Florida Tax Liens For Sale - There are more than 185,709 tax liens currently on the market. Smart homebuyers and savvy investors looking. In florida, if the delinquent taxes are not paid within two years, the county tax collector can enforce the tax lien by selling it in a public auction. The certificate holder is an independent investor who. Buying tax liens at auctions, direct or. Properties offered for sale to the highest bidder in order to satisfy delinquent property taxes are referred to as tax deed sales. A tax certificate is an enforceable first lien against the property for unpaid real estate taxes. Learn how to navigate the. Florida, currently has 185,709 tax liens and 43,209 other distressed listings available as of january 6. Discover the lucrative world of tax lien and deed investing in florida, where tax sale investors get a chance to thrive.

In florida, if the delinquent taxes are not paid within two years, the county tax collector can enforce the tax lien by selling it in a public auction. There are more than 185,709 tax liens currently on the market. Learn how to navigate the. Smart homebuyers and savvy investors looking. Search all the latest florida tax liens available. The certificate holder is an independent investor who. Buying tax liens at auctions, direct or. Properties offered for sale to the highest bidder in order to satisfy delinquent property taxes are referred to as tax deed sales. Discover the lucrative world of tax lien and deed investing in florida, where tax sale investors get a chance to thrive. A tax certificate is an enforceable first lien against the property for unpaid real estate taxes.

A tax certificate is an enforceable first lien against the property for unpaid real estate taxes. There are more than 185,709 tax liens currently on the market. Properties offered for sale to the highest bidder in order to satisfy delinquent property taxes are referred to as tax deed sales. Buying tax liens at auctions, direct or. Search all the latest florida tax liens available. In florida, if the delinquent taxes are not paid within two years, the county tax collector can enforce the tax lien by selling it in a public auction. Learn how to navigate the. Florida, currently has 185,709 tax liens and 43,209 other distressed listings available as of january 6. Discover the lucrative world of tax lien and deed investing in florida, where tax sale investors get a chance to thrive. The certificate holder is an independent investor who.

PPT Florida Tax Liens & Deeds PowerPoint Presentation, free download

The certificate holder is an independent investor who. A tax certificate is an enforceable first lien against the property for unpaid real estate taxes. Smart homebuyers and savvy investors looking. Florida, currently has 185,709 tax liens and 43,209 other distressed listings available as of january 6. Properties offered for sale to the highest bidder in order to satisfy delinquent property.

TAX LIENS & TAX DEEDS EXPLAINED! Each year Florida has 254 counties

Florida, currently has 185,709 tax liens and 43,209 other distressed listings available as of january 6. In florida, if the delinquent taxes are not paid within two years, the county tax collector can enforce the tax lien by selling it in a public auction. Learn how to navigate the. Properties offered for sale to the highest bidder in order to.

Florida Tax Law Group

Buying tax liens at auctions, direct or. The certificate holder is an independent investor who. Properties offered for sale to the highest bidder in order to satisfy delinquent property taxes are referred to as tax deed sales. Search all the latest florida tax liens available. A tax certificate is an enforceable first lien against the property for unpaid real estate.

Florida Tax Pros (FloridaTaxPros) Twitter

Discover the lucrative world of tax lien and deed investing in florida, where tax sale investors get a chance to thrive. The certificate holder is an independent investor who. In florida, if the delinquent taxes are not paid within two years, the county tax collector can enforce the tax lien by selling it in a public auction. Buying tax liens.

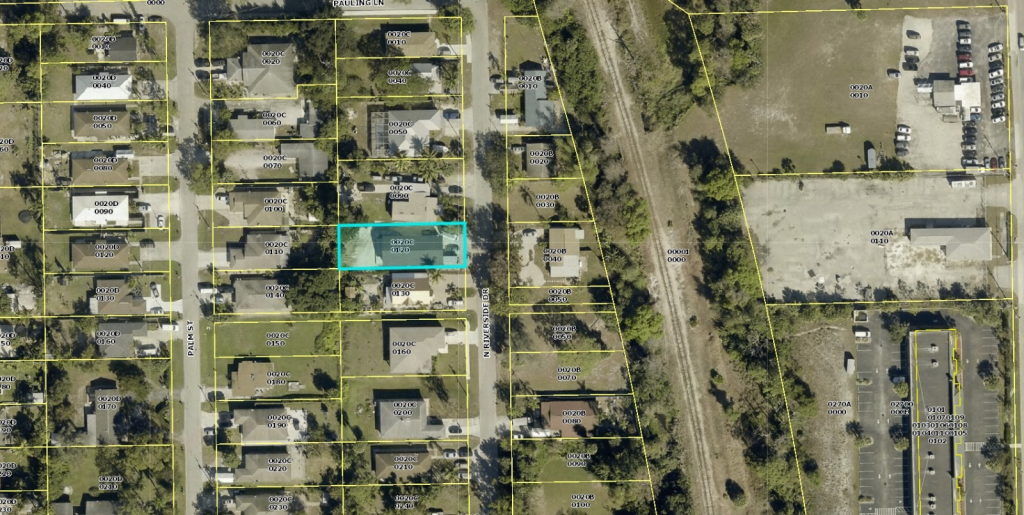

Tax Liens Emanuel Use Case Florida

In florida, if the delinquent taxes are not paid within two years, the county tax collector can enforce the tax lien by selling it in a public auction. A tax certificate is an enforceable first lien against the property for unpaid real estate taxes. Smart homebuyers and savvy investors looking. There are more than 185,709 tax liens currently on the.

Florida Tax Guide Florida Taxes A Quick Look PDF Sales Taxes In

The certificate holder is an independent investor who. Learn how to navigate the. In florida, if the delinquent taxes are not paid within two years, the county tax collector can enforce the tax lien by selling it in a public auction. Florida, currently has 185,709 tax liens and 43,209 other distressed listings available as of january 6. Smart homebuyers and.

Tax Liens Emanuel Use Case Florida

In florida, if the delinquent taxes are not paid within two years, the county tax collector can enforce the tax lien by selling it in a public auction. Discover the lucrative world of tax lien and deed investing in florida, where tax sale investors get a chance to thrive. Florida, currently has 185,709 tax liens and 43,209 other distressed listings.

Miami Tax and Insurance Solutions Miami FL

The certificate holder is an independent investor who. In florida, if the delinquent taxes are not paid within two years, the county tax collector can enforce the tax lien by selling it in a public auction. Search all the latest florida tax liens available. There are more than 185,709 tax liens currently on the market. A tax certificate is an.

FLORIDA SALES TAX ON ONLINE PURCHASES

Learn how to navigate the. A tax certificate is an enforceable first lien against the property for unpaid real estate taxes. In florida, if the delinquent taxes are not paid within two years, the county tax collector can enforce the tax lien by selling it in a public auction. There are more than 185,709 tax liens currently on the market..

Download Florida Tax Liens How to Find Liens on Property for great Tax

A tax certificate is an enforceable first lien against the property for unpaid real estate taxes. Discover the lucrative world of tax lien and deed investing in florida, where tax sale investors get a chance to thrive. In florida, if the delinquent taxes are not paid within two years, the county tax collector can enforce the tax lien by selling.

There Are More Than 185,709 Tax Liens Currently On The Market.

Learn how to navigate the. A tax certificate is an enforceable first lien against the property for unpaid real estate taxes. The certificate holder is an independent investor who. Smart homebuyers and savvy investors looking.

Buying Tax Liens At Auctions, Direct Or.

Properties offered for sale to the highest bidder in order to satisfy delinquent property taxes are referred to as tax deed sales. In florida, if the delinquent taxes are not paid within two years, the county tax collector can enforce the tax lien by selling it in a public auction. Florida, currently has 185,709 tax liens and 43,209 other distressed listings available as of january 6. Search all the latest florida tax liens available.