Florida State Tax Lien Search - You can search for liens on our website. To resolve your tax liability, you must do one of the following: If the debtor is a business entity, the debtor’s assigned department of state document number is. The florida department of revenue begins the collection process when a taxpayer fails to file a return, fails to make a payment, underpays the. For copies of your own tax records , send a written. Pay the amount in full. Search records corporations, limited liability companies, limited partnerships, and trademarks. You can search our database by: Enter a stipulated payment agreement.

To resolve your tax liability, you must do one of the following: The florida department of revenue begins the collection process when a taxpayer fails to file a return, fails to make a payment, underpays the. Pay the amount in full. You can search for liens on our website. If the debtor is a business entity, the debtor’s assigned department of state document number is. Search records corporations, limited liability companies, limited partnerships, and trademarks. Enter a stipulated payment agreement. You can search our database by: For copies of your own tax records , send a written.

Search records corporations, limited liability companies, limited partnerships, and trademarks. Enter a stipulated payment agreement. You can search for liens on our website. If the debtor is a business entity, the debtor’s assigned department of state document number is. For copies of your own tax records , send a written. To resolve your tax liability, you must do one of the following: You can search our database by: The florida department of revenue begins the collection process when a taxpayer fails to file a return, fails to make a payment, underpays the. Pay the amount in full.

Tax Lien Certificate Investment Basics

You can search our database by: Enter a stipulated payment agreement. Pay the amount in full. To resolve your tax liability, you must do one of the following: If the debtor is a business entity, the debtor’s assigned department of state document number is.

Certificate Of Release Of Federal Tax Lien Get What You Need For Free

The florida department of revenue begins the collection process when a taxpayer fails to file a return, fails to make a payment, underpays the. For copies of your own tax records , send a written. If the debtor is a business entity, the debtor’s assigned department of state document number is. Pay the amount in full. You can search for.

Tips On Dealing With A State Tax Lien Legal News Letter

If the debtor is a business entity, the debtor’s assigned department of state document number is. You can search our database by: Search records corporations, limited liability companies, limited partnerships, and trademarks. Pay the amount in full. To resolve your tax liability, you must do one of the following:

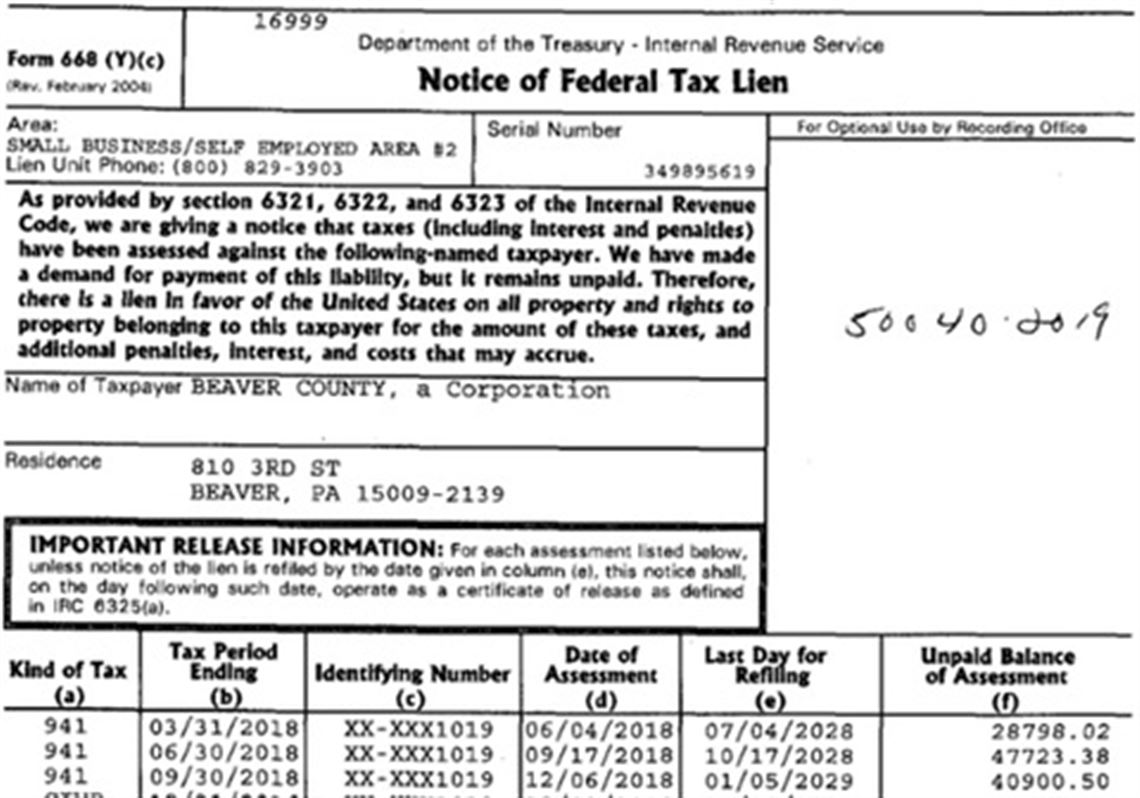

Pennsylvania state tax liability and lien

For copies of your own tax records , send a written. Enter a stipulated payment agreement. Search records corporations, limited liability companies, limited partnerships, and trademarks. To resolve your tax liability, you must do one of the following: You can search our database by:

Property Tax Lien Search Nationwide Title Insurance

For copies of your own tax records , send a written. Enter a stipulated payment agreement. You can search for liens on our website. The florida department of revenue begins the collection process when a taxpayer fails to file a return, fails to make a payment, underpays the. You can search our database by:

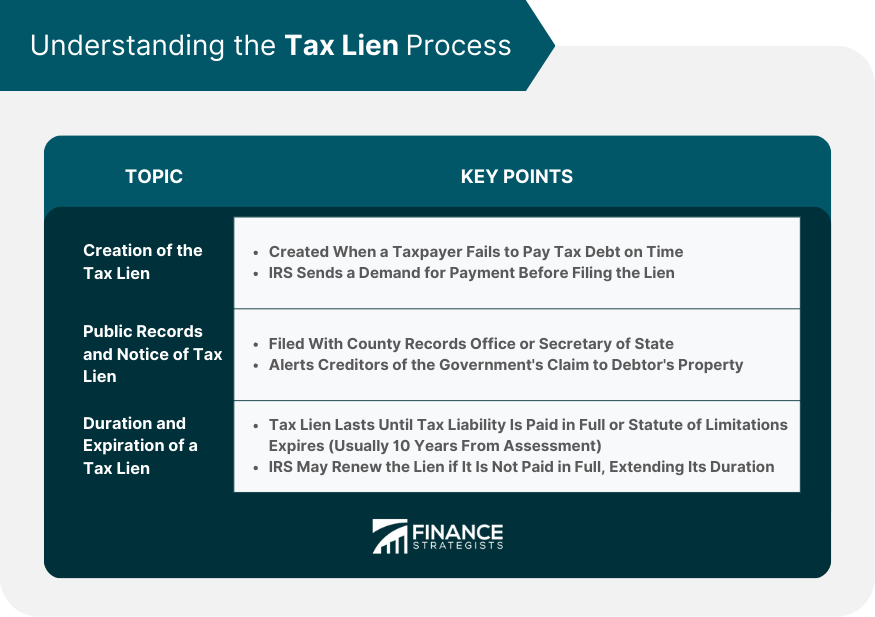

Tax Lien Definition, Process, Consequences, How to Handle

You can search for liens on our website. For copies of your own tax records , send a written. Enter a stipulated payment agreement. To resolve your tax liability, you must do one of the following: If the debtor is a business entity, the debtor’s assigned department of state document number is.

What Is a Tax Lien? Definition & Impact on Credit TheStreet

Search records corporations, limited liability companies, limited partnerships, and trademarks. Pay the amount in full. To resolve your tax liability, you must do one of the following: For copies of your own tax records , send a written. The florida department of revenue begins the collection process when a taxpayer fails to file a return, fails to make a payment,.

Tax Lien Texas State Tax Lien

Pay the amount in full. Enter a stipulated payment agreement. You can search our database by: To resolve your tax liability, you must do one of the following: Search records corporations, limited liability companies, limited partnerships, and trademarks.

Tax Lien California State Tax Lien

Search records corporations, limited liability companies, limited partnerships, and trademarks. For copies of your own tax records , send a written. If the debtor is a business entity, the debtor’s assigned department of state document number is. The florida department of revenue begins the collection process when a taxpayer fails to file a return, fails to make a payment, underpays.

3 Ways to Remove a Tax Lien from your Credit Report

The florida department of revenue begins the collection process when a taxpayer fails to file a return, fails to make a payment, underpays the. For copies of your own tax records , send a written. To resolve your tax liability, you must do one of the following: You can search for liens on our website. You can search our database.

The Florida Department Of Revenue Begins The Collection Process When A Taxpayer Fails To File A Return, Fails To Make A Payment, Underpays The.

Search records corporations, limited liability companies, limited partnerships, and trademarks. Pay the amount in full. You can search for liens on our website. If the debtor is a business entity, the debtor’s assigned department of state document number is.

To Resolve Your Tax Liability, You Must Do One Of The Following:

For copies of your own tax records , send a written. You can search our database by: Enter a stipulated payment agreement.