Box 19 Local Income Tax - It can be the name of the city or county you live in. If you don't live in a city/county with an income tax (and don't have to file a resident return), then it doesn't matter what's in box 19;. Yes, vinrolls2020 it is correct. This code is used to. Box 19 reports the total amount of taxes withheld from your paychecks for local income taxes. Locality name corresponds to the specific local taxation district to which your local income tax.

Yes, vinrolls2020 it is correct. If you don't live in a city/county with an income tax (and don't have to file a resident return), then it doesn't matter what's in box 19;. Box 19 reports the total amount of taxes withheld from your paychecks for local income taxes. This code is used to. Locality name corresponds to the specific local taxation district to which your local income tax. It can be the name of the city or county you live in.

Yes, vinrolls2020 it is correct. Locality name corresponds to the specific local taxation district to which your local income tax. This code is used to. Box 19 reports the total amount of taxes withheld from your paychecks for local income taxes. If you don't live in a city/county with an income tax (and don't have to file a resident return), then it doesn't matter what's in box 19;. It can be the name of the city or county you live in.

What Is Local Tax? Flat Tax Rate, Progressive

Locality name corresponds to the specific local taxation district to which your local income tax. Yes, vinrolls2020 it is correct. This code is used to. If you don't live in a city/county with an income tax (and don't have to file a resident return), then it doesn't matter what's in box 19;. Box 19 reports the total amount of taxes.

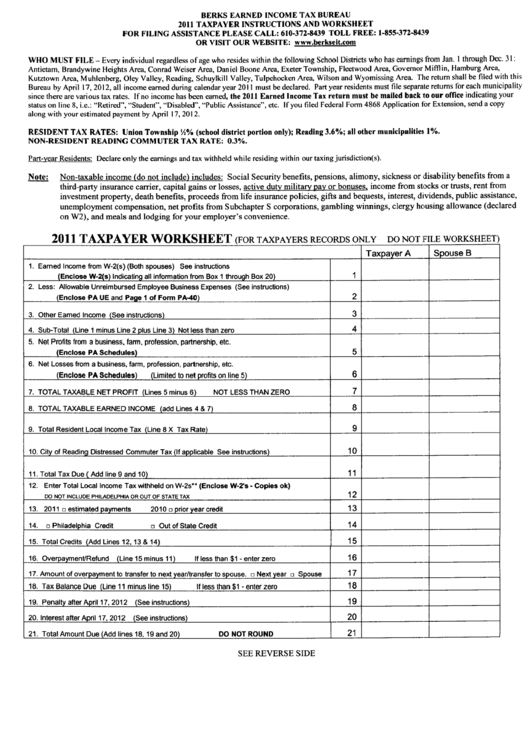

Instructions And Definitions For Filing Final Return For Local Earned

Yes, vinrolls2020 it is correct. If you don't live in a city/county with an income tax (and don't have to file a resident return), then it doesn't matter what's in box 19;. Locality name corresponds to the specific local taxation district to which your local income tax. This code is used to. Box 19 reports the total amount of taxes.

box 19 Local tax (New Jersey Tax). Tax software dont allow me

It can be the name of the city or county you live in. Box 19 reports the total amount of taxes withheld from your paychecks for local income taxes. Locality name corresponds to the specific local taxation district to which your local income tax. If you don't live in a city/county with an income tax (and don't have to file.

State and Local Tax Deduction by State Tax Policy Center

Locality name corresponds to the specific local taxation district to which your local income tax. Box 19 reports the total amount of taxes withheld from your paychecks for local income taxes. This code is used to. It can be the name of the city or county you live in. Yes, vinrolls2020 it is correct.

Local Taxes in 2019 Local Tax City & County Level

It can be the name of the city or county you live in. Yes, vinrolls2020 it is correct. Locality name corresponds to the specific local taxation district to which your local income tax. This code is used to. Box 19 reports the total amount of taxes withheld from your paychecks for local income taxes.

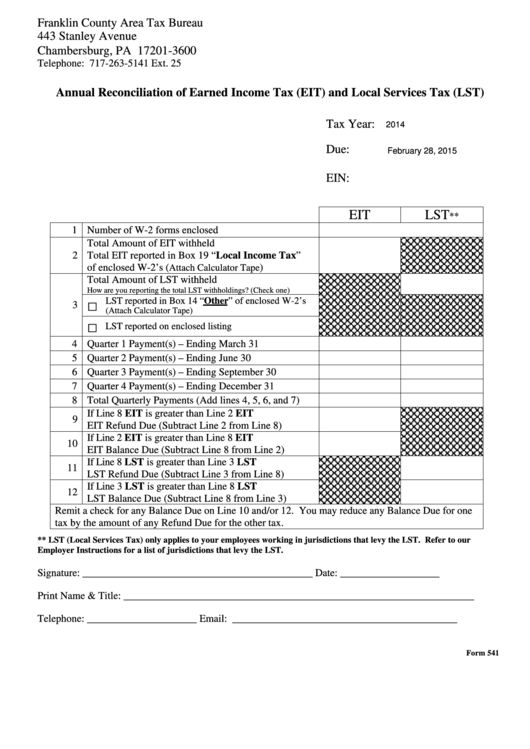

Fillable Form 541 Annual Reconciliation Of Earned Tax (Eit

Box 19 reports the total amount of taxes withheld from your paychecks for local income taxes. Yes, vinrolls2020 it is correct. If you don't live in a city/county with an income tax (and don't have to file a resident return), then it doesn't matter what's in box 19;. Locality name corresponds to the specific local taxation district to which your.

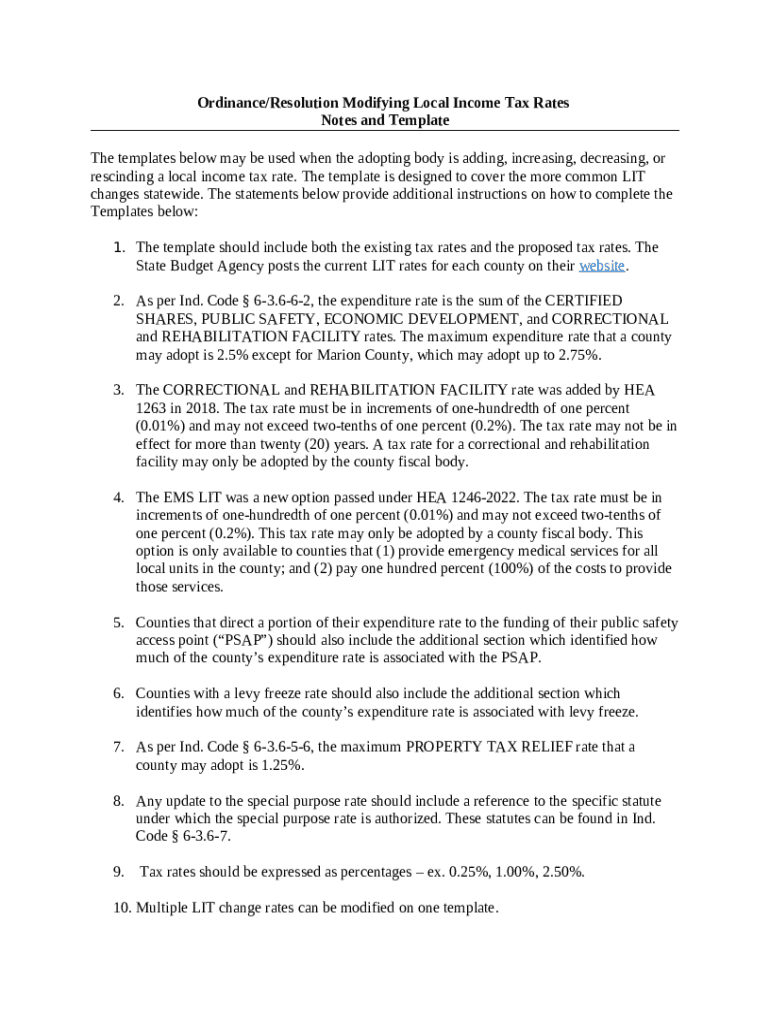

Ordinance/Resolution Modifying Local Tax Rates Doc Template

If you don't live in a city/county with an income tax (and don't have to file a resident return), then it doesn't matter what's in box 19;. This code is used to. Yes, vinrolls2020 it is correct. Locality name corresponds to the specific local taxation district to which your local income tax. It can be the name of the city.

Taxes Per Capita, By State, 2021 Tax Foundation

If you don't live in a city/county with an income tax (and don't have to file a resident return), then it doesn't matter what's in box 19;. Box 19 reports the total amount of taxes withheld from your paychecks for local income taxes. It can be the name of the city or county you live in. This code is used.

Local Taxes by State Local Tax Data Tax Foundation

If you don't live in a city/county with an income tax (and don't have to file a resident return), then it doesn't matter what's in box 19;. It can be the name of the city or county you live in. Box 19 reports the total amount of taxes withheld from your paychecks for local income taxes. Yes, vinrolls2020 it is.

Fillable Online Local Earned Tax Return Form Fax Email Print

If you don't live in a city/county with an income tax (and don't have to file a resident return), then it doesn't matter what's in box 19;. Locality name corresponds to the specific local taxation district to which your local income tax. Box 19 reports the total amount of taxes withheld from your paychecks for local income taxes. This code.

Locality Name Corresponds To The Specific Local Taxation District To Which Your Local Income Tax.

Yes, vinrolls2020 it is correct. If you don't live in a city/county with an income tax (and don't have to file a resident return), then it doesn't matter what's in box 19;. This code is used to. Box 19 reports the total amount of taxes withheld from your paychecks for local income taxes.