Goodwill Printable Donation Receipt - Download our tax receipt (as pdf) goodwill is a qualified tax exempt public charity under section 501(c)(3) of the internal revenue code. Use this receipt when filing your taxes. If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations. Enter your information and instantly receive a donation receipt for the items you bring to goodwill sf bay. Your receipt is the only record of your tax deductible donation. Thank you for donating with us! Goods or services were not exchanged for this. If you donated to a goodwill in the following. No goods or services were provided to the donor by goodwill of southwestern pennsylvania in exchange for this donation. A limited number of local goodwill organizations offer the convenience of electronic receipts to facilitate your donation tracking for tax purposes.

Use this receipt when filing your taxes. If you donated to a goodwill in the following. Enter your information and instantly receive a donation receipt for the items you bring to goodwill sf bay. Goods or services were not exchanged for this. No goods or services were provided to the donor by goodwill of southwestern pennsylvania in exchange for this donation. Thank you for donating with us! A limited number of local goodwill organizations offer the convenience of electronic receipts to facilitate your donation tracking for tax purposes. Download our tax receipt (as pdf) goodwill is a qualified tax exempt public charity under section 501(c)(3) of the internal revenue code. Your receipt is the only record of your tax deductible donation. If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations.

Your receipt is the only record of your tax deductible donation. Download our tax receipt (as pdf) goodwill is a qualified tax exempt public charity under section 501(c)(3) of the internal revenue code. Thank you for donating with us! If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations. A limited number of local goodwill organizations offer the convenience of electronic receipts to facilitate your donation tracking for tax purposes. Use this receipt when filing your taxes. If you donated to a goodwill in the following. No goods or services were provided to the donor by goodwill of southwestern pennsylvania in exchange for this donation. Enter your information and instantly receive a donation receipt for the items you bring to goodwill sf bay. Goods or services were not exchanged for this.

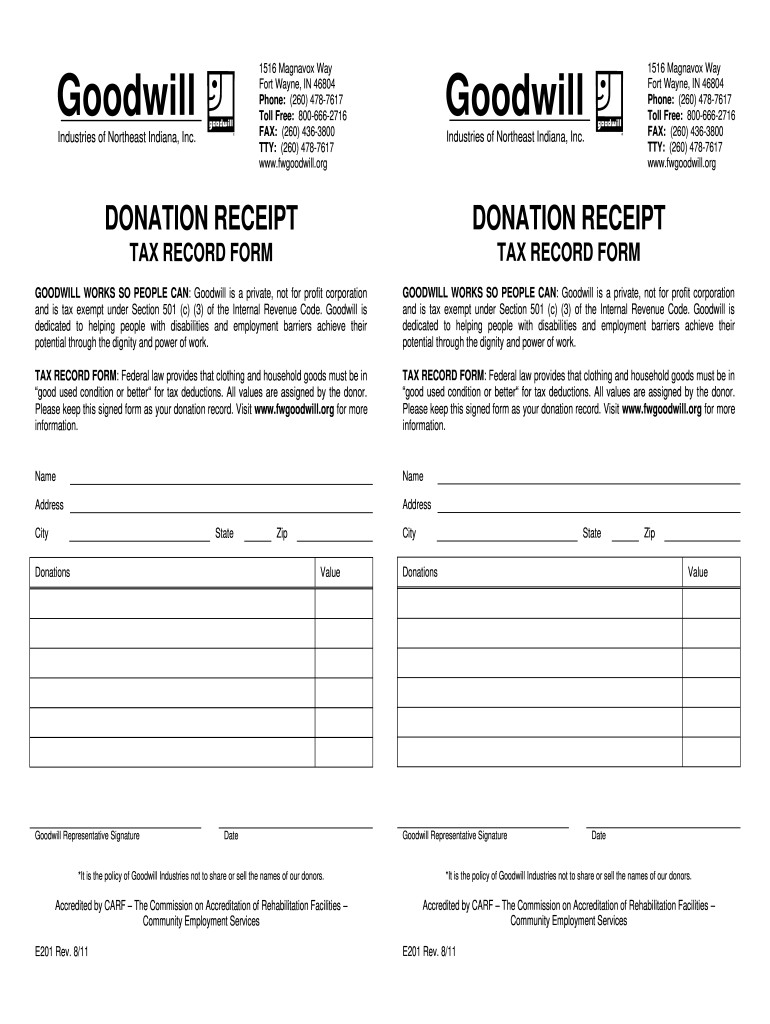

Printable Goodwill Donation Receipt Printable Word Searches

Download our tax receipt (as pdf) goodwill is a qualified tax exempt public charity under section 501(c)(3) of the internal revenue code. No goods or services were provided to the donor by goodwill of southwestern pennsylvania in exchange for this donation. Your receipt is the only record of your tax deductible donation. Goods or services were not exchanged for this..

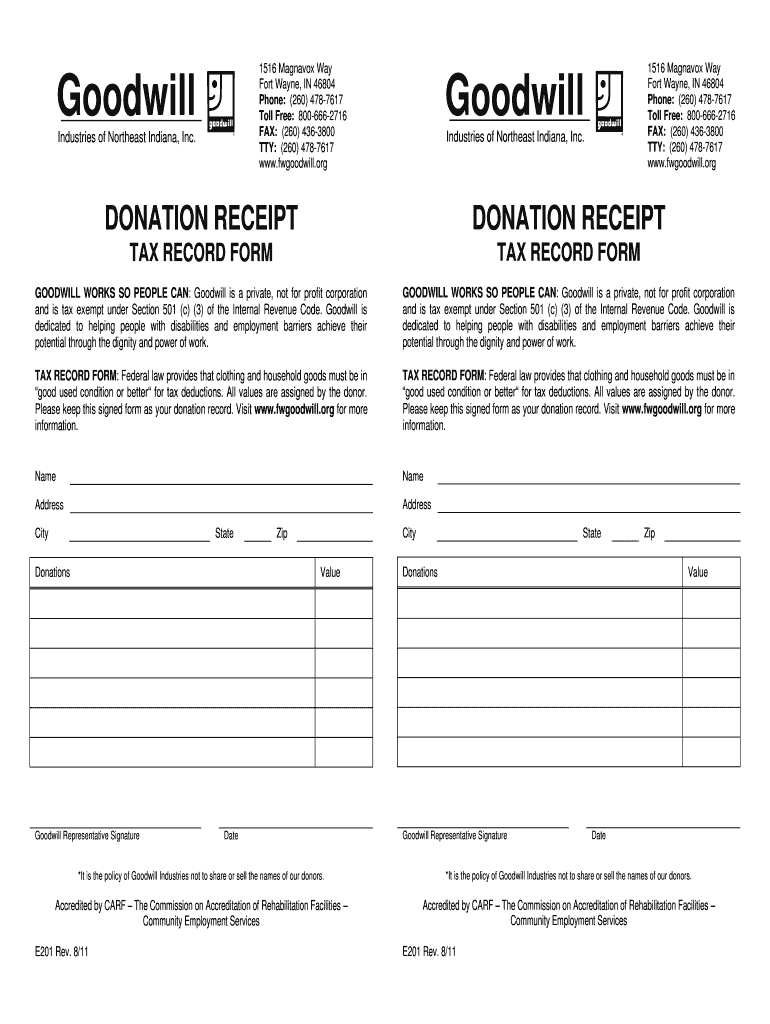

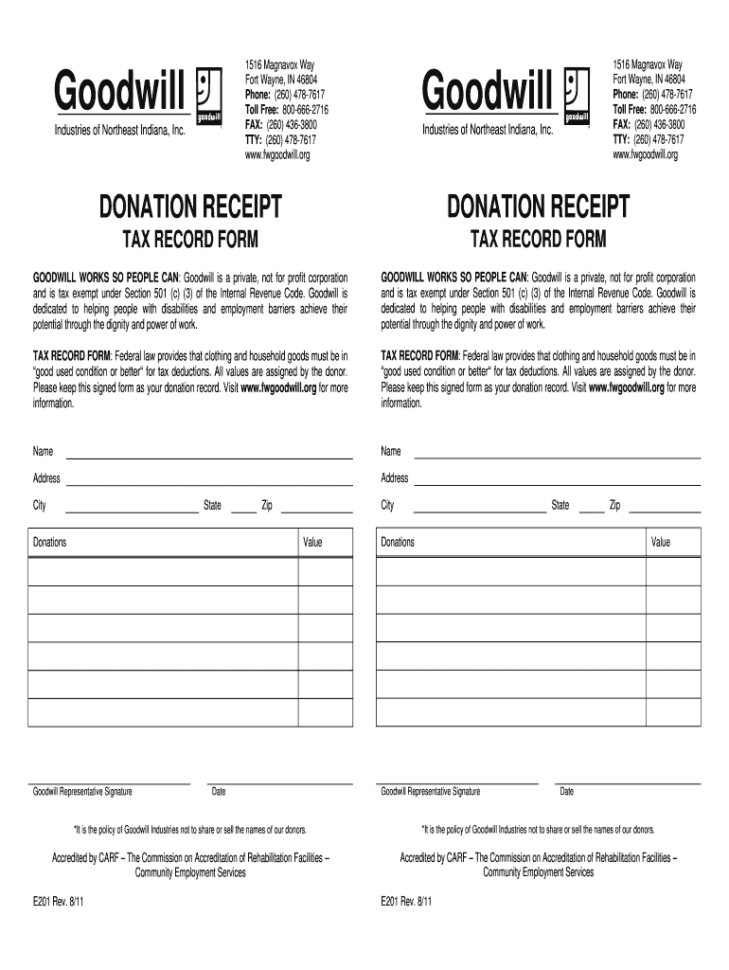

40 Donation Receipt Templates & Letters [Goodwill, Non Profit]

Use this receipt when filing your taxes. Enter your information and instantly receive a donation receipt for the items you bring to goodwill sf bay. Your receipt is the only record of your tax deductible donation. Goods or services were not exchanged for this. A limited number of local goodwill organizations offer the convenience of electronic receipts to facilitate your.

Printable Goodwill Donation 20112024 Form Fill Out and Sign

No goods or services were provided to the donor by goodwill of southwestern pennsylvania in exchange for this donation. Thank you for donating with us! Enter your information and instantly receive a donation receipt for the items you bring to goodwill sf bay. Download our tax receipt (as pdf) goodwill is a qualified tax exempt public charity under section 501(c)(3).

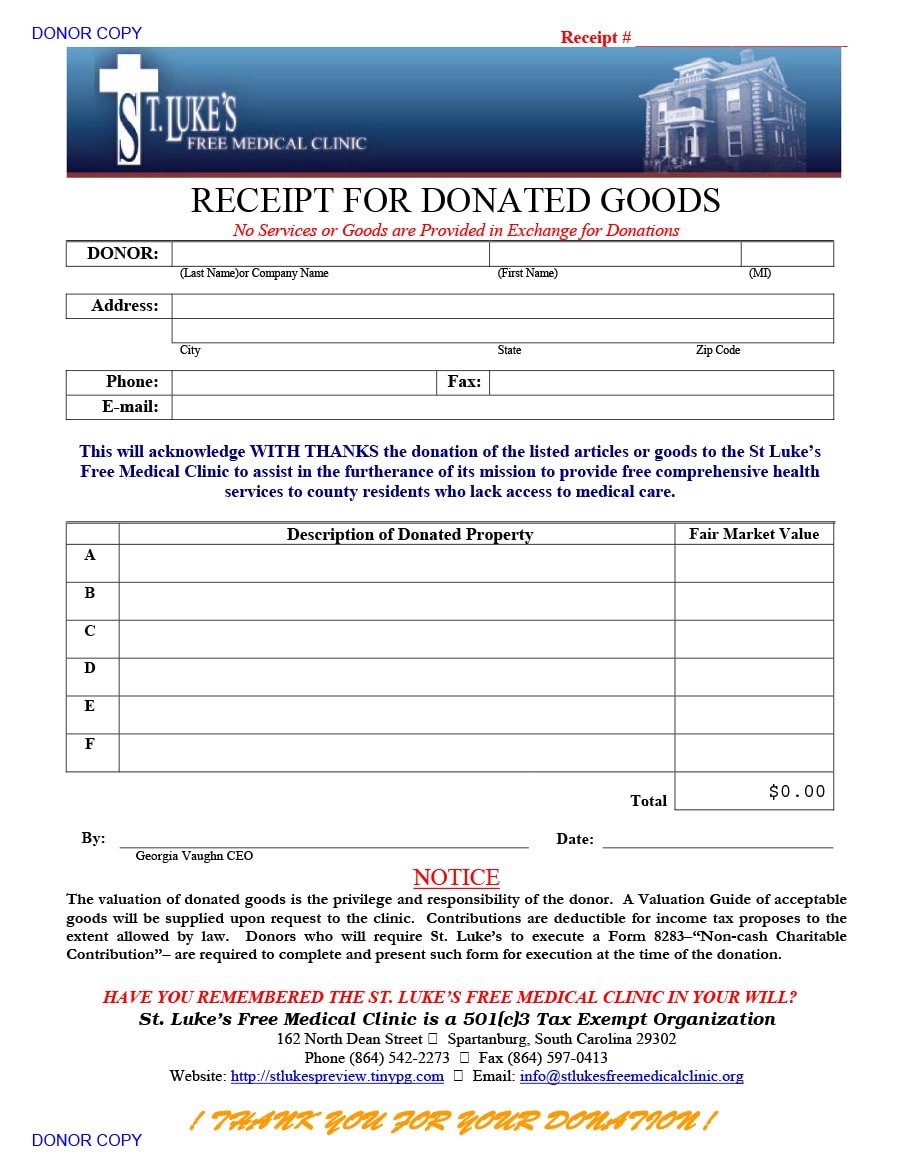

Goodwill Donation Receipt

No goods or services were provided to the donor by goodwill of southwestern pennsylvania in exchange for this donation. Download our tax receipt (as pdf) goodwill is a qualified tax exempt public charity under section 501(c)(3) of the internal revenue code. Thank you for donating with us! Your receipt is the only record of your tax deductible donation. Enter your.

Printable Goodwill Donation Receipt

No goods or services were provided to the donor by goodwill of southwestern pennsylvania in exchange for this donation. If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations. If you donated to a goodwill in the following. Goods or services were not exchanged for this. A limited number.

Goodwill Donation Receipt Fill Online Printable Fillable —

A limited number of local goodwill organizations offer the convenience of electronic receipts to facilitate your donation tracking for tax purposes. No goods or services were provided to the donor by goodwill of southwestern pennsylvania in exchange for this donation. Enter your information and instantly receive a donation receipt for the items you bring to goodwill sf bay. If you.

Free Goodwill Donation Receipt Template PDF eForms

If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations. Enter your information and instantly receive a donation receipt for the items you bring to goodwill sf bay. No goods or services were provided to the donor by goodwill of southwestern pennsylvania in exchange for this donation. Goods or.

Printable Goodwill Donation Receipt

Use this receipt when filing your taxes. Thank you for donating with us! If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations. Your receipt is the only record of your tax deductible donation. If you donated to a goodwill in the following.

Goodwill Donation Receipt Fill Online Printable Fillable —

If you donated to a goodwill in the following. Download our tax receipt (as pdf) goodwill is a qualified tax exempt public charity under section 501(c)(3) of the internal revenue code. A limited number of local goodwill organizations offer the convenience of electronic receipts to facilitate your donation tracking for tax purposes. Goods or services were not exchanged for this..

Professional Goodwill Tax Receipt Form Word Sample Receipt template

If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations. If you donated to a goodwill in the following. Download our tax receipt (as pdf) goodwill is a qualified tax exempt public charity under section 501(c)(3) of the internal revenue code. Your receipt is the only record of your.

A Limited Number Of Local Goodwill Organizations Offer The Convenience Of Electronic Receipts To Facilitate Your Donation Tracking For Tax Purposes.

No goods or services were provided to the donor by goodwill of southwestern pennsylvania in exchange for this donation. If you donated to a goodwill in the following. If you itemize deductions on your federal tax return, you are entitled to claim a charitable deduction for your goodwill donations. Enter your information and instantly receive a donation receipt for the items you bring to goodwill sf bay.

Use This Receipt When Filing Your Taxes.

Your receipt is the only record of your tax deductible donation. Download our tax receipt (as pdf) goodwill is a qualified tax exempt public charity under section 501(c)(3) of the internal revenue code. Thank you for donating with us! Goods or services were not exchanged for this.

![40 Donation Receipt Templates & Letters [Goodwill, Non Profit]](https://templatearchive.com/wp-content/uploads/2017/05/donation-receipt-template-24.jpg)