Cincinnati Local Tax - Help us to use your tax dollars wisely by sending us this information with your tax form. They are intended to supplement cincinnati. The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. Cincinnati, listing dates and location if applicable. Residents of cincinnati pay a flat city income tax of 2.10% on earned income, in addition to the ohio income tax and the federal income tax.

Cincinnati, listing dates and location if applicable. They are intended to supplement cincinnati. The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. Help us to use your tax dollars wisely by sending us this information with your tax form. Residents of cincinnati pay a flat city income tax of 2.10% on earned income, in addition to the ohio income tax and the federal income tax.

They are intended to supplement cincinnati. Cincinnati, listing dates and location if applicable. The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. Residents of cincinnati pay a flat city income tax of 2.10% on earned income, in addition to the ohio income tax and the federal income tax. Help us to use your tax dollars wisely by sending us this information with your tax form.

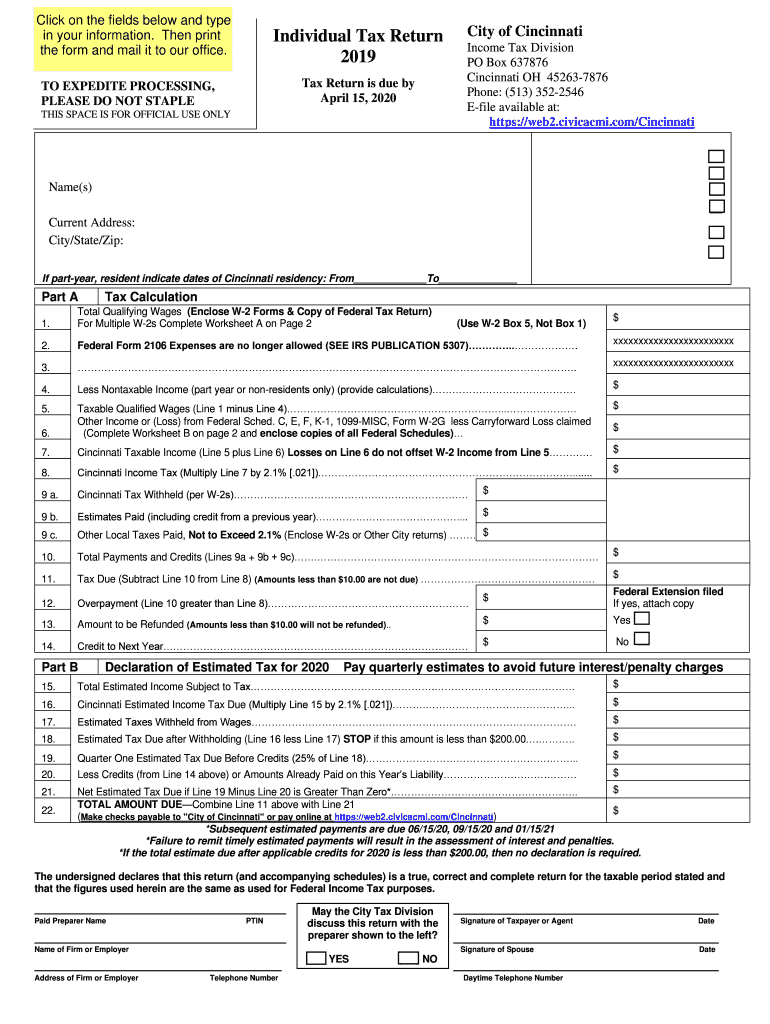

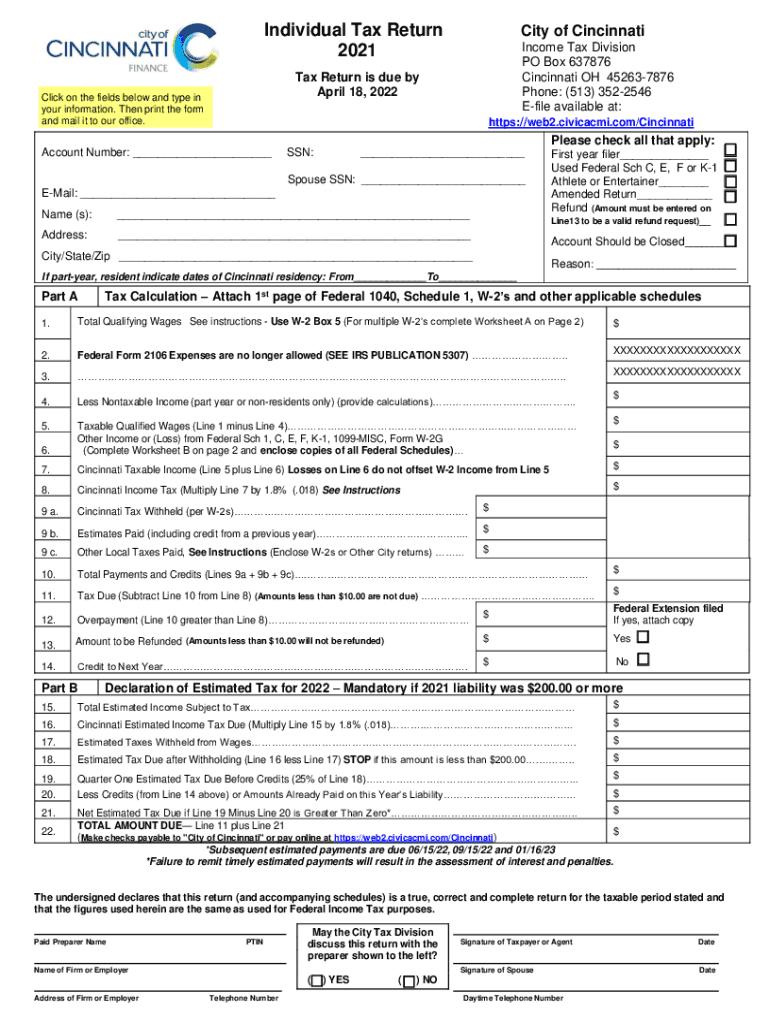

Cincinnati 2024 Tax Forms Microsoft Vikki Jerrilee

Cincinnati, listing dates and location if applicable. Residents of cincinnati pay a flat city income tax of 2.10% on earned income, in addition to the ohio income tax and the federal income tax. Help us to use your tax dollars wisely by sending us this information with your tax form. They are intended to supplement cincinnati. The finder, from the.

Cincinnati City Council approves tax increase

Help us to use your tax dollars wisely by sending us this information with your tax form. Residents of cincinnati pay a flat city income tax of 2.10% on earned income, in addition to the ohio income tax and the federal income tax. Cincinnati, listing dates and location if applicable. The finder, from the ohio department of taxation, provides information.

City of cincinnati business tax return Fill out & sign online DocHub

Residents of cincinnati pay a flat city income tax of 2.10% on earned income, in addition to the ohio income tax and the federal income tax. The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. Help us to use your tax dollars wisely by sending us this information with your.

10 Things to Do in Cincinnati on a Small Budget Holidays in

Cincinnati, listing dates and location if applicable. They are intended to supplement cincinnati. Help us to use your tax dollars wisely by sending us this information with your tax form. Residents of cincinnati pay a flat city income tax of 2.10% on earned income, in addition to the ohio income tax and the federal income tax. The finder, from the.

Cincinnati City Council searches for Landsman’s replacement

They are intended to supplement cincinnati. Cincinnati, listing dates and location if applicable. The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. Residents of cincinnati pay a flat city income tax of 2.10% on earned income, in addition to the ohio income tax and the federal income tax. Help us.

These Cincinnati companies are in default of tax incentive promises

They are intended to supplement cincinnati. Cincinnati, listing dates and location if applicable. The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. Help us to use your tax dollars wisely by sending us this information with your tax form. Residents of cincinnati pay a flat city income tax of 2.10%.

When are property taxes due in Cincinnati? How do I pay? What to know

Cincinnati, listing dates and location if applicable. They are intended to supplement cincinnati. Help us to use your tax dollars wisely by sending us this information with your tax form. Residents of cincinnati pay a flat city income tax of 2.10% on earned income, in addition to the ohio income tax and the federal income tax. The finder, from the.

Cincinnati Sales Tax 2024 Kary Sarena

They are intended to supplement cincinnati. Help us to use your tax dollars wisely by sending us this information with your tax form. The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. Residents of cincinnati pay a flat city income tax of 2.10% on earned income, in addition to the.

city of cincinnati tax dept Benita Tellez

The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. Residents of cincinnati pay a flat city income tax of 2.10% on earned income, in addition to the ohio income tax and the federal income tax. Cincinnati, listing dates and location if applicable. They are intended to supplement cincinnati. Help us.

FullService Digital Marketing Agency Cincinnati LOCALiQ

The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. Residents of cincinnati pay a flat city income tax of 2.10% on earned income, in addition to the ohio income tax and the federal income tax. Cincinnati, listing dates and location if applicable. Help us to use your tax dollars wisely.

Cincinnati, Listing Dates And Location If Applicable.

Help us to use your tax dollars wisely by sending us this information with your tax form. They are intended to supplement cincinnati. The finder, from the ohio department of taxation, provides information on local taxing jurisdictions and tax rates for all. Residents of cincinnati pay a flat city income tax of 2.10% on earned income, in addition to the ohio income tax and the federal income tax.