Can I Accept Credit Card Payments With A Tax Lien - All major credit cards are accepted. Can i pay my taxes by credit card, and which cards are accepted? Can a tax lien affect my ability to get a loan or credit card? Does the commissioner of finance accept the. The irs releases your lien within 30 days after you have paid your tax debt. For more details see, pay real estate. Credit card payments will be accepted in person in the finance office for delinquent real property taxes. Yes, a tax lien can have a negative impact on your credit score, which can make it difficult to.

Can a tax lien affect my ability to get a loan or credit card? All major credit cards are accepted. Yes, a tax lien can have a negative impact on your credit score, which can make it difficult to. The irs releases your lien within 30 days after you have paid your tax debt. Can i pay my taxes by credit card, and which cards are accepted? Credit card payments will be accepted in person in the finance office for delinquent real property taxes. For more details see, pay real estate. Does the commissioner of finance accept the.

The irs releases your lien within 30 days after you have paid your tax debt. Does the commissioner of finance accept the. Credit card payments will be accepted in person in the finance office for delinquent real property taxes. For more details see, pay real estate. Can i pay my taxes by credit card, and which cards are accepted? Yes, a tax lien can have a negative impact on your credit score, which can make it difficult to. All major credit cards are accepted. Can a tax lien affect my ability to get a loan or credit card?

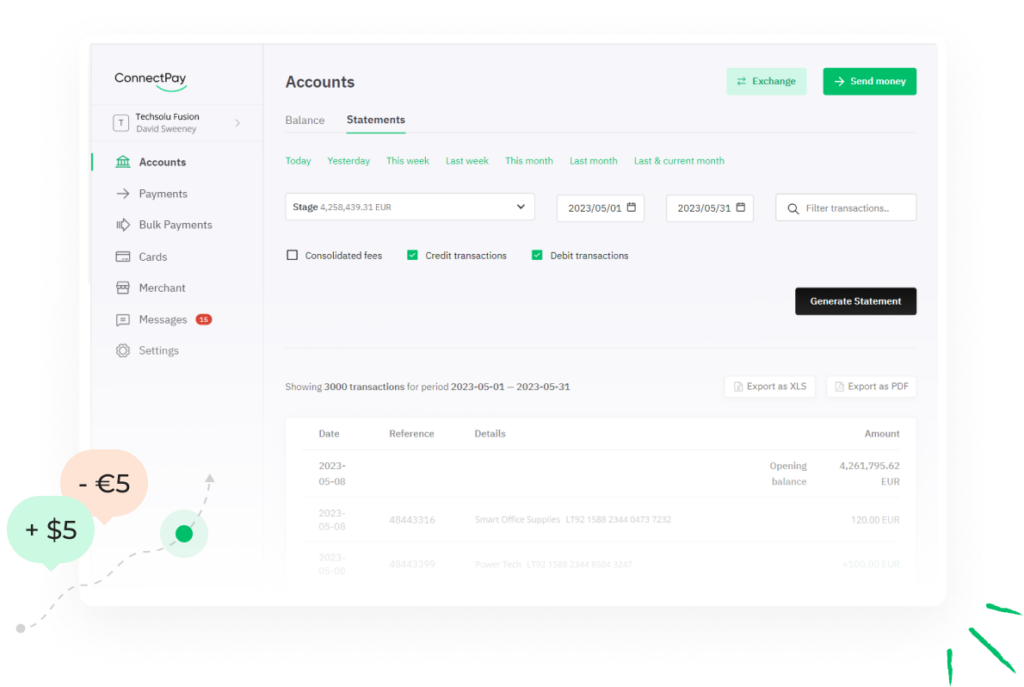

Accept Credit Card & Debit Card Payments Checkout Service

Can a tax lien affect my ability to get a loan or credit card? Can i pay my taxes by credit card, and which cards are accepted? Yes, a tax lien can have a negative impact on your credit score, which can make it difficult to. The irs releases your lien within 30 days after you have paid your tax.

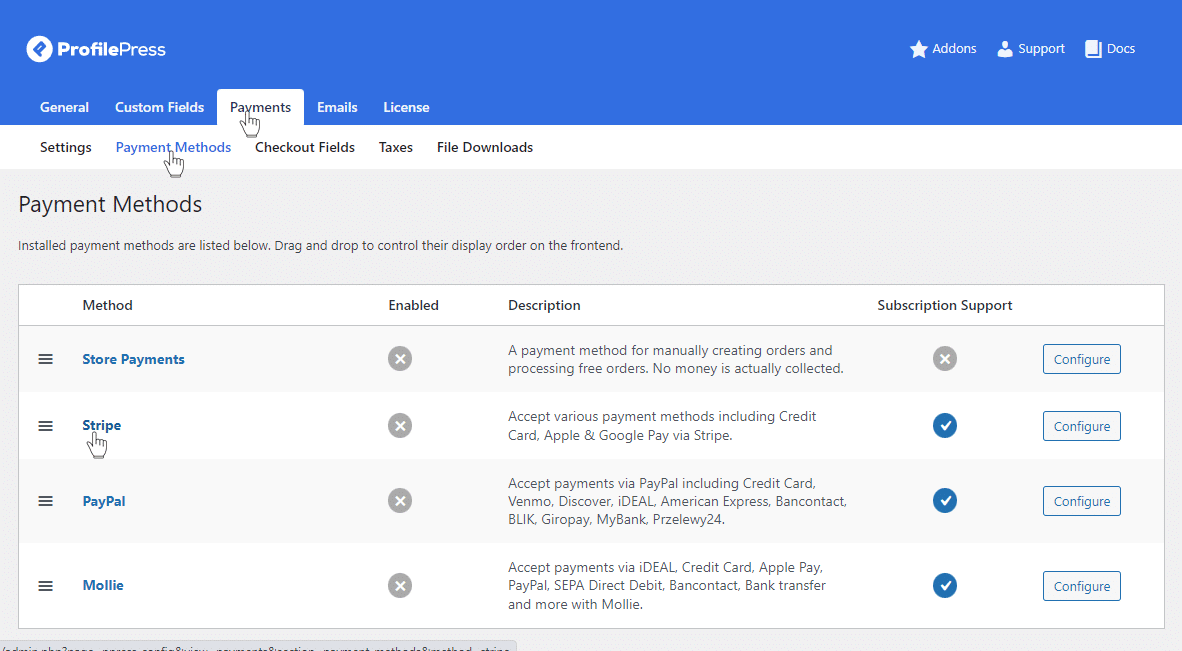

How to Accept Credit Card Payments in WordPress

Can i pay my taxes by credit card, and which cards are accepted? Does the commissioner of finance accept the. For more details see, pay real estate. Can a tax lien affect my ability to get a loan or credit card? Yes, a tax lien can have a negative impact on your credit score, which can make it difficult to.

Credit Card Payments WIZniche

Does the commissioner of finance accept the. Can a tax lien affect my ability to get a loan or credit card? For more details see, pay real estate. Yes, a tax lien can have a negative impact on your credit score, which can make it difficult to. Credit card payments will be accepted in person in the finance office for.

How to Accept Credit Card Payments as a Contractor (+ 6 Benefits)

All major credit cards are accepted. Can i pay my taxes by credit card, and which cards are accepted? Can a tax lien affect my ability to get a loan or credit card? For more details see, pay real estate. Credit card payments will be accepted in person in the finance office for delinquent real property taxes.

How to Easily Accept Credit Card Payments Online in WordPress

Does the commissioner of finance accept the. Can a tax lien affect my ability to get a loan or credit card? Yes, a tax lien can have a negative impact on your credit score, which can make it difficult to. The irs releases your lien within 30 days after you have paid your tax debt. Credit card payments will be.

muhakat We Accept Credit Card Payments

Can a tax lien affect my ability to get a loan or credit card? Credit card payments will be accepted in person in the finance office for delinquent real property taxes. The irs releases your lien within 30 days after you have paid your tax debt. Can i pay my taxes by credit card, and which cards are accepted? Does.

How to Accept Credit Card Payments

Can a tax lien affect my ability to get a loan or credit card? All major credit cards are accepted. Credit card payments will be accepted in person in the finance office for delinquent real property taxes. The irs releases your lien within 30 days after you have paid your tax debt. Can i pay my taxes by credit card,.

Accept Credit Card & Debit Card Payments Checkout Service

The irs releases your lien within 30 days after you have paid your tax debt. Credit card payments will be accepted in person in the finance office for delinquent real property taxes. Yes, a tax lien can have a negative impact on your credit score, which can make it difficult to. Can a tax lien affect my ability to get.

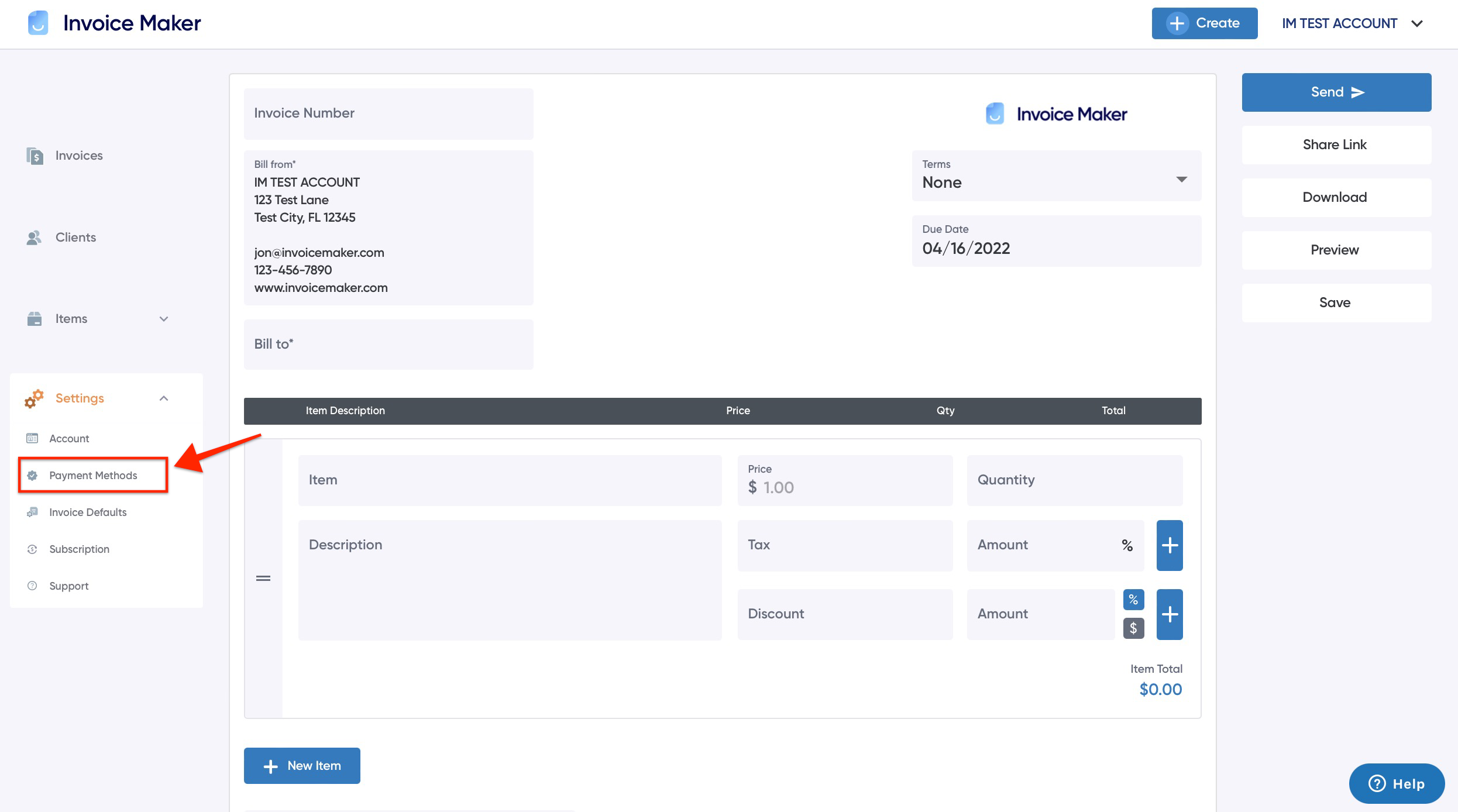

How to Accept Credit Card Payments Invoice Maker

Can a tax lien affect my ability to get a loan or credit card? The irs releases your lien within 30 days after you have paid your tax debt. Yes, a tax lien can have a negative impact on your credit score, which can make it difficult to. Can i pay my taxes by credit card, and which cards are.

How to Accept Credit Card Payments for Your Small Business

Can i pay my taxes by credit card, and which cards are accepted? Yes, a tax lien can have a negative impact on your credit score, which can make it difficult to. For more details see, pay real estate. Credit card payments will be accepted in person in the finance office for delinquent real property taxes. Can a tax lien.

The Irs Releases Your Lien Within 30 Days After You Have Paid Your Tax Debt.

Can i pay my taxes by credit card, and which cards are accepted? Yes, a tax lien can have a negative impact on your credit score, which can make it difficult to. Does the commissioner of finance accept the. Can a tax lien affect my ability to get a loan or credit card?

All Major Credit Cards Are Accepted.

For more details see, pay real estate. Credit card payments will be accepted in person in the finance office for delinquent real property taxes.

/GettyImages-500500849-56a066c43df78cafdaa16b4d.jpg)