Bucks County Pa Local Income Tax - 71 rows download the list of local income tax collector into excel. The tax claim bureau no longer accepts cash payments. To connect with the governor’s center for local government services (gclgs) by. All resident taxpayers must file a local annual earned income tax return each year by april 15th for the preceding year, whether tax is due or is not. These bills are mailed either. Employers with worksites located in pennsylvania are required to withhold and remit. Check the website for appropriate mailing addresses. On march 1 of each year the tax collector mails the combined municipal and county real estate tax bills. Payment is accepted via check or credit card via mail, phone, or online. Residential owners are eligible for one annual.

The tax claim bureau no longer accepts cash payments. All resident taxpayers must file a local annual earned income tax return each year by april 15th for the preceding year, whether tax is due or is not. On march 1 of each year the tax collector mails the combined municipal and county real estate tax bills. Employers with worksites located in pennsylvania are required to withhold and remit. These bills are mailed either. Payment is accepted via check or credit card via mail, phone, or online. Check the website for appropriate mailing addresses. Residential owners are eligible for one annual. To connect with the governor’s center for local government services (gclgs) by. 71 rows download the list of local income tax collector into excel.

Check the website for appropriate mailing addresses. All resident taxpayers must file a local annual earned income tax return each year by april 15th for the preceding year, whether tax is due or is not. The tax claim bureau no longer accepts cash payments. To connect with the governor’s center for local government services (gclgs) by. 71 rows download the list of local income tax collector into excel. Payment is accepted via check or credit card via mail, phone, or online. On march 1 of each year the tax collector mails the combined municipal and county real estate tax bills. Employers with worksites located in pennsylvania are required to withhold and remit. Residential owners are eligible for one annual. These bills are mailed either.

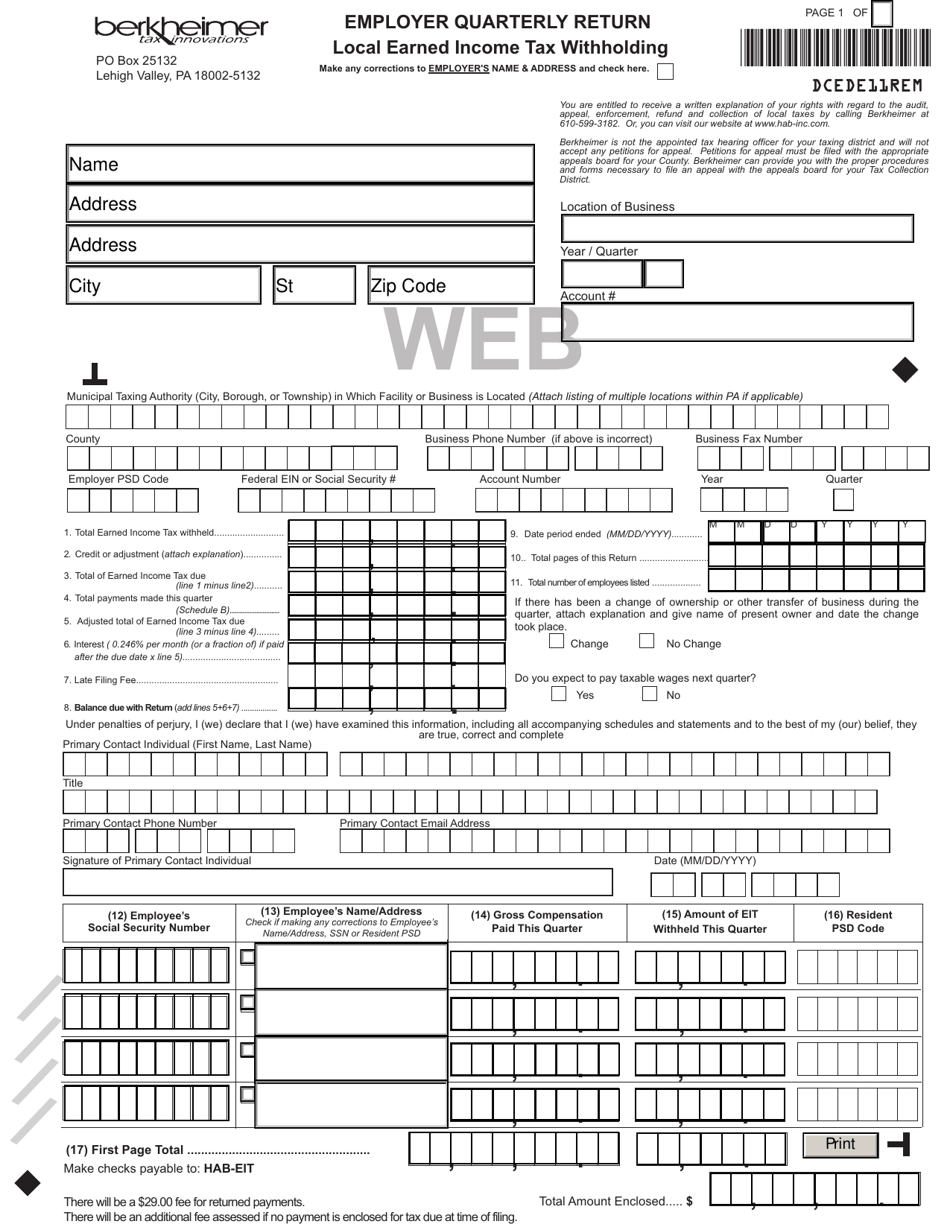

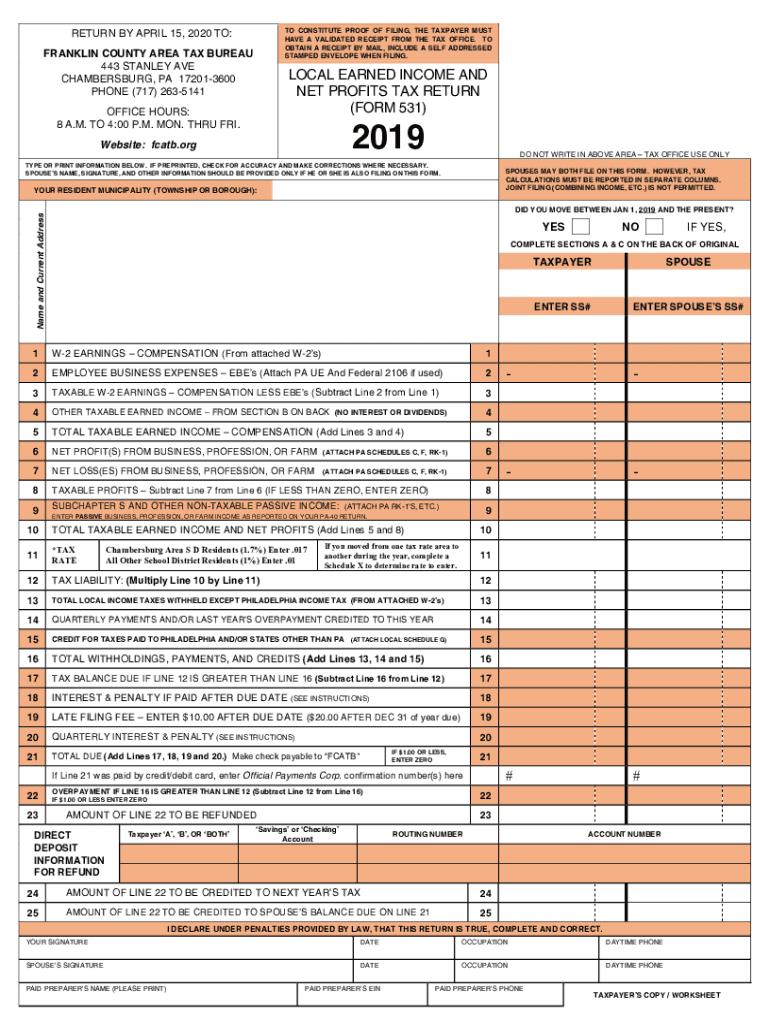

Local Earned Tax Return Form printable pdf download

These bills are mailed either. On march 1 of each year the tax collector mails the combined municipal and county real estate tax bills. Residential owners are eligible for one annual. Check the website for appropriate mailing addresses. Employers with worksites located in pennsylvania are required to withhold and remit.

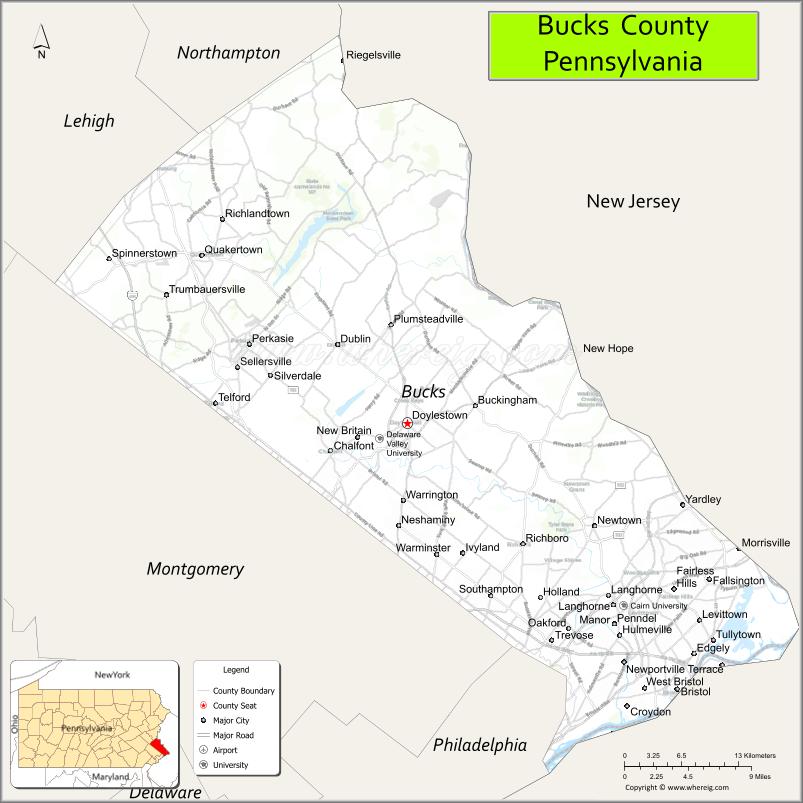

Municipalities Bucks County, PA

All resident taxpayers must file a local annual earned income tax return each year by april 15th for the preceding year, whether tax is due or is not. These bills are mailed either. Check the website for appropriate mailing addresses. On march 1 of each year the tax collector mails the combined municipal and county real estate tax bills. Payment.

Map of Bucks County, Pennsylvania

Payment is accepted via check or credit card via mail, phone, or online. All resident taxpayers must file a local annual earned income tax return each year by april 15th for the preceding year, whether tax is due or is not. 71 rows download the list of local income tax collector into excel. On march 1 of each year the.

Printable Pa Local Tax Return Form Printable Forms Free Online

All resident taxpayers must file a local annual earned income tax return each year by april 15th for the preceding year, whether tax is due or is not. To connect with the governor’s center for local government services (gclgs) by. Residential owners are eligible for one annual. Check the website for appropriate mailing addresses. The tax claim bureau no longer.

Printable Pa Local Tax Return Form Printable Forms Free Online

Check the website for appropriate mailing addresses. Residential owners are eligible for one annual. To connect with the governor’s center for local government services (gclgs) by. On march 1 of each year the tax collector mails the combined municipal and county real estate tax bills. Payment is accepted via check or credit card via mail, phone, or online.

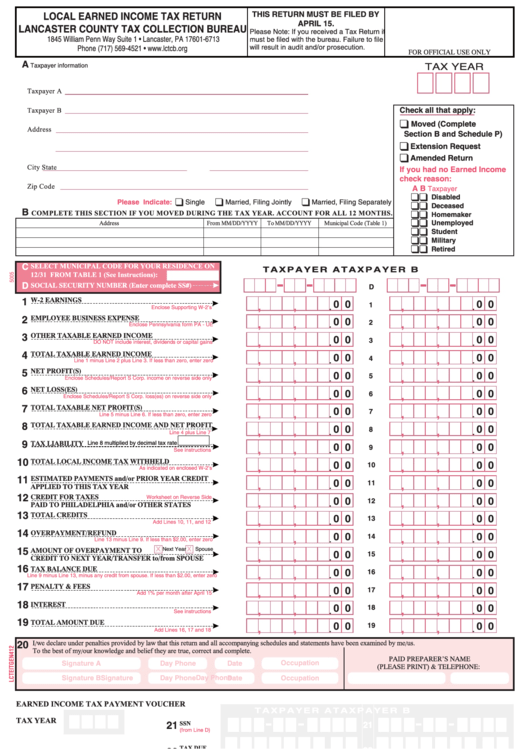

Local Earned Tax Return Form Lancaster County 2005 Printable

These bills are mailed either. 71 rows download the list of local income tax collector into excel. To connect with the governor’s center for local government services (gclgs) by. Payment is accepted via check or credit card via mail, phone, or online. Check the website for appropriate mailing addresses.

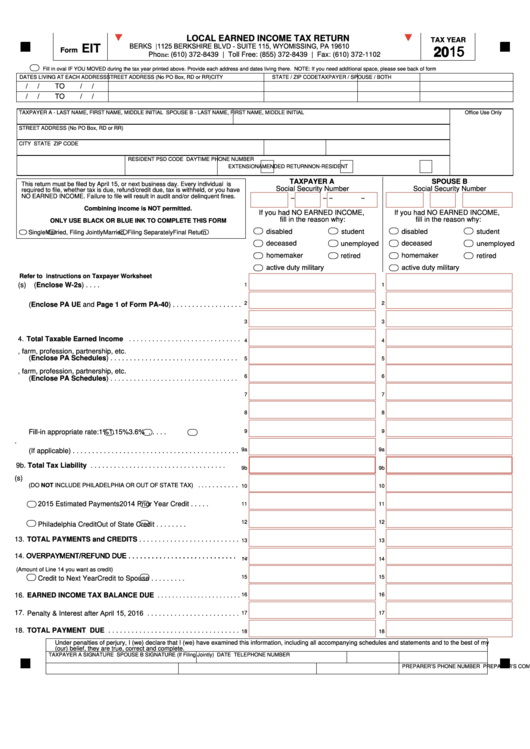

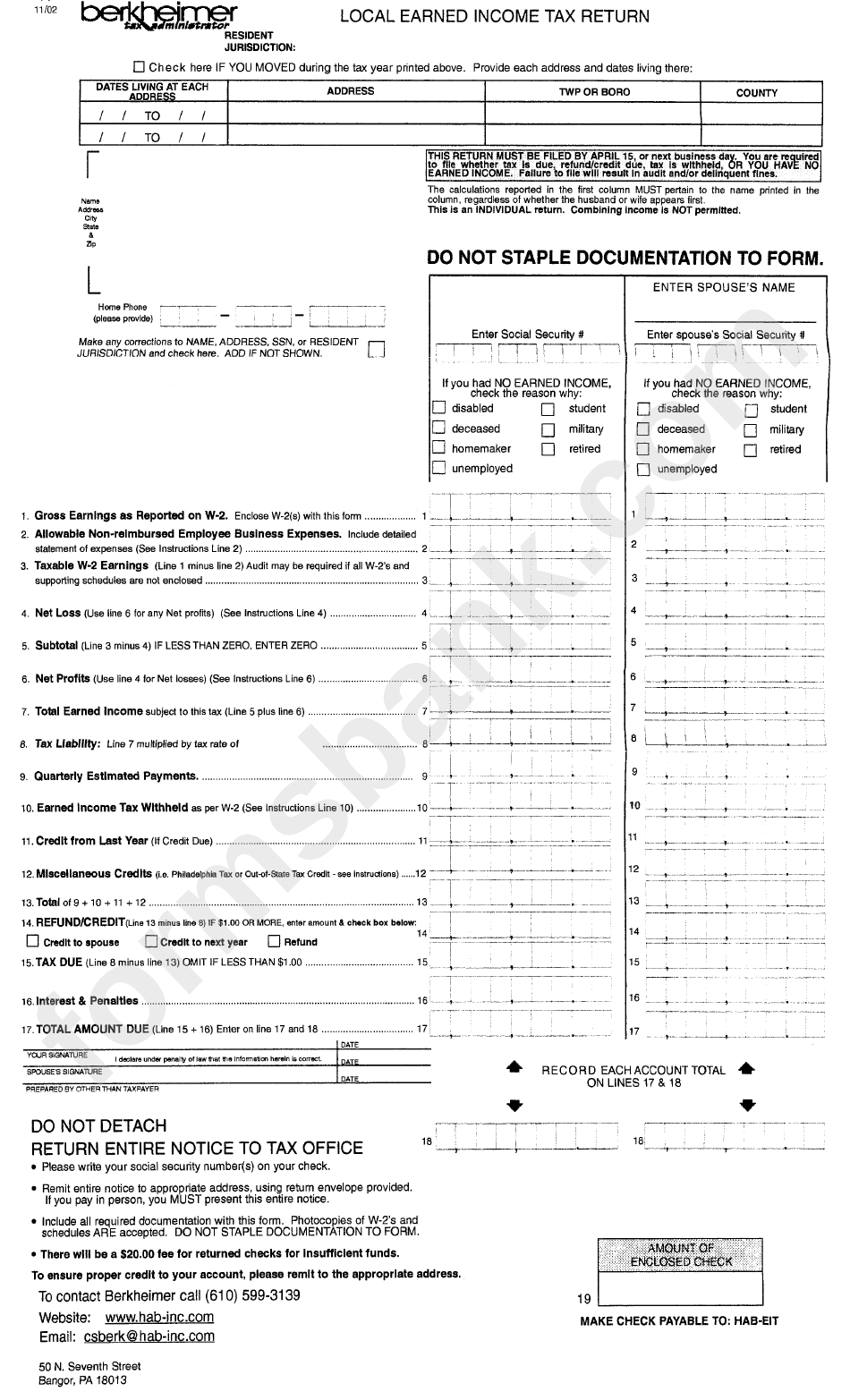

Fillable Local Earned Tax Return Pa Eit 2015 printable pdf download

These bills are mailed either. To connect with the governor’s center for local government services (gclgs) by. Check the website for appropriate mailing addresses. Residential owners are eligible for one annual. Payment is accepted via check or credit card via mail, phone, or online.

PA FCATB 531 Franklin County 20192021 Fill out Tax Template Online

71 rows download the list of local income tax collector into excel. The tax claim bureau no longer accepts cash payments. On march 1 of each year the tax collector mails the combined municipal and county real estate tax bills. Payment is accepted via check or credit card via mail, phone, or online. Employers with worksites located in pennsylvania are.

Cumberland County Pa Local Earned Tax Return

The tax claim bureau no longer accepts cash payments. These bills are mailed either. All resident taxpayers must file a local annual earned income tax return each year by april 15th for the preceding year, whether tax is due or is not. On march 1 of each year the tax collector mails the combined municipal and county real estate tax.

Local Earned Tax Return Form Berkheimer Tax Administrator

Residential owners are eligible for one annual. All resident taxpayers must file a local annual earned income tax return each year by april 15th for the preceding year, whether tax is due or is not. Employers with worksites located in pennsylvania are required to withhold and remit. 71 rows download the list of local income tax collector into excel. Payment.

71 Rows Download The List Of Local Income Tax Collector Into Excel.

The tax claim bureau no longer accepts cash payments. Payment is accepted via check or credit card via mail, phone, or online. All resident taxpayers must file a local annual earned income tax return each year by april 15th for the preceding year, whether tax is due or is not. Employers with worksites located in pennsylvania are required to withhold and remit.

These Bills Are Mailed Either.

On march 1 of each year the tax collector mails the combined municipal and county real estate tax bills. Residential owners are eligible for one annual. To connect with the governor’s center for local government services (gclgs) by. Check the website for appropriate mailing addresses.