Does A Nonprofit Need A Business License - This is because nonprofits are considered charitable organizations. In general, nonprofits are exempt from obtaining a business license. A nonprofit is typically incorporated in its home state as a separate and unique legal entity. This is needed if the organization has. Then, a business license is obtained to allow a. In most cases, a nonprofit organization must register with the secretary of state and in many, the organization must file. Most places require nonprofits to get a business license, known as a business occupational tax certificate.

In most cases, a nonprofit organization must register with the secretary of state and in many, the organization must file. Most places require nonprofits to get a business license, known as a business occupational tax certificate. A nonprofit is typically incorporated in its home state as a separate and unique legal entity. This is because nonprofits are considered charitable organizations. Then, a business license is obtained to allow a. In general, nonprofits are exempt from obtaining a business license. This is needed if the organization has.

Most places require nonprofits to get a business license, known as a business occupational tax certificate. In general, nonprofits are exempt from obtaining a business license. This is because nonprofits are considered charitable organizations. A nonprofit is typically incorporated in its home state as a separate and unique legal entity. Then, a business license is obtained to allow a. This is needed if the organization has. In most cases, a nonprofit organization must register with the secretary of state and in many, the organization must file.

Does nonprofit need a board fundraising committee?

This is because nonprofits are considered charitable organizations. Most places require nonprofits to get a business license, known as a business occupational tax certificate. In most cases, a nonprofit organization must register with the secretary of state and in many, the organization must file. A nonprofit is typically incorporated in its home state as a separate and unique legal entity..

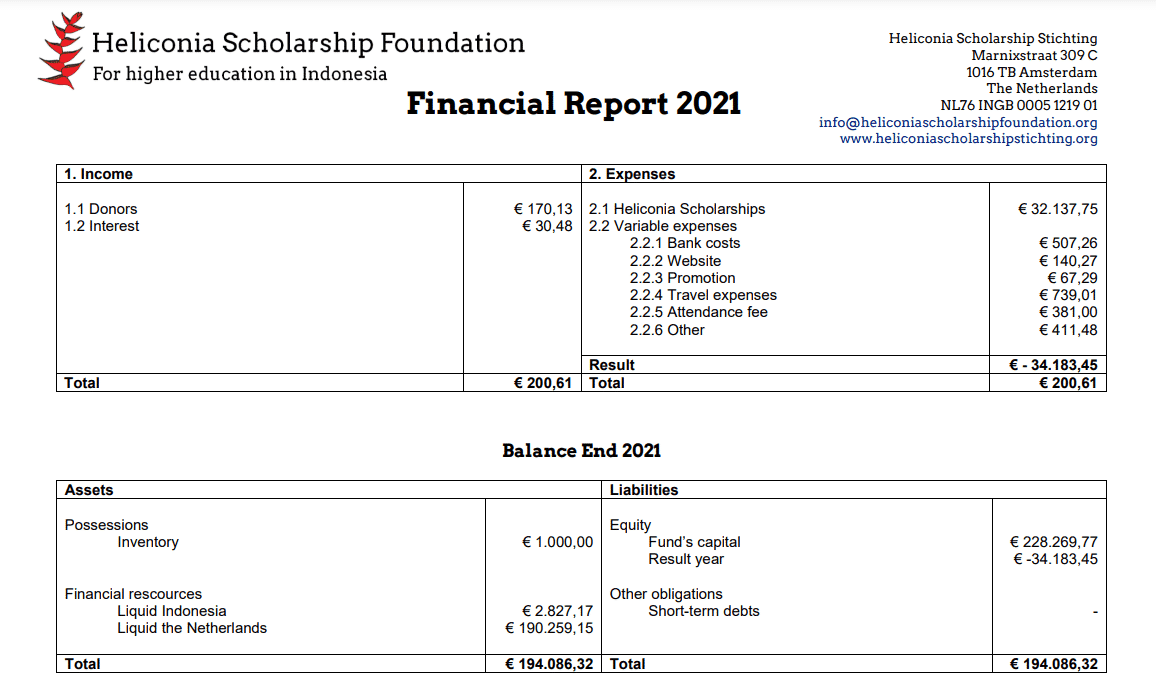

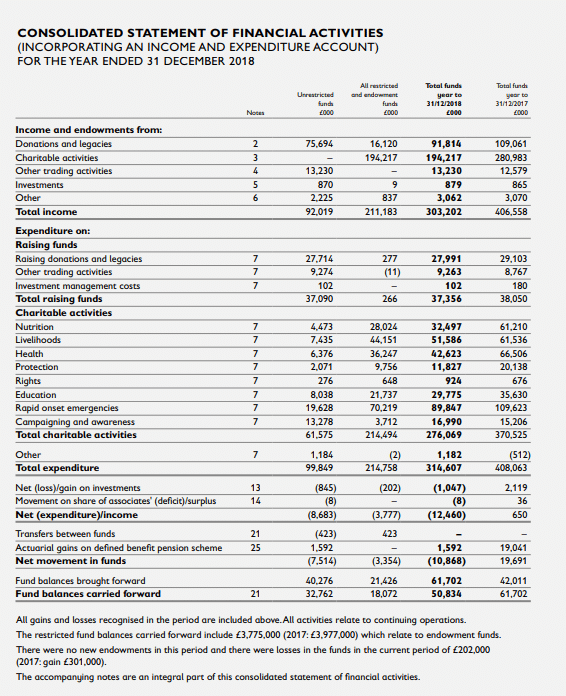

Nonprofit Financial Statements The Complete Guide with Examples

Then, a business license is obtained to allow a. Most places require nonprofits to get a business license, known as a business occupational tax certificate. In general, nonprofits are exempt from obtaining a business license. This is because nonprofits are considered charitable organizations. A nonprofit is typically incorporated in its home state as a separate and unique legal entity.

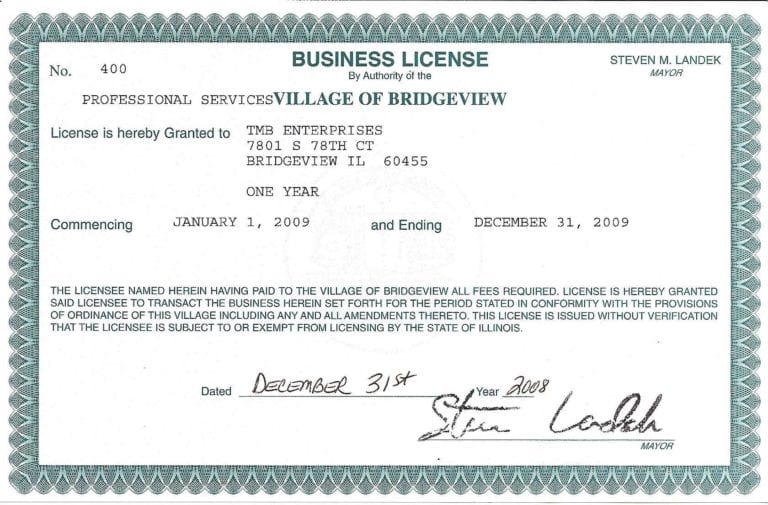

Sample For Master Business License Business Registration Center

This is because nonprofits are considered charitable organizations. In most cases, a nonprofit organization must register with the secretary of state and in many, the organization must file. In general, nonprofits are exempt from obtaining a business license. A nonprofit is typically incorporated in its home state as a separate and unique legal entity. Then, a business license is obtained.

do i need a business license —

This is needed if the organization has. This is because nonprofits are considered charitable organizations. Most places require nonprofits to get a business license, known as a business occupational tax certificate. A nonprofit is typically incorporated in its home state as a separate and unique legal entity. In most cases, a nonprofit organization must register with the secretary of state.

Business Plan For A Nonprofit Templates How To Write & Examples

In most cases, a nonprofit organization must register with the secretary of state and in many, the organization must file. Then, a business license is obtained to allow a. In general, nonprofits are exempt from obtaining a business license. This is because nonprofits are considered charitable organizations. This is needed if the organization has.

What Types of Insurance Does a Nonprofit Need

This is because nonprofits are considered charitable organizations. This is needed if the organization has. In most cases, a nonprofit organization must register with the secretary of state and in many, the organization must file. Then, a business license is obtained to allow a. A nonprofit is typically incorporated in its home state as a separate and unique legal entity.

What Reports does my Nonprofit Need to File?

Then, a business license is obtained to allow a. This is because nonprofits are considered charitable organizations. Most places require nonprofits to get a business license, known as a business occupational tax certificate. In general, nonprofits are exempt from obtaining a business license. In most cases, a nonprofit organization must register with the secretary of state and in many, the.

Do You Need a Business License to Sell on Etsy? Marketer

This is because nonprofits are considered charitable organizations. In general, nonprofits are exempt from obtaining a business license. In most cases, a nonprofit organization must register with the secretary of state and in many, the organization must file. This is needed if the organization has. Then, a business license is obtained to allow a.

Business License

Then, a business license is obtained to allow a. A nonprofit is typically incorporated in its home state as a separate and unique legal entity. This is because nonprofits are considered charitable organizations. Most places require nonprofits to get a business license, known as a business occupational tax certificate. This is needed if the organization has.

Nonprofit Financial Statements The Complete Guide with Examples

In most cases, a nonprofit organization must register with the secretary of state and in many, the organization must file. This is needed if the organization has. Most places require nonprofits to get a business license, known as a business occupational tax certificate. This is because nonprofits are considered charitable organizations. A nonprofit is typically incorporated in its home state.

This Is Because Nonprofits Are Considered Charitable Organizations.

Most places require nonprofits to get a business license, known as a business occupational tax certificate. In general, nonprofits are exempt from obtaining a business license. This is needed if the organization has. A nonprofit is typically incorporated in its home state as a separate and unique legal entity.

In Most Cases, A Nonprofit Organization Must Register With The Secretary Of State And In Many, The Organization Must File.

Then, a business license is obtained to allow a.