Erie County Tax Lien Sale - Install a renewable energy system. Search to obtain tax amounts. As long as each owner and lienholder is notified of the judicial sale, the purchaser will take the property free and clear of claims, liens, mortgages, tax. I received a letter in the mail stating my property is going to be foreclosed, what do i. The erie county in rem auction is scheduled for october 6, 2022. To change tax bill mailing address: Erie county is entitled to foreclose upon tax liens that have been outstanding, unredeemed and unpaid for a period of two (2) or more years. The upset tax sale is for properties located within erie county with outstanding tax balances that are at least two.

The erie county in rem auction is scheduled for october 6, 2022. As long as each owner and lienholder is notified of the judicial sale, the purchaser will take the property free and clear of claims, liens, mortgages, tax. Install a renewable energy system. I received a letter in the mail stating my property is going to be foreclosed, what do i. Search to obtain tax amounts. Erie county is entitled to foreclose upon tax liens that have been outstanding, unredeemed and unpaid for a period of two (2) or more years. The upset tax sale is for properties located within erie county with outstanding tax balances that are at least two. To change tax bill mailing address:

To change tax bill mailing address: The upset tax sale is for properties located within erie county with outstanding tax balances that are at least two. Search to obtain tax amounts. Erie county is entitled to foreclose upon tax liens that have been outstanding, unredeemed and unpaid for a period of two (2) or more years. The erie county in rem auction is scheduled for october 6, 2022. Install a renewable energy system. As long as each owner and lienholder is notified of the judicial sale, the purchaser will take the property free and clear of claims, liens, mortgages, tax. I received a letter in the mail stating my property is going to be foreclosed, what do i.

Suffolk County Tax Lien Sale 2024 Marne Sharona

The erie county in rem auction is scheduled for october 6, 2022. To change tax bill mailing address: The upset tax sale is for properties located within erie county with outstanding tax balances that are at least two. Erie county is entitled to foreclose upon tax liens that have been outstanding, unredeemed and unpaid for a period of two (2).

Erie County Tax Claim Bureau Tax Sale For Sale Erie County, PA

Search to obtain tax amounts. As long as each owner and lienholder is notified of the judicial sale, the purchaser will take the property free and clear of claims, liens, mortgages, tax. The upset tax sale is for properties located within erie county with outstanding tax balances that are at least two. Erie county is entitled to foreclose upon tax.

Maricopa County Tax Lien Sale 2024 Maure Shirlee

Install a renewable energy system. The upset tax sale is for properties located within erie county with outstanding tax balances that are at least two. As long as each owner and lienholder is notified of the judicial sale, the purchaser will take the property free and clear of claims, liens, mortgages, tax. I received a letter in the mail stating.

Erie County, Pennsylvania

Install a renewable energy system. The upset tax sale is for properties located within erie county with outstanding tax balances that are at least two. To change tax bill mailing address: I received a letter in the mail stating my property is going to be foreclosed, what do i. As long as each owner and lienholder is notified of the.

Erie County, Pennsylvania

Erie county is entitled to foreclose upon tax liens that have been outstanding, unredeemed and unpaid for a period of two (2) or more years. Install a renewable energy system. As long as each owner and lienholder is notified of the judicial sale, the purchaser will take the property free and clear of claims, liens, mortgages, tax. The erie county.

Suffolk County Tax Lien Sale 2024 Marne Sharona

As long as each owner and lienholder is notified of the judicial sale, the purchaser will take the property free and clear of claims, liens, mortgages, tax. To change tax bill mailing address: The erie county in rem auction is scheduled for october 6, 2022. The upset tax sale is for properties located within erie county with outstanding tax balances.

Mohave County Tax Lien Sale 2024 Dore Nancey

Erie county is entitled to foreclose upon tax liens that have been outstanding, unredeemed and unpaid for a period of two (2) or more years. The erie county in rem auction is scheduled for october 6, 2022. To change tax bill mailing address: Install a renewable energy system. The upset tax sale is for properties located within erie county with.

Erie County Pa Tax Sale List 2024 Megan Sibylle

Install a renewable energy system. I received a letter in the mail stating my property is going to be foreclosed, what do i. The upset tax sale is for properties located within erie county with outstanding tax balances that are at least two. Search to obtain tax amounts. As long as each owner and lienholder is notified of the judicial.

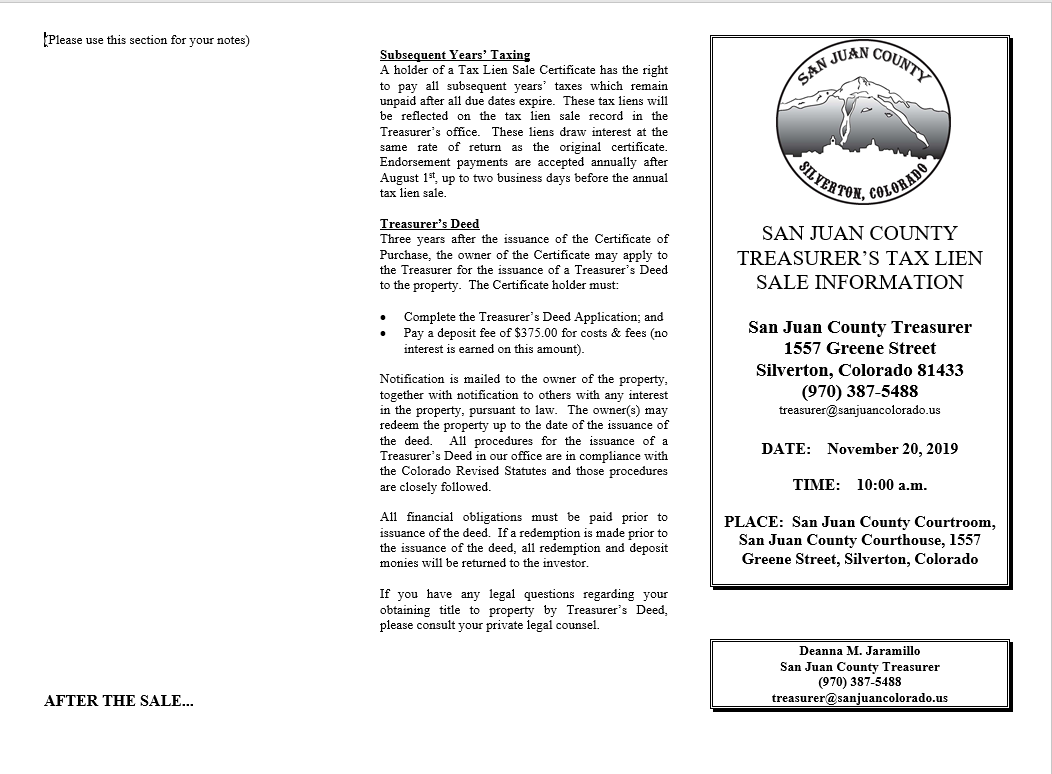

Tax Lien Sale San Juan County

The upset tax sale is for properties located within erie county with outstanding tax balances that are at least two. Install a renewable energy system. To change tax bill mailing address: Search to obtain tax amounts. Erie county is entitled to foreclose upon tax liens that have been outstanding, unredeemed and unpaid for a period of two (2) or more.

NYC Tax Lien Sale Reform Conference EastNewYorkCLT

As long as each owner and lienholder is notified of the judicial sale, the purchaser will take the property free and clear of claims, liens, mortgages, tax. Install a renewable energy system. The upset tax sale is for properties located within erie county with outstanding tax balances that are at least two. The erie county in rem auction is scheduled.

The Upset Tax Sale Is For Properties Located Within Erie County With Outstanding Tax Balances That Are At Least Two.

As long as each owner and lienholder is notified of the judicial sale, the purchaser will take the property free and clear of claims, liens, mortgages, tax. To change tax bill mailing address: Install a renewable energy system. The erie county in rem auction is scheduled for october 6, 2022.

Search To Obtain Tax Amounts.

I received a letter in the mail stating my property is going to be foreclosed, what do i. Erie county is entitled to foreclose upon tax liens that have been outstanding, unredeemed and unpaid for a period of two (2) or more years.