Denver Local Income Tax - This booklet is intended to provide general tax and charge information for anyone conducting business in the city and county of denver. Coloradans’ income is taxed at a flat rate of 4.50% of their taxable income, regardless of your income bracket or marital. Denver has local income tax for residents, so residents of denver pay only the colorado income tax and federal income tax on most forms of. Visit our information for local government or entities implementing a new tax or changed tax rate page for more information. The tax topic guides are intended to be straightforward summaries of particular industries or business subjects. Coloradans' income is taxed at a flat rate of 4.40% of their taxable income, regardless of your income bracket or marital status.

Coloradans’ income is taxed at a flat rate of 4.50% of their taxable income, regardless of your income bracket or marital. Denver has local income tax for residents, so residents of denver pay only the colorado income tax and federal income tax on most forms of. This booklet is intended to provide general tax and charge information for anyone conducting business in the city and county of denver. Coloradans' income is taxed at a flat rate of 4.40% of their taxable income, regardless of your income bracket or marital status. Visit our information for local government or entities implementing a new tax or changed tax rate page for more information. The tax topic guides are intended to be straightforward summaries of particular industries or business subjects.

The tax topic guides are intended to be straightforward summaries of particular industries or business subjects. Visit our information for local government or entities implementing a new tax or changed tax rate page for more information. Denver has local income tax for residents, so residents of denver pay only the colorado income tax and federal income tax on most forms of. This booklet is intended to provide general tax and charge information for anyone conducting business in the city and county of denver. Coloradans' income is taxed at a flat rate of 4.40% of their taxable income, regardless of your income bracket or marital status. Coloradans’ income is taxed at a flat rate of 4.50% of their taxable income, regardless of your income bracket or marital.

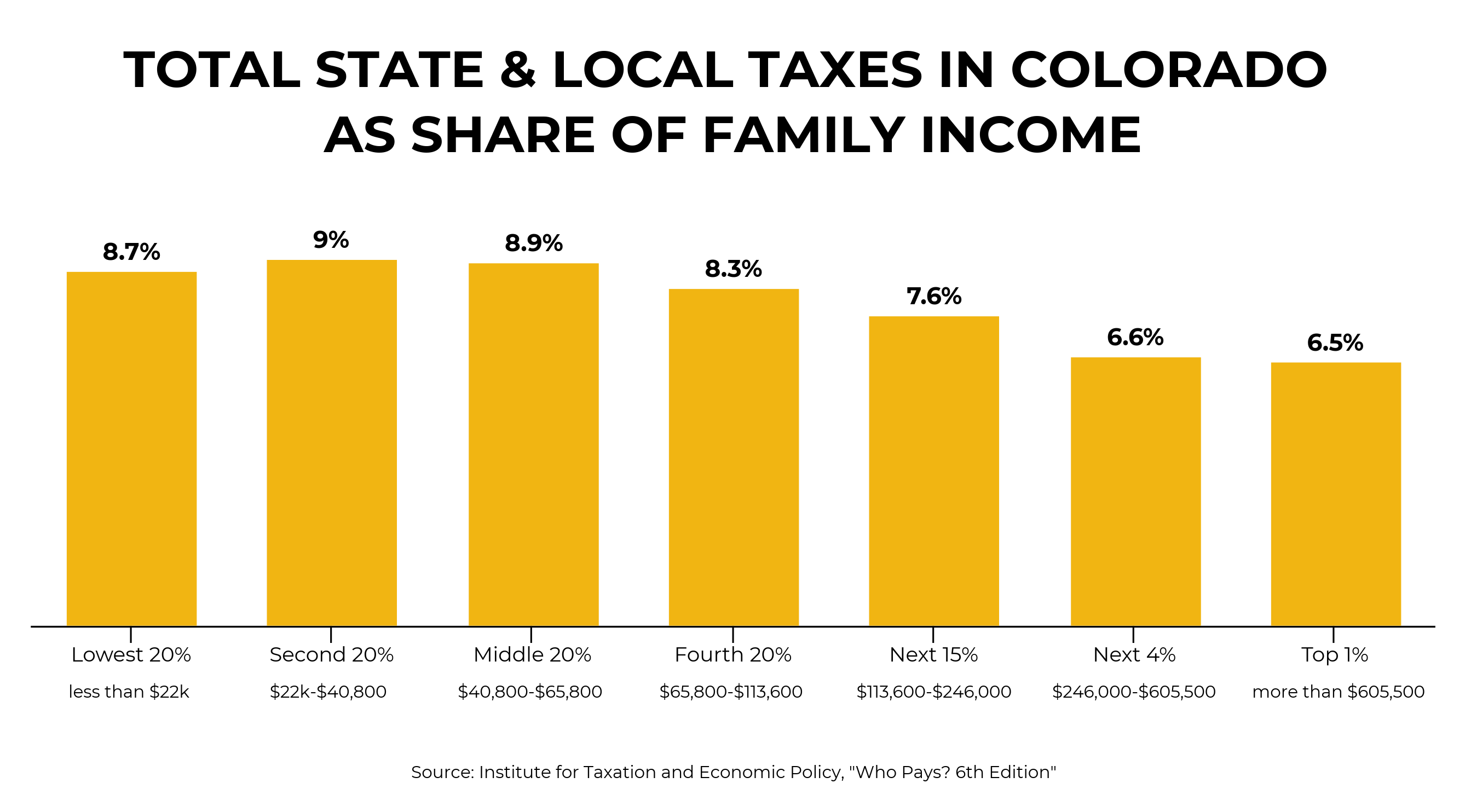

6 Things to Know When Talking About Colorado Taxes

This booklet is intended to provide general tax and charge information for anyone conducting business in the city and county of denver. Coloradans’ income is taxed at a flat rate of 4.50% of their taxable income, regardless of your income bracket or marital. The tax topic guides are intended to be straightforward summaries of particular industries or business subjects. Visit.

These Denver neighborhoods are getting the biggest property tax hikes

Coloradans’ income is taxed at a flat rate of 4.50% of their taxable income, regardless of your income bracket or marital. Denver has local income tax for residents, so residents of denver pay only the colorado income tax and federal income tax on most forms of. Visit our information for local government or entities implementing a new tax or changed.

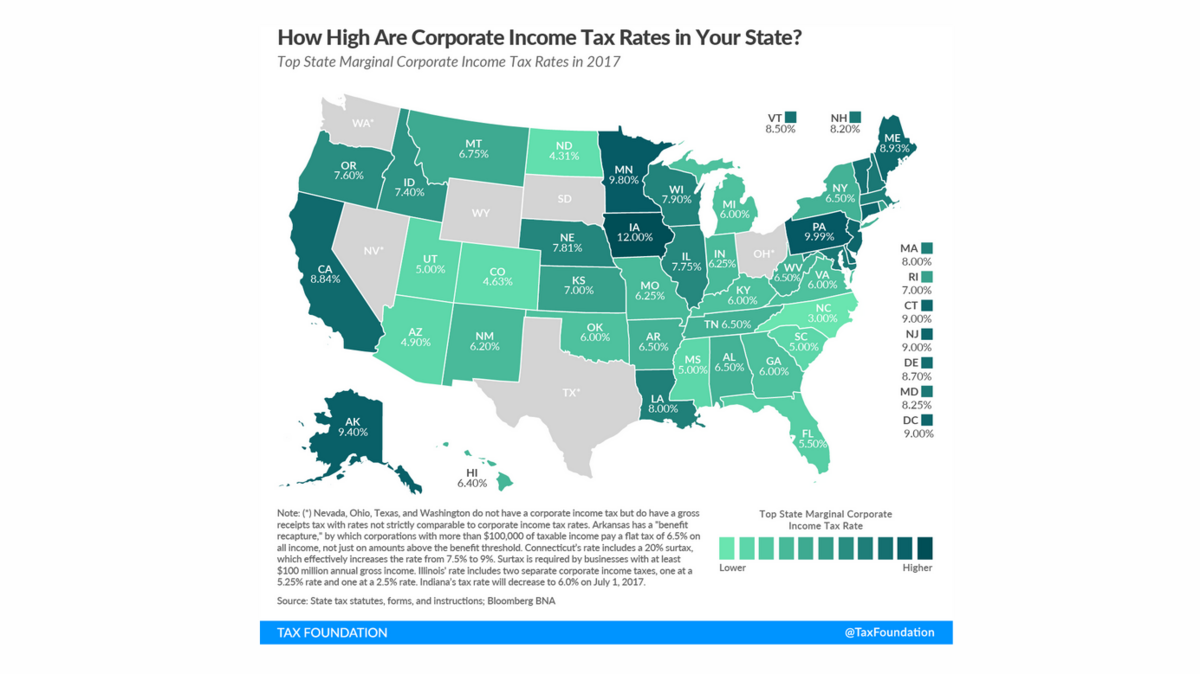

Colorado goes easy on corporate taxes Denver Business Journal

The tax topic guides are intended to be straightforward summaries of particular industries or business subjects. Visit our information for local government or entities implementing a new tax or changed tax rate page for more information. This booklet is intended to provide general tax and charge information for anyone conducting business in the city and county of denver. Coloradans' income.

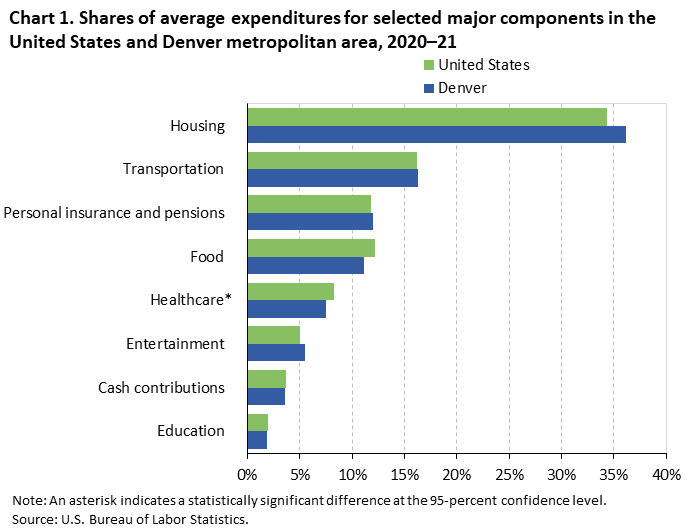

Consumer Expenditures for the Denver Metropolitan Area — 202021

Denver has local income tax for residents, so residents of denver pay only the colorado income tax and federal income tax on most forms of. This booklet is intended to provide general tax and charge information for anyone conducting business in the city and county of denver. The tax topic guides are intended to be straightforward summaries of particular industries.

Local Taxes by State Local Tax Data Etrust Business

The tax topic guides are intended to be straightforward summaries of particular industries or business subjects. This booklet is intended to provide general tax and charge information for anyone conducting business in the city and county of denver. Coloradans’ income is taxed at a flat rate of 4.50% of their taxable income, regardless of your income bracket or marital. Visit.

State to start processing tax returns this week FOX31 Denver

Denver has local income tax for residents, so residents of denver pay only the colorado income tax and federal income tax on most forms of. Visit our information for local government or entities implementing a new tax or changed tax rate page for more information. The tax topic guides are intended to be straightforward summaries of particular industries or business.

Denver Property Tax Rates Momentum 360 Tax Rates 2023

This booklet is intended to provide general tax and charge information for anyone conducting business in the city and county of denver. The tax topic guides are intended to be straightforward summaries of particular industries or business subjects. Visit our information for local government or entities implementing a new tax or changed tax rate page for more information. Coloradans' income.

Tax Preparation Services Denver Tax and Law Research Inc

Coloradans' income is taxed at a flat rate of 4.40% of their taxable income, regardless of your income bracket or marital status. This booklet is intended to provide general tax and charge information for anyone conducting business in the city and county of denver. Denver has local income tax for residents, so residents of denver pay only the colorado income.

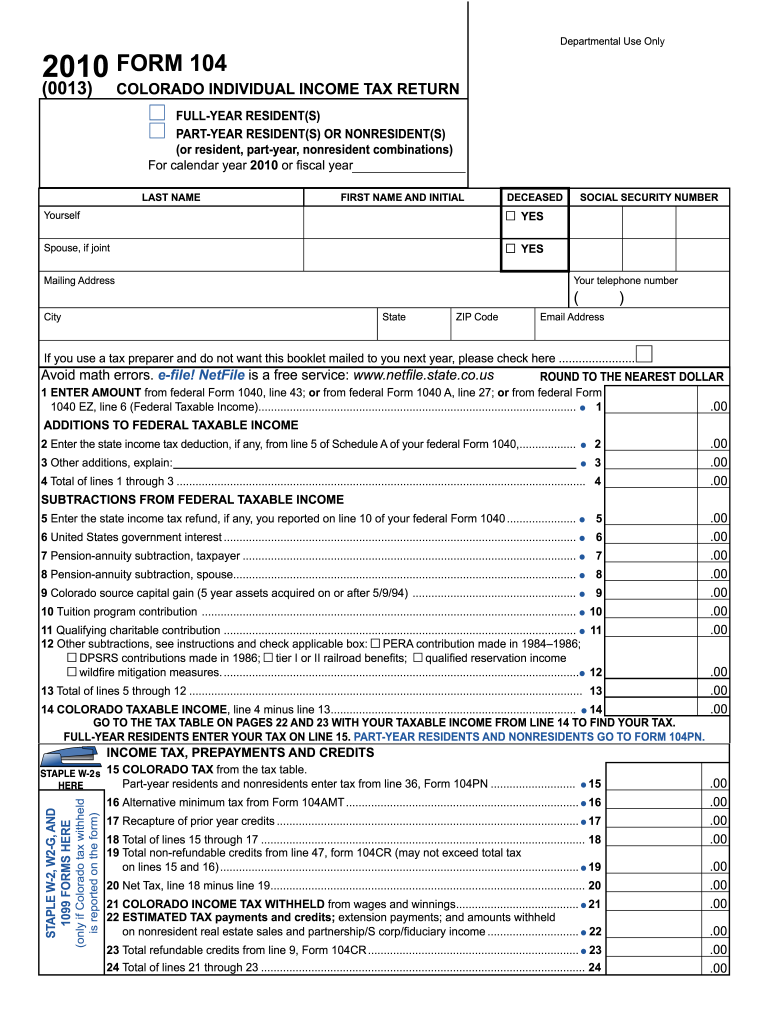

Form 104 colorado Fill out & sign online DocHub

Visit our information for local government or entities implementing a new tax or changed tax rate page for more information. Coloradans' income is taxed at a flat rate of 4.40% of their taxable income, regardless of your income bracket or marital status. Denver has local income tax for residents, so residents of denver pay only the colorado income tax and.

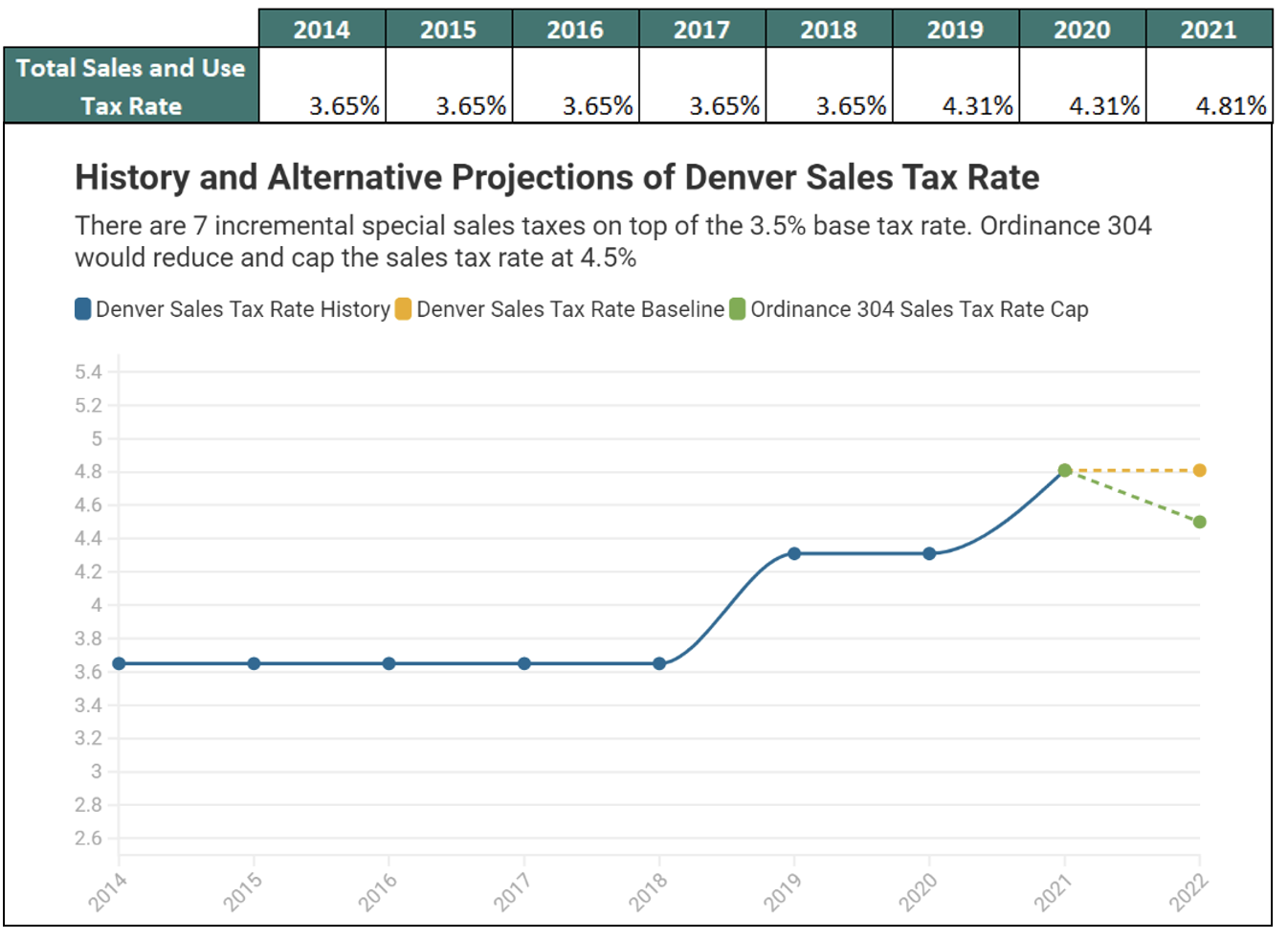

Are Denver Taxes Too High? The Fiscal Impacts of Ordinance 304 “Enough

Coloradans' income is taxed at a flat rate of 4.40% of their taxable income, regardless of your income bracket or marital status. Denver has local income tax for residents, so residents of denver pay only the colorado income tax and federal income tax on most forms of. Coloradans’ income is taxed at a flat rate of 4.50% of their taxable.

Coloradans' Income Is Taxed At A Flat Rate Of 4.40% Of Their Taxable Income, Regardless Of Your Income Bracket Or Marital Status.

The tax topic guides are intended to be straightforward summaries of particular industries or business subjects. This booklet is intended to provide general tax and charge information for anyone conducting business in the city and county of denver. Denver has local income tax for residents, so residents of denver pay only the colorado income tax and federal income tax on most forms of. Coloradans’ income is taxed at a flat rate of 4.50% of their taxable income, regardless of your income bracket or marital.