County Tax Website Tax Liens - If you have paid your bill in full and have not received. Beginning on or before june 1st, the tax collector is required by law to hold a tax certificate sale. The next tax lien sale will be on february 13, 2024 online through realauction. The tax lien sale provides for the payment of delinquent property taxes by a bidder. We will issue a tax lien release once your unsecured property tax bill is paid in full. Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more. If we buy or sell a home. The tax on the property is auctioned in open competitive. The certificates represent liens on all unpaid. The list can be found by clicking on state held liens in the menu to the left.

If you have paid your bill in full and have not received. If we buy or sell a home. The list can be found by clicking on state held liens in the menu to the left. Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more. The next tax lien sale will be on february 13, 2024 online through realauction. The certificates represent liens on all unpaid. The tax on the property is auctioned in open competitive. Beginning on or before june 1st, the tax collector is required by law to hold a tax certificate sale. The tax lien sale provides for the payment of delinquent property taxes by a bidder. We will issue a tax lien release once your unsecured property tax bill is paid in full.

If we buy or sell a home. If you have paid your bill in full and have not received. The list can be found by clicking on state held liens in the menu to the left. The certificates represent liens on all unpaid. The next tax lien sale will be on february 13, 2024 online through realauction. We will issue a tax lien release once your unsecured property tax bill is paid in full. Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more. The tax lien sale provides for the payment of delinquent property taxes by a bidder. Beginning on or before june 1st, the tax collector is required by law to hold a tax certificate sale. The tax on the property is auctioned in open competitive.

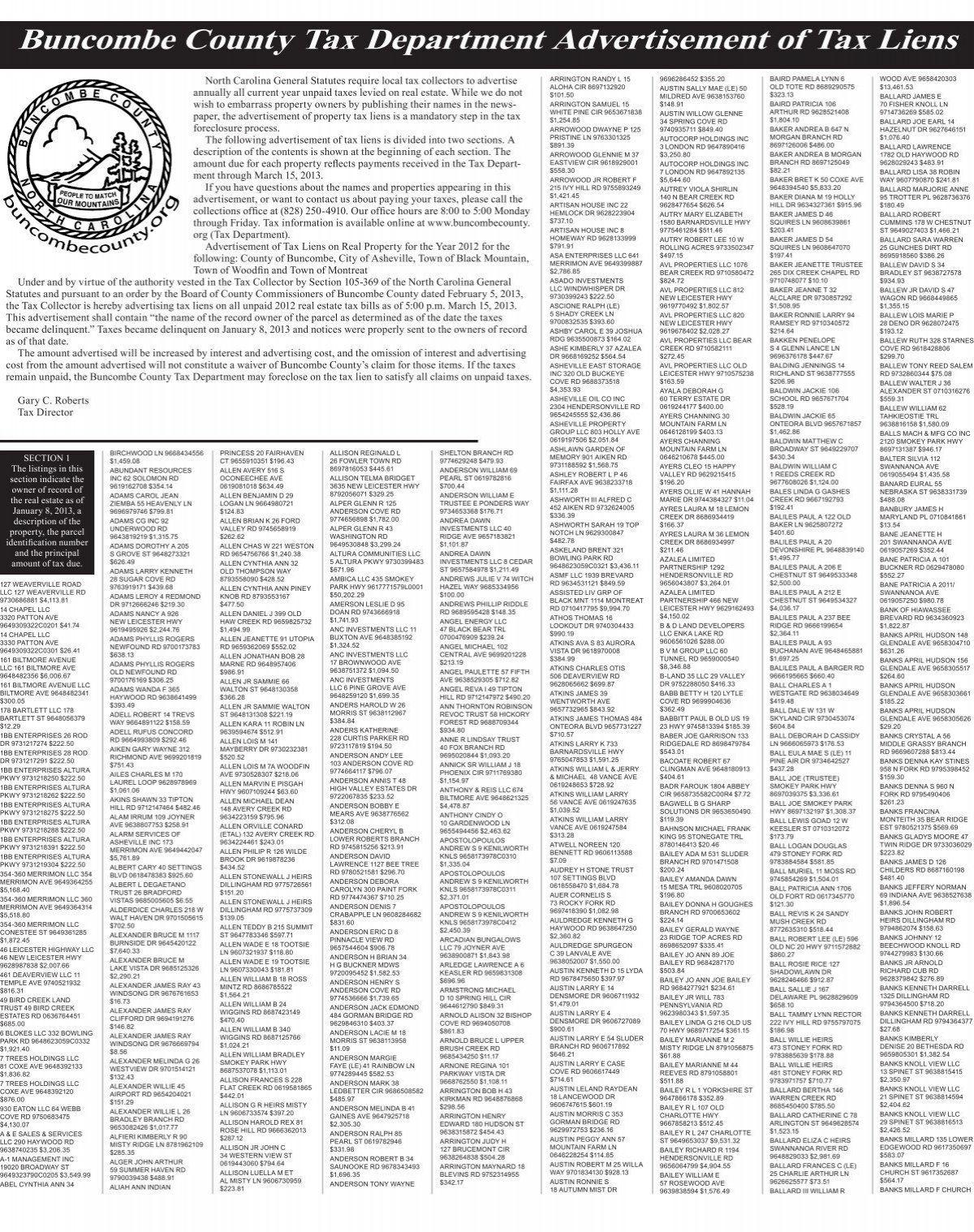

County Tax Department Advertisement of Tax Liens

If we buy or sell a home. Beginning on or before june 1st, the tax collector is required by law to hold a tax certificate sale. If you have paid your bill in full and have not received. The certificates represent liens on all unpaid. The next tax lien sale will be on february 13, 2024 online through realauction.

Tax Liens Grand County, CO Official Website

If you have paid your bill in full and have not received. The next tax lien sale will be on february 13, 2024 online through realauction. We will issue a tax lien release once your unsecured property tax bill is paid in full. Properties become subject to the county tax collector’s power to sell because of a default in the.

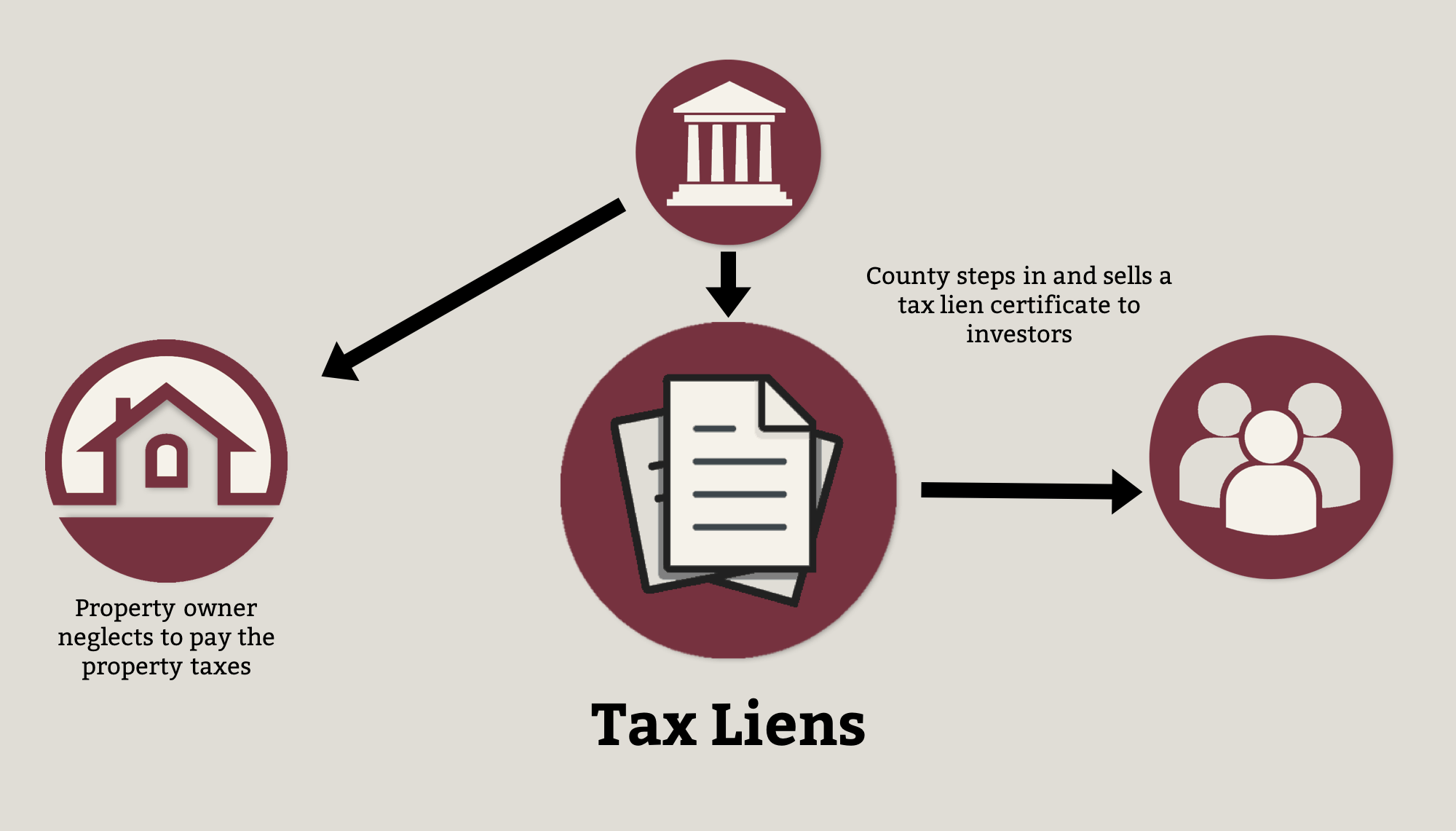

Over the Counter Tax Liens Explained Tax Sale Resources

The tax on the property is auctioned in open competitive. We will issue a tax lien release once your unsecured property tax bill is paid in full. Beginning on or before june 1st, the tax collector is required by law to hold a tax certificate sale. The list can be found by clicking on state held liens in the menu.

Mohave County Tax Lien Sale 2024 Dore Nancey

The tax lien sale provides for the payment of delinquent property taxes by a bidder. The certificates represent liens on all unpaid. Beginning on or before june 1st, the tax collector is required by law to hold a tax certificate sale. The next tax lien sale will be on february 13, 2024 online through realauction. We will issue a tax.

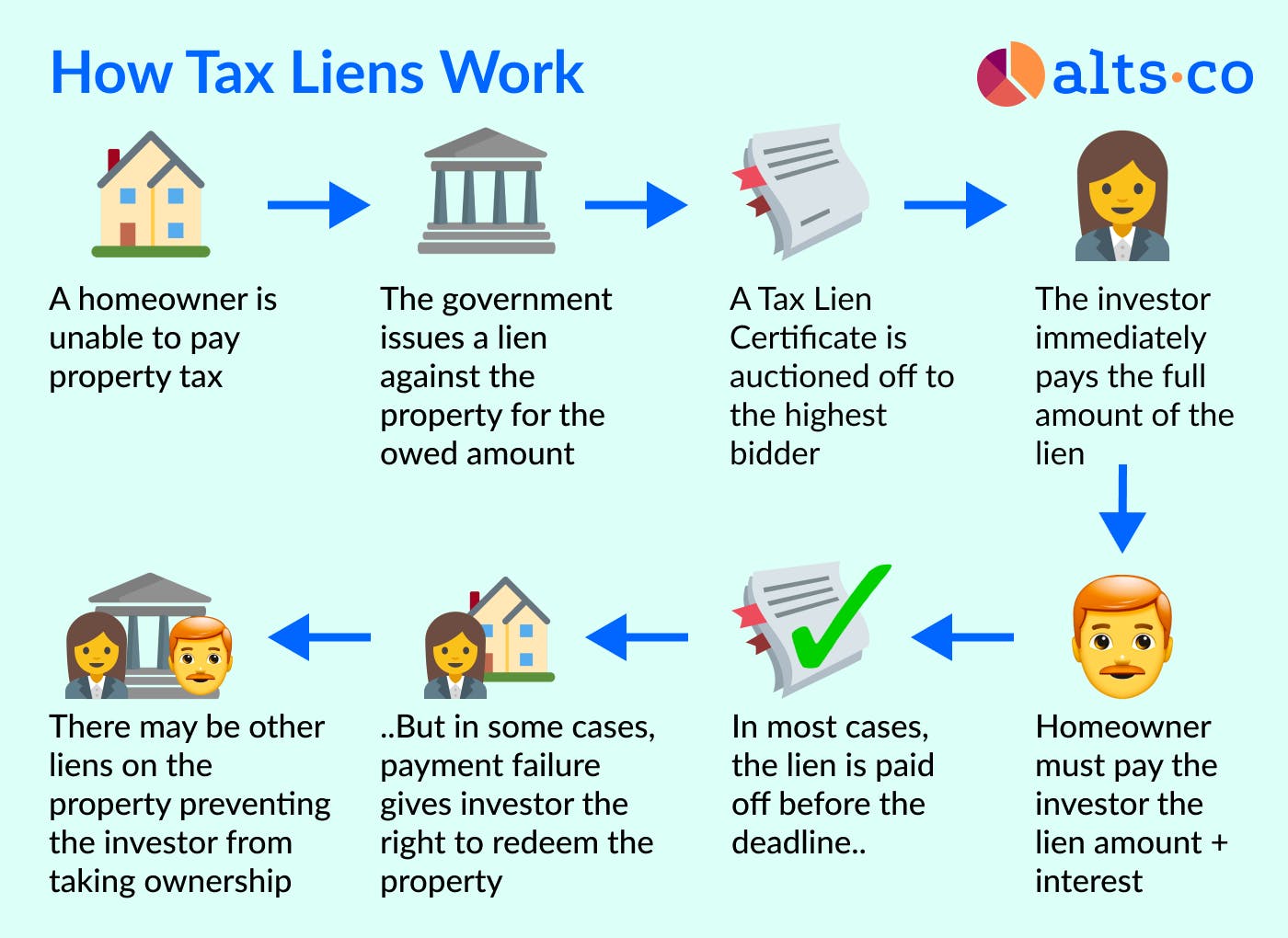

Investing In Tax Liens Alts.co

If you have paid your bill in full and have not received. We will issue a tax lien release once your unsecured property tax bill is paid in full. Beginning on or before june 1st, the tax collector is required by law to hold a tax certificate sale. The tax on the property is auctioned in open competitive. The certificates.

How To Download Palm Beach County, FL Federal Tax Liens YouTube

The certificates represent liens on all unpaid. Beginning on or before june 1st, the tax collector is required by law to hold a tax certificate sale. If you have paid your bill in full and have not received. If we buy or sell a home. Properties become subject to the county tax collector’s power to sell because of a default.

Mohave County Tax Lien Sale 2024 Dore Nancey

If you have paid your bill in full and have not received. The next tax lien sale will be on february 13, 2024 online through realauction. If we buy or sell a home. The tax lien sale provides for the payment of delinquent property taxes by a bidder. Beginning on or before june 1st, the tax collector is required by.

El Paso County Treasurer’s Office to Hold FirstEver Online Tax Lien

The tax lien sale provides for the payment of delinquent property taxes by a bidder. The list can be found by clicking on state held liens in the menu to the left. If we buy or sell a home. The next tax lien sale will be on february 13, 2024 online through realauction. We will issue a tax lien release.

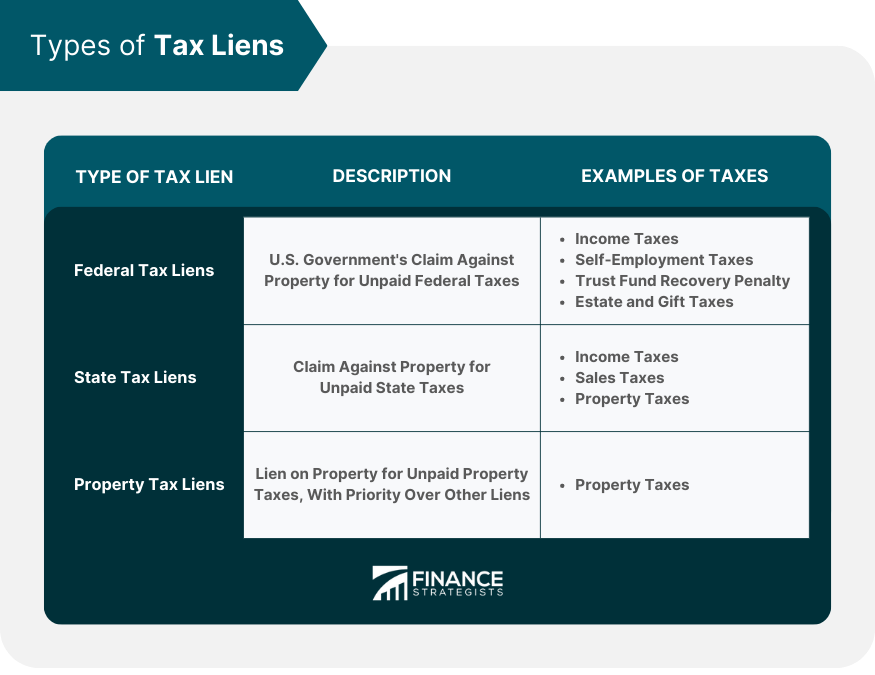

Tax Lien Definition, Process, Consequences, How to Handle

The tax on the property is auctioned in open competitive. The tax lien sale provides for the payment of delinquent property taxes by a bidder. The next tax lien sale will be on february 13, 2024 online through realauction. Beginning on or before june 1st, the tax collector is required by law to hold a tax certificate sale. If we.

Tax Liens Grand County, CO Official Website

We will issue a tax lien release once your unsecured property tax bill is paid in full. If you have paid your bill in full and have not received. Beginning on or before june 1st, the tax collector is required by law to hold a tax certificate sale. The list can be found by clicking on state held liens in.

We Will Issue A Tax Lien Release Once Your Unsecured Property Tax Bill Is Paid In Full.

Properties become subject to the county tax collector’s power to sell because of a default in the payment of property taxes for five or more. The certificates represent liens on all unpaid. The list can be found by clicking on state held liens in the menu to the left. Beginning on or before june 1st, the tax collector is required by law to hold a tax certificate sale.

The Next Tax Lien Sale Will Be On February 13, 2024 Online Through Realauction.

If we buy or sell a home. The tax on the property is auctioned in open competitive. If you have paid your bill in full and have not received. The tax lien sale provides for the payment of delinquent property taxes by a bidder.