of 6.75%, meaning $6.75 on a $100 purchase. Listed below by county are the total (4.75% state rate plus applicable local rates) sales and use tax rates in effect: Sales tax is collected by retailers on taxable goods.

For Instance, The Webpage States Guilford County Residents Currently Pay A Combined State And Local Sales Tax Of 6.75 Percent, Which Comes Out To $6.75 Per $100 Purchase.

Guilford county residents currently pay a combined state and local sales tax of 6.75%, meaning $6.75 on a $100 purchase. Sales tax is collected by retailers on taxable goods and services at stores and. Listed below by county are the total (4.75% state rate plus applicable local rates) sales and use tax rates in effect: The local sales tax rate in guilford county is 2.25%, and the maximum rate (including north carolina and city sales taxes) is 7% as of january 2025.

* Includes The 0.50% Transit County Sales And Use Tax.

The guilford county, north carolina sales tax is 6.75% , consisting of 4.75% north carolina state sales tax and 2.00% guilford county local sales taxes.the local sales tax consists of a 2.00%.